Holding trades over the weekend?

To what extent is holding trades over the weekend risky? This infamous, yet essential question has left us wondering whether holding a trade over the weekend is actually profitable. Before we dive into the math, we’ll examine how market gaps impact trading performance in general and what risk we are undertaking when we let positions open through the weekend, using historical data to calculate the impact on risk management.

What is a gap?

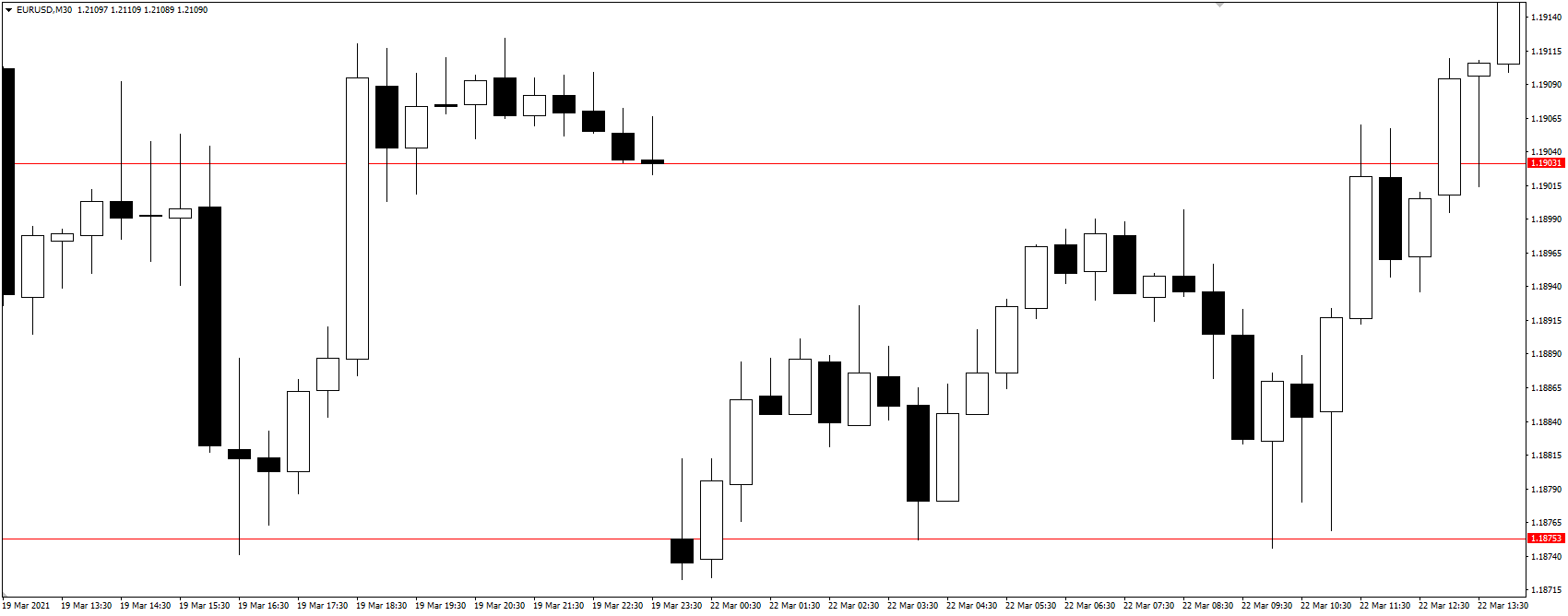

As you can see on the above EURUSD chart, the price of this pair closed at 1.19031 on Friday, 19th March, and resumed on Monday, 22nd March, at a price of 1.18753.

Zooming in, the empty space between the last candle of the week and the first candle of the following week is called a gap and in this case, it is a weekend gap.

These so-called gaps are the results of the weekend fluctuations in the price derived from transactions between market participants. You might be thinking: ‘How is this possible when the market is closed during the weekends?’

