How to develop a scalping strategy

Scalping is a trading strategy that involves buying or selling securities with the aim of profiting from small price movements in a short amount of time. This strategy requires traders to make multiple trades throughout the day, taking advantage of small price fluctuations in the market. While scalping can be profitable, it is also risky and requires good discipline, a reliable strategy, and a thorough understanding of the market.

Here are some tips with visual explanations on how to trade using a scalping strategy:

Choose liquid markets

Scalping is most effective in highly liquid markets, and most of the time high liquidity markets are tied with specific market sessions. An example could be the market opening of the New York Stock Exchange when traders and investors begin the trading session. This is because the high trading volume in these markets ensures that price movements are frequent, making it easier to take advantage of them. Additionally, most modern prop firms/brokers or trading platforms have commission-free trading on indices and that is an advantage you can utilize for your benefit.

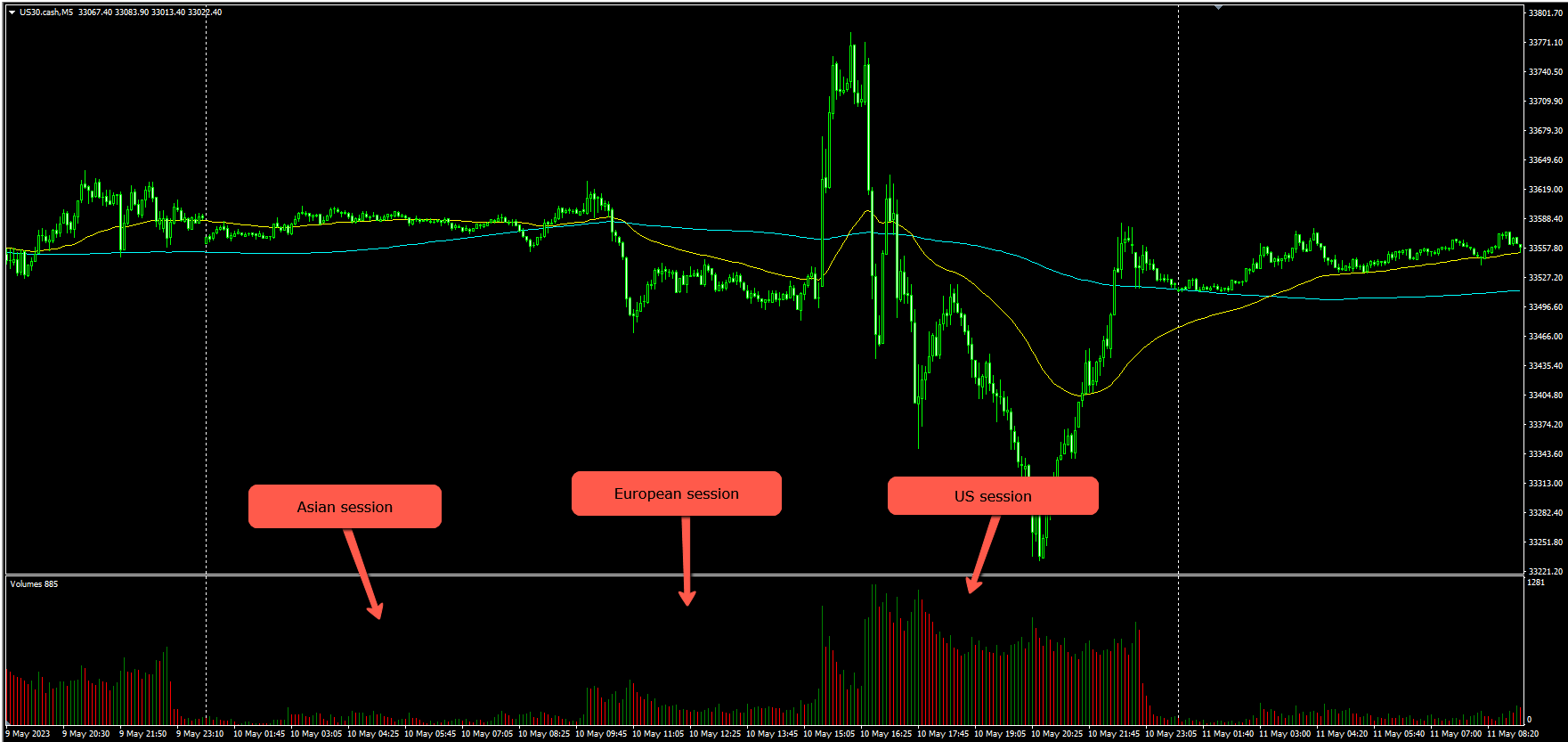

Example: Liquidity in terms of volume can be perfectly illustrated by the picture of the chart below. Instrument: US30.cash

Use a reliable platform

Scalping requires quick execution of trades, which means you need a reliable trading platform that can handle high-speed trades. Choose a platform that offers fast order execution, low latency, and a user-friendly interface. One of the most popular trading platforms is MT4/MT5 developed by Metaquotes. MT4/MT5 is one of the oldest trading platforms available on the market and its high popularity is undoubtedly also due to the fact that it is coded in such a simple programing language that it can offer high operation speed, as well as a straightforward user interface. If you are more familiar with advanced trading platforms, you may also utilize the cTrader (Spotware) which in terms of performance is very similar to the MetaTrader platform.

Set Take Profit and Stop Loss orders

It's important to set a Take Profit and a Stop Loss order for each trade. This will help you minimize losses and take profits before the market reverses. As a scalper, you should aim to make small profits consistently throughout the day, rather than trying to make big gains from a single trade. Different traders have different settings for their SLs and TPs. To define your “exits”, you need to justify them. If you are just beginning with scalping, you may use predefined SL/TP levels.

