Risk Management in Trading

It goes without saying that risk management is the most important part of trading. Although most traders think they are losing money in trading because of flaws in their trading strategy, the truth is that in most cases they are not using proper risk management. In this article, we will cover everything you need to know about risk management in trading and how you can become a better trader.

Risk Management in Trading

Proper risk management in trading is what separates it from gambling.

Even though we can never be sure of what markets are going to do next, by using proper risk management we can cover our potential losses and aim for wins that will make us profitable in a long run.

Undercapitalization

The first and the biggest problem of bad risk management is undercapitalization.

Because a lot of brokerage firms offer deposits as small as $50, a lot of traders come into trading with $1,000 and think they can double or triple their capital very quickly.

This leads to opening too big of positions where a short losing streak can cost you a whole funded trading account.

At FTMO, we are well aware of this and that’s why we provide traders initial balance of up to $200,000.

This way you can keep your risk per trade very small while still potentially achieving large gains.

Risk per trade

How much should you be risking per one trade?

In most textbooks and online education programs, you will learn that you should not be risking more than 2% per one trade.

Although the answer to this is more complicated, let’s start with saying that 2% risk per trade is a good base to start with.

As you can see from the below chart, keeping your risk at 2% per trade would only cost you approximately 20% of your account on 10 consecutive losses which should not happen in the first place for traders with robust trading strategy.

However, if you decide to risk 10% per trade you would be down over 60%, and that would be a deep hole to dig yourself out of.

As you can see above, the percentage required to go back to break even as calculated from the remaining balance can be dangerously huge.

Making 25% of your account back is not easy but it is still doable compared to the 150% required to break even after a 60% drawdown.

Because there are no two organic traders with the same trading style, risk should differ based on strategy.

If you are a scalper or day trader who takes 5 trades every single day, should you risk 2% per trade? Absolutely not.

With this amount of trades, risking 2% is simply too much as you can experience large drawdowns very quickly.

Daytraders and scalpers usually risk only 0.5-1% per trade.

On the other hand, if you are a swing trader who only takes 1-2 trades per week, the 2% risk might be too small.

If you know that the next trade will come up in a few days, you can probably bump your risk a little.

But don’t go too crazy, in general, the rule of thumb is that the risk per trade should not be over 5%, an exception to this could be if you are taking a long term investment.

Drawdowns

We all hate them but the truth is they are inevitable in trading and we must be well prepared for them.

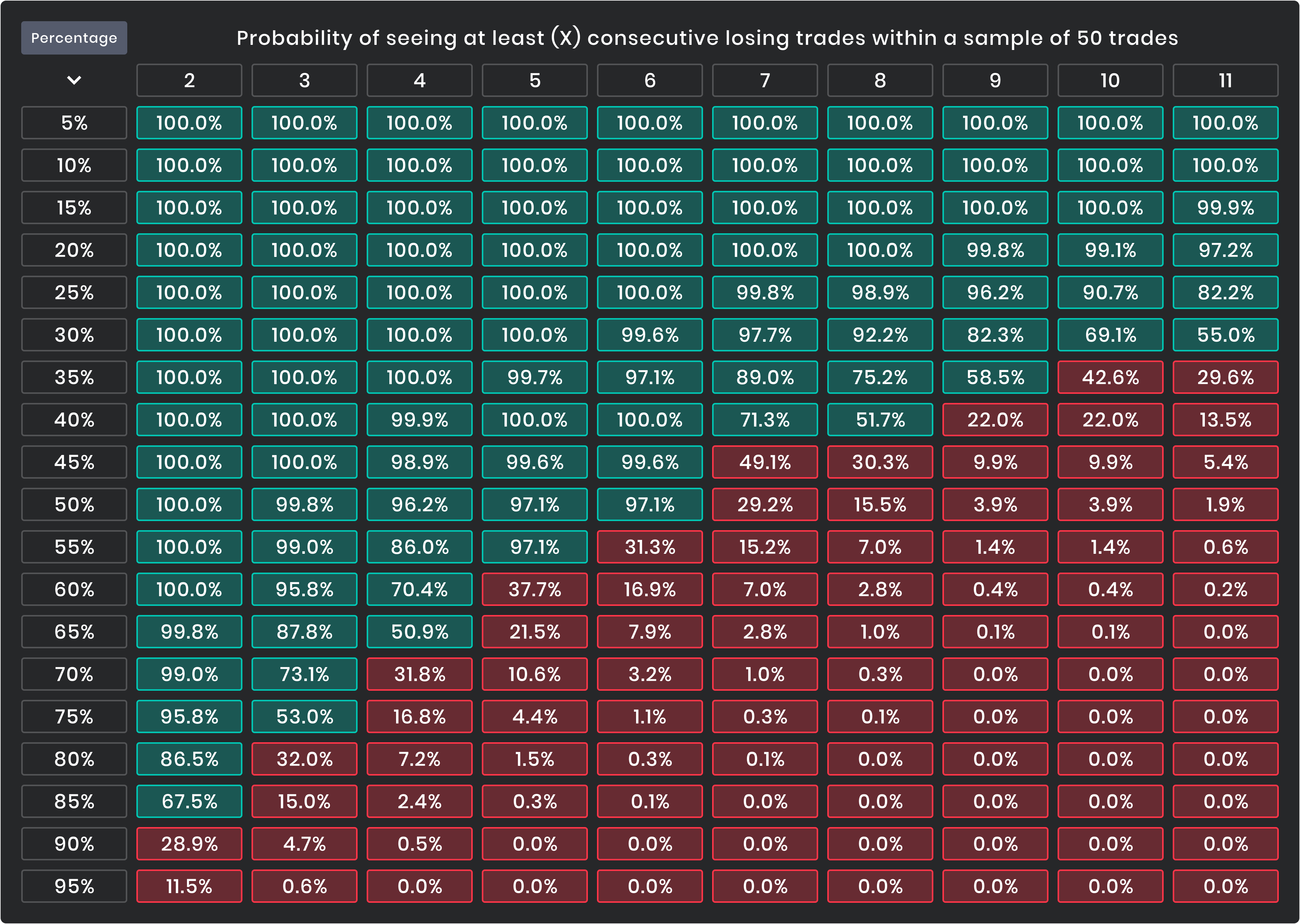

As you can see on the above table, if you have a trading strategy with a 60% probability win rate, there is still a 70% chance you will get four consecutive losses in a row.

