Slippage & order execution

Have you ever experienced an executed order at a different price than your preset SL/TP? Do you know what happened? Did you think it was a faulty platform mistake? Slippage is easy to understand but can trigger many questions if you are not fully familiar with it. If you want to recognize why slippages happen, when they happen and how to avoid them, you might find this article informative. You will also learn what happens behind the scenes and what journey your order takes when you hit the execution button in the platform until it gets filled.

After reading this article, you will be able to create a habit to stay aware of:

- Market Rollovers

- Significant news releases

- Volatile markets

- Low-liquid assets

- Weekend gaps

What is Slippage?

Slippage is the difference between the expected price and the executed price. It ensues when the order execution is fulfilled at a different price than requested. Most of the time, slippage can be observed under various circumstances.

The first is when the market is experiencing low liquidity and this can be observed especially during Market Rollover when major financial institutions in the world are closed. Therefore, markets across the globe lack liquidity and trading during this time may lead to slippage as the counter order necessary to fill the execution request might not be available at the desired price level. Spreads are also higher when liquidity is thin. In the chart below, you can see the market hours of major trading sessions in the world.

The transition between the U.S. session and the Asian session can be considered as the Market Rollover. There certainly are minor financial institutions in the world operating during that one-hour gap such as in New Zealand or in Australia, however, the amount of available liquidity is very limited.

A similar effect of slippage during the Market Rollover can be also observed in low-liquid assets. In Forex, these instruments are mostly minors or exotic forex pairs that struggle to have a sufficient level of liquidity compared to forex majors. For this very simple reason, such assets tend to experience higher spreads and slippages.

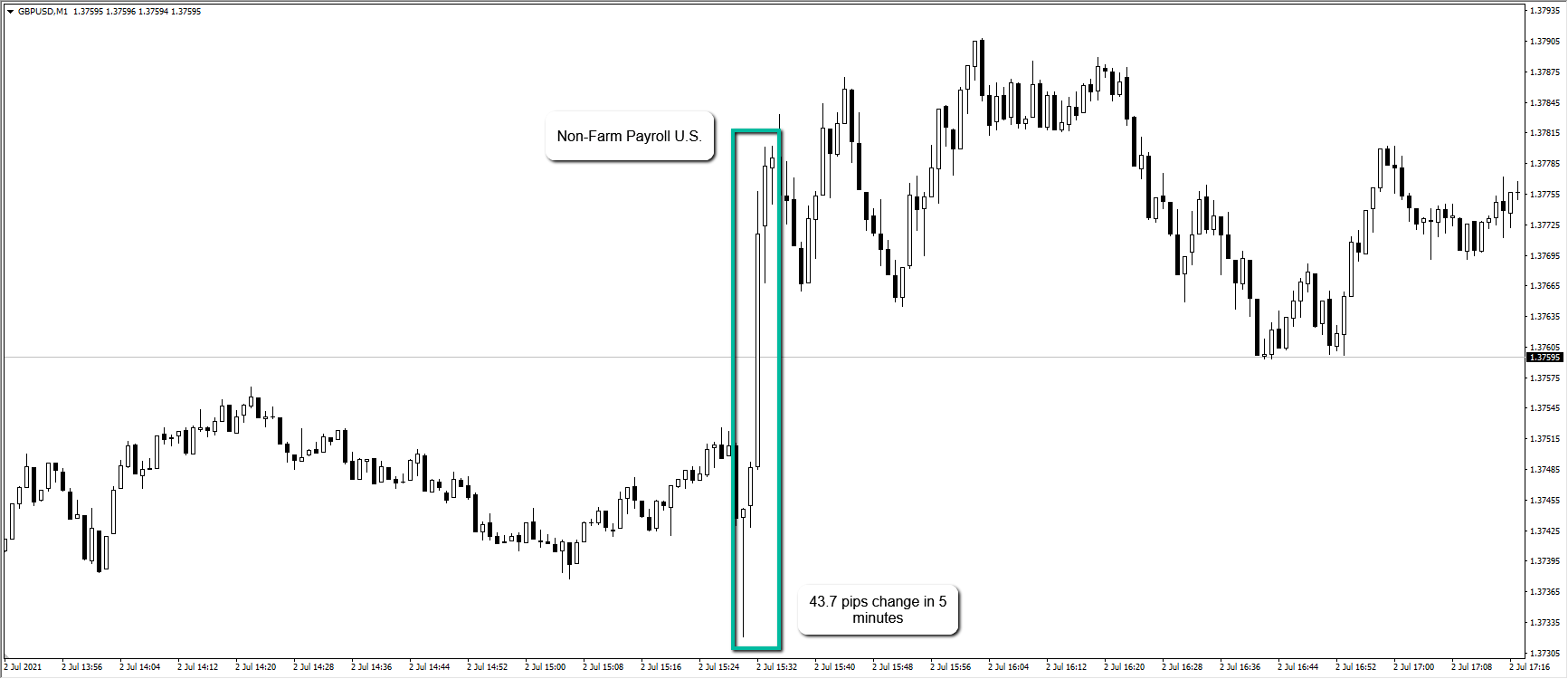

Another instance of slippage occurrence is when the market experiences high volatility. We can observe this during significant macroeconomic news releases, such as during the US NFP, as depicted in the chart below. At FTMO, we have identified the major market mover news in the table here.