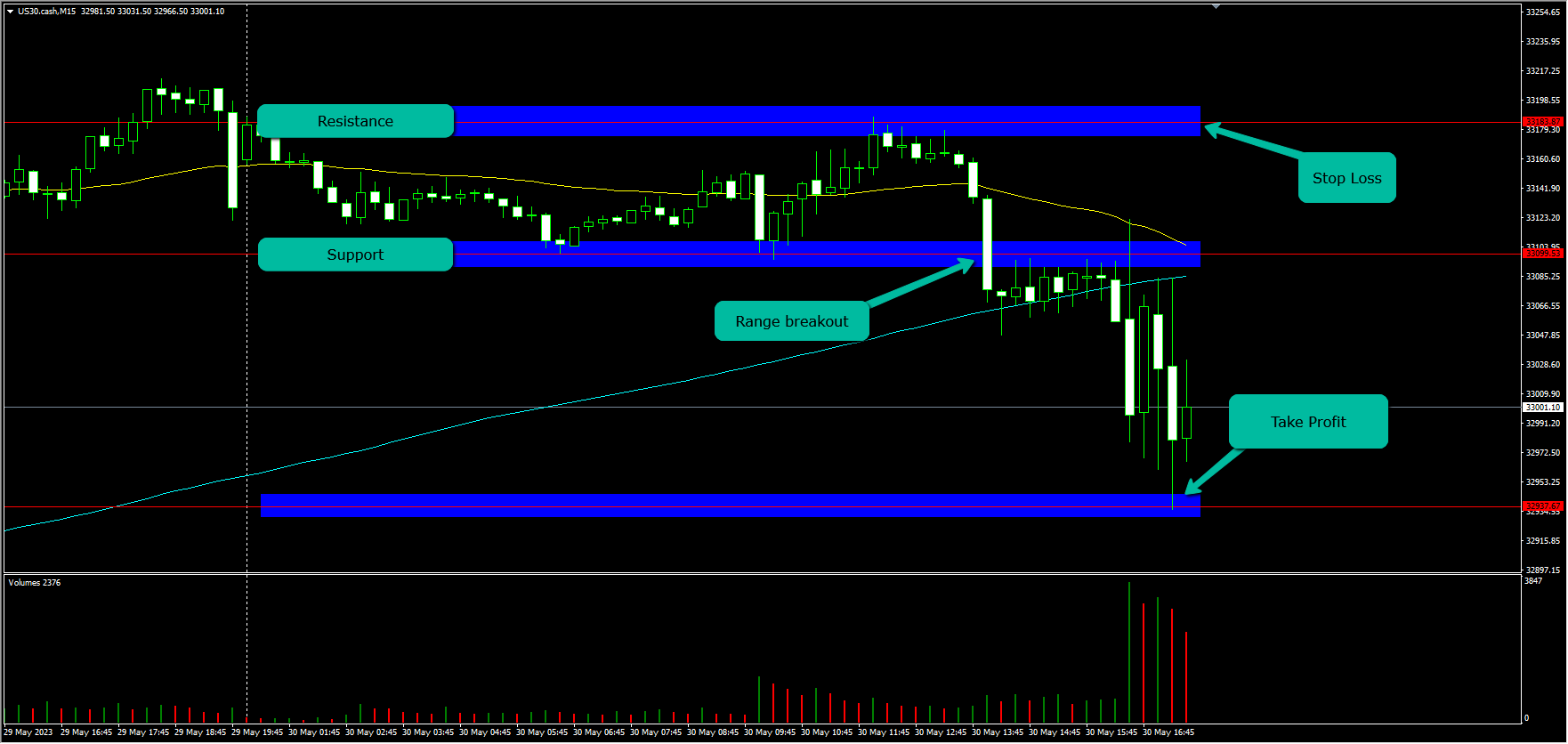

Example: My trading strategy is based on Support and Resistance levels and entries are at the breakout from the range. Stop Loss is at the nearest resistance level (80 points) and Take Profit is twice as big as the Stop Loss in the absolute value (160 points).

Use technical analysis

Technical analysis is a crucial aspect of scalping. Use indicators such as moving averages, Bollinger Bands, and RSI to identify short-term trends and price movements. This will help you make quick and informed trading decisions.

Example: If we have a look at the previous example, the range breakout would not be fully confirmed because the volume in the market is not at the ideal level. Therefore, the entry would be refined as per the picture below.

