Loss limits must be watched by every trader

The loss limit rules are much more important to us than high yield, because they give us a picture of the client's ability to handle risk management. Even those who are able to achieve above-average returns need to be careful to follow them. Today's two FTMO Traders are proof of this.

Even if a client manages to achieve a very interesting return, one mistake can cost them an account and, in a worse case, their entire earnings too. The client doesn't even have to execute very large positions and can trade consistently. The Maximum Daily Loss rule may seem strict to some traders, but it makes sense. The FTMO clients in today's series on successful traders came dangerously close to this limit, but in the end, they managed to avoid unnecessary losses and notched up a very nice return.

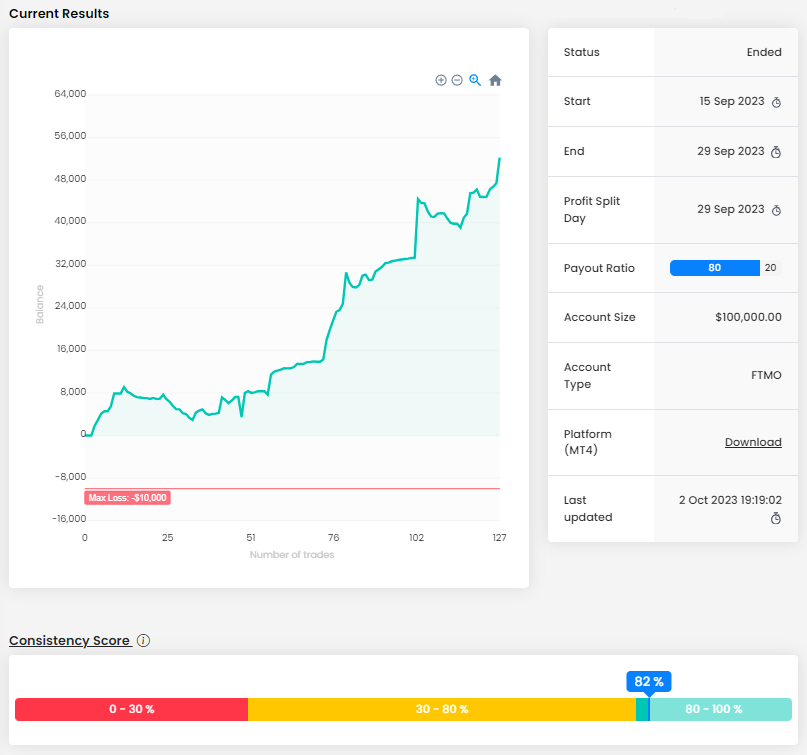

Our first trader's curve is a bit "bony", but the overall return is well above average. Although there were periods with longer and more pronounced drawdowns, he stayed in the green for virtually the entire trading period. The bonus then is the very good consistency of the trader.

The profit of $52,222 is truly impressive. Not just anyone can make 50% in two weeks, so hats off to this trader. The only minor problem is the very close approach to the Maximum Daily Loss limit (-4.93%), which threatened the trader twice, once at the beginning and once before the end of the trading period. Fortunately, the trader was able to recover from these losing streaks and in both cases eventually offset these losses with subsequent profitable trades.

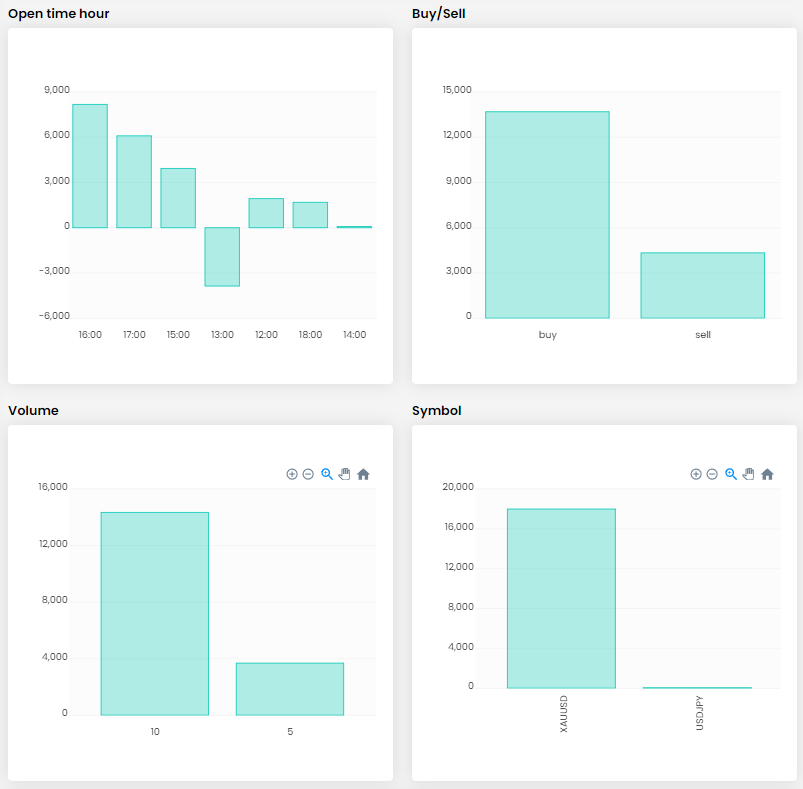

During the ten trading days, the trader opened 127 positions with a total size of 686 lots. This means an average of almost 5.5 lots per position, which is not much given the size of his account. Although the trader used to open multiple positions, the largest position was around 15 lots, even this is not a serious problem with the size of the account. The average RRR (1.73) and the high success rate (63.78%) only underline the correct risk and money management setup.

