FTMO Traders Analysis: what consistent trading looks like

With today's article, we start a new series about successful traders and their way of trading. It will not be about traders who have met the conditions of the Evaluation Process, but about those who trade on FTMO Account.

Unlike traders who have met the requirements of the Evaluation Process, but may not yet have made a profit on an FTMO Account that we can pay out, in this article (and series) we will talk about traders who have made a profit their on FTMO Account and were able to realize a payout.

Compared to the FTMO Challenge and Verification, some of the conditions (the minimum number of trading days and the minimum required profit target) are removed in this case, so traders have more freedom in trading and can trade with less stress. Only the basic requirements of risk and money management, i.e. Max Daily Loss and Max Loss, remain in force.

Consistency over returns

In today's first part of the series, we will describe a few monthly results of one of our most successful traders, who is able to show profitable months for a long time and has already made dozens of payouts. The trader manages several accounts and his strongest weapon is just consistency, the size of the monthly profits does not matter very much.

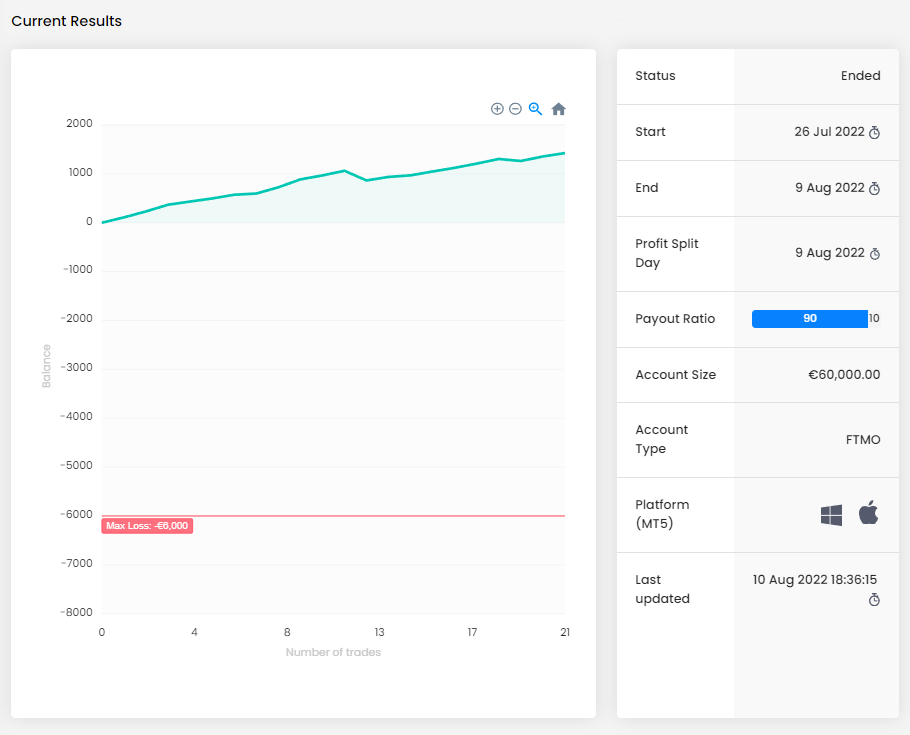

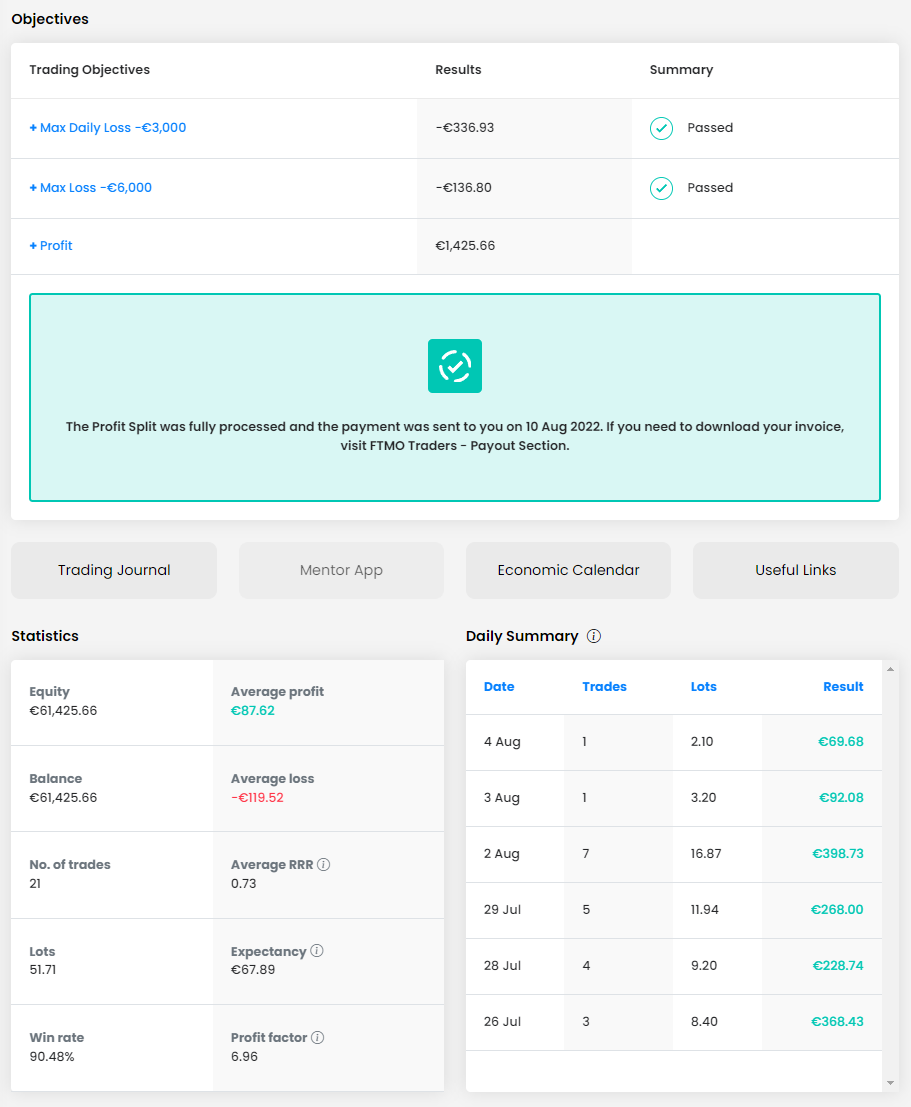

According to the first balance curve, we can see that the trader's results have been very consistent and he has executed 21 trades in the minimum possible period, all of which ended in profit with two exceptions. It can also be seen here that, given the size of the account, the total profit is quite small ($1,425.66), but, as already mentioned, consistency is the key. Thanks to it, the trader has already scaled-up his account and his payout ratio is 90%.

The trader obviously has no problems with the Max Daily Loss and Max Loss. The problem may be that his average RRR (reward to risk ratio) is below 1 (0.73), but the trader “makes up” for it with a very high success rate of over 90%. As we can see, the trader traded six days during the reviewed period and all of them ended in profit.

