Don't be afraid to make a good profit

Cut your losses and let your profits run. We started with this famous rule in our last article in our Series on successful traders. Today, however, we're going to look at how traders can leave their profits on the table due to impatience and exiting the market too soon.

Sometimes it seems like some traders are afraid to make a profit. Instead of letting their trades run out at the pre-set take profit, they close their trades early. They unnecessarily deprive themselves of part of their profits. In the last part, we described the opposite phenomenon, where a trader sometimes unnecessarily held a trade open when he could have already taken a profit with an RRR of 4:1. Instead, he took a much smaller profit and then opened several more unnecessary trades, on which he lost more money.

In today's article, we will look at a trader who did not set his TPs badly at all, but due to impatience sometimes unnecessarily realised profits much earlier than necessary. At the same time, we have to admit that this is not an explicit mistake, because it is still true that even a small profit is a profit. Indeed, for some traders, it is more beneficial in terms of their psychological well-being to realise a smaller profit and be calm, rather than stressing out in anticipation of further developments and a possible trend reversal.

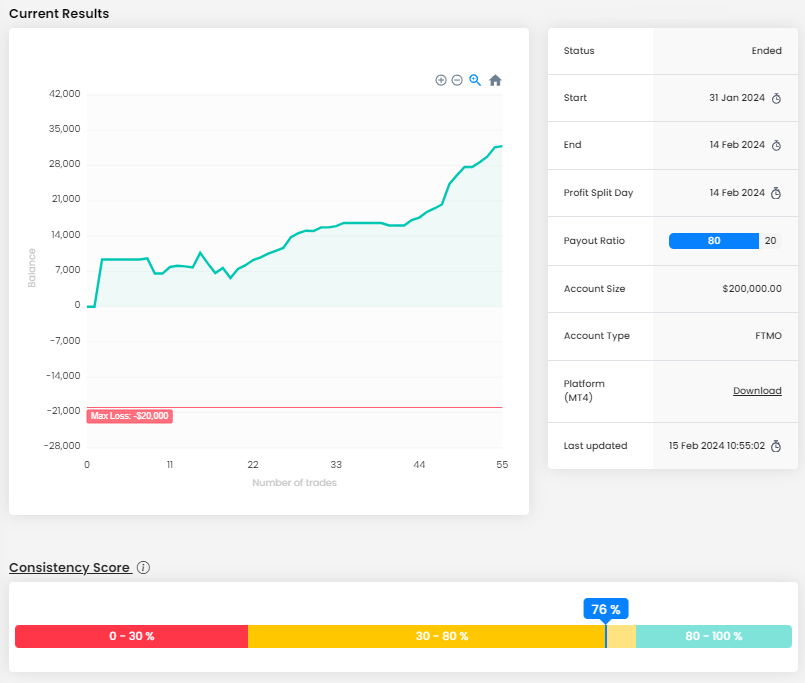

The trader's balance curve doesn't look ideal, but it was in profit throughout the trading period and the trader avoided any significant drops. As a result, he had no problem at all with the Maximum Loss or Maximum Daily Loss limits. With a consistency score of 76%, the trader then made a profit of nearly $32,000 in the trading period, which is over 15% on an account size of $200,000.

