Why benchmark rates are important and what led to the end of LIBOR

The London Inter-Bank Offered Rate, or LIBOR, was one of the most widely used benchmark interest rates, influencing the valuation of money in the financial markets, as well as the loans and borrowings of ordinary people. However, its weakness became apparent after the financial crisis and in the last few years it has been replaced by new benchmark rates.

Benchmark interest rates, known as IBORs, have operated in the unsecured interbank market (a market where financial institutions exchange short-term liquidity without using collateral) for more than 40 years. These rates determined the average interest rate at which banks were willing to lend money to each other in the interbank market. Alongside central bank base rates, they were one of the most important instruments in determining the price of money in the financial markets and were used as reference rates for a large number of financial instruments and their derivatives.

They were based on the central bank base rate plus a money market premium (when there was excess liquidity in the market or a reduction in rates was expected, these reference rates could be lower than the central bank base rates). These rates indicated, among other things, how easy or difficult it was for banks to raise money on the interbank market that they could then lend to their clients. Reference rates were thus also a good source of information for central banks themselves when setting monetary policy, as they influenced the cost of funding for firms but also for consumers themselves.

What is LIBOR?

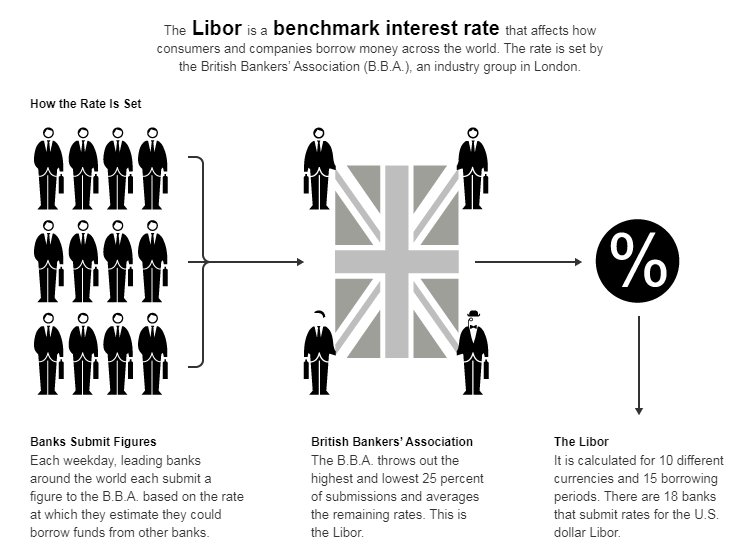

For many years, the most widely used benchmark interest rate was LIBOR (London Interbank Offered Rate), which was compiled by the British Bankers' Association (BBA) until 2012, and since 2012 the rate has been compiled by the US Intercontinental Exchange Benchmark Administration (IBA) based on data from selected London banks. The rate is published daily by Thomson Reuters at around 11:45 London time.

