Do you want to manage risk seriously? Use our calculators

Before executing a trade, every serious trader should know how much money he will need to have to open the position and how much he can lose if the trade fails. Our calculators will help you determine these important values without any complicated formulas.

Following proper risk management and money management is one of the cornerstones of any successful trader. Determining the correct position size and being aware of the amount at risk can help a trader manage positions and maintain consistent results. At the same time, it can protect him from entering incorrect positions that could lead to excessive losses and put his trading account at risk.

Do not underestimate the correct position size

Many novice traders have a problem with opening the right positions and often solve this by opening positions "blindly". By doing so, they often open a position that is too big and does not allow them to manage the trade as they wish. As a result, they are then forced to reduce their stop loss (and risk closing the trade too quickly at a loss) or, in the worst case, accept a larger potential loss and risk a much larger percentage of the account than would be consistent with their risk management rules.

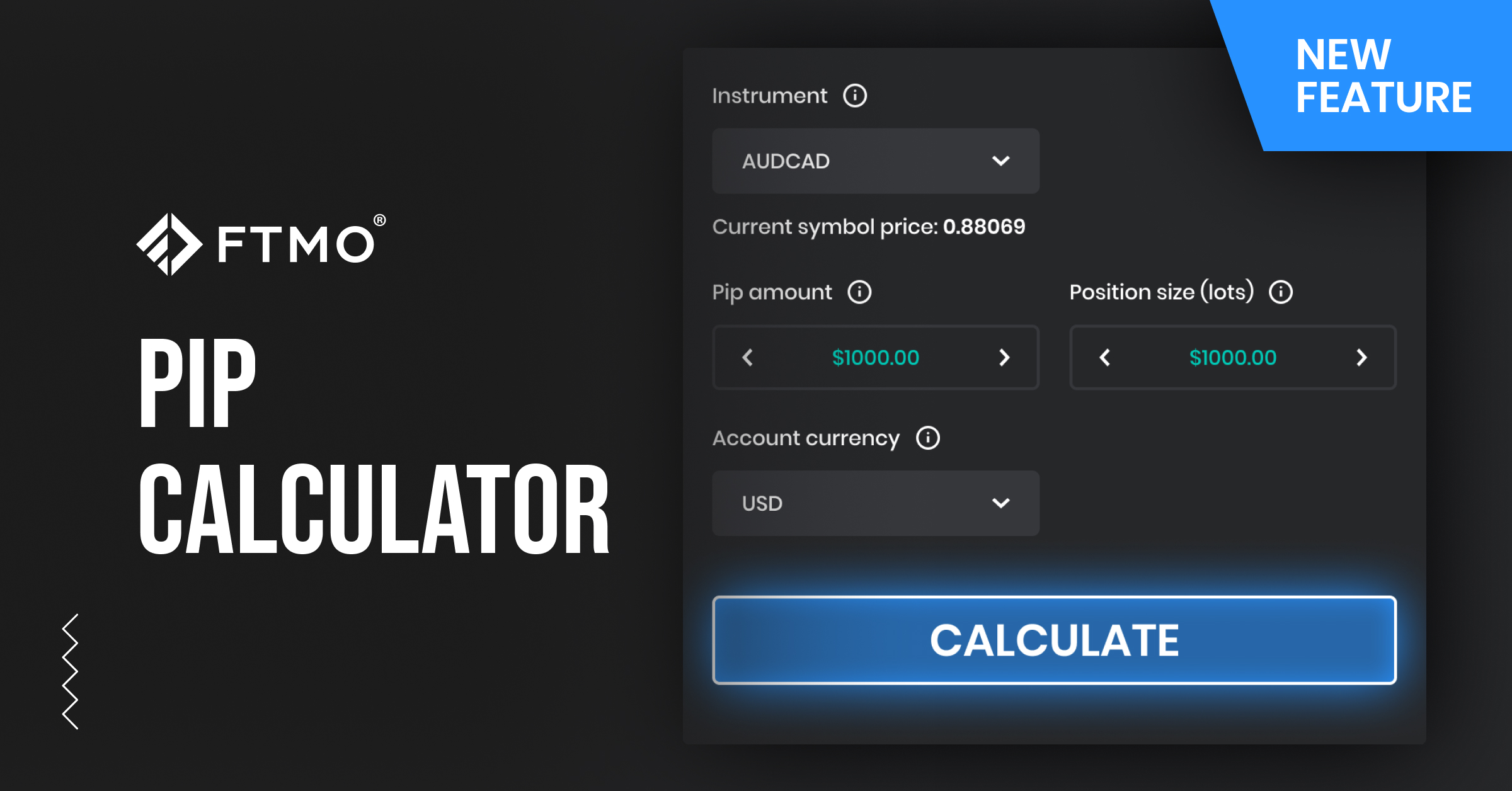

Pip Calculator

The latest innovation among our trading applications is the Pip Calculator, thanks to which FTMO Traders who trade Forex pairs no longer need to use formulas to calculate the value of their position and convert the result into the correct account currency. Just enter the currency pair, the required size of the position in lots as well as the the number of pips, and the suggested values will be available immediately. Of course, the calculation considers the currency of the account to eliminate further recalculations, in case the currency pair is different from the account currency.

