Trust your strategy

If you have confidence in your strategy and can weather periods of significant losses, you have practically won in Forex trading. In the next part of our series on successful traders, we will look at two traders who have achieved exciting returns by trusting their strategy.

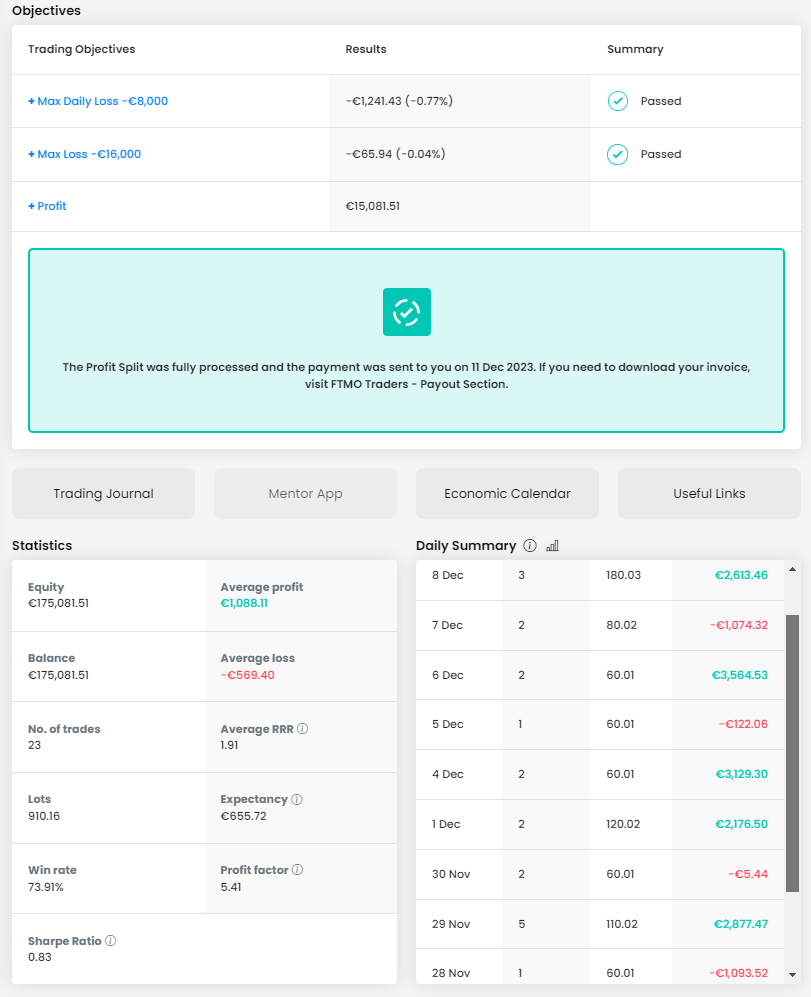

Our first trader in today's selection is a typical scalper. He opens trades for a very short period of time, but he obviously knows what he is doing because his balance curve looks almost ideal and he has managed to avoid significant losing streaks. The bonus is then a very high consistency score that shows the ability to stick to the risk management and money management setup.

The profit of €15,081 is not one of the highest in our series, but it is still a great result. The trader had no problem at all with the loss limits, had a great success rate of almost 74%, and at the same time a high RRR (1.91), so success was practically guaranteed.

The trader traded for eleven days, opening 23 positions with a total size of 910.16 lots. This represents almost 40 lots per position, which is no small amount. However, given the size of the account, the strategy, and the instrument being traded, it is still a risk that can be accepted.