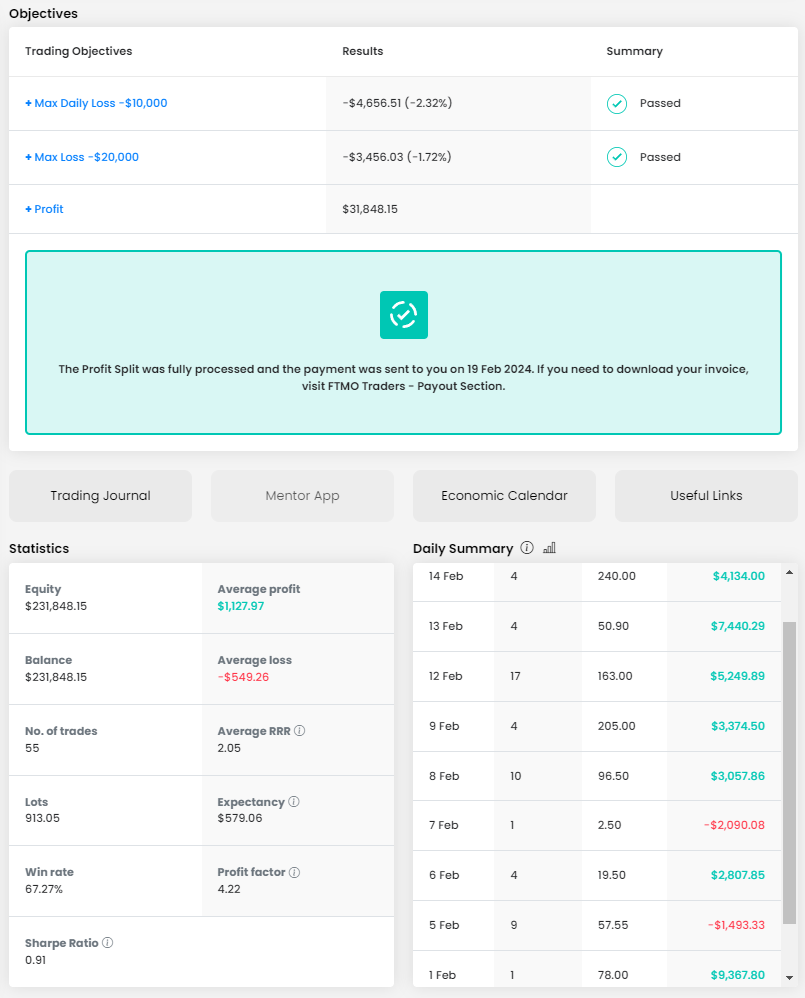

The trader opened 55 positions with a total size of 913.05 lots, which represents over 16 lots per position. With an account size of $200,000, this is fine. Some positions, especially on the DJIA index (US30.cash) were much higher and reached a size of over 100 lots, which is indeed a lot, but it can still be accepted.

The average RRR was over 1:2, which is very good and combined with a success rate of over 60%, we cannot be surprised that the trader made a profit of over $30,000 in 10 trading days.

Looking at the trading journal, we can see that the trader opened the mentioned larger positions at the end of the trading period when he had already "made money", but even so, we would not recommend taking such high risk to traders. Coming in at the end of a trading period and taking a larger portion of the profit just because you feel you can afford it is not a wise thing to do. Plus, it can unnecessarily erode your mental well-being on other accounts.

The trader could be classified somewhere between a scalper and an intraday trader, usually holding his positions from a few tens of minutes to several hours. Only rarely has he held a position open for more than a day. We have a positive view on the placing of Stop Losses on most open positions. The trader was able to keep his losses in check, so that only in two cases did he lose more than one percent on a losing trade, which indicates good risk management.

The trader opened most of his positions on the US DJIA index (US30.cash), on which he recorded the largest profit. In addition, he traded gold quite often, where he also did quite well. On the USDJPY and EURJPY currency pairs, he opened only three trades in total. The trader's ratio between sell and buy orders is quite balanced, so it is clear that he has no preferences in this direction.

