What does profitable trading look like with a working EA?

In the next part of the series on successful FTMO Traders, we will look at a trader who bet on the most liquid and popular investment instruments using an automated trading system.

If the trader wanted to trade seven or eight instruments manually, he would have a lot of trading opportunities at his disposal, but such an approach can be quite time consuming. One solution that today's trader has used is the use of an automated trading system, or expert advisor (EA), which can make trading multiple instruments much easier.

A good AOS can really simplify the trader's work, help him with the emotions that the trader cannot get rid of when entering trades and at the same time help in eliminating unnecessary mistakes when trading. However, it must be kept in mind that before deploying such a system in real trading, the conditions for entering trades must be properly defined and the system must be properly and thoroughly tested and optimized. The trader should also have at least a minimum knowledge of programming to be able to detect and fix errors that might occur in the program code itself if necessary, otherwise he is setting himself up for a big problem.

According to the trader's balance curve, it is clear that the EA did indeed work well during the period under review. At first glance, it looks like a near-perfect result, but there were a few hiccups. However, the system was able to generate profits quite steadily in the end, as evidenced by the high consistency score.

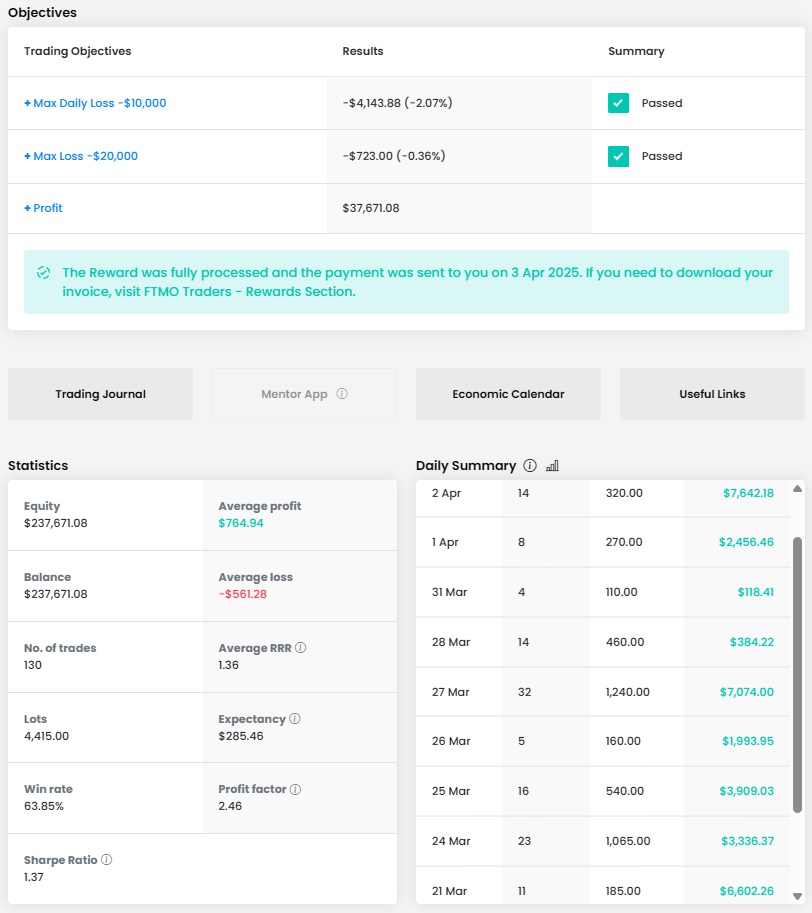

A profit of over $36,000 on an account size of $200,000 is excellent and as for the Maximum Daily Loss and Maximum Loss limits, the trader had no problem with them either. During the trading period the trader opened 159 positions with a total size of 437.7 lots, which means about 2.75 lots per position. While EA often opened multiple positions, overall the trader stayed within the limits and did not expose himself to unnecessarily large risk, at least in terms of position sizes.

The average RRR of 1.64 is very good, especially when combined with a trade success rate of almost 68%. Most days ended in profit and interestingly, the trader's most profitable trading day was the last trading day when he opened the smallest positions. Usually we are used to traders venturing into larger positions as profits increase, but this can backfire when the trader just gets into a losing streak.

