“Market is wanting to take money away from you”

Forex trading is not for the faint of heart. The market is a hostile environment where only those who can be resilient, disciplined and willing to follow the rules of risk management and money management will survive. Among them are our new FTMO Traders, Phong, Ben Tyler, Simiso Edgar and Yashveer.

Trader Phong: “I understand that psychology is an inevitable part of being a trader.”

Has your psychology ever affected your trading plan?

Sometimes psychology affects my trading plan, for example after a few failed trades. I understand that psychology is an inevitable part of being a trader. As soon as I observed that, I calmed down to avoid falling into an uncontrolled trading state.

What do you think is the key for long term success in trading?

There are many factors that influence a sustainable, long-term trader in the markets. However, in my opinion, the most important key that determines the success of a sustainable trader is capital management and a balanced mindset of the trader.

How would you rate your experience with FTMO?

As a serious trader myself, I always considered this a dream job. I also searched for many companies that provide capital for traders. I highly appreciate the service FTMO provides to traders in general and to the Vietnamese market in particular. In Vietnam, not only me but many other traders in the community also put their full trust in FTMO. We hope FTMO continues to provide good service and build a clean, strong, and long-term trader community. With my experience up to now, I rate it 5 stars!

How did passing the FTMO Challenge and Verification change your life?

I focused on building a dream job with FTMO, which had goals and an implementation strategy broken down into phases. The short-term goal is to stabilize trading with a reasonable, sustainable win rate. The medium-term goal is to increase the account size according to FTMO's capital growth plan. Besides, I am also planning to travel around Vietnam, I can travel and work at the same time. A job with FTMO can help me achieve that dream!

How did the Maximum Loss limit affect your trading style?