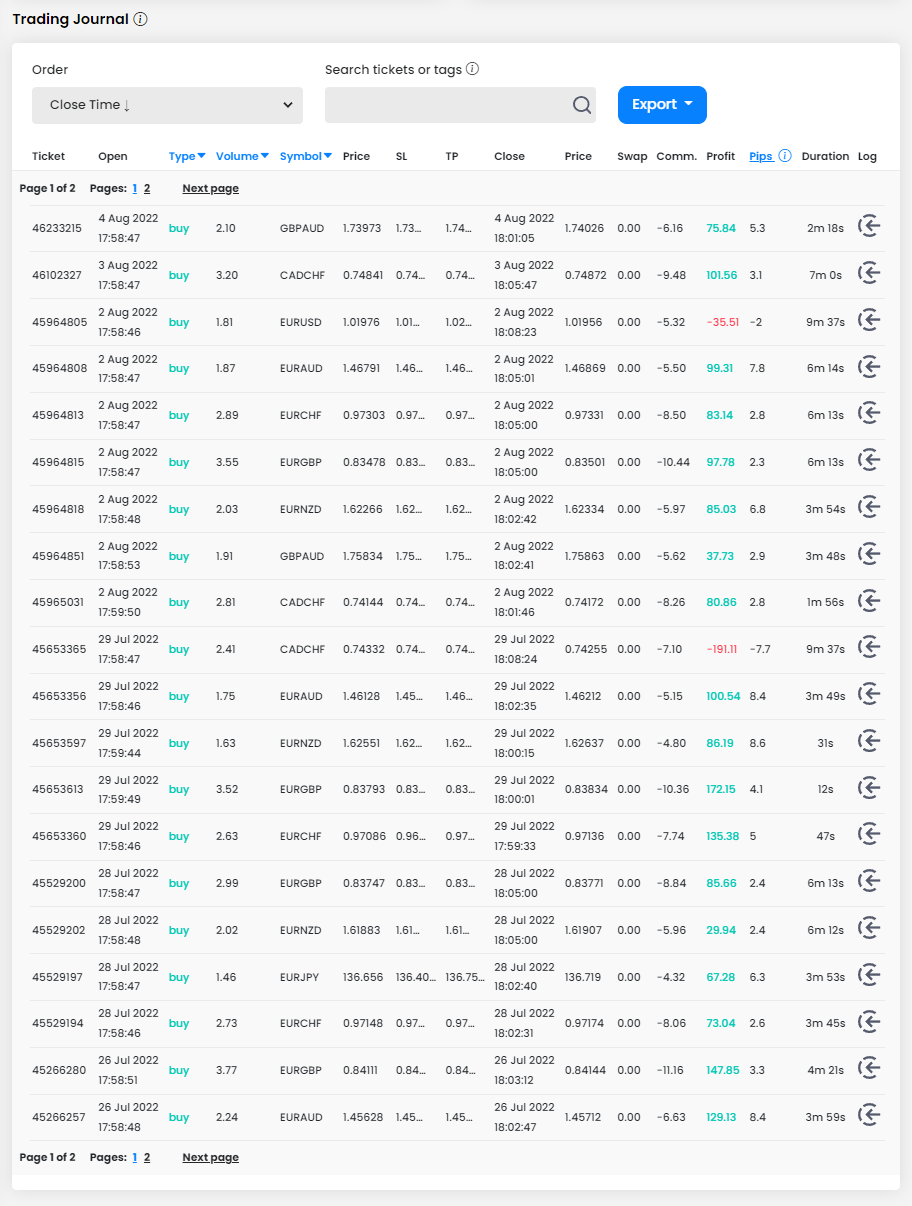

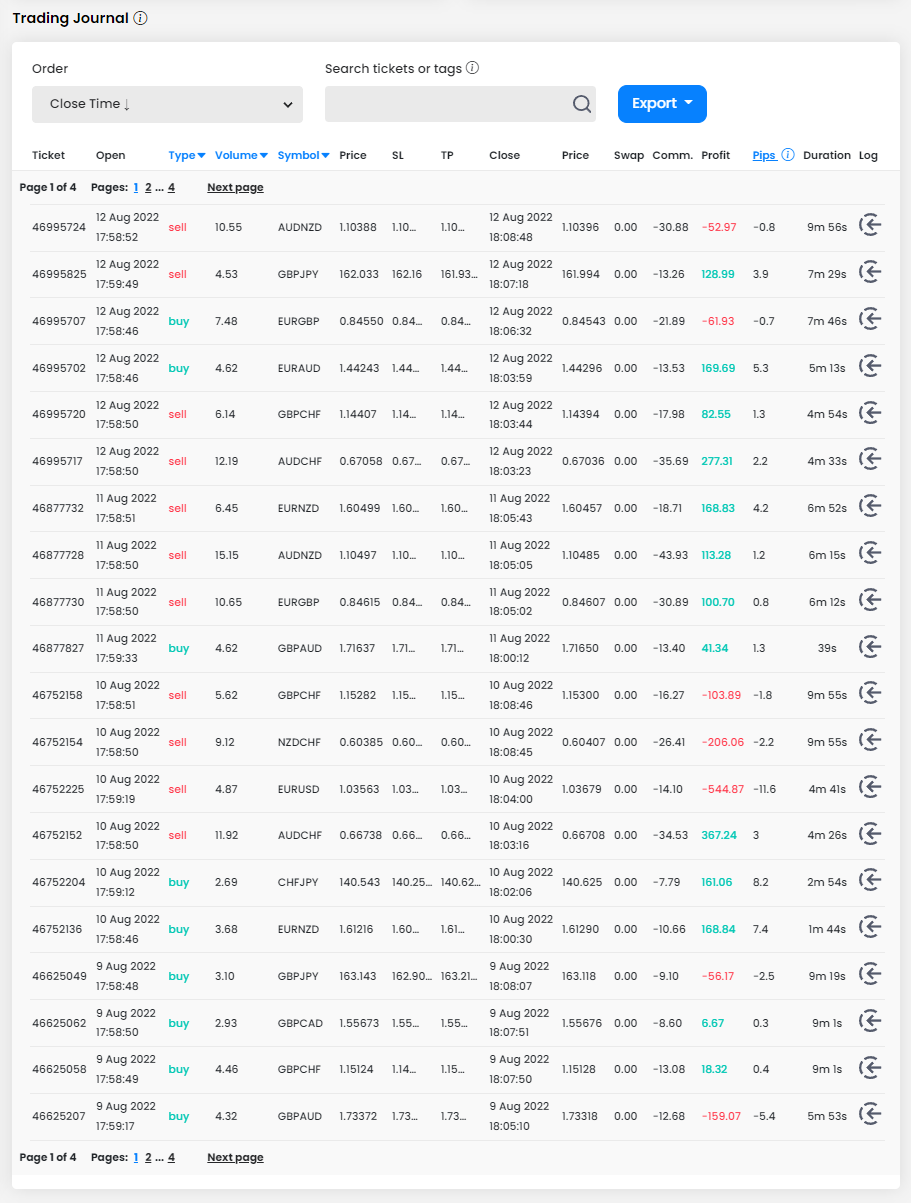

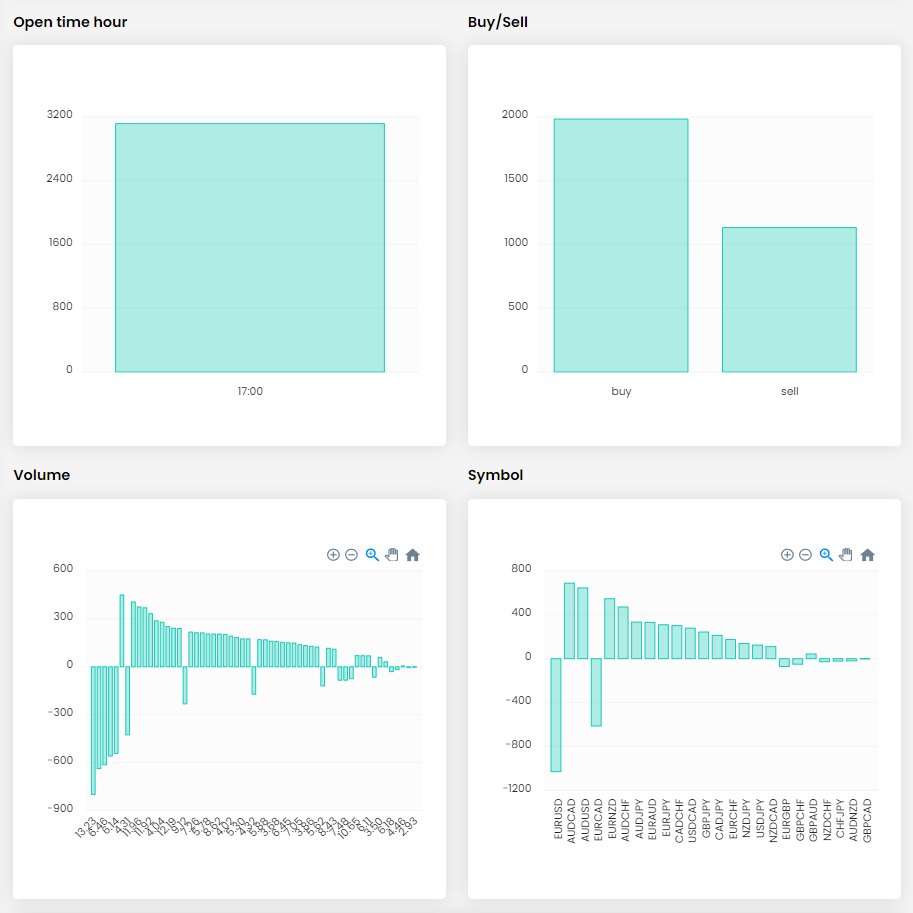

From the trading journal it is clear that the trader is trading similarly large positions (in lots), opening them on several currency pairs and holding the trades for only a few minutes, so we can classify him as a scalper (the size of the positions, which represent only a few pips, looks like this). On the positive side, there is a set SL and TP for each trade, but this account has two interesting things. The trader opened all his trades just before 6pm of the platform time and only entered long positions.

