How to fine-tune your exits from the markets?

Proper risk management should ensure that forex traders maximize profits when a trade succeeds and minimize losses when a trade fails. So how do you set up risk management to best suit you?

In our last article, we wrote a bit about how in trading you should focus on your exits, which can often be more important than the way you enter the market. Therefore, when you are designing and possibly testing your exit strategy, you should place a lot of emphasis on how you will exit your positions and how you will treat risk management.

Focus on exits

Dealing with the right exit from the market is much more complex than an entry, as many factors play a role and each trader has different expectations. Realistically, it is thus virtually impossible to ideally exit the market in such a way that you get the most out of the market every time. On the other hand, a trader who has mastered an exit strategy and can rely on it is much better off mentally and makes fewer unnecessary mistakes. This is even when his trades end up in losses.

And since in forex, it's a case of one trader, one approach, let's take a look at some of the basic most common ways you could (or should) approach risk management and therefore how to handle exits from the markets. We won't write about the basics of risk management here, we wrote about that in an earlier article. We also reckon that entering SL and TP is a given for traders trying to manage risk properly.

Fixed TP and SL

Fixed number of pips

One popular approach that many traders use is a fixed Stop Loss and Take Profit value. Thus, the trader enters a fixed number of pips representing the Stop Loss on each trade. Depending on how he has set the RRR, he then also sets a fixed TP size. This is a very simple approach that may suit especially short-term traders and scalpers for whom speed of entry into the market plays a significant role and thus do not want to be delayed by position size calculations etc.

For traders who do not trade fast markets and plan to hold a trade for a longer period of time, this is not a very suitable approach. A fixed SL may not reflect what is happening in the market and such trades may lead to unnecessary losses (too tight SL) or, on the contrary, the inability to reach the set TP (wider SL or too large RRR).

Fixed amount

Another popular approach of traders is to adjust the size of the SL in the pips so that the potential loss still represents the same amount. Thus, before each entry, the trader adjusts his position in lots so that the SL size in pips corresponds to the pre-established amount (and the TP corresponds to this). This approach is not suitable for scalpers, as the calculation of the position size can take some time. The solution is to use a calculator or simple add-ons to the platform that can quickly calculate the position size.

A fixed percentage of capital

In this case, the approach is the same as in the previous case, but the trader adjusts the amount of a potential loss in each trade to represent a predetermined percentage of the trader's account size. Thus, after a profitable trade, when the account balance grows, the trader increases the amount; after a losing trade, the trader decreases the amount. The advantage is that during a losing streak, the next potential losses are still slightly lower. To avoid having to constantly calculate this amount, the trader can solve this by adjusting it after a certain profit/loss (for example, after a 5% profit, he adjusts the amount upwards and vice versa).

SL and TP based on Price action

The question of where to actually place SL levels can also be addressed by the trader in different ways. A very popular way to place SL and TP levels is to use price action. For example, a trader can use support and resistance levels, or supply and demand zones (for both SL and pto TP), which can act as a good landmark where price movement can stop or reverse. Similarly, round numbers, for example, can often act as such psychological thresholds. Or a trader can follow more sophisticated tools such as orderflow, volume profile or market profile.

A good additional tool to help in deciding on SL and TP placement are various chart patterns and candlestick patterns, which can also be a very good reference point for placing both Stop Losses and Take Profits.

SL and TP by indicators

Indicators are also a very popular tool, especially with novice traders who try to use them mostly for market entries. At the same time, they can serve as a tool for placing a suitable Stop Loss or Take Profit.

Scaling out

Scaling out is another fairly popular method of exiting the markets for those who want to make a sure profit but don't have the nerve to hold a trade with a high RRR. The trader in a scaling out executes part of the profit by gradually closing the position and "locking in" part of the profit. At the same time, the open portion of the position can be fully utilized in case the market sees a strong trend.

Trailing Stop Loss

A very popular way to hedge your profits without closing your position too early is to move your stop loss to the break even level or into profit when the trade is going in the trader's favour. The popularity of trailing stops lies precisely in the fact that the trader will not end up in a loss even if his trade does not reach the take profit. Again, there are several ways to use the trailing SL.

Trailing Stop and Fixed TP

The trader can move the SL manually or set a Trailing Stop order directly in the platform. The second method has the advantage that once the predetermined threshold is reached, the price moves further to profit as it moves in the direction of the trader's trade, in addition to moving to break even.

Combination with scaling out

However, when the trader wants to have more control over the trade, he can move the SL manually, for example by a certain number of points after reaching a given number of pips. One of the ways is also to combine scaling out and moving the SL every time the trader closes part of his position.

