How Paper Trading Prepares You for Real Markets

Trading can be both thrilling and daunting. The fear of losing money often keeps people from taking their first step or progressing further. When looking for an alternative way to practise without risking your capital, paper trading can be the right answer for you.

What is paper trading?

Paper trading, also known as virtual trading or simulated trading, is the practice of buying and selling financial instruments using a simulated account. The term originated when traders practised trading literally on paper before risking their money in the markets—long before online platforms took over.

How does paper trading work?

Learn more about how paper trading works before looking for the best paper trading app. The main goal of paper trading is to mirror real-world market conditions, enabling users to test their strategies. What is the key difference from trading? Instead of actual money, with paper trading, you are not working with your real capital but with virtual funds. This can help you fine-tune your strategy, as paper trading offers a playground for practice without risking your funds.

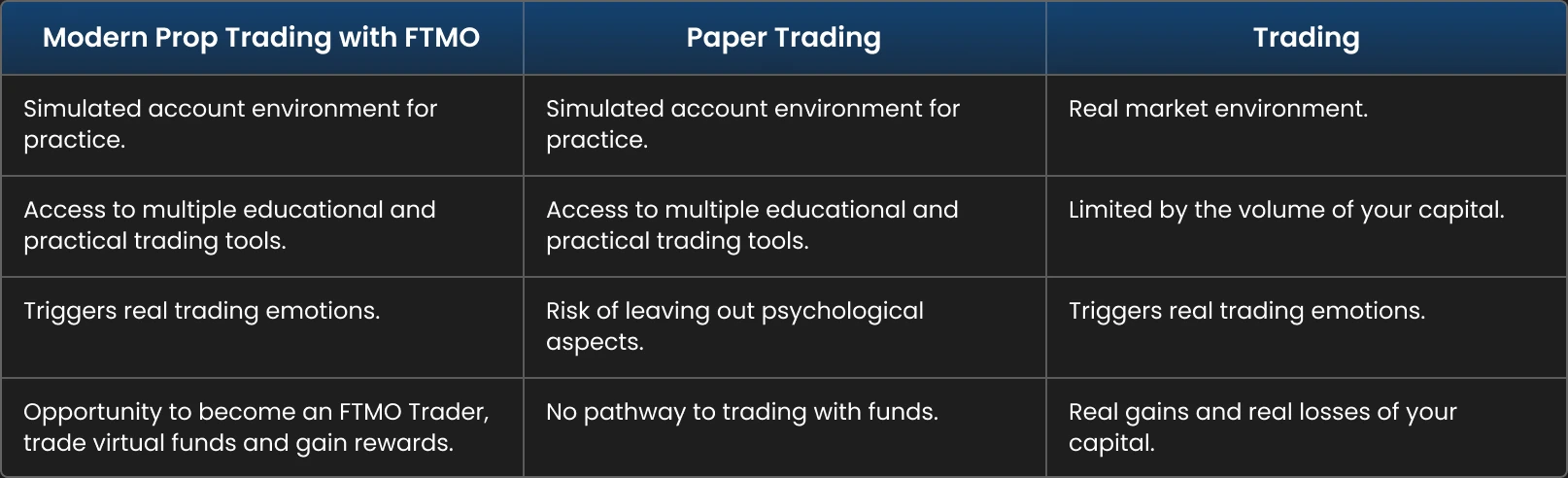

What is the difference between paper trading and Modern Prop Trading?

While paper trading and Modern Prop Trading allow you to trade without risking personal capital, their purposes differ. Paper trading is purely educational, offering a risk-free, simulated environment in which to practice strategies. In Modern Prop Trading, you can also test your trading plan, but if your results perform well, you will gain rewards from your simulated profits. Find some key points summarised and compared to trading in the real market environment below.

The Importance of Trading Psychology

Trading success depends not just on strategy, but also on mindset. Emotions like fear and greed can lead to impulsive decisions, disrupting well-planned strategies. Simulating real trading conditions helps traders understand their psychological reactions, strengthen discipline, and build confidence.

Mastering emotional control is key to long-term consistency. With FTMO, you are offered the full journey: from practising a strategy in the FTMO Free Trial and gaining solid basics in our FTMO Academy, to testing your strategy in the FTMO Challenge and becoming an FTMO Trader. As an FTMO Trader, you gain access to two coaching sessions per month to discuss trading psychology with a professional.

How does Paper Trading differ from Stock Simulators?

Paper trading is a form of stock market simulation that allows participants to practice buying and selling stocks without risking real money. Traditionally, paper trading involved manually recording trades on paper, hence the name. Today, the process has transitioned to digital platforms, offering a more convenient and realistic trading experience. These platforms enable users to test strategies and gain market experience in a risk-free environment.

