How to trade Smart Money Concepts (SMC)

In the ever-evolving realm of finance and investing, the rise of the internet has sparked a wave of modern trading concepts and strategies. Among these innovative approaches, Smart Money Concepts (SMC) has emerged as a compelling force. But is this concept, born in the digital age, really worth the attention of investors and traders?

This article navigates the intricate landscape of Smart Money Concepts and examines their origins, principles, and potential impact on the contemporary financial world. As we delve into the intricacies of this trading method, let's determine whether it holds the promise and potential to be a valuable addition to your arsenal of investment knowledge and strategies.

Smart Money Concepts (SMC)

This trading strategy was initially popularized by an infamous trader who is also the founder of the Inner Circle Trading (ICT) method which is claimed to be the evolved version of the SMC. Let’s first take a look at the building blocks of this trading strategy and compare it with the well-known trading concepts by industrial titans (Dow, Wyckoff, Elliott).

Essentially, SMC puts forth the notion that market makers, including institutions like banks and hedge funds, play a deliberate role in complicating trading endeavours for retail traders. Under the Smart Money Concepts framework, retail traders are advised to construct their strategies around the activities of the "smart money," denoting the capital controlled by these market makers.

The core concept involves replicating the trading behaviour of these influential entities, with a specific focus on variables such as supply, demand dynamics, and the structural aspects of the market. Therefore, as an SMC trader, you'll meticulously examine these elements when making trading decisions, aligning your approach with the sophisticated techniques of prominent market figures. By embracing this perspective and closely monitoring the actions of market makers, SMC traders endeavour to establish an advantageous position in their trading activities, aiming to capitalise on market movements driven by smart money.

When you initially dive into the Smart Money Concepts (SMC), the technical vocabulary can be a bit overwhelming. To help demystify it, here's an overview of some common terms used by SMC traders

Order Blocks

These are used to discuss supply and demand. Some SMC traders consider order blocks as a more refined concept than standard supply and demand, although not everyone agrees on this.

An order block signifies a concentrated area of limit orders awaiting execution, identified on a chart by analysing past price movements for significant shifts. These zones serve as pivotal points in price action trading, influencing the market's future direction. When a multitude of buy or sell orders cluster at a specific price level, it establishes a robust support or resistance, capable of absorbing pressure and triggering price reversals or consolidation.

Fair Value Gap

You should clarify whether your current trading style suits you. If you don't have time to look at charts during the day, you should not focus your strategy on intraday trading using 1

5-minute or 30-minute charts. It is definitely better to develop an approach that works on a 4-hour or daily chart so that you have enough time to analyze the charts before or after work.

Ideal time and timeframe

This phrase describes an imbalance in the market. It occurs when the price departs from a specific level with limited trading activity, resulting in one-directional price movement.

In the case of a bearish trend, the Fair Value Gap represents the price range between the low of the previous candle and the high of the following candle. This area reveals a discrepancy in the market, which may indicate a potential trading opportunity. The same principle applies to a bullish trend but with the opposite conditions.

Liquidity

Liquidity plays a pivotal role in SMC. It pertains to price levels where orders accumulate, rendering an asset class "liquid." Essentially, these are price points with available orders ready for transactions. Liquidity can manifest in various forms, such as highs and lows or trend line liquidity.

How liquidity is handled varies depending on the trader. One of the most common approaches is to use a pivot high or pivot low. For better understanding, a pivot high or low is formed when several adjacent candlesticks have a higher low or lower high.

In the picture, we can see the pivot low. The candlestick has the lowest low compared to its three neighbours to the right and left.

Break of Structure (BOS)