The quick calculation is especially suitable for intraday traders or scalpers. This way, the trader can determine the amount he is risking even before opening a position, based on the parameters of the trade. In addition, he can also adjust the entered parameters (changing the position size in lots as well as the number of pips) so that the size of the Stop Loss corresponds to the amount he wants to risk. Alternatively, you can simply determine how many units one pip represents in a given currency for your position size. The calculator is therefore particularly useful to those traders who risk the same amount of money over and over again, but the size of their position in pips is different each time and changes according to market conditions.

Don't underestimate the size of the margin

Since FTMO Traders trade with leverage, they must also know the amount of funds they need to have available on their account to open a trade and to hold their position for the required period of time. If a trader is unable to determine how much money he needs to have available to open a trade and how much he is risking on each trade, he will not be able to manage his positions properly and his trading career may be short-lived.

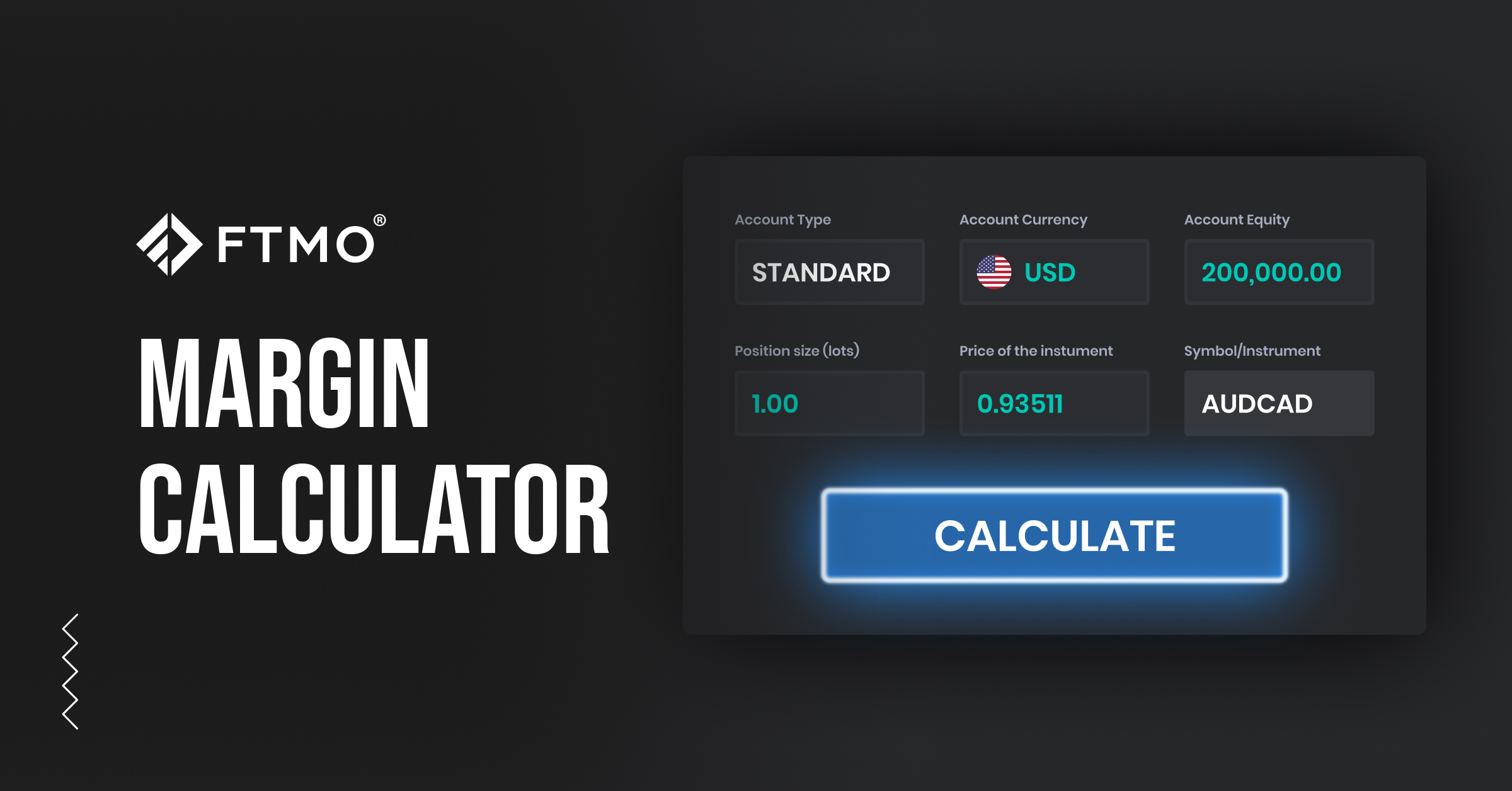

Margin Calculator

Another of our gadgets that allows traders to calculate the amount of funds required to open a trade is the Margin Calculator. In the application, you simply need to enter basic data such as the type of account (standard, swing), the currency of the account, the asset class (for example Equity), the size of the position, and, of course, the instrument or symbol of your position.

There is no need to enter the price of the instrument as the application will fill in the current bid price according to FTMO quotes. If the trader wants to know the required margin at a price other than the current price, he can of course enter the required price himself. The calculator will also calculate the maximum possible position size that the trader could theoretically open for the size of his account in lots. However, we do not recommend opening such position sizes in any case. Lack of available funds can cause unnecessary problems for traders.

If you want a quick overview of the amount of money required to open your trade, or the profit value you can gain if your trade succeeds (or how much you would lose if it fails), feel free to check out our calculators which can be found at the bottom of the left panel of your Client Area.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.