Greed doesn't always pay off

Cut your losses and let your profits run. One of the basic rules of investors and traders, which allows patient and disciplined traders to make more profits than others. Sometimes, however, the exaggerated desire for the highest returns may not pay off.

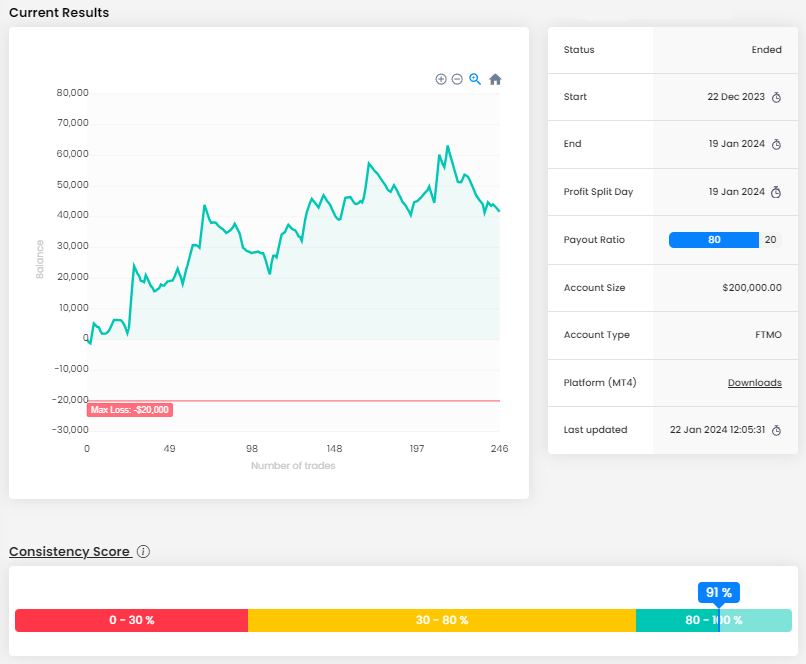

This is also the case of today's trader, who managed to hold positions with the goal of maximum profit, but in some cases it did not pay off and unnecessarily deprived himself of more profits. The trader's balance curve does not look perfect at first glance, and the trader did not avoid several losing streaks.

But the end result is very good. A profit of over $41,000 is not seen often, and even with an account size of $200,000 it is an above average result. If it wasn't for the last few days, where the trader made some unnecessary mistakes, the profit could have been even bigger. As we have already mentioned, the trader did not avoid losing streaks, and in one of them he came quite dangerously close to the Maximum Daily Loss limit.

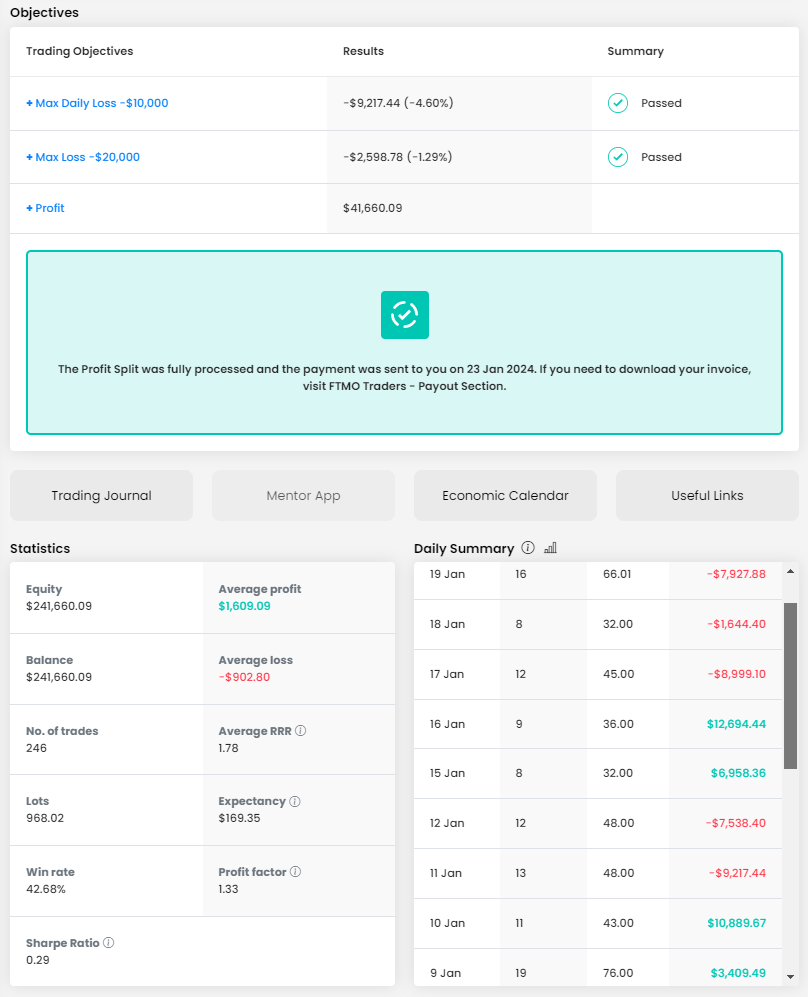

Eventually, he managed to recover from this, helped by good consistency of results and a good RRR (1.78). Thanks to this, he was able to make a high profit even with a relatively low success rate (42.68%). He executed 246 trades with a total volume of 968.02 lots, which means an average of 3.9 lots per trade.

