Position sizes (don't) matter

The vast majority of inexperienced traders think that a few large enough positions over a few days is the ideal way to make quick and high profits. But the reality is different, large positions will not bring you quick profits in most cases.

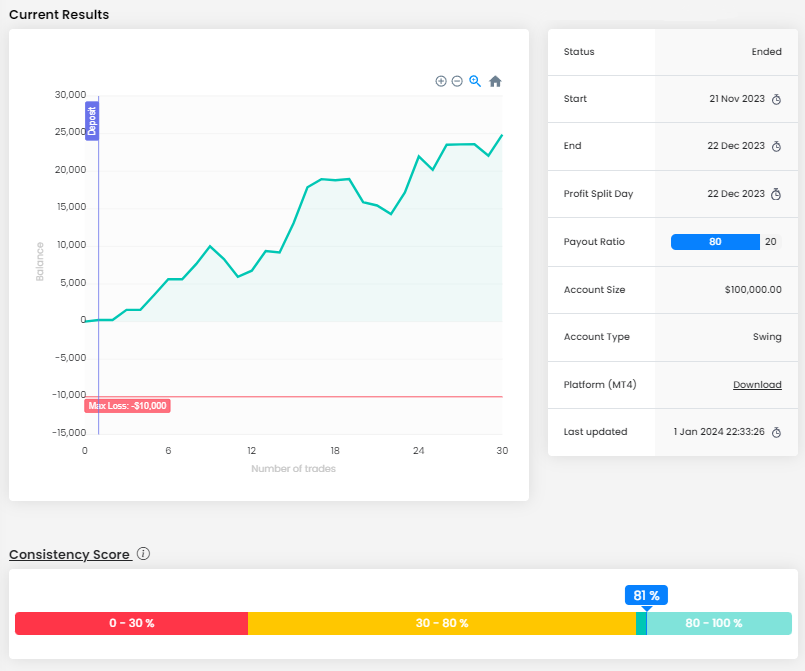

Our first trader is proof that you don't need to open large positions to make interesting profits, and that you don't need to execute hundreds of trades even when opening smaller positions. His balance curve doesn't look ideal, but he has been in the green since the beginning of the trading period and has easily overcome the losing streaks.

The Consistency score shows a responsible approach to money management, but during the first losing streak the trader came quite close to the Maximum Daily Loss limit (-4.05%). The final profit of nearly $25,000 is great for an account size of $100,000.

Trader benefited from both a high RRR (1.83) and a relatively high success rate (62.07%), a combination that should lead to success. Trader traded for 20 days, during which he opened 29 positions with a total size of 136.01 lots. This means that he opened an average of one to two positions per day with an average size of 4.68 lots.

In fact, the trader opened positions of 5 lots, except for two positions of 1 lot and 0.01 lot, and only in rare cases did he open multiple positions. Given the size of the account, this is a conservative and very consistent approach. However, it can create a risk management and money management problem as different sized SL positions in points lead to different potential losses.

When a trader is doing well, it may not seem like a problem, but if he gets a bigger SL several times in a row, he may get unnecessarily close to the loss limits. In this case, there were two occasions when the trader experienced a loss of more than $2,000, which is a lot for a single trade on a $100,000 account size.

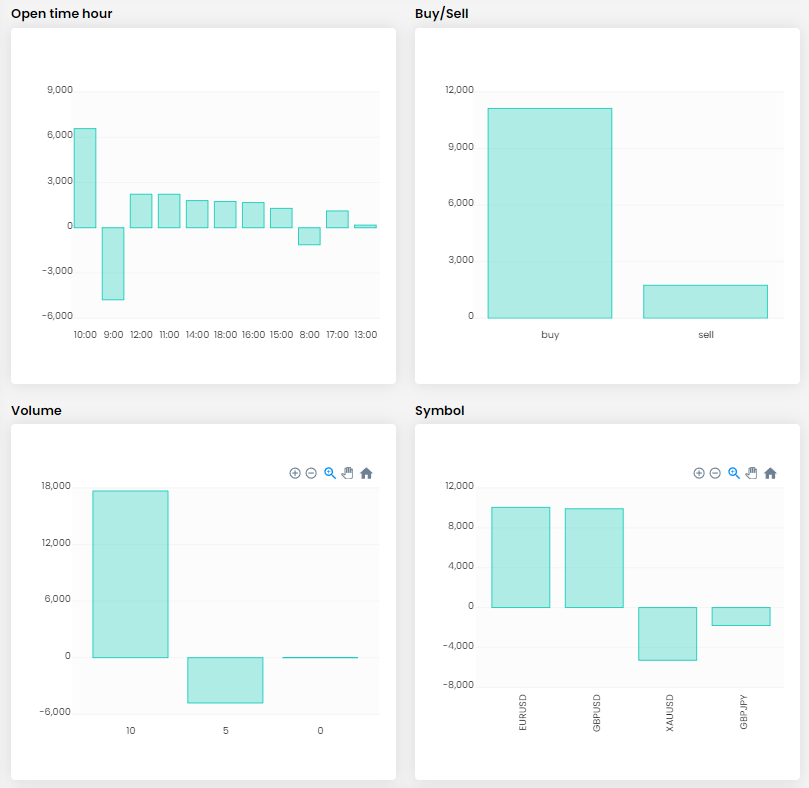

The trader did not hold positions overnight in most cases, but a third of the trades lasted more than a day and the longest trade was even held open over the weekend, which is not recommended in most cases. On the other hand, we commend the placement of Stop Losses and Take Profits on all positions.