Combination with price action

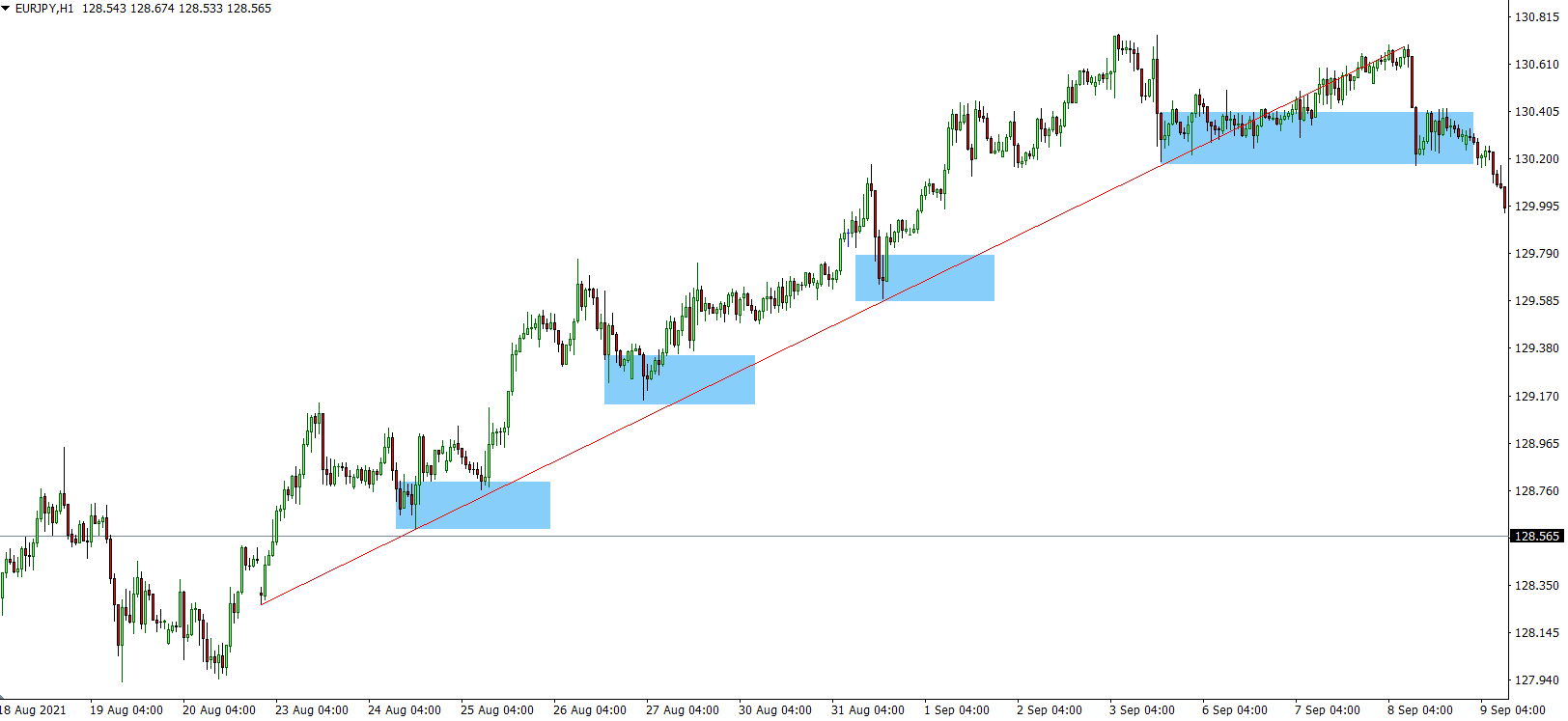

Of course, one of the ways to move SL is to use price action and various important price levels (supports and resistances, orderflow, volume profile, etc.). At these price levels, the trader can then move the SL to break even and wait for further developments. Since there is a good chance of a trend reversal to the trader's disadvantage, it may be a good solution to close part of the position with the rest being closed at TP or BE.

Multi timeframe approach

One approach that is likely to be suitable for short-term traders is a combination of approaches in different time frames. For example, a trader may execute his trade on a higher timeframe (H1, M30), but he already shifts his stop loss based on the price movement on a lower timeframe (M5, M1), for example, on local support and resistance levels.

Although the exits from the markets are very important for the overall outcome of the trade, it probably makes no sense to overcomplicate their rules. A simpler approach can often be much more effective than some overcomplicated set of rules that a trader may end up having trouble following. And what method of exiting the markets do you use? Are some of the simpler solutions sufficient, or do you use some of the more sophisticated tools? Trade safely!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.