Looking at the trader's journal, we can notice that our trader can be classified somewhere between intraday swing traders. In some cases, he has no problem closing a position after a few minutes and keeping the very next position on the same instrument open overnight or even for more than one day.

According to the opening times, it is evident that the trader was using an automatic trading system that even entered Stop Losses when opening a trade, but these were set quite "wide" and served more as a rescue in case of extreme market movement. Thus, the price never reached the SL and the EA closed orders according to pre-set parameters. Take Profits were entered exceptionally, which, given the use of EA is also not a problem.

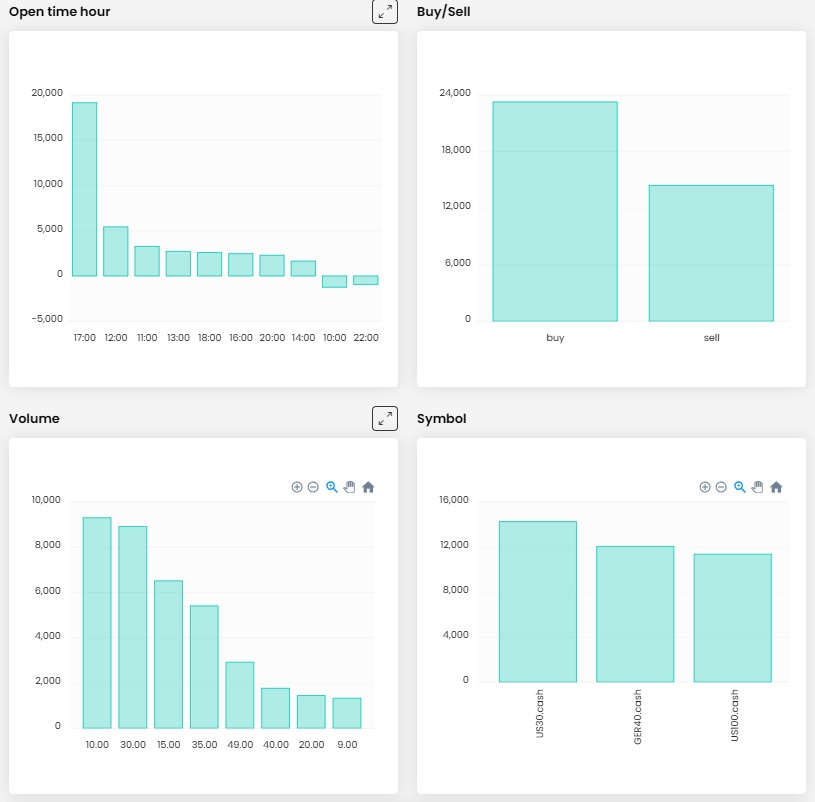

Given that the trader was using EA, it is not surprising that the variance of position opening times is really large, so at first glance it seems as if the trader was sitting at the trading platform all day. The same can be said about the size of the positions the trader was opening. The trader traded eight investment instruments, six of which were major currency pairs plus gold (XAUUSD) and the DJIA index (US30.cash).

These are therefore the most traded pairs on forex and the most popular instruments outside forex among FTMO Traders, so the trader certainly had no problem with liquidity and ample trading opportunities. As we mentioned, under normal circumstances it might be problematic for a trader to trade so many instruments effectively, but for EA it should not be a problem.

Finally, we will look at one trade that was one of the most profitable for the trader and is a good example of the advantages and disadvantages of AOS. On the one hand, it can be said that the system opens trades quickly and without the influence of emotions, when immediately after closing a losing position, it opens another one in the same direction that has already ended in profit. On the other hand, we can say that if AOS had not closed the first position when the market was already moving in the direction of the open position, the trader might not have realized a loss.

The picture shows that EA opened a long multiple position on AUDUSD against the trend, but it ended in a slight loss. Shortly after closing this one, however, EA opened another position after the trend reversal and it ended with an interesting profit of over $2,600.

From the above example it is well seen that EA can be a good servant but also a bad master. If a trader takes care to fine tune it, set the important parameters correctly and spend enough time backtesting it, EA can serve him well. Trade safely.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?