FTMO Traders Analysis: Different paths to great results

In the next part of our series evaluating successful FTMO Traders, we will again look at two traders with different approaches. In the world of Forex, there are probably no two traders with exactly the same approach and today's traders are a good example of this.

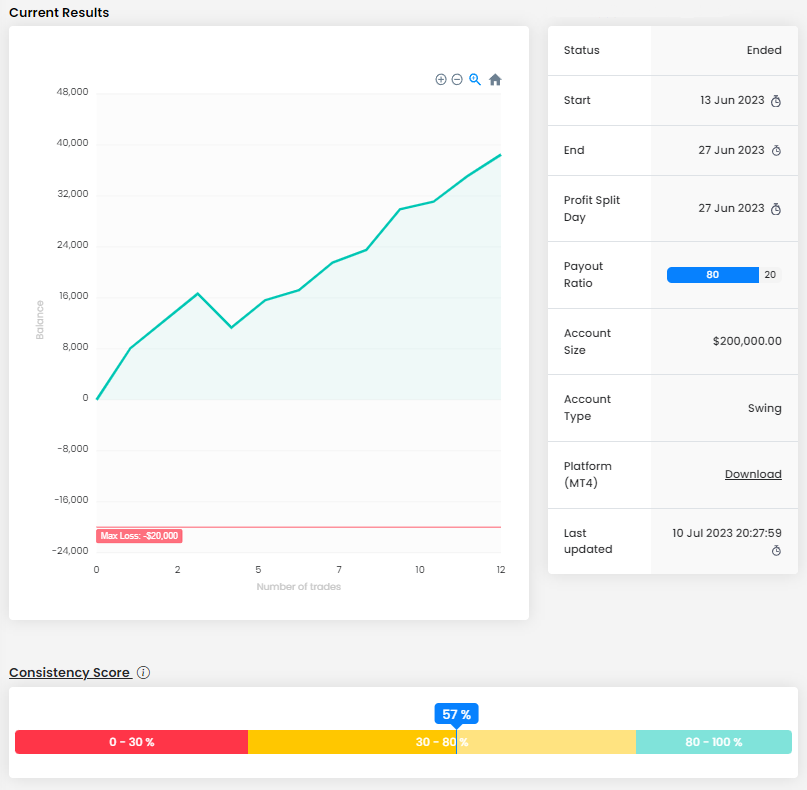

The balance curve of our first trader looks almost perfect. With the exception of one losing trade, the trader has seen virtually only profitable trades. It is nice to look at, but you have to remember that such a result in such a short period of time, when a trader makes practically only profits, is not common. It requires a dose of luck, which the trader must have.

In just 5 trading days, the trader made a profit of $38,479 which is close to 20% of an account size of $200,000 and is a very impressive result for such a short period of time. The trader's consistency score is not high, but this is due to one very successful day he had right at the beginning of the trading period as well as a relatively low number of trading days. Overall, the trader had no problem with loss limits and recorded the Maximum Daily Loss on the one day when he had an open losing trade. However, he managed to end even this day in profit.

