Use the power of currencies to your advantage

When opening positions in forex, we make decisions based on various criteria and factors. In addition to traditional ways such as using price action or various indicators, identifying strong and weak currencies can also help us. But how can we identify a strong or weak currency?

Currency pair trading is specific in that within one investment instrument, we have two currencies, where the value of one currency is quoted against the value of the other currency. For example, the currency pair USDJPY represents the value of the US Dollar in Japanese Yen. The EURUSD pair in turn represents the value of the Euro in US Dollars.

Two instruments in one

By opening one position, we speculate on the strengthening of one currency and/or the weakening of the other. When we speculate on the strengthening of one currency, it does not necessarily mean that the other one must depreciate. In fact, when we open a long position in, for example, the EURUSD pair, it may mean that we are speculating on the Euro strengthening, but the Dollar may not be weakening relative to other currencies. Or we may speculate on the Dollar weakening in this position, but that does not necessarily mean that the Euro will strengthen against other currencies.

The strengthening or weakening of an individual currency depends on many factors, but we cannot clearly read the strength or weakness of a currency (for example, the Euro in the EURUSD pair) from one currency pair. It is true that currently, investors can determine the strength of individual currencies by using currency indices, which are available for all major currencies. However, these indices are not available in the trading platforms of mainstream brokers. One way to do this, then, may be to use so-called heatmaps. These graphically show the relative strength of individual currencies against each other, or the relative performance of individual pairs on different time frames.

How to find a strong and weak currency?

Another way may be to compare several currency pairs in which a particular currency occurs and determine its current strength or weakness accordingly. This will allow us to pick out currencies (and it doesn't have to be just the so called "major" currencies) that have the potential to rise and combined with simple price action, this can help us in our decision making.

A strong currency that strengthens against most currencies in the market has the potential to grow further, while a weak currency may tend to weaken more significantly. Or conversely, if a strong currency has had a longer uptrend relative to most other currencies, this may be a sign of overvaluation, and we can look for signals indicating a trend reversal. If we can find one potentially strong and one potentially weak currency, this may be an interesting investment opportunity.