For us, the retail traders, specific trading hours are applied depending on the settings imposed by brokers/liquidity providers and most of the time trading hours take place during the weekdays 24/5 and is disabled during the weekends. As we know, Forex is a decentralized market and since there are numerous banks and other financial institutions involved, the conditions vary. Although it would be pleasant to enjoy the luxury of being able to trade during the weekends, it seems that it is only possible within the interbank market and that is the main reason gaps are created during the weekends. Big banks are not the only institutions affecting the currency throughout the weekend, however, considering their traded volume, they play a major role in the price movement.

What may happen if you keep a trade through the weekend?

When it comes to gaps, there are 2 possible outcomes. In the best-case scenario, your trade would be closed in a bigger profit as shown on the chart below. This is an ideal case and as a trader, you would not complain about the outcome as the trade actually worked out in your favour. The appropriate term for such behaviour in the market is ‘positive slippage’ as the trade “slipped” through the TP and would get closed on the opening price on the candle of the following week. However, as we have mentioned earlier in this article, this would be an ideal scenario and unfortunately, these scenarios are less likely to happen as there tend to be wider spreads on the candle open at the beginning of each trading week. The scenario illustrated in the screenshot below would happen on accounts with instant execution in which real-market execution is basically neglected.

Read more about trading according to the real market in this article.

On any live account, positive slippage in the above screenshot would never take place due to live execution of trades. A more realistic scenario of positive slippage is depicted in the screenshot below as charts are drawn by the Bid price.