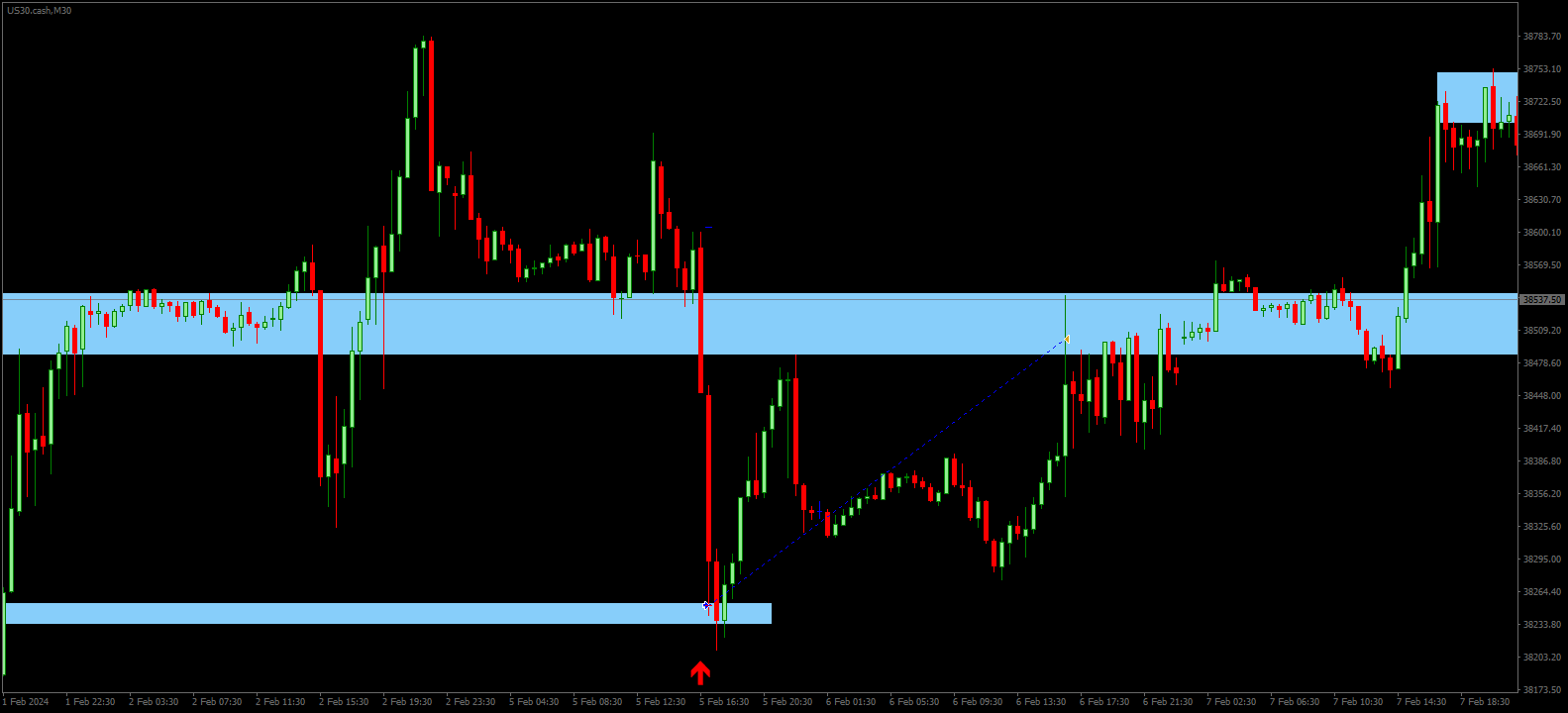

In the picture below, we see the first sell position opened by a trader at the beginning of February. It was his second trade and from the looks of the chart, he was probably speculating on a price bounce off the resistance level. This had been support two days before, but the DJIA had dropped significantly in late January (after the Fed press conference following the interest rate announcement). Support then became resistance, at which the trader placed a pending sell limit order. This was a bit risky as it was just before the announcement of the Purchasing Managers' Index from ISM. In the end, his trade worked out great, the Stop Loss was not hit and prices practically bounced off the Take Profit.

Another trade, this time a buy, was done by the trader at the same price. Again, the price rose and then fell, with the trader counting on the price bouncing off the support that had been resistance a few days before. The trader did set a TP on the last short-term swing, but in the end it didn't last, and he exited the trade almost as soon as the price reached the resistance level. He secured a nice profit, but missed out on one third of his profit.

Even in the third trade, the trader set a good SL and TP, but eventually exited after a few minutes. His entry was practically ideal and if he had not exited so unnecessarily early, his profit on this trade could have been triple. He was probably counting on the previous low being a new local resistance level and prices reversing, but it was more of a rash move.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.