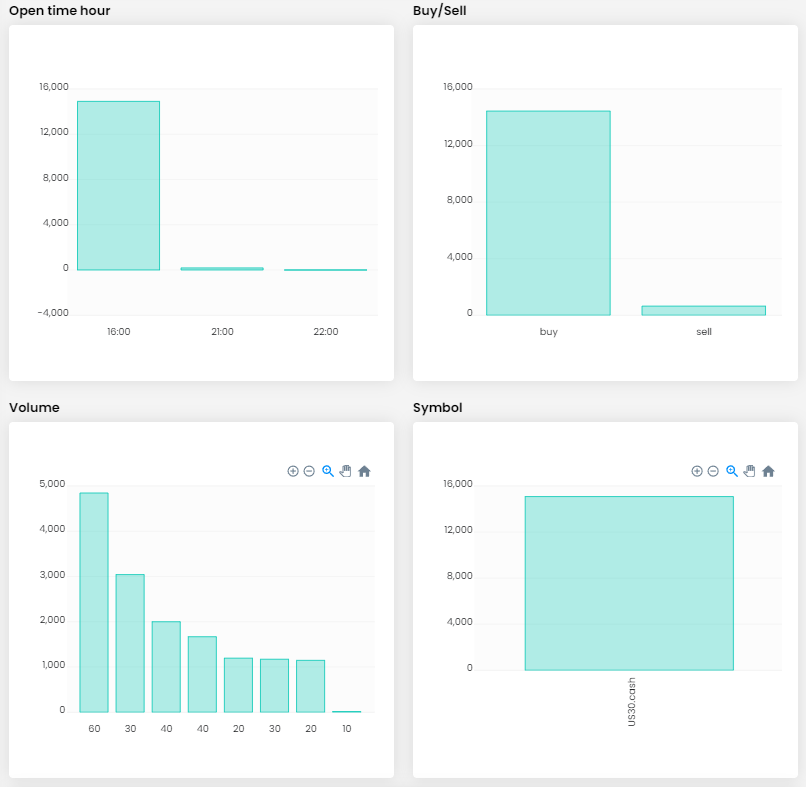

The trading journal shows that the trader opened trades for a very short period of time, his longest trade lasting 14 minutes. He is therefore a typical scalper who only trades one selected investment instrument, namely the DJIA Index (US30.cash). The positive surprise in this case is the fact that the trader entered Stop Losses in most cases, as this is not usual for most scalpers. However, given the position sizes, we definitely have to appreciate it. It is also a positive fact that the Maximum Loss was just over €1,000, which does not even correspond to one percent of the trader's account size.

Although the trader is a scalper, he did not open many positions during the days, mostly one or two positions. This is due to a specific approach where the trader opened positions only at the opening time or just before the close of the New York Stock Exchange. This is a rather specific approach where the trader wants to take advantage of the time when the market is most volatile, and at the same time, this short period is characterized by high volatility, from which scalpers benefit.

Another interesting fact is that the majority of trades that the trader opened were long positions. This is probably because, at the time of trading, there was a relatively strong uptrend on the DJIA Index. This allowed the trader to make a very interesting profit. The trader opened quite large positions, but given the size of his account, appropriately set risk management (considering his strategy) and a small number of trades during the day, this can be accepted.

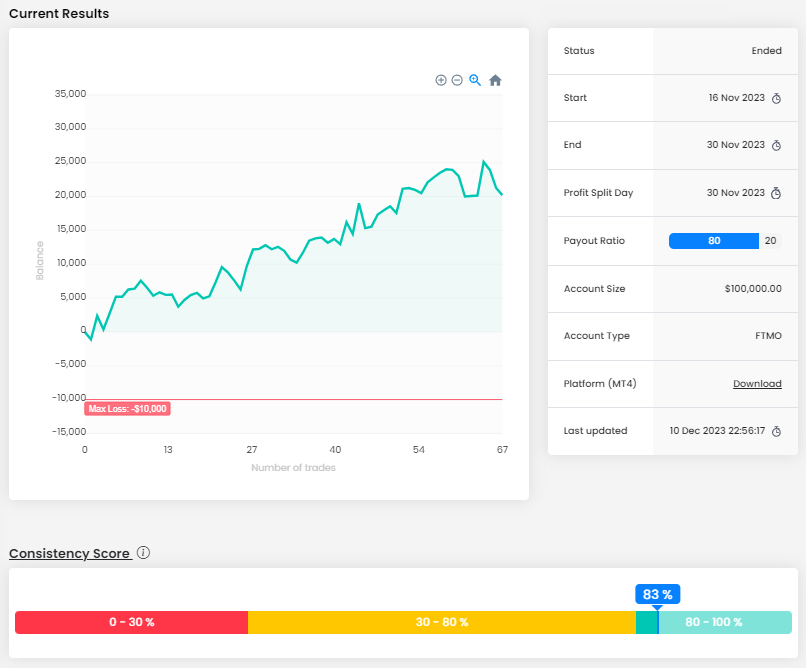

The balance curve of the second trader doesn't look as nice, but the overall result is better than the first trader. Although the curve is not quite as smooth, as there were significantly more losing trades in this case, this trader could also count on very good consistency of results (consistency score of 83%) and ultimately celebrated success.

