Multi-timeframe Range Strategy

The trading strategy we are about to describe is based on technical analysis using multiple timeframes. At the same time, it includes additional confirmation that helps to make entries more precise, leading to safer risk management. This strategy is suitable for traders who have experience with technical analysis and prefer to consider the timeframe for day trading.

This strategy combines range trading with multiple timeframes (multi-timeframe analysis). It is designed to maximize profits.

Range Trading Strategy

1. Trend Identification

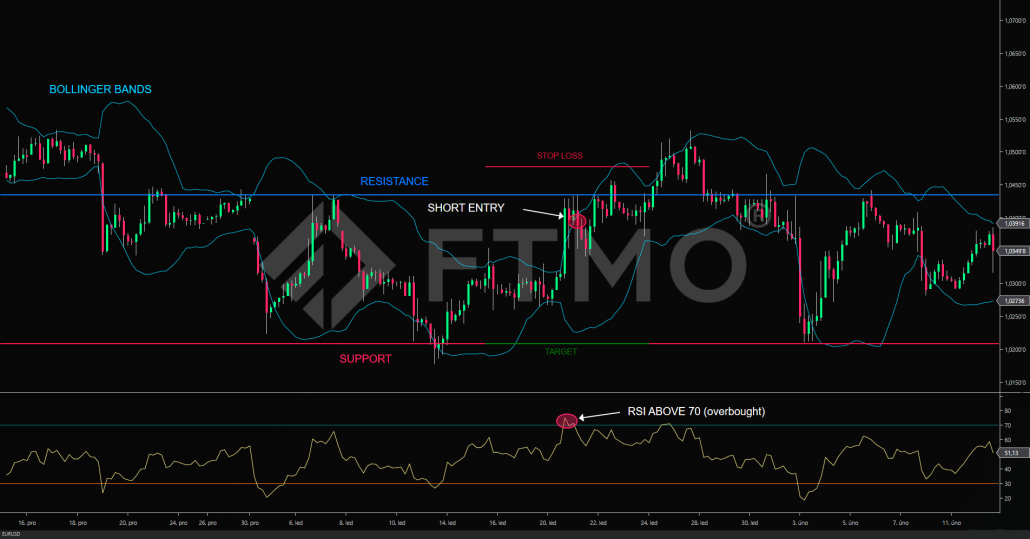

Higher timeframe (e.g., daily chart):

- - Draw key horizontal support and resistance levels where the price repeatedly reverses (swing high/swing low).

- - Determine the overall trend (e.g., using EMA 50 and EMA 200 moving averages).

2. Entry Strategy:

- - Buy (long): When the price reaches the lower boundary of the range (support) and RSI is below 30.

- - Sell (short): When the price reaches the upper boundary of the range (resistance) and RSI is above 70.

- - Additional confirmation from Bollinger Bands: If a price candle closes outside the band and immediately returns inside, it signals a potential reversal.

- - The entry position must be in the direction of the trend.

3. Stop-Loss and Take-Profit:

- - Stop-loss: Place just beyond the support/resistance level.

- - Take-profit: Target the opposite boundary of the range (e.g., from support to resistance).

4. Risk Management

- - Never risk more than 1–2% of your capital on a single trade.

- - Use a trailing stop-loss during strong price movements to secure profits.

Advantages of the Strategy

The key benefits of this strategy include its flexibility, high success rate due to multiple confirmations, and more precise risk optimization.

- Flexibility: Works with different time frames.

- High success rate: Combining multiple confirmations reduces false signals.

- Risk optimization: Multi-timeframe analysis ensures more accurate trade entries.

Disadvantages and Challenges

Like any strategy, this multi-timeframe approach may not be suitable for all traders. The main challenges or disadvantages include:

- Time-consuming: Requires monitoring three different timeframes.

- Complexity: A solid understanding of technical analysis and proper indicator interpretation is essential.

- Risk of false breakouts: Despite multiple confirmations, sudden price reversals back into the range can still occur.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations. FTMO companies do not act as a broker and do not accept any deposits. The offered technical solution for the FTMO platforms and data feed is powered by liquidity providers.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?