Setting of LIBOR

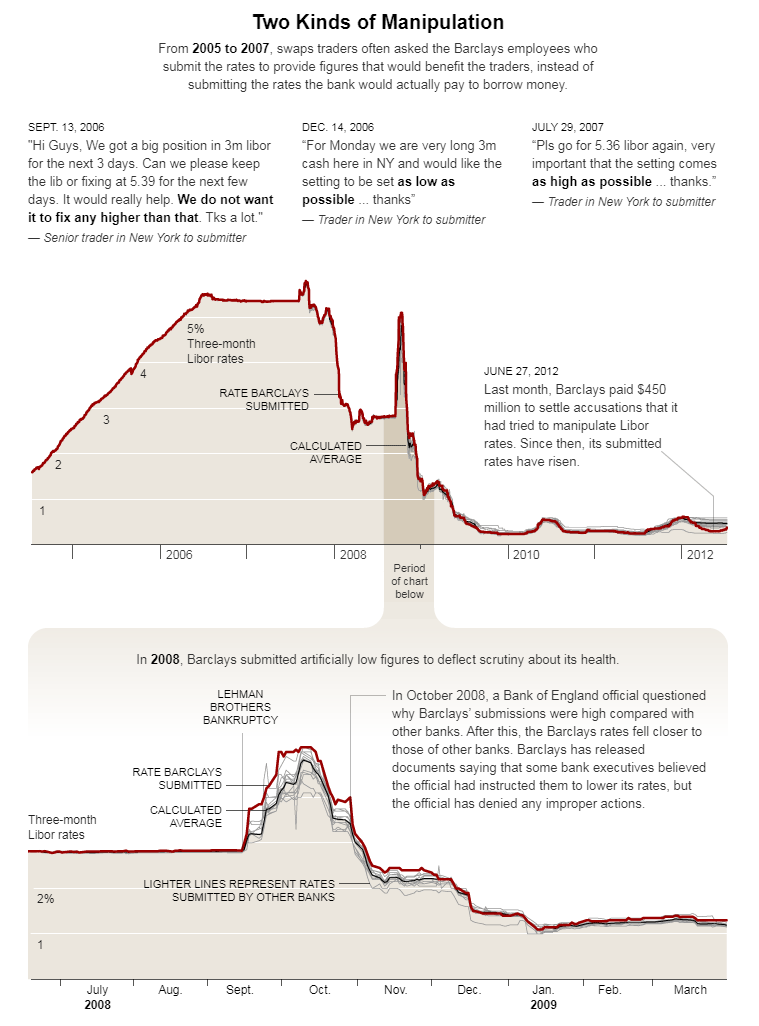

Source: The New York Times

Although it is, or was, the London banking market rate, it was accepted as the global benchmark rate and was published for up to ten world currencies (GBP, USD, JPY, EUR, CHF, NZD, SEK, DKK, AUD, CAD, and in 2013 ICE stopped publishing data for the last five currencies). The rate was originally published for up to twelve maturities (from overnight to 12 months), but is now published for only five maturities for USD and three maturities for GBP and JPY. By 2023, the publication of these rates will also be discontinued.

Why is LIBOR coming to an end?

Reference rates have many uses in the financial market and should reflect the realities of the markets, so it is very important that they are independent, respect market principles and are as universal as possible. If these conditions apply, reference rates provide reliable information to market participants and are beneficial to both parties to the contractual relationship as they cannot be influenced. As already mentioned, rates of other financial products and their derivatives have been linked to LIBOR and many lending institutions have derived their own rates from them. As much as USD 370 trillion worth of financial instruments and derivatives have been linked to USD LIBOR alone.

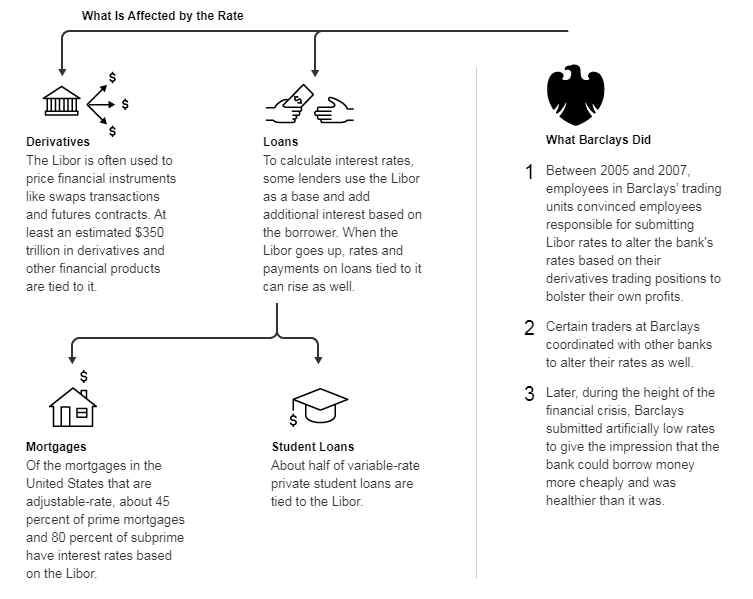

Source: The New York Times

However, the IBOR group’s rates, of which LIBOR was the best known and most widely used, were not guaranteed to be independent and were not based on actual transactions. It was a process whereby selected banks were asked by the rate setter to estimate how much money they were willing to lend to other banks, the highest and lowest estimates were discarded and the average of the other estimates was calculated.

Weaknesses of calculation and manipulations

This method of calculation worked for a long time, but it had weaknesses that became apparent during the financial crisis and culminated in the reform that is still underway today. Borrowing on the interbank market and between banks is one of the sources of bank lending, and interbank interest rates are one of the factors that indicate the financial health of the banks themselves. By setting these rates themselves, banks have reduced their estimates of the cost of borrowing when setting LIBOR, thereby increasing their credibility. LIBOR was thus not at all in line with what the real market situation was, as the financial crisis reduced the willingness of banks to lend without collateral.