Stay informed

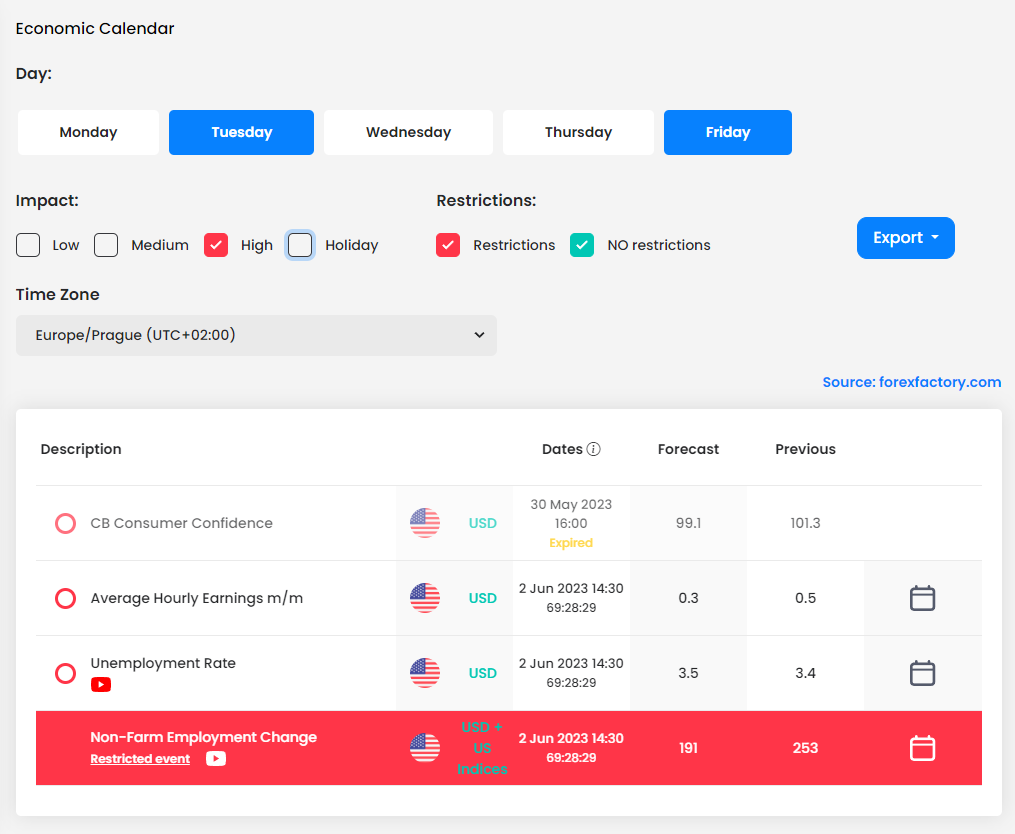

Stay up to date with market news and events that can affect the securities you are trading. This will help you anticipate price movements and adjust your trading strategy accordingly. Generally, when you are scalping, you may want to avoid high-impact news as the volatility along with potentially wider spread can trigger your Stop Losses more often than your Take Profits. However, for the higher time frame bias and direction, high-impact news is a great indicator.

Example: Non-farm payrolls in USA is one of the major high-impact news that triggers high volatility.

Manage risk

Scalping is a high-risk strategy, so it's important to manage your risk carefully. Use a strict risk management plan, such as a maximum percentage of your account per trade or a maximum number of trades per day. Don't chase losses or let emotions cloud your judgment. Some may use SL/TP values in terms of money, others tend to set their SL/TP according to the percentage of their account. However, it is important to note that the percentage risks on your live accounts can differ from the accounts provided by modern prop firms.

Example: In a live account, you are allowed to risk more as there is no set rule for the maximum daily drawdown. On the other hand, accounts from modern prop firms have maximum daily loss limits that force you to set Stop Losses accordingly. Moreover, Max Loss limits can even limit you for the trading account, therefore, you may want to risk less so that you do not lose the account and allow room for potential consecutive losses.

Practice and refine your strategy

Like any trading strategy, scalping requires practice and refinement. Start with a demo account to practice your strategy and fine-tune it before risking real money. Keep track of your trades and analyse your results to identify areas for improvement.

Here are a few other examples of scalping strategies

Scalping with Moving Averages: In this approach, traders use multiple moving averages to identify short-term trends and trade in the direction of the prevailing trend. When a shorter-term moving average crosses above a longer-term moving average, it may indicate a buying opportunity, and vice versa for sell signals.

Scalping with the Order Flow: This strategy involves monitoring the order flow data, such as bid-ask spreads, order book depth, and volume, to identify short-term imbalances in buying and selling pressure. Traders look for opportunities to enter trades when there is a sudden surge in buying or selling activity.

It's worth noting that scalping requires a high level of skill, experience, and discipline. It also demands quick decision-making and the ability to manage risks effectively, as the profit margins per trade are typically small. Moreover, scalping often requires access to advanced trading platforms that offer fast execution and low latency to capitalize on short-term price movements.

Keep in mind that scalping may not be suitable for all traders. It requires active monitoring of the market and can be mentally demanding. Additionally, transaction costs, such as spreads and commissions, can have a significant impact on scalping profits, so traders need to consider these factors as well.

In conclusion, scalping can be a profitable trading strategy if executed properly. To succeed as a scalper, you need discipline, strategy, and a thorough understanding of the market just as you would need for an intra-day or swing trading. Continuously refine your strategy to improve your chances of success and remember that scalping is a high-risk strategy, so manage your risk carefully and don't let emotions cloud your judgement.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.