A high win rate is the foundation of success

In the next part of our series evaluating successful FTMO Accounts of our traders, we are looking at the performance of two traders whose biggest weapon in achieving above-average results was the win rate of their strategy.

Traders usually look at whether a strategy has a high win rate when building and testing a strategy, or they focus on a higher RRR and then the win rate doesn't matter as much. Of course, something different suits everyone, but when you combine an RRR of more than 1 with a high win rate of over 70%, then success is virtually guaranteed. And this is the case of the traders we will evaluate in today's part of our series.

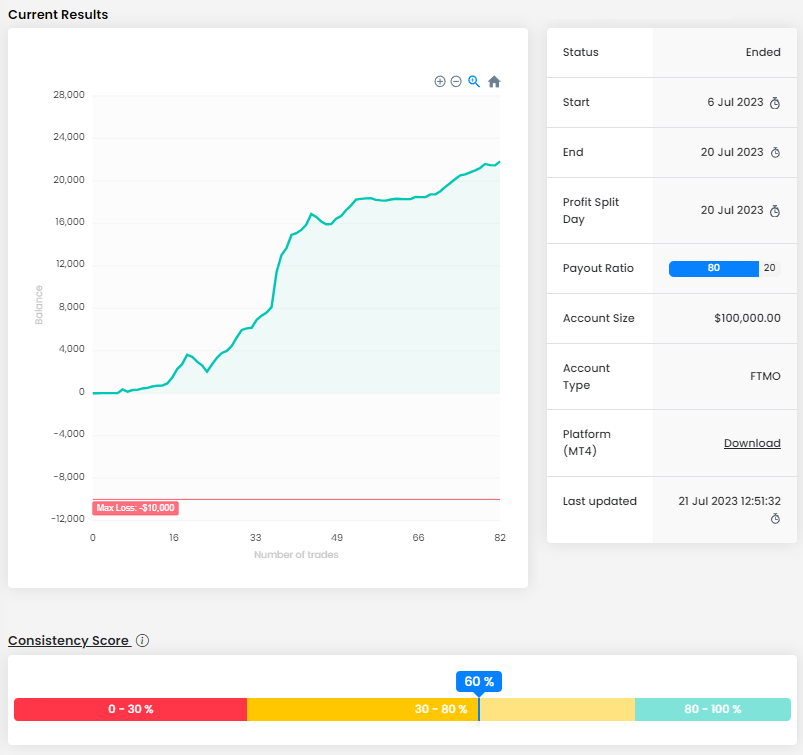

For the first trader, we can see an almost perfect balance curve, with only two slight fluctuations, which could in no way affect his result. The trader was in profit from the beginning of the trading period, which in most cases has a very positive impact in terms of psychology. You can see that the trader started slowly and did not overdo it with position sizes right from the beginning, which is only good.

In ten trading days, the trader made a total profit of nearly $22,000, which is a great result for an account size of $100,000. He didn't even come close to the Maximum Daily Loss or Maximum Loss limits during that time. This certainly also probably contributed to his mental state, as did the fact that only two days out of the ten ended in a loss.

The trader executed 82 trades with a total size of 97.78 lots, which is nearly 1.2 lots per trade. With an account size of $100,000, this means a very conservative approach, even if the trader opened multiple positions (which he didn't do very often). Combined with a good RRR (2.04) and an excellent trade win rate of almost 80%, the trader was able to earn almost 20% in a short period of time, even with this relatively conservative approach.