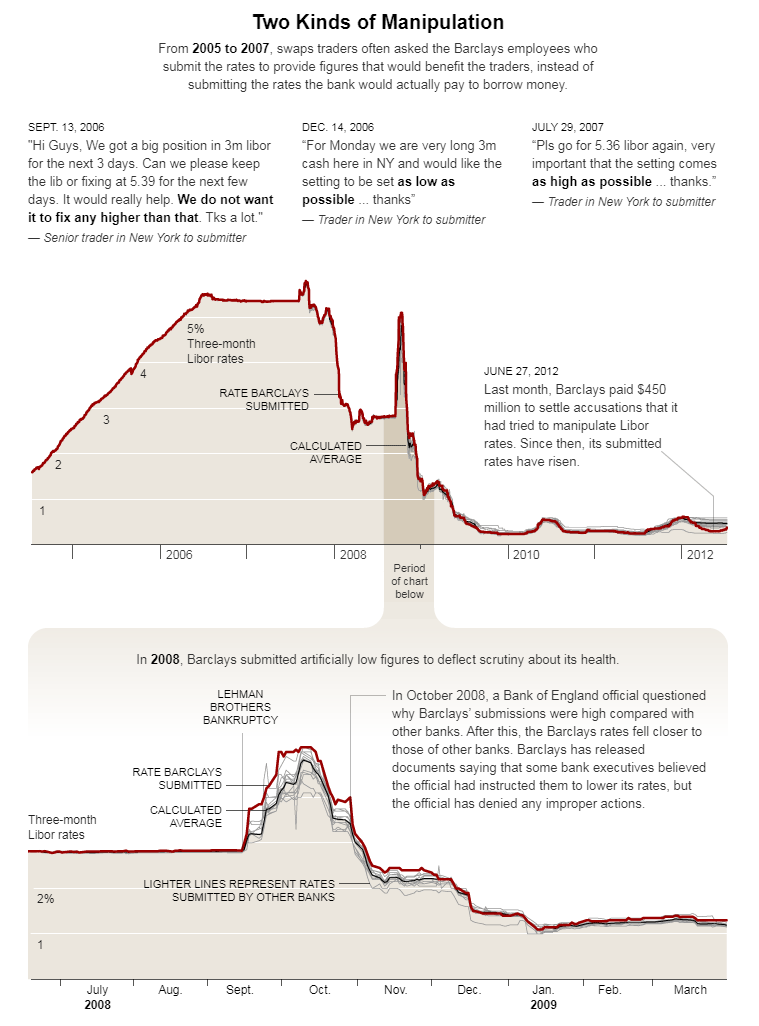

LIBOR manipulation

Source: The New York Times

The problem was also that the banks involved in setting the benchmark rates themselves had their financial instruments linked to these rates and the rates announced had a direct impact on their portfolio. Depending on the positions held by the bank, the rate quoted by the bank in the calculation was then artificially increased or decreased. Speculation about rate manipulation emerged as early as in 2008, and in 2012 rate manipulation was revealed at several large banks such as Barclays, UBS, Royal Bank of Scotland, Deutsche Bank, JPMorgan and Citigroup.

The need for reform

The Financial Stability Board (FSB), then recommended rate reform aimed at ensuring stability of funding through capital markets. The new rates should thus be based on actual transactions and not on estimates. However, the problem is that there are not many unsecured transactions actually taking place between banks that could be used to calculate different maturities, which is again solved by estimating the selected banks.

In 2017, the UK regulator, the Financial Conduct Authority (FCA), announced that after 2021 banks will no longer have to report rates for calculating LIBOR, marking a move to alternative reference rates (ARR). These will no longer be the responsibility of the IBA, but will be overseen by a separate body in each country. For example, in the EU, LIBOR and EURIBOR will be replaced by a new ESTR (Euro Short Term Rate), which will be under the responsibility of the ECB. In the US, it will be the Secured Overnight Financing Rate (SOFR), administered by the New York Fed; in the UK, it will be the Sterling Overnight Index Average (SONIA), overseen by the Bank of England; and in Japan, LIBOR and TIBOR will be replaced by the Tokyo Overnight Average Rate (TONA), overseen by the Bank of Japan.

Alternative reference rates to LIBOR

The big change from the original LIBOR and other IBOR rates is the time aspect. LIBOR was set at the beginning of the day and therefore it was clear in advance what the rate was. The new rates are set retrospectively, based on the actual transactions, and are available with a lag. However, unlike past rates, these are only overnight rates, with no other maturities available, thus limiting credit risk.

Changing rates is a relatively complex process as LIBOR rates are firmly embedded in market activities and are used for accounting purposes. Banks and corporates will need to reflect all these changes in their one-off asset repricing and future reporting.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?