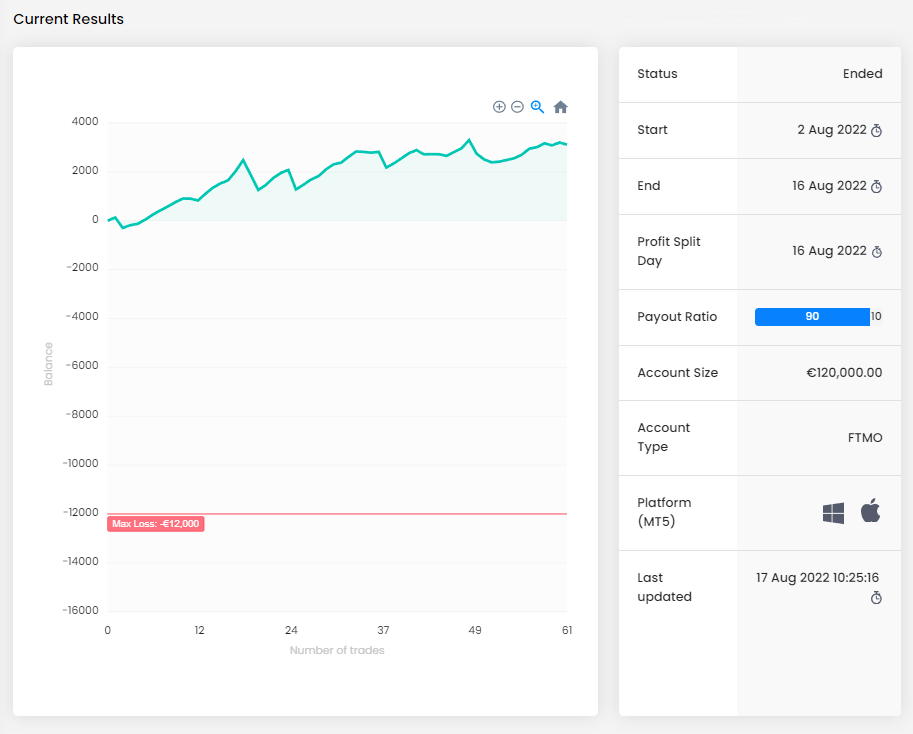

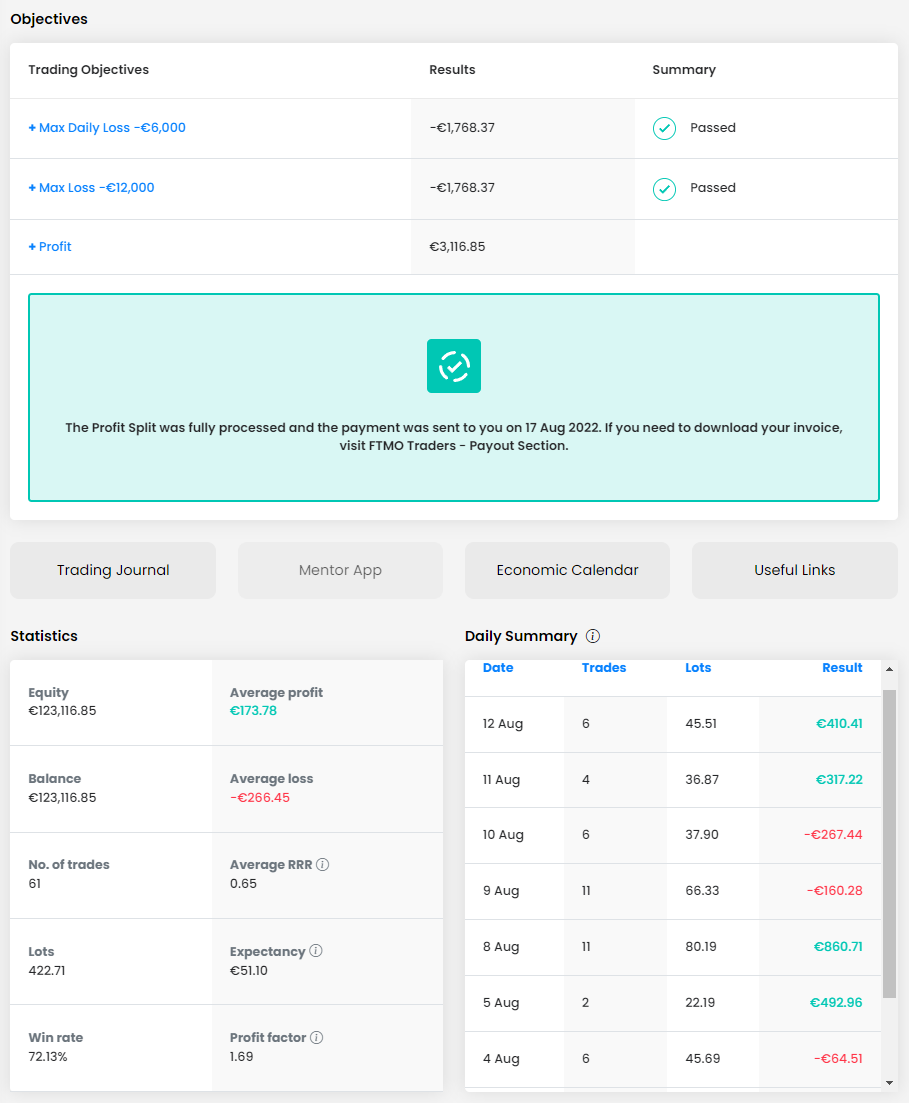

On the second account, the trader has already recorded more losing trades, but even in this case the balance curve has a fairly clear course and the trader was in profit except for a few trades at the beginning of the trading period. Again, he traded the minimum number of days required and set the Profit Split Day to be 14 days from the start of the account. This is a different account, with a larger size, but even here the trader achieved a relatively low return, on the basis of consistent returns.

Again, it is not even close to the values of the Max Daily Loss and Max Loss, but its weakness is again the value of average RRR, which is less than 1 (0.65). Again, it is catching up with the success rate of trades, but in this case there are more losing positions and some trading days ended in the negative. No wonder, because the amount of trades is much higher and the number of trading days is also higher.

Looking at the trading log, we can see that the open positions in lots are also much higher than in the first account, but again, they are relatively short-lived and match the scalping in terms of size in pips. What hasn't changed is the fact that the trader opens positions exclusively between 17:58 and 18:00, but in this case he has already opened some short positions.

In terms of the number of investment instruments, the trader’s choice is quite wide, we can say that he trades practically all pairs in the group of majors and crosses. Considering his strategy, which is limited to very short time periods, this gives him an interesting opportunity for diversification. For conventional strategies, however, a similar number of instruments can be counterproductive. We can also see that he did not do well on the EURUSD (four losing trades out of five) and EURCAD pairs and would have done better to avoid them.

That's all for today, in the next parts we will look at other traders who managed to make interesting returns during the month, but we will certainly not leave out the traders who did not do well and their bad strategy or unnecessary mistakes led to losses. What do you think about a series like this? Do you also manage to make consistent profits or are you more of a trader who looks for yield and consistency is not important to you?

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.