How to scalp the dollar through three currency pairs

In the next part of the series on successful FTMO Traders, we will look at a trader who, although he divided his trades into three currency pairs, actually speculated on the development of the US dollar through them.

It is unclear if the trader wanted to diversify his risk by splitting his trades into three pairs, or if he really only wanted to speculate on the US dollar, but chose different pairs based on the signals he was getting on them. In reality, from our point of view, it probably doesn't matter, because the resulting profit is very interesting.

Traders should definitely take into account their correlation when choosing which instruments to trade. Indeed, knowledge of asset correlation can greatly assist a trader in managing the risk in his trades. Thus, a trader can limit risk by trading low-correlated instruments, or he can increase his return potential by taking advantage of momentum and strong market trends by trading highly correlated instruments.

In today's article, we will look at a trader who belongs more in the latter group. Given his trading style, it is not surprising, as he is a typical scalper and uses highly correlated pairs more to expand his opportunities when speculating on the movements of one selected currency.

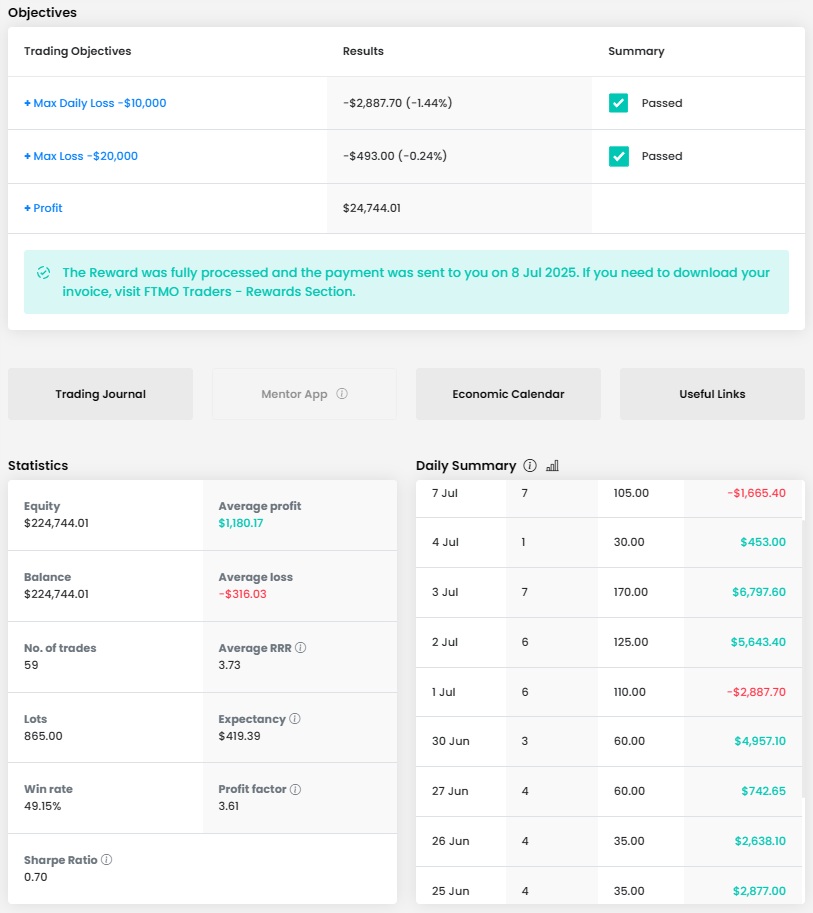

His balance curve looks good, he was in profit for the whole trading period, which certainly helped him from a psychological point of view. Of course, there were some fluctuations and periods of losses during the trading, but the trader demonstrated excellent risk management skills, as evidenced by the high consistency score.

A total return of over €15,000 on an account size of €80,000 is great, that's nearly 20% return, which you certainly don't get every month. Good risk management and money management are also indicated by the Maximum Loss and Maximum Daily Loss values, which the trader is nowhere near the limits of.

The trader executed 32 trades in ten trading days with a total volume of 347.16 lots, which is almost 11 lots per trade. The trader usually opened two positions on one instrument, so the largest position totalled nearly 30 lots, which is a lot, but given the size of his stop losses (we'll see below), this is acceptable. Due to the mentioned SL size, his average RRR is very good (3.22) and the overall win rate is above half (53.13%), so the achieved return is not a surprise.

Looking at the trader's journal, you can clearly see that the maximum losses per trade (usually the two positions mentioned) do not exceed €800, which is one percent of the initial account size. In addition, the trader set a Stop Loss for each of his positions and in most cases also a Take Profit. The trader is to be commended for such a well-managed money management and risk management, as such discipline significantly increases the likelihood that the trader will be consistently profitable.

He is a scalper who holds his trades for a few tens of minutes at most and never holds positions open overnight. On the other hand, it is a bit untypical for this style of trading that the trader opened only a few positions during one day. Despite being a scalper, he has no need to open dozens of trades a day, but chooses his positions carefully.

The trader traded at the time when the European markets open and then in the afternoon when the US markets slowly open, and there is an overlap of trading hours in the US and Europe until the European markets close. It is at these times that liquidity in the markets is at its highest, and it is seen that it is at these times that the trader is most successful. So he might as well skip opening positions around noon European time.

As we mentioned in the beginning of the article, although the trader is trading three pairs (AUDUSD, EURUSD and GBPUSD), they are also majors pairs, so you can say that the trader is speculating on the movement of the dollar. On longer timeframes their correlation is between 60% and 90%, which can be considered a high correlation, but on lower timeframes it is not so clear.

It could be said that the AUDUSD pair stands out the most in this regard, but since the trader did not open positions on two pairs at the same time, his point was probably that three pairs would offer him more trading opportunities than one pair.

We can also look at a few of the trader's trades. The first trade we will look at was made by the trader on the AUDUSD pair. After the price reached the last support that was formed in the morning of the same day, the trader entered a long position. This position can also be considered a bear trap for traders who were setting their short positions below local supports that formed a few minutes before the trader entered the trade.

Given that the trader moved the SL above the break even level during the trade, we can only assume (based on the size of the position and the amount he was used to risking on the trade) that the original SL was somewhere at the level of the red arrow, which turned out to be a good choice. The TP was set at four times the SL, and it was also one of the resistances, and this level also proved to be a good choice. The trade lasted 32 minutes and the total profit of over €3,200 represents 4% of the account size, which is a great result.

We can see a similar trade in the second picture, which again shows the AUDUSD pair. The trader entered in a similar manner, this time taking advantage of resistance and bull trapping traders who entered long positions after breaking the last resistance.

The Stop Loss is again placed at a level where we would expect it given the size of the position and the TP was just over three times the SL, so the profit on the trade was something around 2,600 euros. Again, nothing to fault, a very nice trade.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?