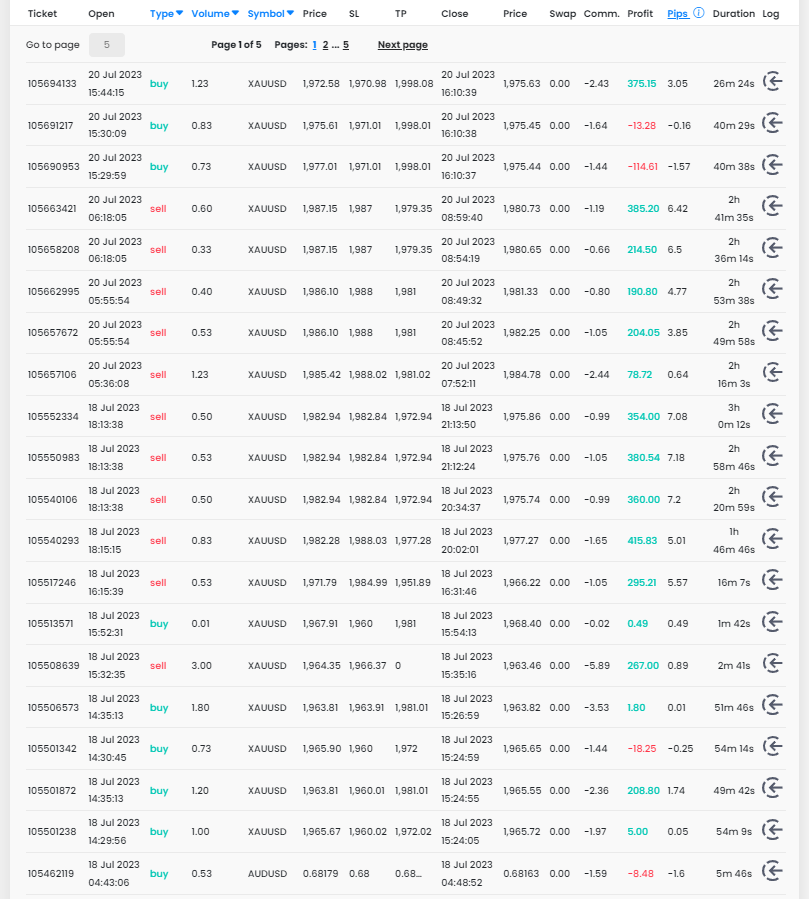

The journal shows that he is an intraday trader who usually does not keep positions open overnight. The exception was made on two positions, one of which he held for a day and a half and the other, a rather large one, he held for over two days, but both ended with good profits despite negative swaps. The shortest position was held for only a few minutes, which could be considered scalping. For all trades, even the shortest ones, the trader had a Stop Loss set, and in most cases, he also set a Profit Target, which we rate very positively.

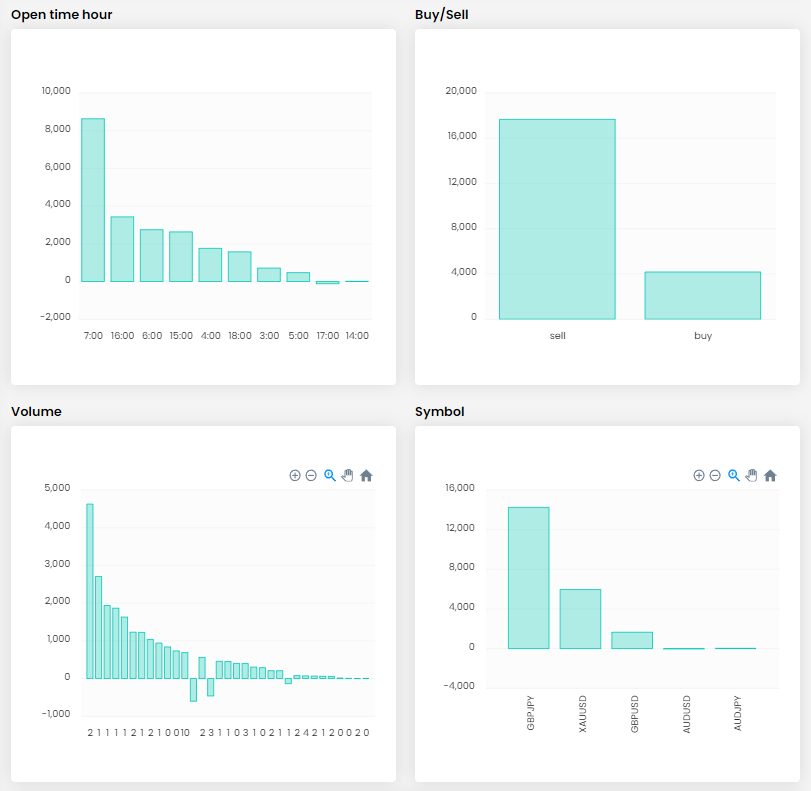

The trader traded both long and short positions, but he was much more successful when speculating on the decline of the instrument. The Trader's favorite instrument was gold (XAUUSD), which has long been one of the most traded symbols for FTMO Traders. The second most traded symbol was the currency pair GBPJPY, but in this case, there were only three trades divided into multiple positions. One of these trades was the one that the trader held for the two days in question. Patience clearly paid off in this regard.