It is clear from the diary that he is a typical intraday trader who does not hold trades overnight and the longest trade lasted 9.5 hours. Together with multiple position openings, the trader then opened more than 12.5 positions per day, so he is a fairly active trader. Interestingly, the trader sets Take Profit much more often than Stop Loss. This is not a good way to manage risk, even though this is a trader who probably does not leave the trading platform "unattended".

Some trades where the trader closes a position only to open the same position on the same instrument and in the right direction a few seconds later are a bit incomprehensible. Perhaps his intention was to "lock in" at least some return, but this can be done in other ways that do not involve paying unnecessary extra commissions.

Another criticism may be opening positions at a loss, which is quite popular among traders. In one case, this approach was even the reason for unnecessary losses, which led to the aforementioned approach to the Maximum Daily Loss limit. This is also why we do not recommend this approach to our traders in the vast majority of cases.

The trader clearly favors the most popular instrument among FTMO clients, which is gold (XAUUSD). Due to the relatively strong downtrend in gold, sell positions prevailed, which ultimately made the trader a great success. On the first day of trading, he did try one position on the US100.-cash index, but the failure probably discouraged him from further trading on this instrument.

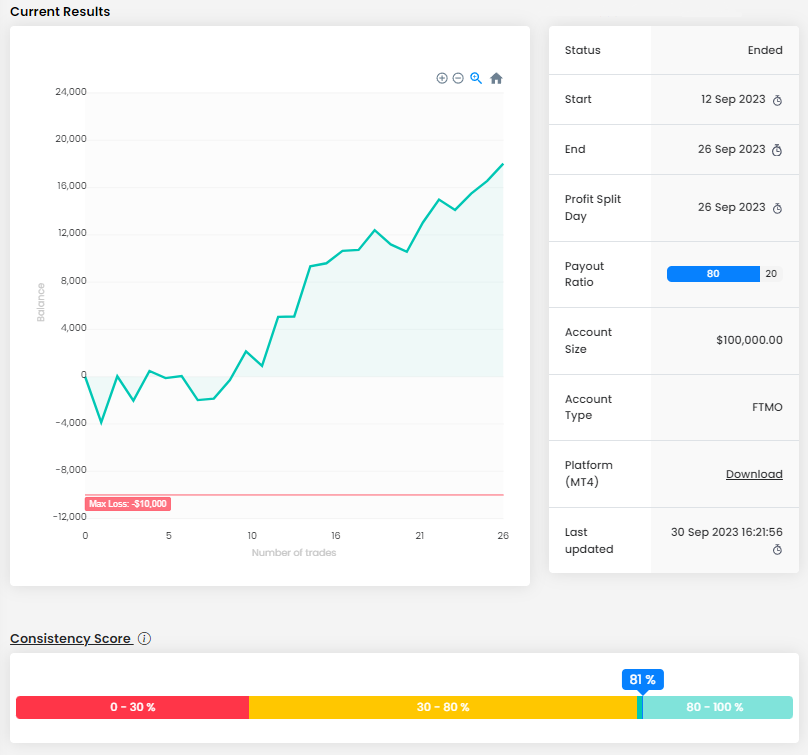

The second trader also had to face a significant loss right at the beginning of the trading period, but he was able to cope with the loss quite successfully. His balance curve is somehow not ideal at first glance either, but thanks to his consistent approach he ended up making a very interesting profit.

The profit of $18,025 is also very nice for an account size of $100,000, and the trader needed one fewer trading day than in the first case. Here too, the Maximum Daily Loss limit was in danger of being broken (-4.90%), but then the trader took care of his positions and the next trading days ended in the green. It can be said that this particular trade made it clear to him that risking 4% on one trade is not a good idea.

The trader opened 26 positions totaling 220 lots over nine trading days, which is less than 8.5 lots per position. Since the trader does not open multiple positions, this size is still okay in an account of $100,000. An average RRR of around 1 (1.09) is not great, but together with a high success rate (69.23%), it can lead to very good results.

Again, this is an intraday trader who holds trades for an even shorter period of time than our first trader. Even so, his total and average number of trades per day is much lower. On the positive side, we appreciate the effort to set stop losses on most positions, and the fact that losses never exceeded 2% of the account (except for the first day). The active approach is also evident from the fact that the trader often opens opposite positions immediately after closing a losing trade, which may smack of revenge trading, and some positions may have been closed early with small profits.

The journal clearly shows that the trades where the Take Profit was set, closed the position in profit, but quite far from the TP value. On the one hand, it can be said that the ends justify the means, so the main thing is the overall profit. On the other hand, it may be indicative of the impatience of the trader who is simply not willing to wait for a profit and prefers to close positions with a smaller profit than planned. However, we do not know the exact strategy of the trader, so we cannot accurately evaluate or criticize in this regard.

This trader was also primarily focused on gold (XAUUSD), but in his case buy positions prevailed. Making money with buy positions when half of the trading period is a steep downtrend is quite a feat. The trader was quite strict about position sizes, which certainly made it easier for him to enter the market. The time span in which he traded then gives the answer as to why the number of his positions is much smaller than the first trader.

The example of today's two successful traders shows that a trader does not need to open unnecessarily large positions or take unnecessary risks at first glance, and can still get dangerously close to the Maximum Daily Loss limit. Keep this in mind when you open your trades. Trade safe!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.