Why do we care about open losses?

In the following example, we will look at why it’s so important for investors to monitor the open losses, why the equity curve is more important for traders than the balance curve and why they should not take into account MetaTrader statements, myFXbook statements or other external sources.

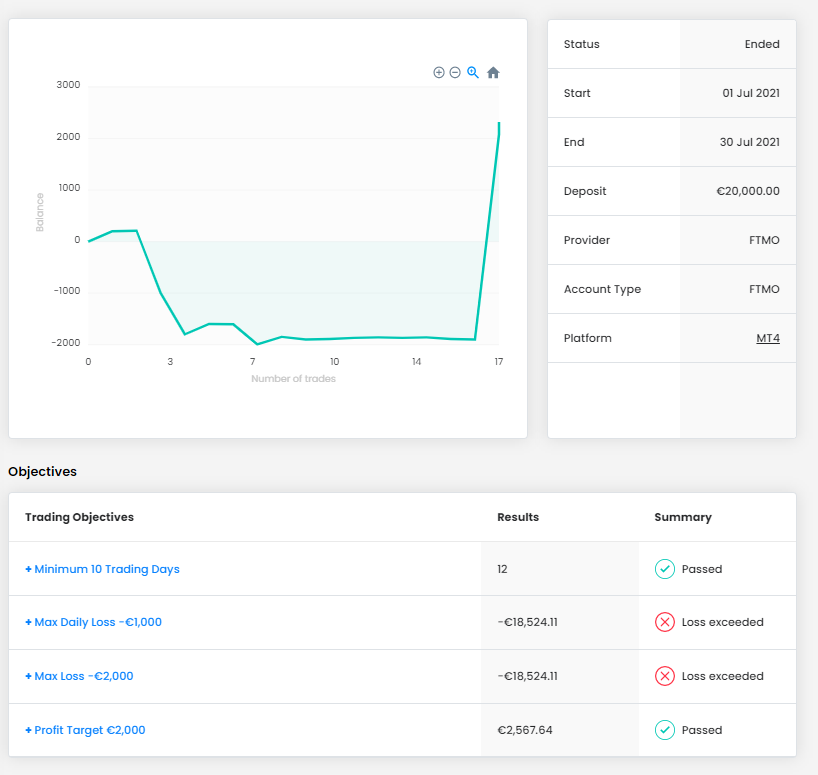

This trader has never crossed the Maximum loss on his closed positions. His last trade has even hit the desired Profit Target. We might say that this trader observes the trend following a system where he awaits break-outs. These trading strategies have something in common. They often have smaller losses, but then the potential profits are really high. If we were not following the open losses, we could consider this FTMO Challenge being passed and the trader would normally advance into Verification stage.

However, if we look into the open losses, we observe an interesting phenomenon. This trader actually had 92,6% of his account in the floating losses, probably hoping that the market conditions could reverse his losses one day. Or not… His total open loss was -€18,524.11 on €20,000 FTMO Challenge. In one moment, the trader’s Equity was as low as €1,475.89, down from the initial €20,000 .

We often experience beginner traders complaining with the argument that the market conditions will eventually change and so why is their FTMO Challenge marked as violated? In other words, if a trader doesn’t have a proper control of his account Equity and risks taken, he/she probably does not have enough discipline to consider trading a serious business. We hope this short article clearly explains that no serious investor ever observes the Balance curve that displays the closed trades only, but the current assets in a form of Equity curve.

For the above reasons, investors also don’t accept MetaTrader statements, myFXbook statements or other external sources that don’t prove the progress of the Equity curve and the reliability isn’t always assured.

At FTMO, we understand that market conditions might vary and that’s why we offer our traders a generous 10% drawdown buffer and 5% max daily loss. These conditions are in a ratio of 1:1 (loss to profit) and this is probably the best prop trading environment out there. Our major aim is that our traders are experienced and that’s also why we introduced the above risk parameters that should keep traders in a game.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.