Except for the releases of significant news, there are types of markets that are highly volatile on their own. A great example is the most popular instrument among all cryptocurrencies - Bitcoin (BTCUSD). From the term volatile market, we can already understand that it is a market that experiences drastic fluctuations of price in a short period of time.

The last instance at which slippage can be expected is a weekend gap. For swing traders who tend to hold their trades for a longer period of time such as days, weeks or months, there is a high chance that a market resumes with a gap. The opening price of an instrument may trigger the Stop Loss/Take Profit and the trade eventually gets executed at a different price neglecting the SL/TP. For more information on weekend gaps with examples and statistics that we gathered from our extensive research, you may access here.

So far, we have learnt that an order can be filled exactly at the same price that you requested, therefore, it will not show any slippage. However, on the other hand, there are situations in which the executed price of your order is different which in result leads to two types of slippages – Positive or Negative. Since there are two market orders to complete a trade, slippage may occur both at the entry, as well as at the exit of a trade.

Positive Slippage

Positive slippage happens when a trade is executed (open or close) at a price that benefits the trader.

We recognize two scenarios:

- When the Ask price has decreased while hitting a Buy button. In other words, when you open a buy order which eventually gets filled below the trigger price, giving you extra room for more profit.

- When the Bid price has increased while hitting a Sell order. In other words, when you open a sell order which eventually gets filled above the trigger price, giving you extra room for more profit.

The above scenarios, as you might have noticed, only illustrate orders at the entry. But what about orders to exit a position? In practice, when you are submitting an order to exit a buy position, you are technically submitting a market order to sell and if the position gets closed on a higher bid price than the price you have expected, you have then received positive slippage at the exit of this buy position. It goes the same way for sell orders as well.

Negative slippage

A less favourable slippage, called a negative slippage, can happen under the same circumstances as the positive slippage when an order gets filled at an unfavourable price for the trader.

- It can happen when a buy order is triggered on a certain price level, and the order gets filled above the expected price.

- It can happen when a sell order is triggered on a certain price level, and the order gets filled below the expected price.

As we have learnt about the types of slippages with graphical examples above, the main reason for their occurrence is simple. Since orders need some time to be delivered to the server on which it is executed, meaning the order is paired with the available quotes of the liquidity providers resembling market liquidity. Due to the time that takes the order to arrive on the server, the slippage may vary. The route the order travels can be seen in the picture below.

Spread widening

To grasp the principle behind spread, first we must distinguish between the Ask and the Bid price for each instrument.

When you place a buy by market order, meaning you go long on the instrument, your order will be executed by the Ask price. Whenever you want to close the position, it will be filled at the Bid price. If we want to sell, it works in the reversed order - sell (short) is executed by the Bid price, while the close is executed by the Ask price.

The difference between Ask and Bid prices is called a spread.

In a real market execution model, the spread keeps moving and tends to widen during highly volatile times or when the liquidity is scarce. On the other hand, spreads tighten when there is plenty of liquidity in the market.

News events, rollovers of the market and political instability are factors that can trigger volatility in the market, affecting liquidity and widening spreads. In reality, the spread ticks during the market rollover can widen considerably, often taking trader’s SL with a slippage that appears unrealistic under the naked eye, yet resembling the real spread ticks at a given time during low liquid markets.

Spread widening is a very critical aspect of trading and every experienced trader should know how to handle their positions during times of low liquidity. Stop-Loss doesn’t guarantee fill on the desired price level as the widened spreads can cause slippage. This should never be underestimated.

Live execution VS instant execution

Live execution is the accurate way an order is being processed. Technically speaking, when an order is placed via the trading platform, it travels from the local platform of a trader onto the server where liquidity provider(s) match the order with a quote and revert a confirmation to the trader’s platform where the order was placed from. The prices of an instrument that the trader sees in the platform are prices at the top of the book and depending on the level of liquidity, the order might receive a slippage or not. In short, the trade is executed by the liquidity provider according to the market depth of an instrument at the given time. This is considered as a live execution model at which market depth must be kept in one’s consideration.

On the other hand, the instant execution model is the type of execution in which the platform completely ignores the liquidity provider(s) and market data. In practice, this can be observed on classical demo accounts at most of the retail brokers. Trader comfortably receives instant confirmation of the trade, without even considering market depth and order book. This is an artificial shortcut as opposed to real live market execution.

At FTMO, even though provided accounts are demo, we were able to implement the live execution model that brings our traders the true experience of the real market. Our aim is to not only provide the opportunity to experienced traders with the meaningful account size to trade, but to educate novice traders and prepare them for trading as if they were on a real market. This is only possible thanks to technologies that allow us to reflect the real live market trading conditions as if you were on a live account.

Conclusion

In this article, we have learnt that slippage does not have to be an unpleasant outcome but also a nice surprise in addition to the positive result of a trade. Every slippage can either be Positive or Negative. What triggers a slippage are market rollovers, spread widening, significant news releases, volatile markets, low liquidity and/or weekend gaps. At FTMO, we provide traders with the best conditions and robust technical infrastructure, reflecting real markets in real-time. Besides this, we strive to educate traders about all the aspects related to trading so that we bring them the most transparent picture about how things factually work, making traders aware of all circumstances related to their trading progress and experience. In case you are unsure or suspect a technical issue in the processing or the execution of your trade, our Support Team is always ready to review your trade and bring clarity to any possible misunderstanding you might have.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?