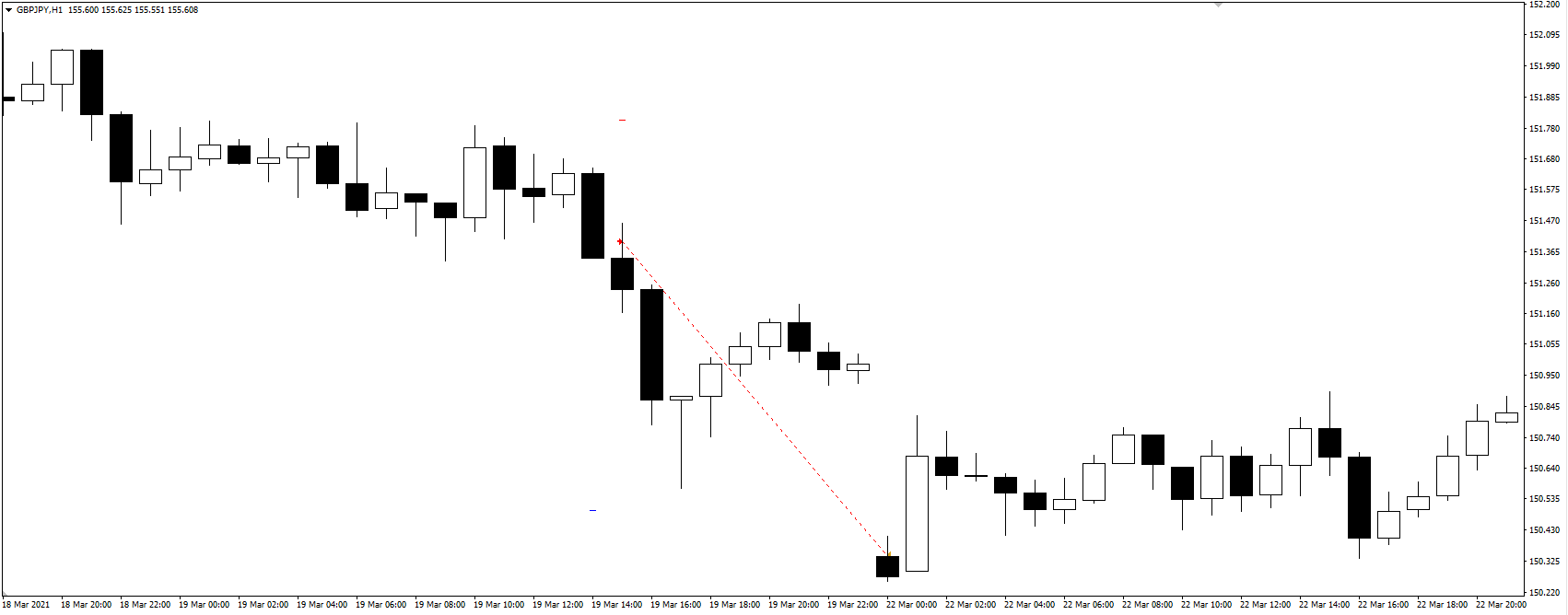

On the other hand, ‘negative slippage’ may also take place after the weekend gap and this occurrence is less pleasant than the positive slippage due to the whole fact that its term already emits negativity. On a different note, the trader in a trade below must have been certainly excited that he was able to carry out a ‘sniper entry’ only to find out on the next Monday that the price gapped and the trade was closed in a higher loss than the set Stop Loss. Unfortunately, in the real market, this case is very common.

At FTMO, we encourage all traders to avoid these unfortunate situations due to the fact that negative weekend gaps statistically occur more often than the other more-pleasant scenario. If we consider a live execution model, then the chances of negative slippage over positive slippage are 3:1 as positive slippage is less likely to take place because of the spread widening between the Ask and Bid price. If you consider instant execution to be the only acceptable execution then this article might not be the right one for you and you are advised to re-evaluate the level of your seriousness towards trading as a job or as a career.

On a side note, if you do not consider trading to be a serious career and you treat it like gambling, you may find some shocking facts in one of our articles about Forex and gambling.

If you are certain that you are serious enough to take trading as a long-lasting career, try our Free Trial to test your abilities to find out whether you possess the right trading skills for the FTMO Challenge. Free Trial accounts can be obtained directly in the Client Area.

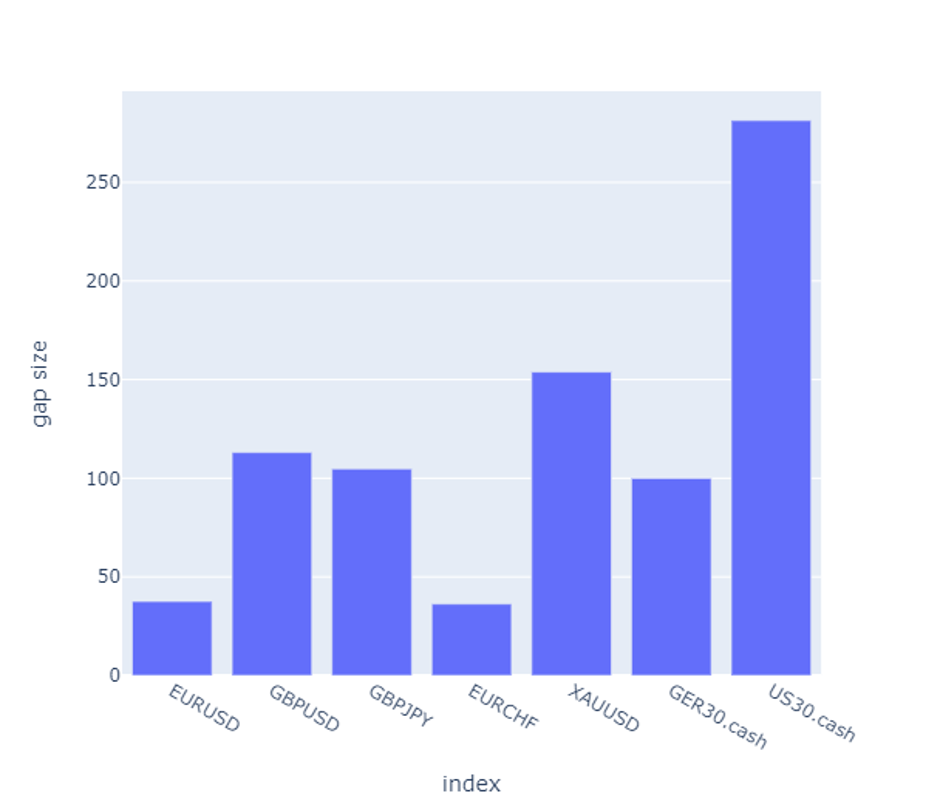

What is the average weekend gap on the 7 most traded instruments?