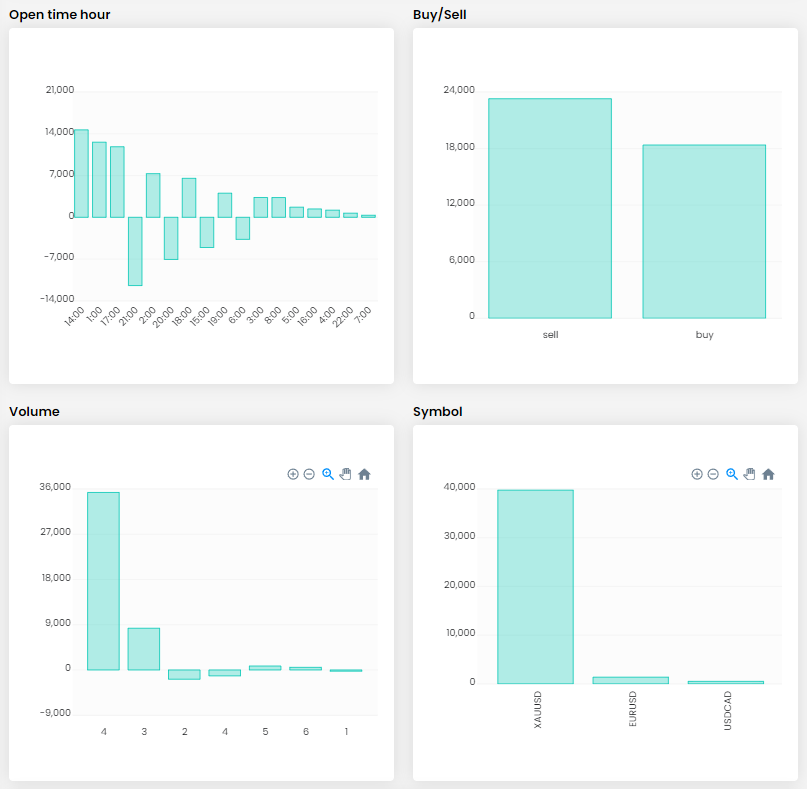

This is not that much for this account size, but in some cases the trader opened additional positions. Reasonable trade management of 12 lots on XAUUSD can be problematic, so we do not recommend such large positions as a matter of principle. Of the 19 days in which the trader executed his trades, he ended up with a loss in eight cases. Considering the final result, this is quite interesting.

The trading journal shows that the trader set a Stop Loss on all his open positions, for which we commend him. On the other hand, he didn't bother much with Take Profits, so he closed his positions manually. For scalpers this approach is quite understandable, but in this case it is not a typical scalper.

The trader holds positions for several hours. While it is true that he did not hold any position overnight in a given trading period, it must be quite exhausting to watch an open position for several hours in order to close it with a good profit. In our examples, we will show you, that this can end up costing the trader the profits he leaves unnecessarily in the market.

This Trader mainly focused on gold, which is generally very popular among FTMO Traders. With the exception of five trades (EURUSD and USDCAD), he opened all his positions on this instrument. Some people may lack diversification, but on the other hand, this allows him to focus on an instrument he really understands. The ratio between sell and buy positions is balanced, and the trader took advantage of all opportunities to enter the market.

Looking at some of the trader's positions, we can say something about the aforementioned desire for the highest possible returns. On the morning of January 19th, the trader opened two positions in the uptrend after a short swing downwards. It looks like a good trade that could ideally have ended (with the assumed SL below the last low) with a very good profit of $6,800 with an RRR of 4:1.

Unfortunately, the trader was probably too greedy or simply didn't manage to close the trade in time. After all, the price action at the time was influenced by macro data from the US regarding consumer confidence and partly the housing market. His gains were "only" $1,624 and $1,704 respectively, which probably represents an RRR of 1:1 to 1.4:1.

This in itself may not be a problem if the trader had not opened another trade when the price was in a steep decline. He then recorded his biggest loss of the trading period on it. Immediately after the close, the trader opened two more positions, on which he set a much tighter SL and again ended up in a loss.

After that, the trader opened four more positions, which could be considered a classic case of "revenge trading". In the first two, unfortunately, the trader did not even keep his Stop Loss set, which means further unnecessary losses. From the original trade, which could have ended with a very nice profit, the trader ended up with a loss of over two thousand USD.

We can also have a look at the trader's best trade. The trader waited in an uptrend for the market to "break structure" and then entered three long positions. He closed them with an average RRR of around 4:1 and a total profit of nearly $17,800. The only problem with this trade was that it was opened on 27 December, a period when trading is not recommended due to the lower liquidity in the markets. But it was a nice belated Christmas present anyway.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of the article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.