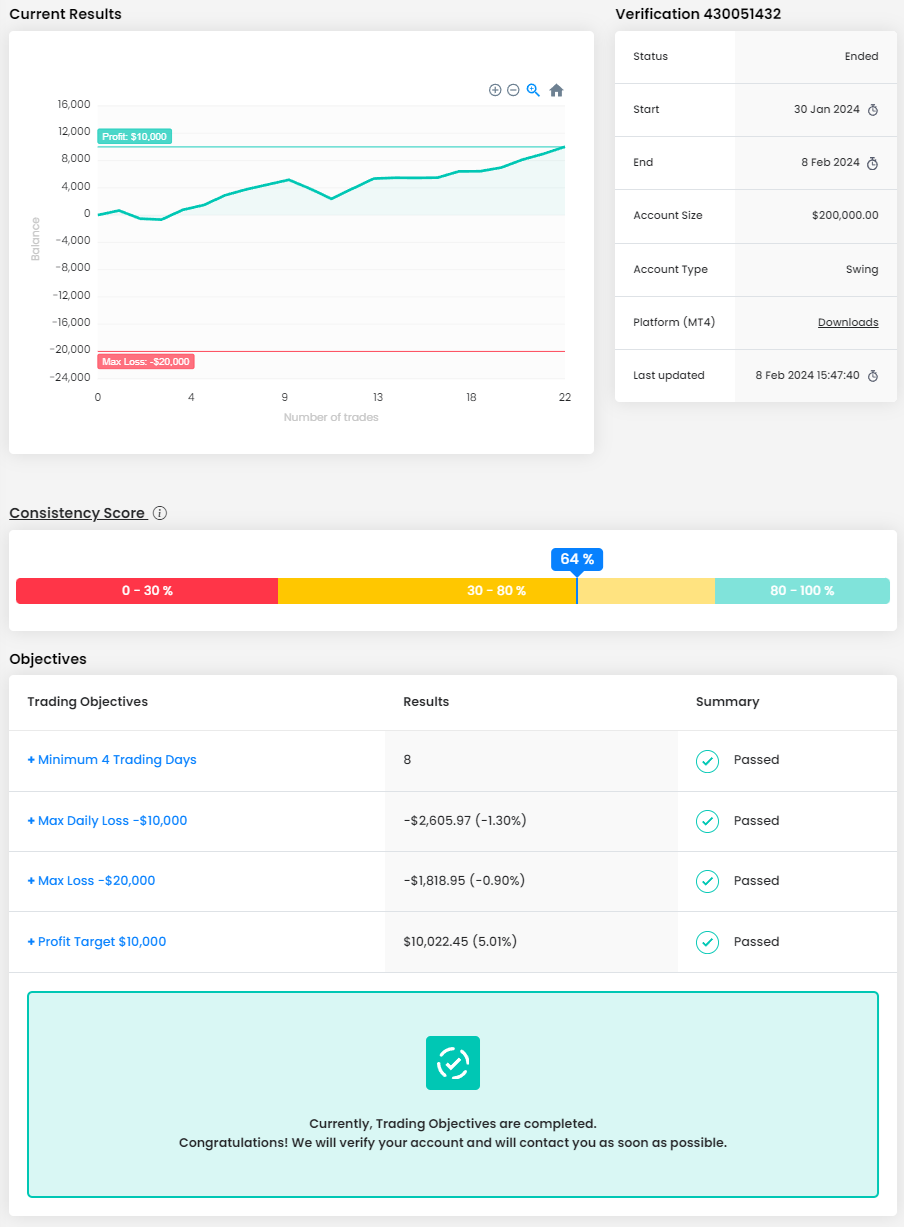

As mentioned above, the most important factor for me in trading is capital management. Depending on the size of the different accounts, I will have a maximum open status suitable for that account. If the account declines, I will adjust the open status for each trade according to the new account status. With a 200k USD account, I will typically open a maximum of 2 XAU lots at a time. And so, my trading method will be almost stable, not affected by losing trading positions.

What is the number one advice you would give to a new trader?

It takes you 4 years to study at university, 2 to 3 years to learn a profession, then you can have the skills and knowledge to start applying for a job. Trading is a noble and challenging job. Spend time and effort to learn knowledge and practice trading skills. And always remember that trading is not only a job that brings income, but trading also helps us cultivate our minds.

Trader Ben Tyler: “Take your time and be patient.”

Describe your best trade.

