How to use fundamental analysis in forex

Forex traders in the vast majority of cases make their trading decisions on the basis of technical analysis. However, it is not desirable to ignore fundamentals completely, as they can significantly influence what happens in the financial markets. How does fundamental analysis work in forex, and what are its advantages?

Most forex traders (and this also applies to FTMO Traders) are short-term traders trading intraday (or are classic scalpers). It is therefore not surprising that technical analysis is so popular in this environment. For short-term trades, the technical approach is probably more suited, as traders are primarily looking at the risk/reward ratio and can profit in both rising and falling markets.

Fundamentals are mainly dealt with by investors

Fundamental analysis is much more applicable to traditional investors with a longer investment horizon. Investors assess the economic health of a company and examine the numbers in the financial reports that companies publish on a quarterly basis. Based on various models, value investors then look at the intrinsic value of a stock and determine whether the stock is undervalued or overvalued compared to the current market price. They then decide whether to buy the stock (or hold it or increase their holding if they have it in their portfolio) or consider selling it.

However, even in forex, there are traders who prefer fundamentals, or both approaches are equivalent for them and have equal importance when deciding to enter a trade. In addition, we have a group of speculators who try to profit from short-term movements just after the publication of macroeconomic news. However, this approach can be considered more as gambling and at FTMO we do not recommend this form of speculation to traders.

Geopolitics affect the whole world

Unlike stock investors, the purpose of fundamental analysis in forex is to monitor economic, social and geopolitical events and trends that can affect the supply and demand of individual currencies and thus the value of the currencies of individual countries. However, individual events and factors may not only affect the currency of a single country. They may be events or trends affecting an entire region or group of countries, some of which, such as the spread of Covid-19, may affect events worldwide.

For example, when a crisis spreads globally, currencies that are considered to be safe havens (JPY, CHF) thrive as investors/traders seek safety. In return, when emerging countries in a region start to prosper, their currencies may also appreciate because investors and traders like new growth opportunities.

Full calendar of macro data

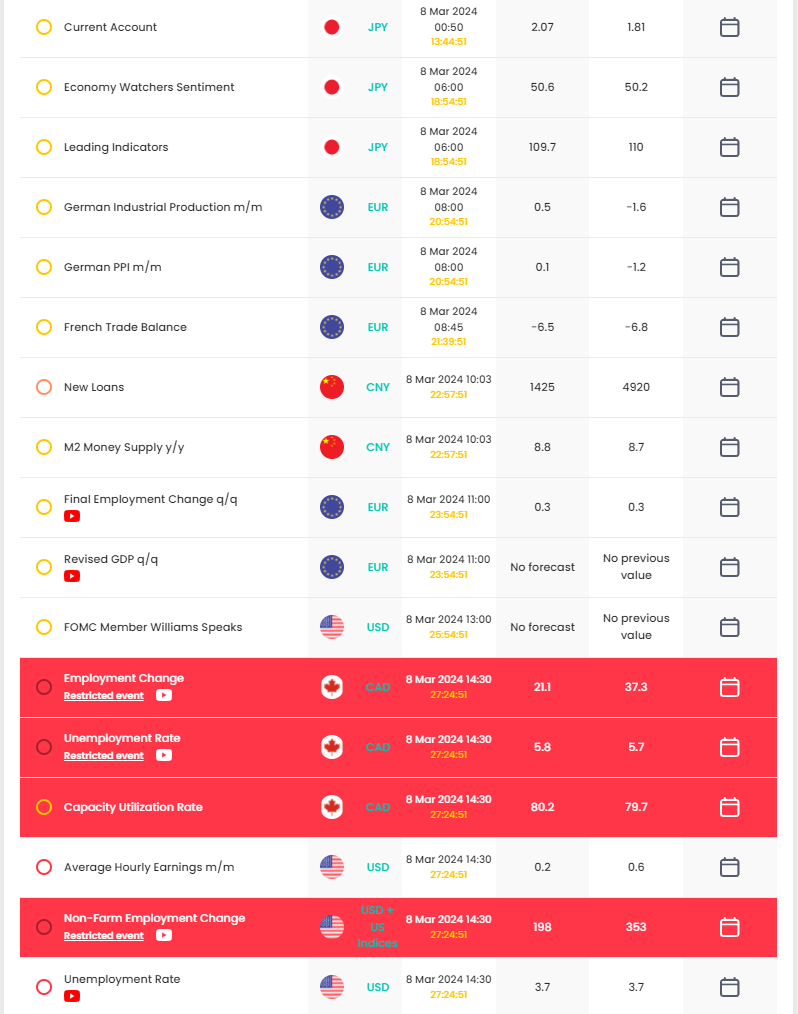

The above factors can affect multiple currencies at once, but are also difficult to predict. The second group of factors that affects currencies of individual countries, is the macro data, which is published regularly. This data is published by individual countries on a regular basis, and traders can keep track of them through various macroeconomic calendars (including our FTMO Economic Calendar). This allows them to prepare for the short-term volatility that can occur in the markets after these reports are published.

Among the most important reports that have a major impact on the value of individual currencies are those relating to developments in the labour market, inflation rates, interest rates announced by central banks or economic growth i.e. GDP. However, data relating to retail sales, purchasing managers' indices (PMIs), developments in the housing market, durable goods orders and, last but not least, data relating to consumer sentiment are also important.

Although it may seem like a lot, the publication of individual data is spread out over the month. For some data, the preliminary numbers are published first (such as the PMI) and only after a few days, we learn about the final readings. Central bank interest rates are announced every six to seven weeks, and this also varies for GDP data. We have written about all the important macro data mentioned above on our blog, so if you are unsure of the numbers, you can educate yourself there.

Every trader, including those who focus primarily on technical analysis, should be very aware of the impact of various economic and geopolitical events on individual currencies. Before each trading day, every trader should study the economic calendar thoroughly to keep track of what important news will be published that day.

Short-term traders should avoid trading during times of important news. Traders who hold their positions for longer periods of time should be prepared for more significant moves and adjust their SL and TP levels accordingly if necessary. Once the numbers are out, it is too late to quickly adjust open positions. In such cases, patience is rather advised, as volatility may subside after a few minutes. Long-term trends and their changes may not be immediately apparent after the news is published, but important macro data can have a significant impact on them.

Conclusion

Fundamental analysis may not be as widespread among forex traders as technical analysis, but that does not mean that traders should avoid it. In fact, it can be a very valuable addition even for those who focus mainly on price charts. Knowing the economy and what is going on in the world can give a trader the needed additional edge that will make the difference between a profitable and a losing trade.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.