How can you improve your Stop Loss and Take Profit?

Are you in the process of backtesting your strategy and want your SL and TP values to match your trading style and strategy as closely as possible? Or do you feel that your SL and TP values are not optimal and your profits are unnecessarily "left on the table"? Then you should focus on the Maximum Adverse Excursion and Maximum Favorable Excursion values.

Backtesting a strategy is an essential part of creating a trading strategy for any serious Forex trader. Without backtesting, a trader cannot estimate how his strategy will work in the long term and what potential returns he can expect (if he follows it).

It is also important to optimize the Stop Loss and Take Profit values, which can be very helpful with the Maximum Adverse Excursion and Maximum Favorable Excursion.

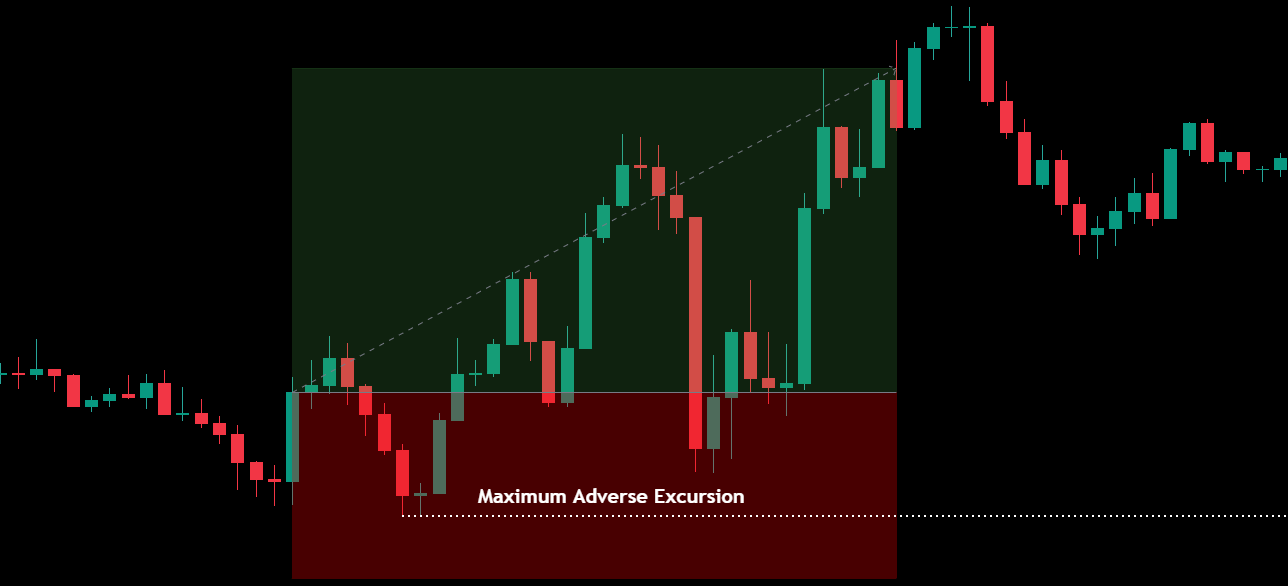

Maximum Adverse Excursion

Maximum Adverse Excursion is simply the level of loss an open position will fall into if it ends up in profit. In backtesting, it is a very useful tool that can help the trader to determine the appropriate Stop Loss at such a level. If a trader decides to backtest his strategy, he should definitely think about how and where he will place his SL.

Losses must be taken into account, as well as the fact that even profitable trades do not always move in the direction the trader wants. If a trader sets his Stop Loss too tight, the number of losing trades may be unnecessarily high. On the other hand, if he sets his Stop Loss too conservatively, he may find that his trades (with a reasonable RRR) do not end up at Take Profit as often as he would like.

Don't underestimate the volume of data

It is the MAE data that is useful for a trader to figure out what levels are suitable for his strategy and then he can adjust them. However, MAE is also useful for traders who keep a trading journal and want to optimize their strategy after a certain period of time. At the same time, in order for the values to be meaningful, the data sample must be as large as possible to avoid data bias and to make it clear how the strategy reacts to different market conditions. This is true both in the case of backtesting and the trading diary.

Suppose that after entering your trades did not always go in the direction you wanted, but were in a losing position for some time. Below are a series of numbers representing the MAE levels that the price reached during the period of the profitable trades (zero means the trade was successful and the price did not turn negative during the course of the trade):

15; 23; 18; 16; 0; 11; 31; 17; 8; 0; 19; 26; 0; 38; 22; 13; 16; 21; 24; 11; 14; 23; 4; 0; 7;

Better SL and TP value

Ideally, after analyzing a large enough sample of data (we do not consider the numbers listed above to be such a sample), you may be able to adjust your original SL in such a way that you can increase the size of your positions while keeping the risk percentage unchanged. So with an unchanged RRR you may end up with a profit much more often, or you may increase your RRR even further, ensuring a larger profit in absolute terms on each trade.