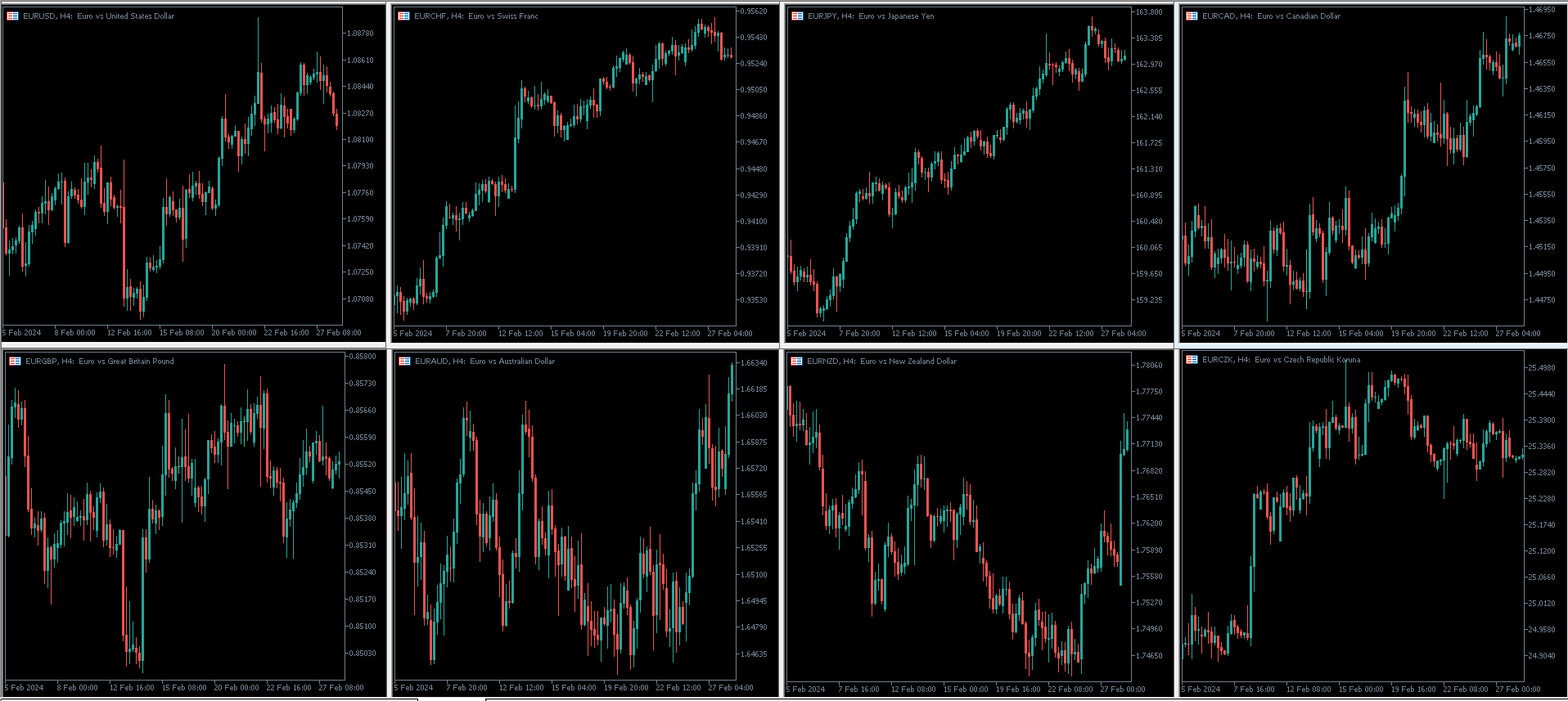

In the picture below, we have several currency pairs whose common currency is the Euro. These are the Euro pairs with all the major currencies on the four-hour (H4) charts, and we have added the EURCZK pair for reference. The advantage in this case is the fact that the Euro is the base currency in all cases (it comes first in the pair), so it is clear when the Euro is rising and when it is weakening compared to the other currencies. On the CHF and JPY pairs the EUR is in a fairly strong trend, on the USD pair it looks like an end to this strong trend and a possible reversal. On the CAD pairs, it is more the start of a stronger trend that could last for a longer period of time and the EUR is in a similar position on the pair with NZD (and possibly AUD), where a reversal of the downtrend could occur.

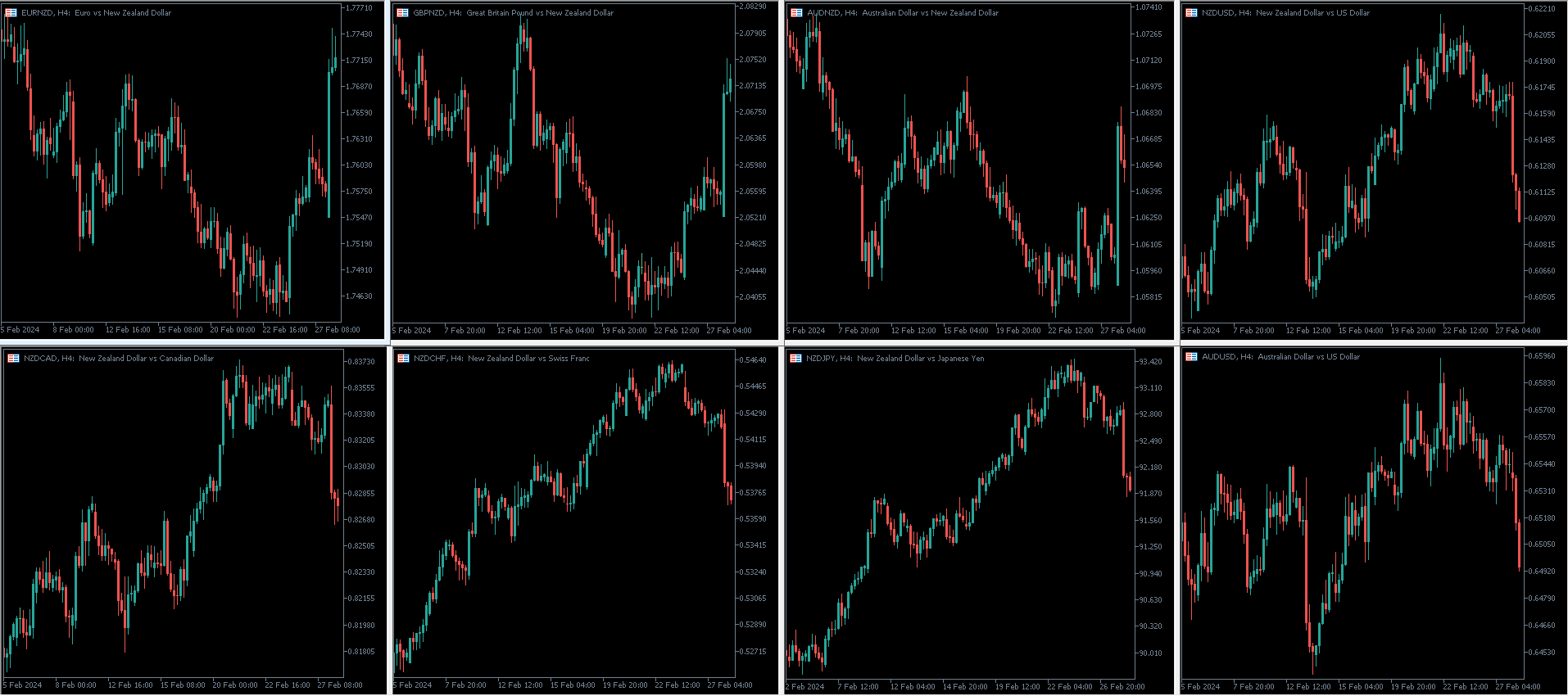

Looking at the USD pairs, we can see that in most cases (compared to EUR, GBP, AUD, NZD and CAD) there is a trend reversal in favour of the US currency. On the pairs in the upper half of the figure, we have to remember that the USD is the quote currency in these cases (it is the second in the currency pair), so a move downwards means it is strengthening against the other currency in the pair. On the pairs with CHF and JPY, the USD is then in consolidation. From these two examples, the USD appears to be a strong currency and the NZD and AUD appear to be weak currencies.