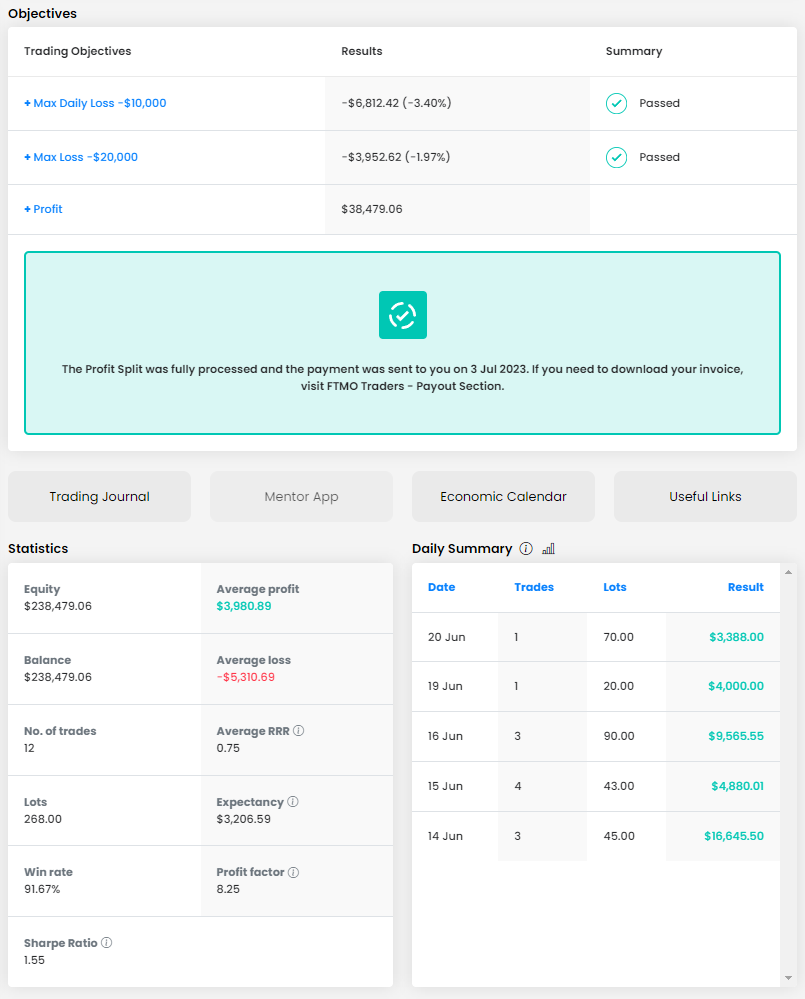

An interesting fact is that the average profit is less than the average loss, which makes the trader's RRR lower than 1 (0.75), which is a bad value in most cases. In this case, however, the average profit figure is affected by the fact that the trader split some of the profitable trades into multiple positions, but not the losing one. The success rate of the trades (91.67%) was then so high that the worse RRR could not affect the trader's results. With 12 trades, the trader traded 268 lots, which is more than 22 lots per position. Although it may seem like a substantial amount, it is important to consider that the impact was influenced by a series of significant positions. Given the account size of $200,000, such fluctuations are deemed acceptable within reasonable limits.

Looking at the trading log, it is evident that the trader opened positions of varying sizes, in two cases as large as 50 and 70 lots. This is indeed a lot, but it should be noted that the trader did not open a large number of positions per day and his stop losses were set in such a way that even in case of losses it should not have jeopardized his account. We have to commend the trader's stop losses, we do not recommend the large positions mentioned above.

At the beginning of the trading period, the trader held the positions overnight, but then he abandoned this approach and therefore avoided negative swaps which were unnecessary. Thus, he is an intraday trader who holds trades for several hours and determines the size of positions based on the distance to the set Stop Loss.

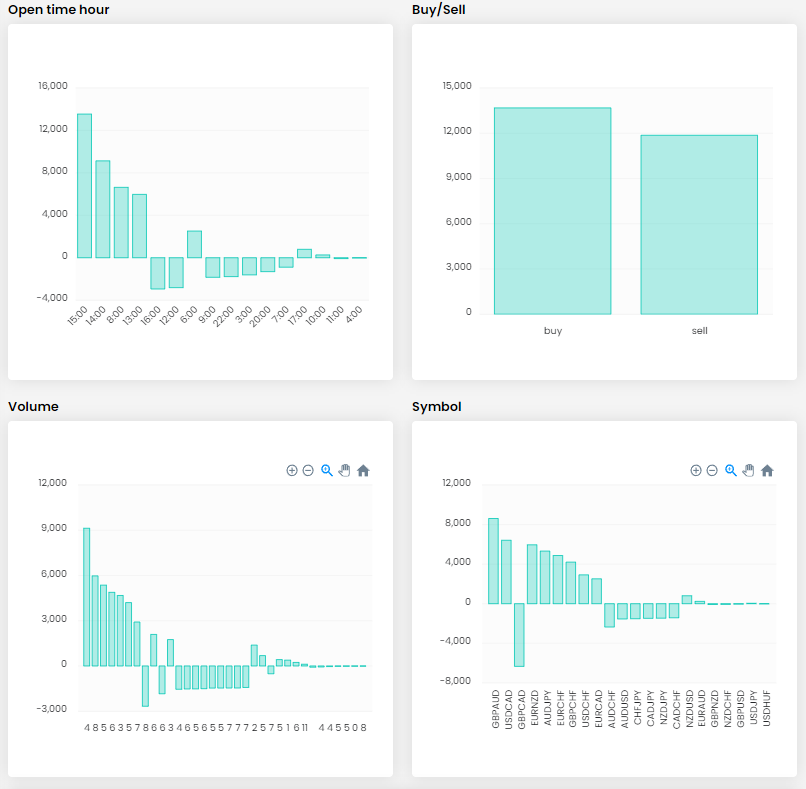

Most of the positions on his account were sell positions, but there is certainly no pattern in the trader's behavior. The trader traded five investment instruments, four of which were currency pairs and one was an index instrument. The given number can be considered sufficient for diversification and the trader cannot be faulted in this respect.