Things to know about Paper Trading

- • Builds Confidence: The stock market can seem overwhelming for beginners. Paper trading helps you get comfortable with trading platforms and terminology without the pressure of using real money.

- • Hones Strategy: Experienced traders can test new strategies or refine existing ones in a risk-free setting before applying them in live markets.

- • Educational Tool: It’s an excellent resource for learning about various asset classes, such as stocks, options, or cryptocurrencies, and understanding how market movements affect your portfolio.

- • Emotional Triggers: It is essential to understand the limits of paper trading and recognize that you might react differently when dealing with your own capital.

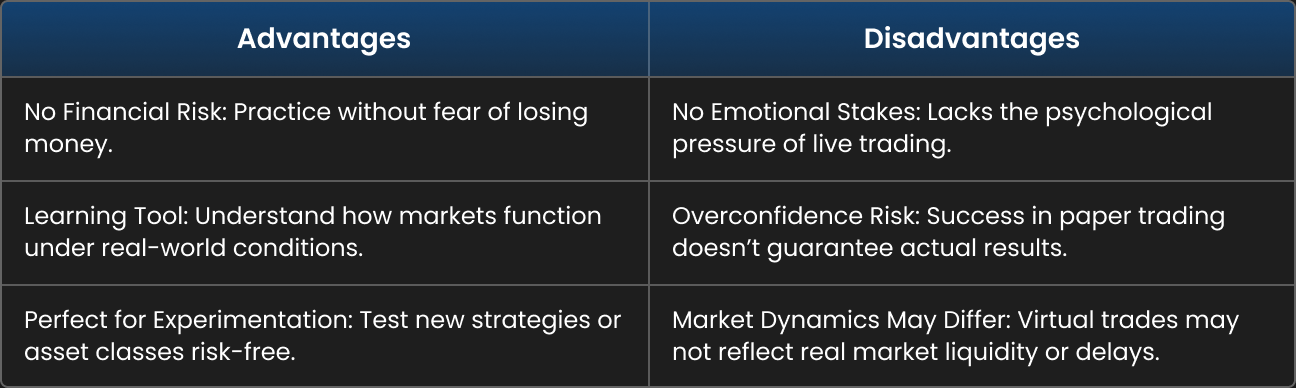

Advantages and Disadvantages of Paper Trading

Is Paper Trading for You?

Paper trading is a valuable tool for traders at all levels. Beginners can use it as a stepping stone to gain confidence, while experienced traders can use it as a testing ground for new ideas. It can help you assess your risk management and work with the high volatility of the markets. However, it’s essential to understand its limitations and not rely on it as your sole preparation for live trading.

Limitations of Paper Trading

- • Lacks Emotional Pressure: Hard to simulate the stress of live trading without real money.

- • Potential Overconfidence: Success in a risk-free environment doesn’t guarantee success in live trading.

- • Market Dynamics Differences: Instant execution in virtual accounts may not reflect real-world liquidity or order delays.

How do you start with Paper Trading?

Most brokerages and trading platforms provide paper trading accounts. The best platform for you will depend on your specific needs and goals. Here’s how to get started:

- • Choose a Platform: Select a platform that offers paper trading. Very popular is TradingView, but brokerage companies and also FTMO in the form of a Free Trial offer the opportunity to try paper trading directly on their platforms in the form of a demo account.

- • Set Up an Account: Register for a simulated account. Many platforms provide virtual funds to start your practice, typically ranging from $10,000 to $1,000,000.

- • Trade as You Would in Reality: Use the platform’s tools to buy and sell assets, set stop-losses and take profits, and track your portfolio—just as you would with a real account.

- • Analyse Results: Review your trades to identify patterns, strengths, and weaknesses in your strategy.

Tips for Effective Paper Trading

- • Treat It Like the Real Thing: Approach your paper trading account as if you were trading with real money. This mindset will help you develop habits and discipline that can be transferred to live trading.

- • Set Realistic Goals: Avoid taking excessive risks because it’s not real money. Simulate trades that you’d genuinely consider in live markets.

- • Record Your Trades: Keep a journal to log your decisions, learn from mistakes, and track your progress.

- • Transition Gradually: Once you feel confident in your skills, start small in live trading to ease the transition from virtual to real-world investing.

How can you apply Paper Trading?

By combining the lessons learned from paper trading with real-world experience, you’ll be better equipped to navigate the complexities of the financial markets and achieve your trading goals. Paper trading allows you to grow as a trader, refine your strategy, and approach the markets with a sharper edge.

Final recommendation

Compare these results with your backtesting results, to identify differences and use the new insights to optimise your trading strategy. You can incorporate other tools like the Equity Simulator to see how a refined strategy might perform in the long run.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?