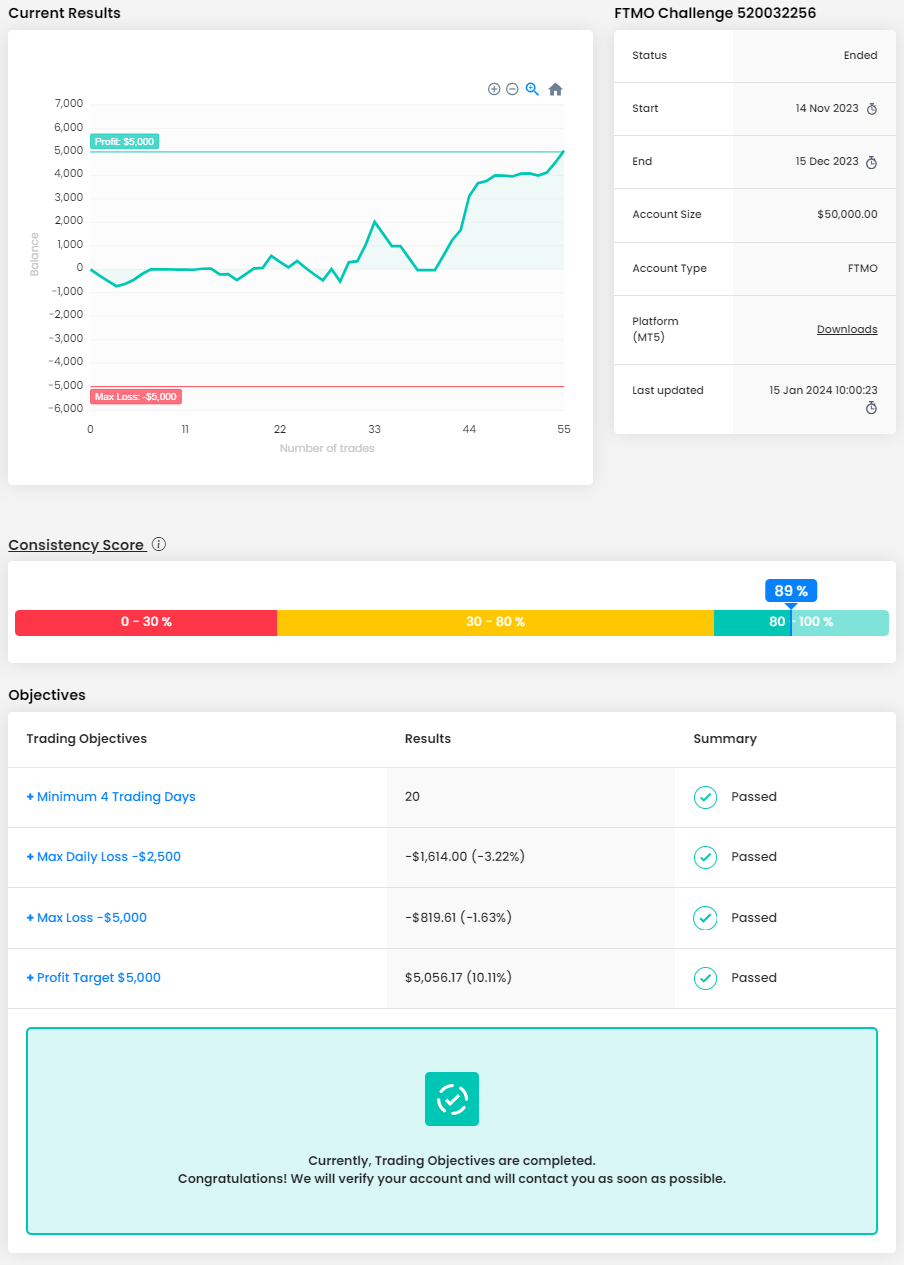

I have had many great trades, but a favourite of mine was the final trade of passing Verification. Was confident in my bias and ignored the psychological triggers that wanted me to close the trade early due to market slowing down but I was confident in my target and decided to hold the trade. Managed risk by moving stop to Break Even and allowed trade to run, and it hit TP and allowed me to pass this Verification stage.

What do you think is the most important characteristic/attribute to become a profitable trader?

Definitely being humble and always knowing the market is wanting to take money away from you. Have to be persistent and to always be open to learning and improving.

How did you eliminate the factor of luck in your trading?

I stuck with the same strategy the whole way through the FTMO Challenge and Verification and only traded within a set time I set myself. Every trade had to meet certain conditions and those conditions have been built over the past 2 years.

How did loss limits affect your trading style?

I always kept an eye on the daily and maximum loss. My intention was to not get close to the max and to manage my trade allowance to a point I could never go over the daily loss.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, absolutely.

What would you like to say to other traders that are attempting the FTMO Challenge?

Take your time and be patient. I have only passed when I have waited for trades rather than everyday knowing I will take a trade. Manage risk well and take only A+ set ups.

Trader Simiso Edgar: “Resist the urge to chop and change or tweak strategies mid-challenge.”

What do you think is the key for long term success in trading?