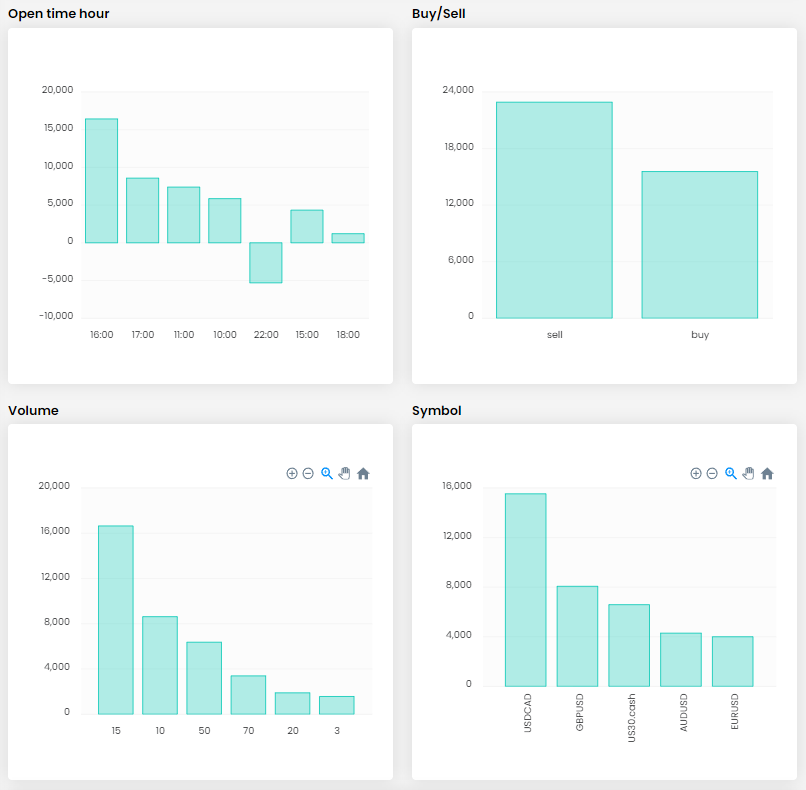

The second trader took a slightly different approach, but he also managed to make some great profits. Had it not been for a series of six unsuccessful trades during the first four trading days, his profit might have been even better. In any case, we have to appreciate the trader's ability to get out of a difficult situation relatively quickly and stick to his plan without "taking revenge" on the market by unnecessarily increasing the volume of his positions, etc. from the very beginning.