Other statistics show that in addition to the same position size, the trader opened buy and sell positions, but was much more successful on the buy. He opened most of the positions on the EURUSD currency pair and once he tried on gold (XAUUSD), but unfortunately he was unsuccessful.

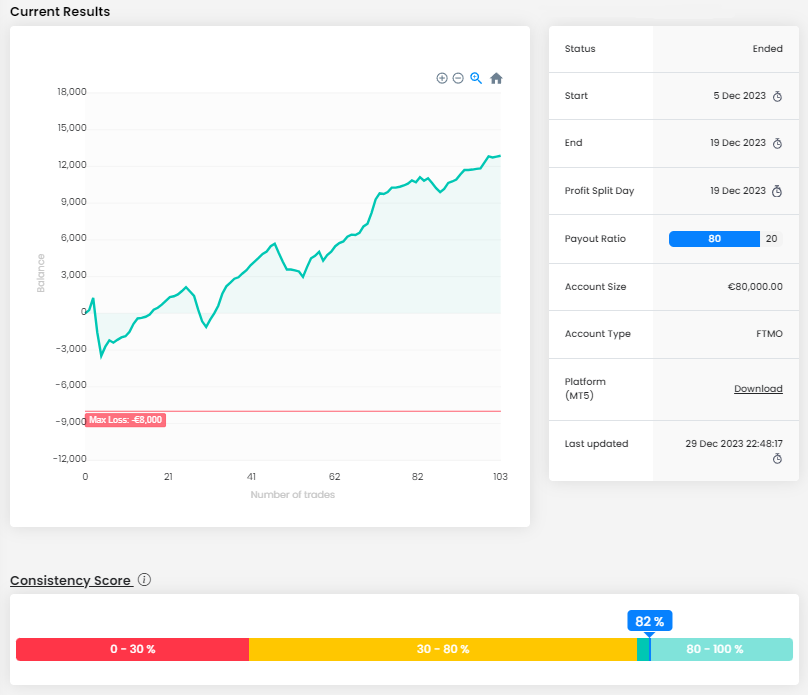

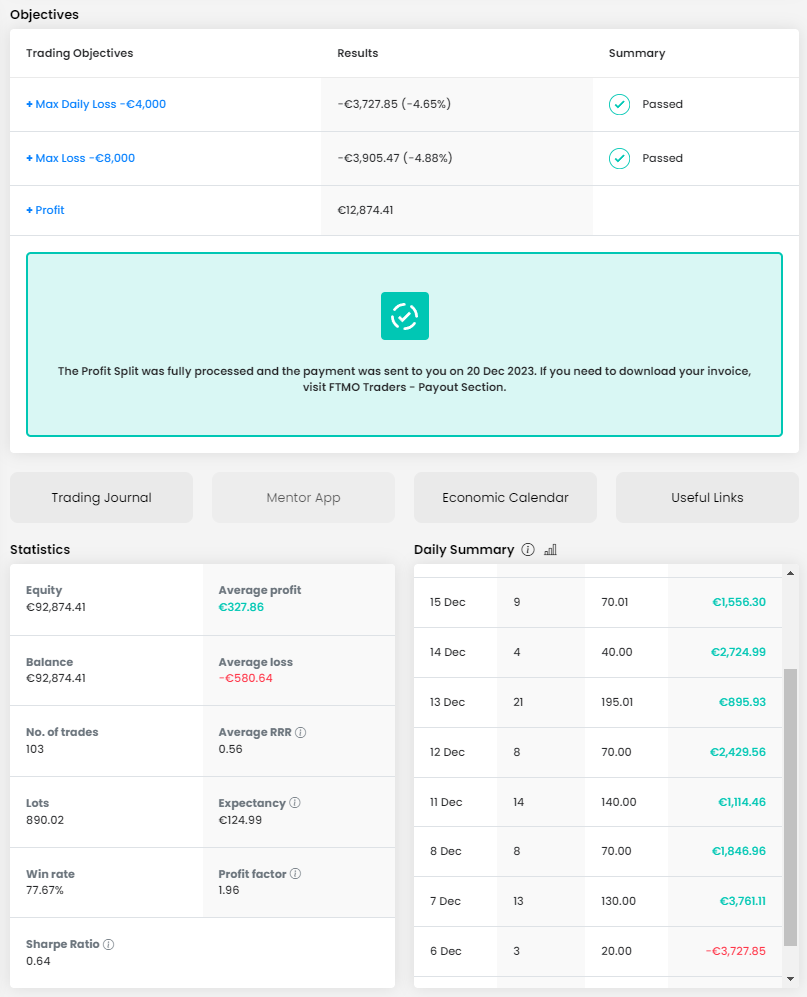

The second trader took a slightly different approach, but he too had to deal with several losing streaks. Unlike the first trader, the first losing streak was right at the beginning of the trading period, but luckily the trader stood up to it and ended up with a very nice result.