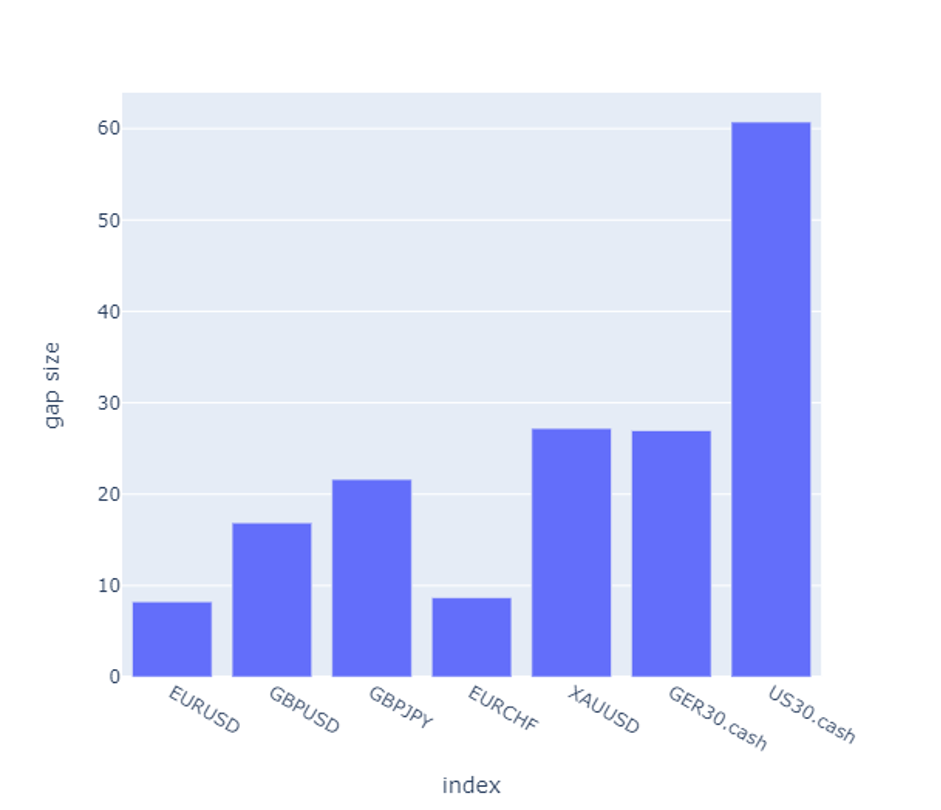

In this section, we’ll show you the findings we have gathered from historical data while analyzing the 7 most traded instruments and their weekend gaps for the past year. The goal is not to provide you financial or investment advice, but to give you an overview of a certain aspect of the market in a hope to help you as a trader, to develop your knowledge and skills for improving your trading system.

The methodology we used in our research, a code that analyzes the weekend gaps for the past 55 weeks, was able to export data that contained the price difference from the closing price and opening price which we simply converted into pips. In order to ensure the accuracy of the price difference, the table was sorted by the date_time column and prices were also checked in the platform. Below is the table with average weekend gaps from the previous 55 weeks in pips. We could have certainly used a larger sample size of data, however, this was compensated by the fact that the last 2 years have been rather volatile due to the current global situation. More on this topic in a different article.

Average weekend gap (pips)

| EURUSD | 8.25 |

| GBPUSD | 16.88 |

| GBPJPY | 21.6294 |

| EURCHF | 8.69 |

| XAUUSD | 27.204 |

| GER30.cash | 26.97 |

| US30.cash | 60.72 |

Looking at the numbers above, some of you might not relate to them and probably thinking that this information is somewhat useful but not really as they are just average numbers. If you wonder what was the biggest gap, for the risk-averse, conservative traders, we are also presenting the biggest recorded gaps on the researched instruments below.

