Calculate your position size and trade seriously

As part of our ongoing expansion of our Tools and Services to help clients improve their trading skills, we have expanded our trading calculator offering. These should make decision-making easier for all traders who are serious about their trading.

One of our main goals in serving our clients, besides educating them, is to improve their trading habits, especially in the area of risk management and money management. Any trader who wants to be profitable in the long term should be clear about how much money he can use for a trade, how much risk he will take and how large his position will be before entering a position.

After offering traders two calculators a year ago that allow them to calculate the required margin per trade and the value of their position, we are expanding our offer with a new Position Size Calculator.

In addition, we have also unified the design of all three calculators to make it easier for our clients to navigate when they need to calculate the aforementioned important parameters when opening a position. Our traders now have a comprehensive solution in one place. Of course, we also offer language localization in all languages offered by today's version of our website and trader environment.

Know your position size

Every trader should have a clear idea of how big their position will be before entering a position to meet their money management rules. Of course, the basic premise is that the trader should have these rules clearly set out within his strategy and not change them during the course of trading, as such trading is pointless.

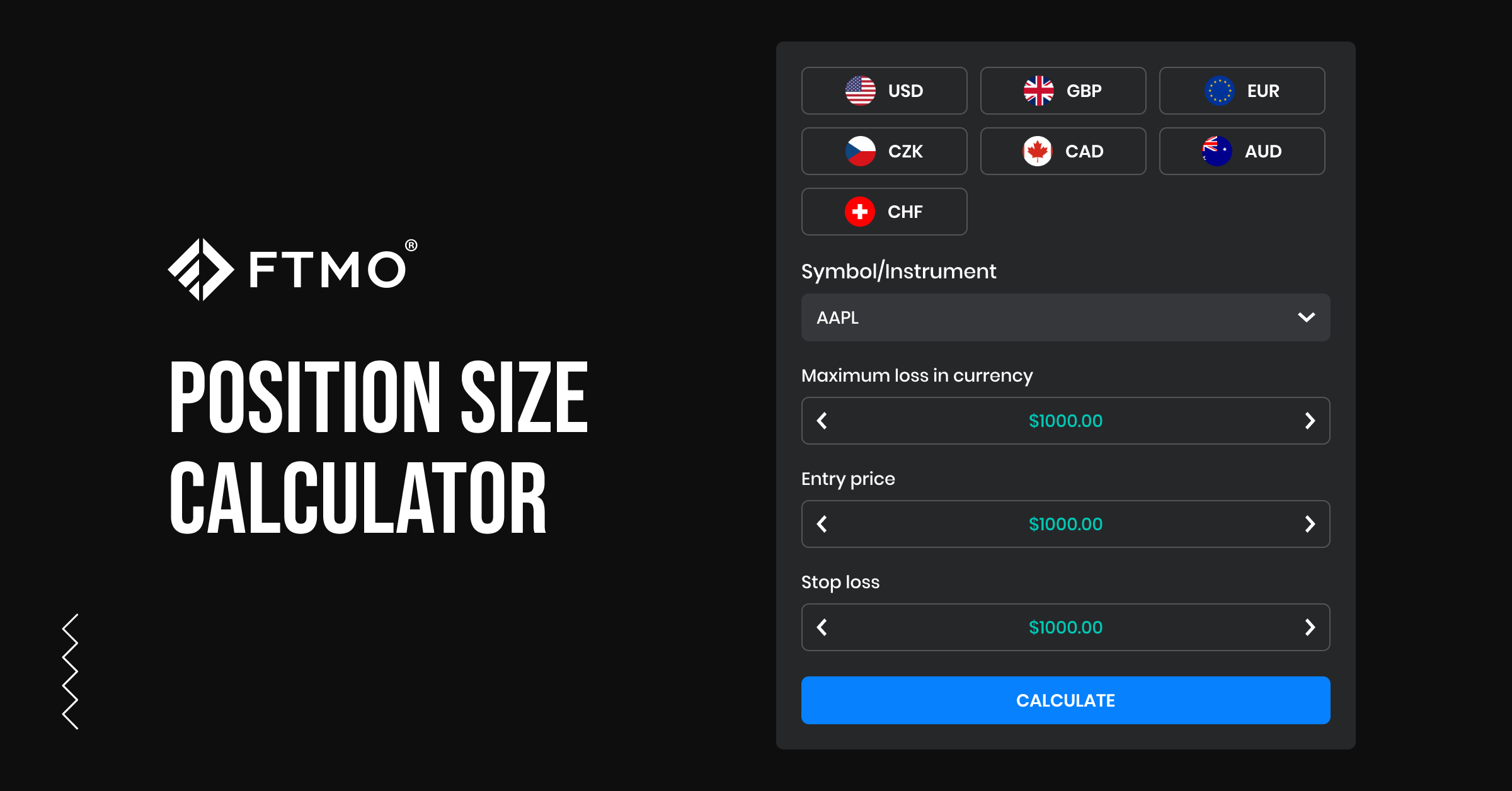

Position Size Calculator

Our Position Size Calculator allows the trader to calculate the position size in lots on the symbol of his choice and in the currency of his account. It is particularly suitable for those traders who have a clearly defined amount they are able to lose per trade when opening a position, for example 0.5% of the account balance. At the same time, however, they set a different Stop Loss size in points for each position depending on how the exchange rate of the currency pair or the price of the instrument develops.

All the basic parameters such as the currency of the trader's account, the entry price, the Stop Loss (the price at which he wants to exit a trade that has failed) or the amount he wants to risk can of course be changed according to the trader's needs. The calculator is available for all symbols/instruments that can be traded on FTMO platforms and is designed for all types of traders, from scalpers to swing traders.

Our trading calculators aim to make it easier for traders to calculate the basic parameters they need when opening their positions. If you are serious about trading and consistently follow the rules of money management, using them is almost a must. You can find them in the left panel of your Client Area under Tools & Services. Trade safely!

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?