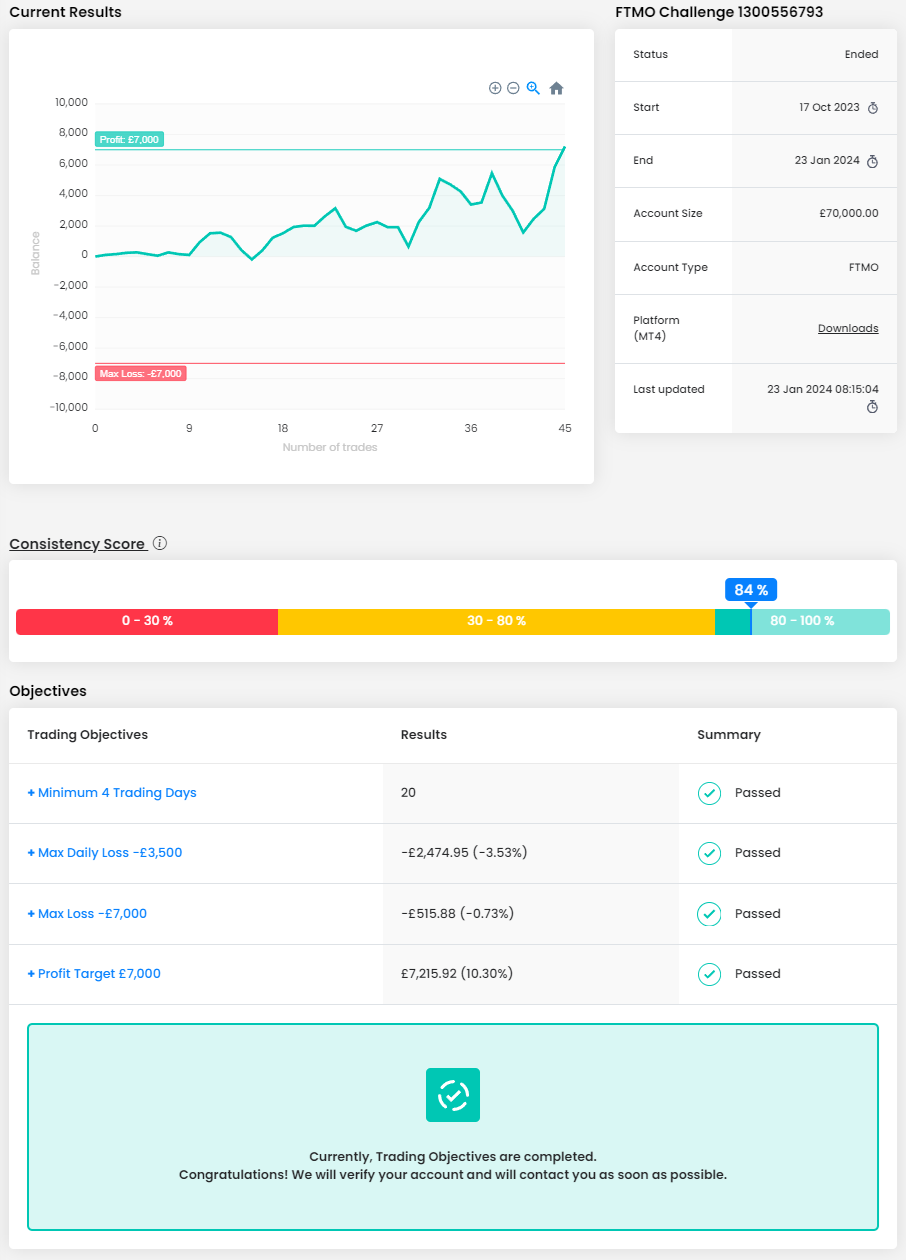

Mastering yourself and your emotional impulses. If you can stay calm after a streak of winning trades/losing trades and execute in accordance with your system, then you are on the right track. I have found that the biggest drawdowns to P&L come after a series of winning trades. This happened most recently after passing phase 1 of this Challenge, I let my emotions get the better of me and ended up starting phase 2 with a HUGE loss because I was feeling overconfident.

Where have you learnt about FTMO?

YouTube at first, and then I've spent a lot of time in the FAQ section of the website.

What do you think is the most important characteristic/attribute to become a profitable trader?

Self-awareness. Being able to identify when your emotions are dictating the trades you are taking, and being able to stop yourself and walk away from your screens.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, definitely! Max allocation is possible by June 2024, and then I'll work to achieve Supreme status by the end of the year.

How did you manage your emotions when you were in a losing trade?

Firstly, a precalculated Stop Loss with proper trade sizing is essential. That way, you have peace of mind that you won’t violate the max daily loss. Secondly, with sufficient back testing, you gain a certain level of confidence in your system. When losing trades come, it becomes easy to stay positive because you know the probabilities are in your favour, and you'll be back in profit after the next couple of trades.

One piece of advice for people starting the FTMO Challenge now.

Go and watch as many ICT videos as you can on YouTube. They're free... if you already have a system/strategy that works, then stick to it. Resist the urge to chop and change or tweak strategies mid-challenge. Consistency in the types of set-ups you take will lead to consistent results and less emotionally charged trading.

Trader Yashveer: “Don't rush to pass the Challenge.”

What was easier than expected during the FTMO Challenge or Verification?

Although the FTMO Challenge and Verification require consistency, in order to maintain my consistency, I admire that the prices of both currencies and indices were almost exactly the same as the demo account brokers on Trading View. By keeping the price range, the same, it allows for exact entries with minimum calculation between price differences.

What do you think is the most important characteristic/attribute to become a profitable trader?

Only risk what you can afford to lose. Accepting the risk or loss before you take the trade. This will prevent you from revenge trading or acting impulsively. Personally, you have to have a system in place for trading such as risk/reward, win rate, etc. However, the rest of it comes down to psychology and the mindset of a trader. Having a system in place to deal with the mental aspect of a trader when they take a loss will help a Trader to become profitable.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes. I am planning to scale up to max allocation.

What was the hardest obstacle on your trading journey?