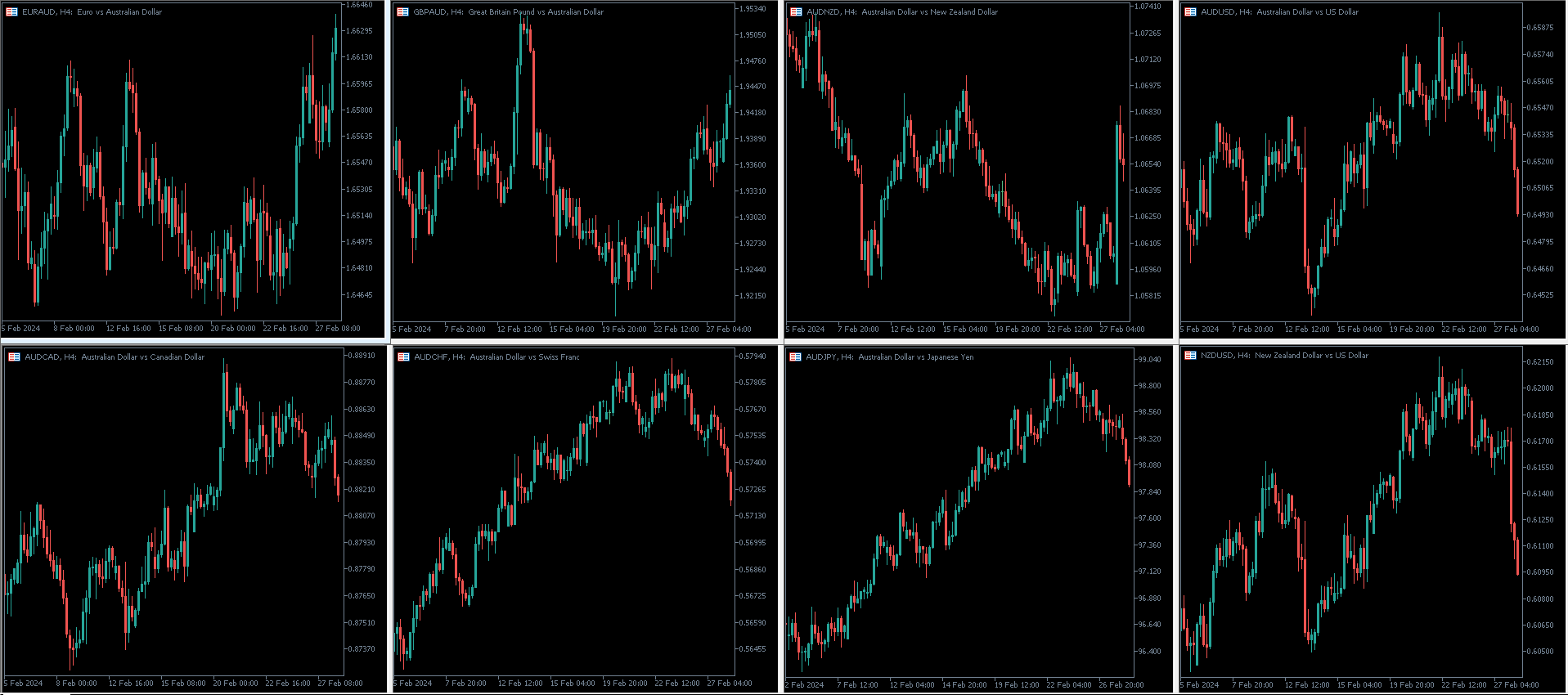

Looking at the AUD and NZD currency pairs, we can see quite clearly that both currencies are poised to weaken relative to most other currency pairs.

If the trend reversal in these pairs is confirmed, speculating on a strong currency, in this case the USD, rising and a weak currency (AUD or NZD) weakening could be an interesting opportunity. If this signal is confirmed, it could be a good trade in the longer term.

We can do the same for other currencies, and we can of course analyse them on different time frames. Short-term investors can follow H1 or M30 charts, swing traders can also consider D1 charts. As with other technical analysis tools, we need to take into account that charts on longer time frames require more patience but can give more accurate results.

Identifying the strength or weakness of individual currencies can assist traders in making informed decisions and adds another interesting factor to the decision making process. As is the case with other technical analysis tools, currency strength and weakness should be used in combination with other technical analysis tools for even better results. Trade safely!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.