The second trader executed more than three times the number of trades (103) in half the number of days (11) as trader number one, and the total lot size (890) and average position size (8.64) were larger, as was the higher success percentage (77.67%), yet he ended up making a much smaller profit. This is probably due to the much lower RRR (0.56), but this case clearly shows that large positions and a large number of trades do not necessarily lead to better results.

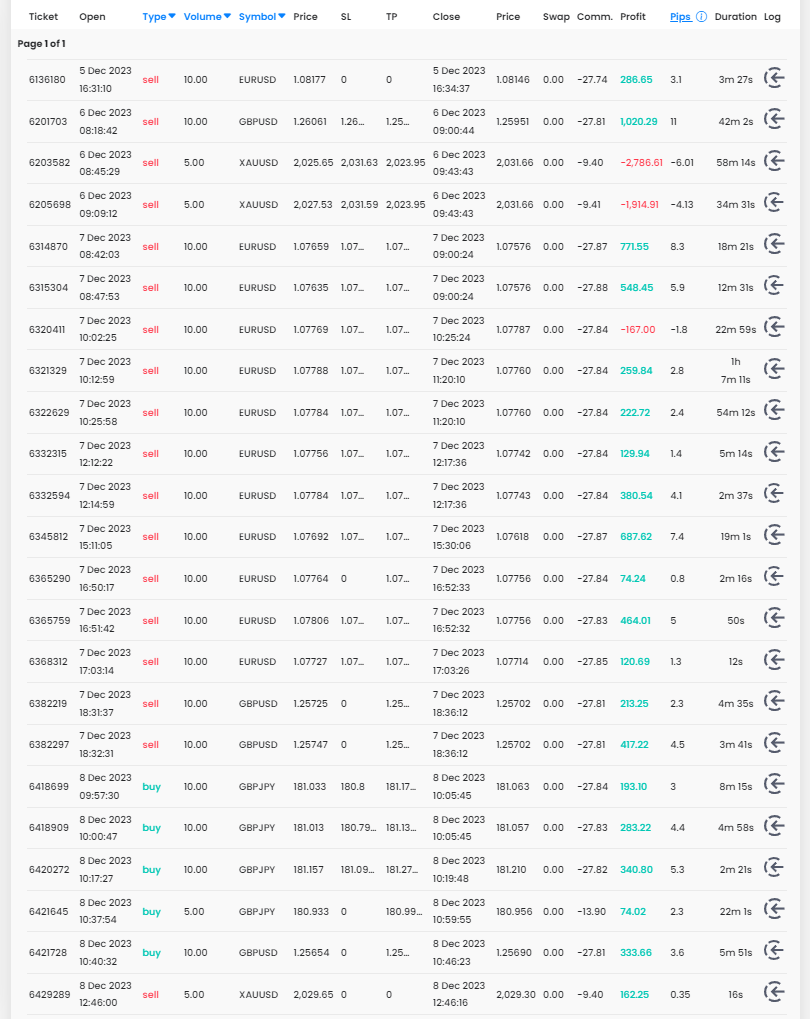

Even in the diary we find differences. The first one we mentioned in the previous paragraph, the second trader opened larger positions (5 and 10 lots) and more often opened multiple positions, so sometimes his position size could be up to 20 lots. While this is still fine, it is a less conservative approach. Also, the holding time was much shorter for the second trader, so he closed trades with much lower profits than the first trader, despite the larger positions.

If we were to describe the first trader as an intraday trader who sometimes holds a position overnight, the second trader is more of a combination of a scalper and an intraday trader who never holds a position for more than a few hours. We can find consistency in both traders in entering Stop Losses (in most cases), which is of course appreciated because SL and TP should not be skipped by any trader regardless of their trading style.

The last difference that is noticeable at first glance is the number of instruments traded. The second trader traded three currency pairs, two of which (EURUSD and GBPUSD) provided the majority of his returns. The GBPJPY pair and gold (XAUUSD) did not fare as well.

In today's article, we have shown, using the example of two slightly different approaches, that large positions and short-term trades with a higher frequency of open positions may not lead to a better result. Conversely, a more conservative approach can have a positive impact on a trader's overall results. Trade safely!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.