Biggest weekend gap (pips)

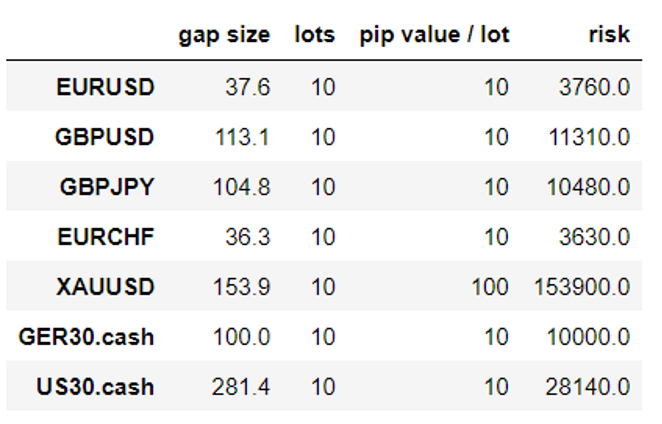

| EURUSD | 37.6 |

| GBPUSD | 113.1 |

| GBPJPY | 104.8 |

| EURCHF | 36.3 |

| XAUUSD | 153.9 |

| GER30.cash | 100 |

| US30.cash | 281.4 |

As we have learnt above, the average gaps are not as drastic as we would imagine, however, in comparison with the biggest gaps incurred, it is evident that the deviation from average gaps to the biggest gap is 4-6 times higher than the average gaps. We must also keep in mind that these numbers are only informative and the sample size of 55 weeks should not be considered as an absolute representative sample or precise prediction of future fluctuations in prices.

How can a gap affect the profitability?

Since trading involves leverage, losses, as well as profits, are magnified. This is the fact that all traders already learn from day 1 of their trading careers and it has become somewhat common sense. At FTMO, our traders are allowed to trade with the following maximum leverages.

FX: 1:100 | Metals: 1:50 | XAUUSD 1:30 | Cryptos: 1:50 | Indices: 1:50 | Stocks 1:10

For detailed specifications of all symbols, access this link.

To properly understand how gaps affect profitability, you as a trader must be willing to critically evaluate your traded setup and what risk management you are deploying in your trading as each strategy is unique. If you are a scalper or a day trader, holding trades over the weekend does not concern you. However, in case you make a mistake of forgetting to close trades before the market closure on Friday, do not panic as this research should be able to help you identify the correct Stop Loss levels and ensure smooth trading. If you are a swing trader or a seasonal trader, you might have already asked the question regarding weekend gaps.