If a trader had set the SL in his original strategy (RRR at level 2) at 35 points and now counts on SL at 25 points, he will have 4 losing trades instead of 1, but at the same time, he will reduce the number of points needed to make a profit to 50. This can increase his probability of winning again. Alternatively, he can leave the TP at 70 points and his RRR increases to 2.8, significantly increasing his profit. With a risk of $250 and a profit of $500, his total result from profitable trades will be $11,750 in the first case and $13,700 in the second case.

Better entry position

Another option is to move the entry against the direction of your trade. Then, when you get a signal to enter a long position, you can enter a buy limit order a few pips below the level of the entry you were originally considering. This allows you to move your stop loss to a safer level, increasing your chances of reaching TP, while again allowing you to set a higher RRR.

So, if a trader sets a buy limit 10 pips against the direction of his trade (10 pips below the original entry on a long position and vice versa) when on the entry signal he would only execute 18 trades instead of 25. However, he could also set the Stop Loss to 20 points and at the original TP value (which now changes to 80 points) his RRR would increase to 4. Thus, with the same dollar risk, his total result from profitable trades would rise to $18,000.

So you might end up missing out on a few good trades that could lead to profits, but remember the old rule "it's better not to be in a profitable trade than to be in a losing trade". Ultimately, you will avoid a few losing trades and the profitable trades can end up with a much higher absolute profit at the same time. This can significantly increase your self-esteem and psychological well-being. And that's what we all want.

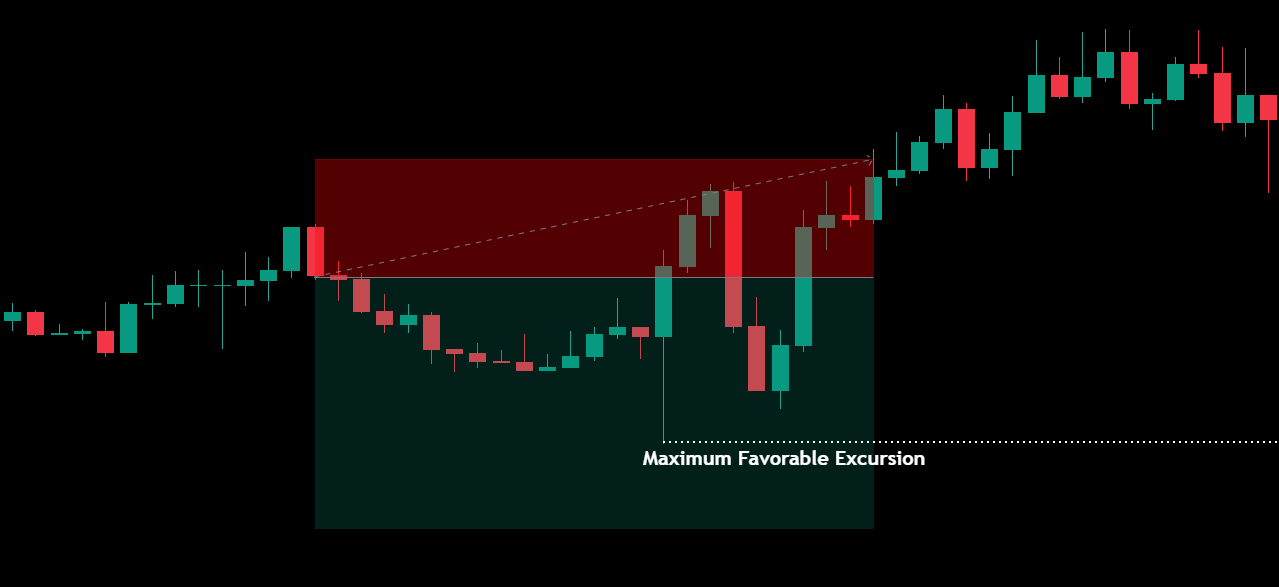

Maximum Favorable Excursion

Maximum Favorable Excursion shows the trader what maximum profit he could have made on each trade. As with MEA, this tool is useful for both backtesting and optimizing the trader's strategy. Based on the measured and analyzed data, the trader can then see whether he is setting his Take Profits too low and leaving a large portion of potential returns in the market. Alternatively, the data may show him that his TP is unnecessarily far away and for many losing trades a better setting could mean a profitable trade.

Combined with a properly set MAE level, a trader can then refine his strategy and significantly increase his RRR without increasing the number of his losing trades. On the other hand, he may find that a lower RRR setting is more beneficial to his trading strategy but results in a much higher success rate. This, in turn, can have a positive impact on the trader's psychology, which is essential for long-term success.

There are certainly many ways to use MAE and MFE in your trading and you need to spend some time on it. However, ultimately this will prove to be a very good investment that can steer your trading in the right direction to ensure your results are the best and most consistent possible.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.