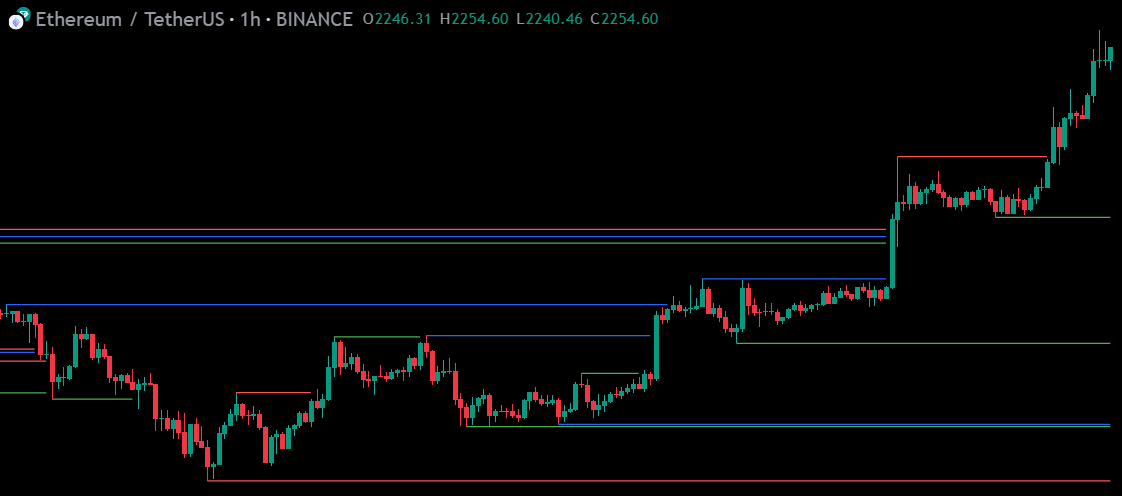

Once you become familiar with this terminology, you'll realize that many SMC concepts are consistent with traditional trading ideas. A fundamental element of SMC market analysis is the emphasis on the "break of structure" (BOS) in the market.

Change of Character (ChoCH)

For instance, in a chart illustrating breaks of structure, each time the price surpasses the previous high, a break of structure occurs. Conversely, when the price drops below previously established lows, it signals a change of character (ChoCH). SMC traders leverage their understanding of these patterns to make informed decisions based on the market's behaviour.

Very often BOS and CHoCH are used together, as shown in the picture below.

In contrast with Wyckoff’s Theory

The term Smart Money was first introduced and mentioned by Richard D. Wyckoff, a renowned stock market authority, trader, and educator who contributed significantly to the field of technical analysis. He is known for his work on the Wyckoff Method, which aims to reveal the intentions of "smart money" in the market. In Wyckoff's framework, "smart money" refers to large, well-informed investors, institutions, and professionals who have the financial capacity and knowledge to move markets strategically. Wyckoff's analysis seeks to detect the footprints of smart money through price and volume analysis, enabling traders to make more informed decisions based on the actions of these influential market participants. In essence, Wyckoff's concept of smart money revolves around understanding the behaviour and motives of key players to gain a competitive edge in trading and investing.

When we closely study Wyckoff’s price cycle, we can see that in each cycle whether it is accumulation or distribution, some points are similar to the points laid out in the SMC.

The Wyckoff Price Cycle consists of four main phases:

Accumulation

In this phase, informed investors (smart money) are quietly accumulating positions while the general public is still bearish or unaware of the potential upward movement. Prices may trade within a range, and volume tends to be low. The goal is to accumulate a substantial position without causing noticeable price increases.

Markup (Advancing or Bullish Phase)

After accumulating a significant position, smart money starts to push prices higher. This phase is characterized by a strong uptrend, increasing volume, and positive sentiment. The public begins to notice the price movement and may start entering the market.

Distribution

During the distribution phase, smart money players begin to sell their accumulated positions to the less-informed public. Prices may trade within a range or show signs of weakness. Volume might start to decline as the market loses momentum. This phase is marked by a shift from bullish sentiment to uncertainty or bearishness.

Markdown (Declining or Bearish Phase)

In the markdown phase, prices decline, and the market enters a downtrend. Volume may increase, reflecting increased selling pressure. The public sentiment turns increasingly bearish as losses accumulate.

For a detailed explanation of each aspect within each cycle, please refer to the following article about The Wyckoff theory and its application in trading.

Conclusions

In conclusion, Smart Money Concepts (SMC) provides traders with a strategic framework that focuses on understanding the actions and motives of market makers, particularly institutions such as banks and hedge funds. This approach involves replicating the trading behaviour of influential entities, focusing on variables such as supply, demand dynamics, and the structural aspects of the market.

SMC introduces specific terminology, including Order Blocks, Fair Value Gaps, and Liquidity, which are key elements in analyzing market movements. These concepts align with traditional trading ideas and contribute to a deeper understanding of market dynamics.

The emphasis on the "break of structure" (BOS) is a fundamental aspect of SMC market analysis, where each break signifies a change in the market's behaviour. SMC traders leverage their understanding of these patterns to make informed decisions based on market dynamics.

Comparatively, the origins of the Smart Money Concepts can be traced back to Richard D. Wyckoff, a renowned stock market authority. Wyckoff's work on the Wyckoff Method emphasizes understanding the intentions of "smart money" in the market through price and volume analysis. His concept of smart money aligns with SMC, and the Wyckoff Price Cycle illustrates similar phases of accumulation, markup, distribution, and markdown.

Essentially, both SMC and the Wyckoff Method provide traders with valuable insights into market dynamics, helping them make informed decisions based on the actions of well-informed investors and institutions. Understanding these concepts and their applications can contribute to a more comprehensive and strategic approach to trading and investing.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.