In contrast to the first trader, the second trader experienced more significant losses and at one point even came dangerously close to the Maximum Daily Loss limit (-4.90%), but in the end, he managed to avoid the disaster of account deletion. The final profit of $20,211 is a great result for an account size of $100,000.

Considering the relatively low average RRR (1.17) and the win rate of trades of just above 50% (58.21%), it is a great achievement for the trader to be able to record such a great result. Confidence in the strategy, a clear plan, and a consistent approach can ensure an interesting return even without a high RRR and win rate. The trader traded for ten days and executed 67 trades with a total size of 725 lots, which is almost 11 lots per position. That's pretty okay for an account size of $100,000.

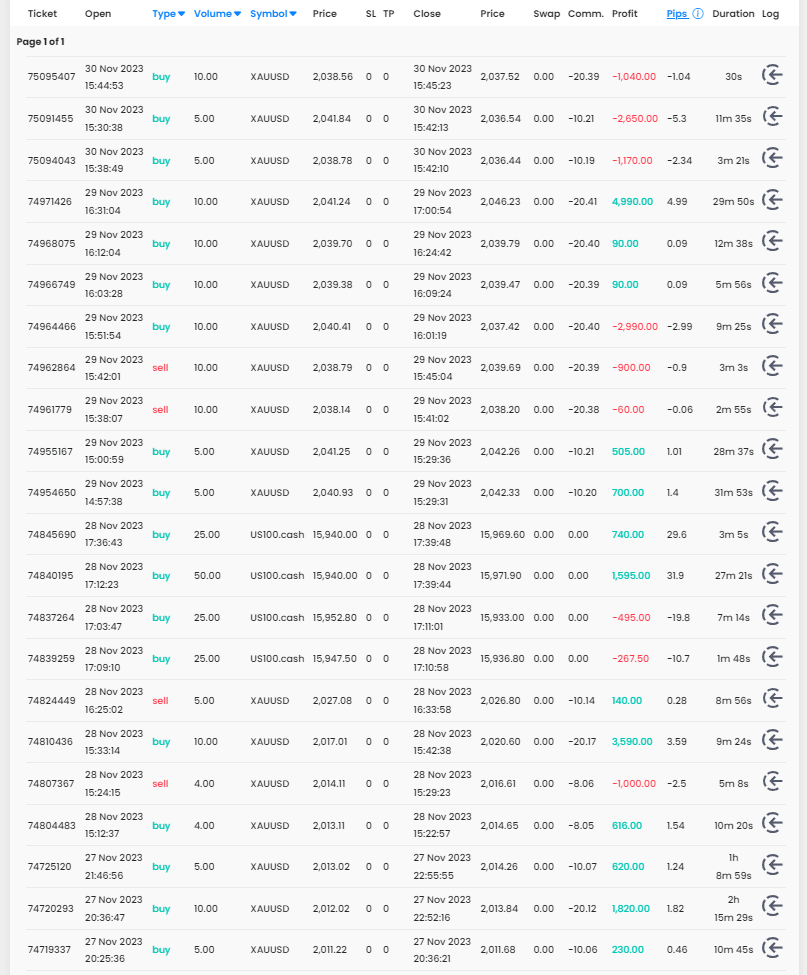

It is clear from the trading journal that the trader rarely opened multiple positions, but when he did, he added to a losing position, which may not pay off for inexperienced traders. This approach almost proved fatal for the trader as he opened two additional positions at a loss, causing him to approach the Maximum Daily Loss limit. Since this happened to him on the last day of the trading period, we can speculate whether he was simply too greedy, or simply thought that he could take a little more risk with an interesting profit. In any case, this case clearly shows that this approach should not be underestimated and is not recommended for most traders.

Another disadvantage that we have to criticize the trader is the absence of Stop Losses, which is an unnecessarily risky approach that can also backfire. Although the trader takes a short-term approach and rarely holds his positions for more than an hour, we still cannot recommend this approach.

The trader traded two instruments. Most of his trades were on gold (XAUUSD), while a smaller portion of his positions were speculations on the direction of the Nasdaq Index (US100.cash). The second trader executed more short positions, but the number and success rate of long positions was much better. This is again due to the fact that gold was in a strong bullish trend at the time the trader was trading.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.