But things can be even more drastic if you are the type of trader with a 40% win rate, there is over 50% chance that you will have 8 consecutive losers in a row.

Does that mean you cannot be profitable? Absolutely not!

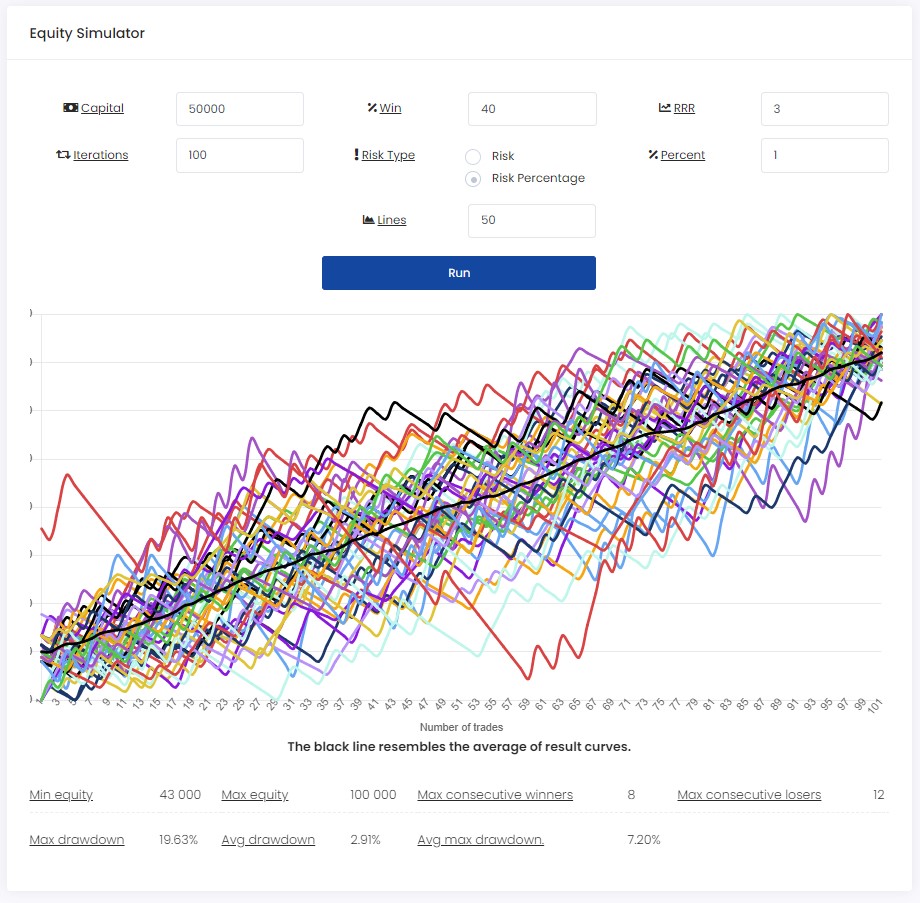

As you can see from our equity simulator, there is no single occasion from 50 different simulations that you would end up with a negative balance after 100 trades.

From all the projected simulations, the highest number of consecutive losses could be 12 and this brings an important question you should ask yourself: Are you able to sustain 12 losses in a row?

This is something you have to take into consideration when you are building your trade plan.

It is not an easy process, but once you are done with it, you will know exactly what to expect from your trading strategy.

Reward – Risk ratio

The last piece of the puzzle is the Reward to Risk ratio.

The reward to risk ratio simply tells you how much you win compared to your risk.

If you are taking the trade with a 3:1 reward to risk ratio, it means that for every $100 of your risk you aim the potential reward of $300.

This chart shows the sequence of 10 trades with a 50% of win rate and random distribution of wins and losses.

As you can see, although you have won only 50% of the times, you still ended up with a $10,000 gain.

In real trading, things are not always that easy as you might not get a fixed 3:1 reward to risk ratio for every trade.

In general, taking trades under the 1:1 reward to risk ratio can be quite tricky as you are essentially losing more than you are winning.

Because of that, your system would need to compensate for it with a very high win rate.

Another important factor with your risk to reward ratio which you have to realize is how you manage your winners.

If you are taking a trade with 2:1 R:R but you decide to close half of your position once you are at 1R profit and then you close the rest at 2R, your win is only 1.5R instead of 2.

To practice this notion, you take a trade with $200 risk and $400 gain, at $200 unrealized PnL you close half of your position which is $100, the rest of your position is closed at that 2R target but instead of $400, it is only $200.

As you can see you have won $300 instead of $400 which equals to a 1:5 reward to risk instead of the original 2.

This scaling out of trades can turn against you once you hit a streak of consecutive losses as your prior wins were not that significant.

Unexpected Risks

The last thing in the risk category are risks that very few traders think about.

These are risks that you really do not expect to happen, but they still can occur.

Unexpected news releases, gap risks with holding positions during the market close, internet disruptions in the middle of the trade, psychology and other factors can come to you at any time of the day.

That is why you should always be prepared for them and have a plan for what to do once they happen.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.