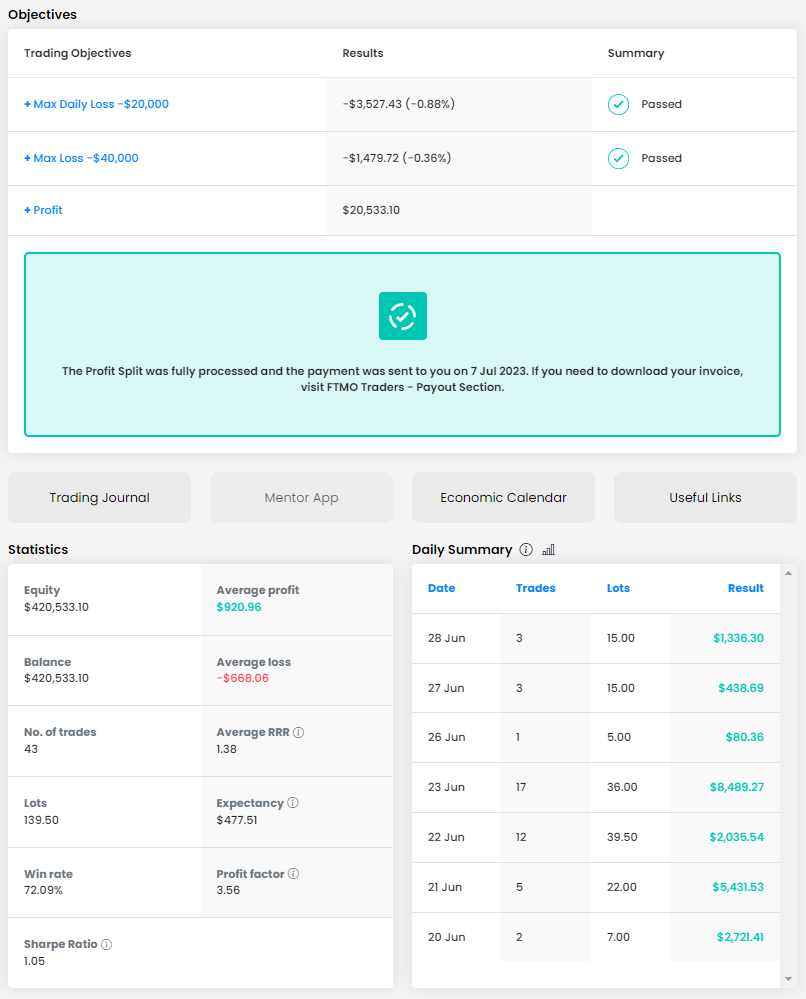

The balance curve of the second trader doesn't look so great anymore, but it is still true that every FTMO Trader would like to see a similar development of his FTMO Account. Again, the trader was in the green right from the beginning of the trading period and only scored one series of three trades in which he recorded a significant loss.

Although the profit of over $20,000 with an account size of USD 400,000 is not as impressive as in the previous case, it should be taken into account that the trader achieved it in just 7 days, and none of these days ended in a loss. The second trader did record a lower RRR (1.38) and had a lower success rate (still a great 72.09%), but it required fewer trades for him to achieve a similar result in absolute terms.

This is also due to the larger open positions, a total of 139.5 lots for 43 trades, or 3.2 lots per trade. As in the previous case, this is a rather conservative approach given the size of the account. For completeness, it can only be added that the second trader did not have a problem with the Maximum Daily Loss and Maximum Loss limits either.

The trader opened positions ranging from two to five lots, and only rarely opened more positions in one trade, which only confirms his conservative approach. When a trader does not feel the need to risk large positions to make good profits, again this can have a very positive effect on his psychological setup. This is because he risks a small percentage on each position and is aware that even a longer series of losses cannot put his account in any significant danger.

In this case, the trader recorded a maximum loss per trade of only $1,550, which is less than 0.4% of the account, and the trader can feel very comfortable with that. Given that the trader held his positions for a very short period of time, his profitable trades are not staggeringly high either, but it was enough for an above-average result. Again, we commend the placement of stop losses on most positions.

Also, for this trader, the most popular instrument was gold (XAUUSD), on which the trader opened the vast majority of trades, and the currency pair GBPJPY was also a success here, for which the trader opened three trades. And to make the similarity between accounts even less obvious, this trader was also much more successful in opening short positions.

Today's examples of traders’ performance clearly show that to achieve an exceptional result, a trader does not have to open extremely large positions which could result in unnecessarily large losses every time. A conservative approach, combined with a good strategy that can generate a sufficient number of profitable trades, can provide the trader with the necessary psychological state of mind which can help to achieve very good results.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.