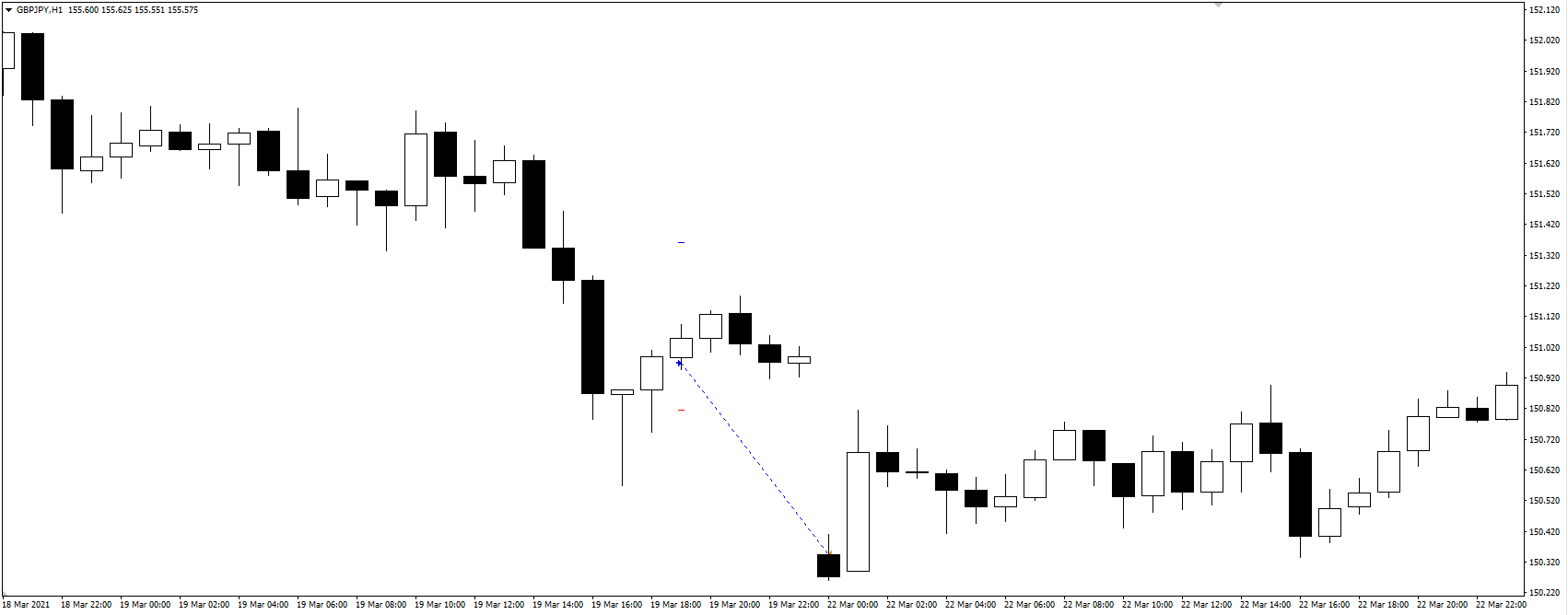

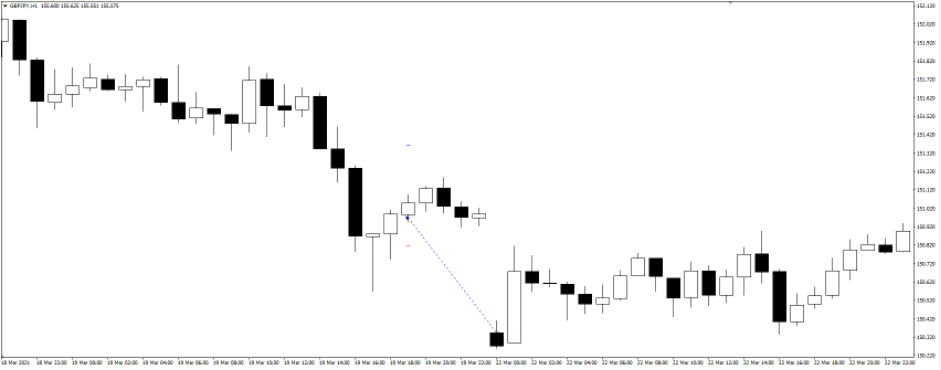

In the example below, this trader with the capital of $100,000 entered 10 lots on GBPJPY at 150.964 with RRR 1:2 and the Stop Loss was set at 150.814 which was approximately 15 pips, risking $1,000.

As you can see, the trade was eventually closed at 150.343, ignoring the Stop Loss and the losses amounted to $4,038.96.

If we take the highest gaps of the researched instruments and considering the trade size being 10 lots, we can calculate the risk from the closed price on Friday before the weekend gap and the opening price on Monday as below.

The final note

In conclusion, trading is a complex endeavour and in this article, we have uncovered whether it is really worth holding a trade over the weekend. As you can see, there is no correct answer to this question as it largely depends on the traded system one has deployed. However, considering the whole fact that only 1 trade out of 4 trades is a profitable one after the weekend gap, the traded strategy throughout the weekend shall be subjected to improvements. At FTMO, holding trades through the weekend is allowed in the Evaluation Process, meaning the FTMO Challenge and Verification.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.