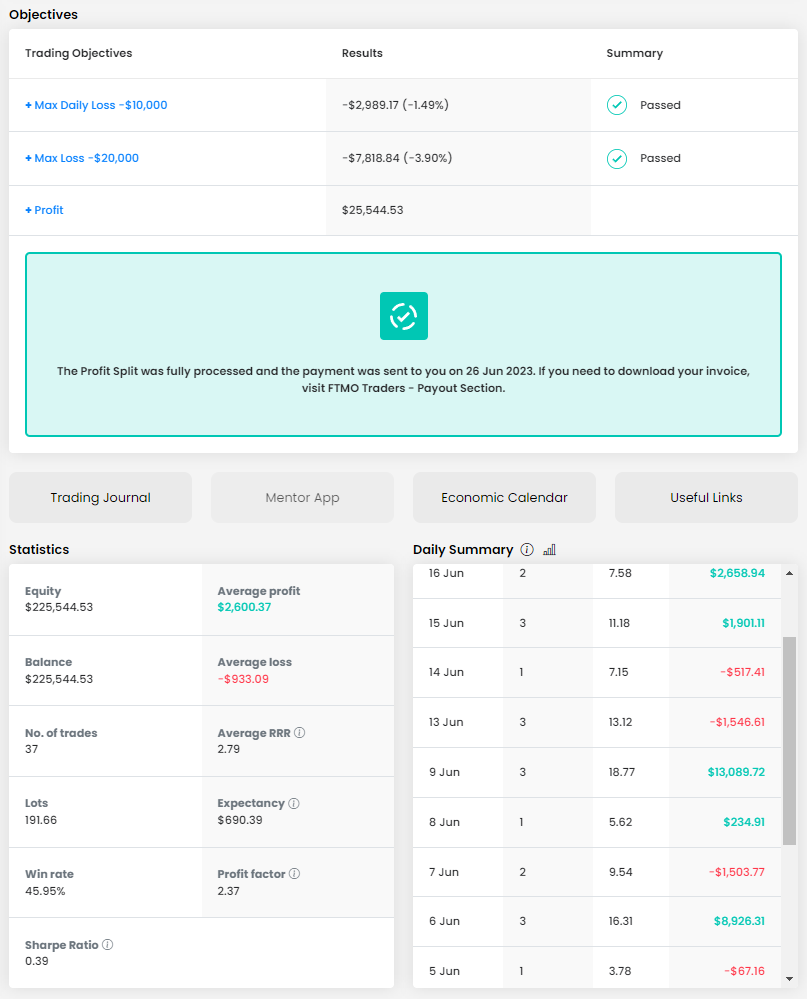

Despite the bad start, the trader's balance curve has quite an interesting development, which is also shown by the relatively high consistency score. The total profit of USD 25,544 also means a great result for an account size of USD 200,000. In this case, however, the trader needed much more time and many more trades to achieve it.

As in the first case, loss limits were not an issue for this trader. His RRR (2.79) is also much better as it allows the trader to be profitable in the long run even if more than half of the trades end in a loss (success rate of 45.95%). The ratio of profitable to losing days is similar (7:8), but even in this case, it does not pose any serious problem.

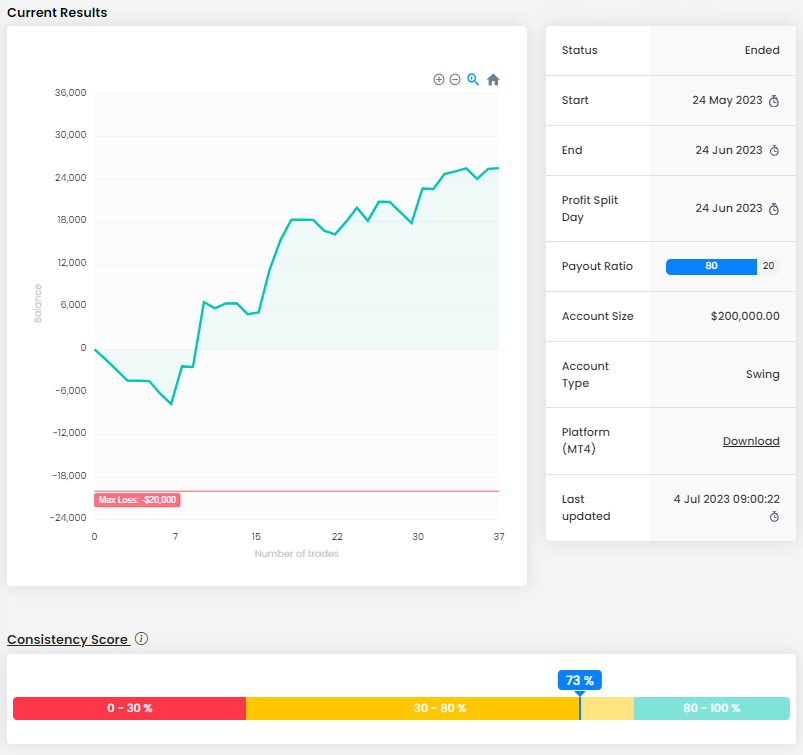

The trader opened 37 trades over a period of 15 days with a total volume of 191.66 lots, which is just over 5 lots per position. This volume is not too high for an account size of $200,000. Looking at the trading journal, we can see that the trader's highest loss did not exceed $1,825, i.e. not even one percent of the account. In only a few cases did the trader open more than 3 positions in a single trading day, which is a positive factor given the size of the position.

We must also commend the trader for entering a Stop Loss for each position, but he probably handled the Take Profits for his positions manually. Thus, this trader quite often (in about half of the cases) kept trades open overnight. Since he often traded pairs with the Japanese yen and Swiss franc, where the interest rate differential (when speculating in the right direction) makes the swaps positive, his balance sheet was positive in this respect as well.

Similarly to the first case, this trader opened positions of different sizes depending on the distance to his Stop Loss. However, the big difference between both accounts is in the number of investment instruments traded, all of which are currency pairs. On the one hand, the trader probably wanted to diversify his entries, but too many investment instruments may not always be an advantage. Sometimes it is better to concentrate on one or just a few selected instruments. In this case, however, the trader was able to manage up to twenty instruments, which is admirable.

As you can see in today's example, we can achieve great results in different ways. Different trading days, instruments, and the number of trades ultimately led to a very good result in both of today's cases. All that remains is to congratulate the traders and keep our fingers crossed that they will do just as well in the months ahead.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.