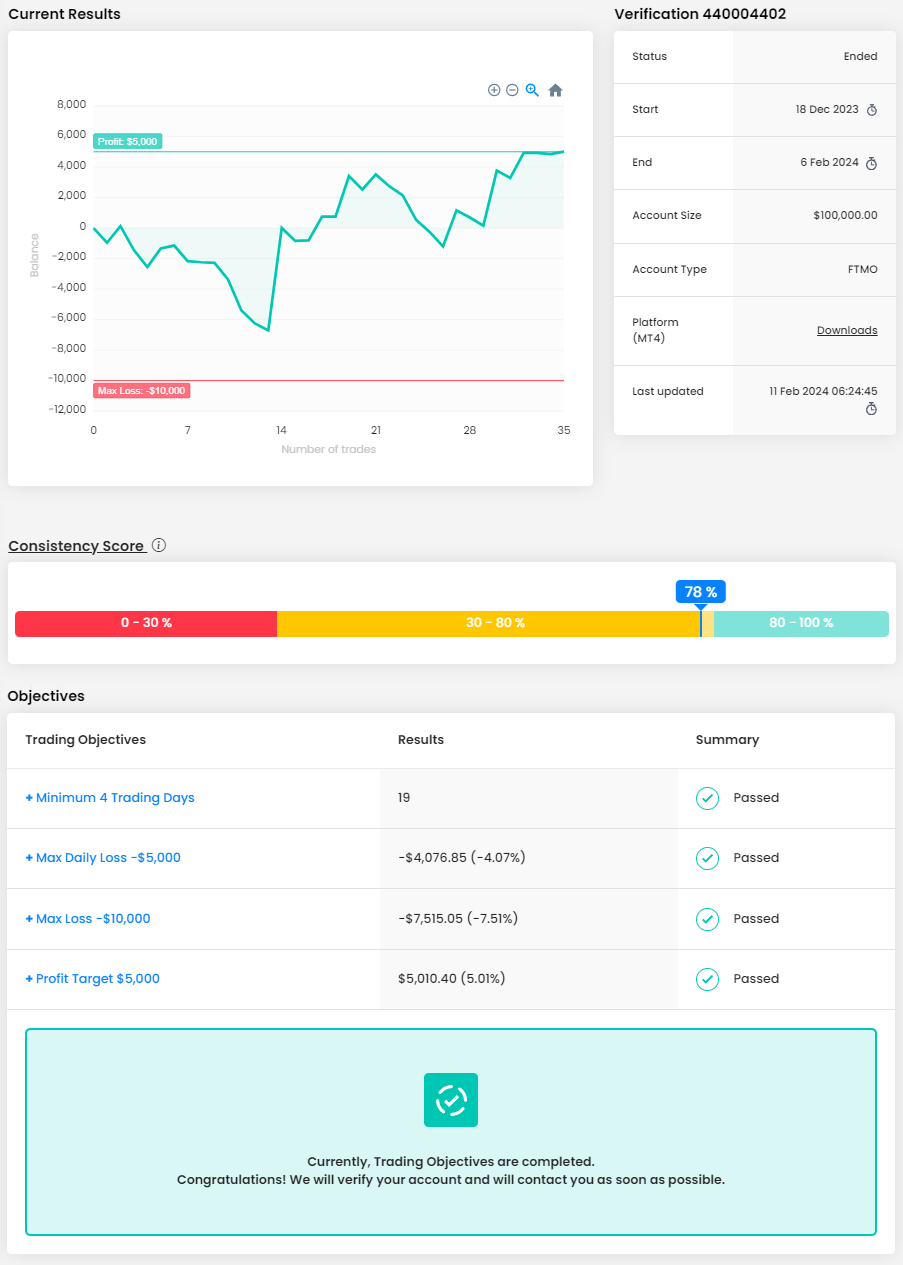

The Psychology aspect and mindset. Although I had the right trading strategy in place, each time I would come close to hitting the target of the challenge and verification, I would do silly things by taking stupid trades because I wanted to rush and pass the challenge. However, I realized that I should not set a time to pass the challenge and give myself unlimited time so that I would not end up taking silly trades allowing me to take high quality setups.

How did you eliminate the factor of luck in your trading?

By using a risk/reward system as well as win rate. I knew from my calculations that if I have a lower win rate, then I would need to find setups to increase my risk to reward. Adjusting these 2 variables helped to eliminate luck. Also staying away from trading during high impact news events also helped a lot.

One piece of advice for people starting the FTMO Challenge now.

Don't rush to pass the Challenge. We feel that we need to be funded immediately, however by taking as much time as possible will allow you to only take high quality setups which will pay off in the long run. Also remember that if you enter into a drawdown, do not give up. Try to recover from drawdown. If you are able to achieve this, then you are guaranteed to be a profitable trader. This will help you to gain the necessary skills to always be profitable. Remember that if you just give up when you are in drawdown, then how would you expect to be profitable when your funded account goes into drawdown.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.