Zero Commissions on Indices

Have you ever found yourself frustrated by the impact commissions have on your bottom line? High commissions don’t just reduce your profitability, but they also limit your ability to freely implement your trading strategy. At FTMO, we’ve made it possible for you to reclaim full control over your earnings on indices.

We constantly seek ways to enhance your trading experience. Your ongoing support and trust in our platform mean a great deal to us. Therefore, we believe gratitude should be shown through meaningful actions, not just words.

Trade Indices with Absolutely ZERO Commission

Did you know that trading simulated indices on the FTMO platform is completely commission-free? While this isn’t a new feature, we want to clearly highlight its benefits to ensure you’re making the most of your trading opportunities.

Specifically, this zero-commission advantage applies to all index symbols on the FTMO platform. Every trade executed within this category is completely commission-free.

Why Is This Beneficial for You?

Commission-free trading increases your efficiency by:

• Minimising your overall trading costs, so more of your profits stay with you.

• Allowing greater flexibility for frequent trading strategies without worrying about fees.

• Offering clear, straightforward, and transparent trading conditions.

This means you can focus on what truly matters, such as your strategy, risk management, and consistent profitability.

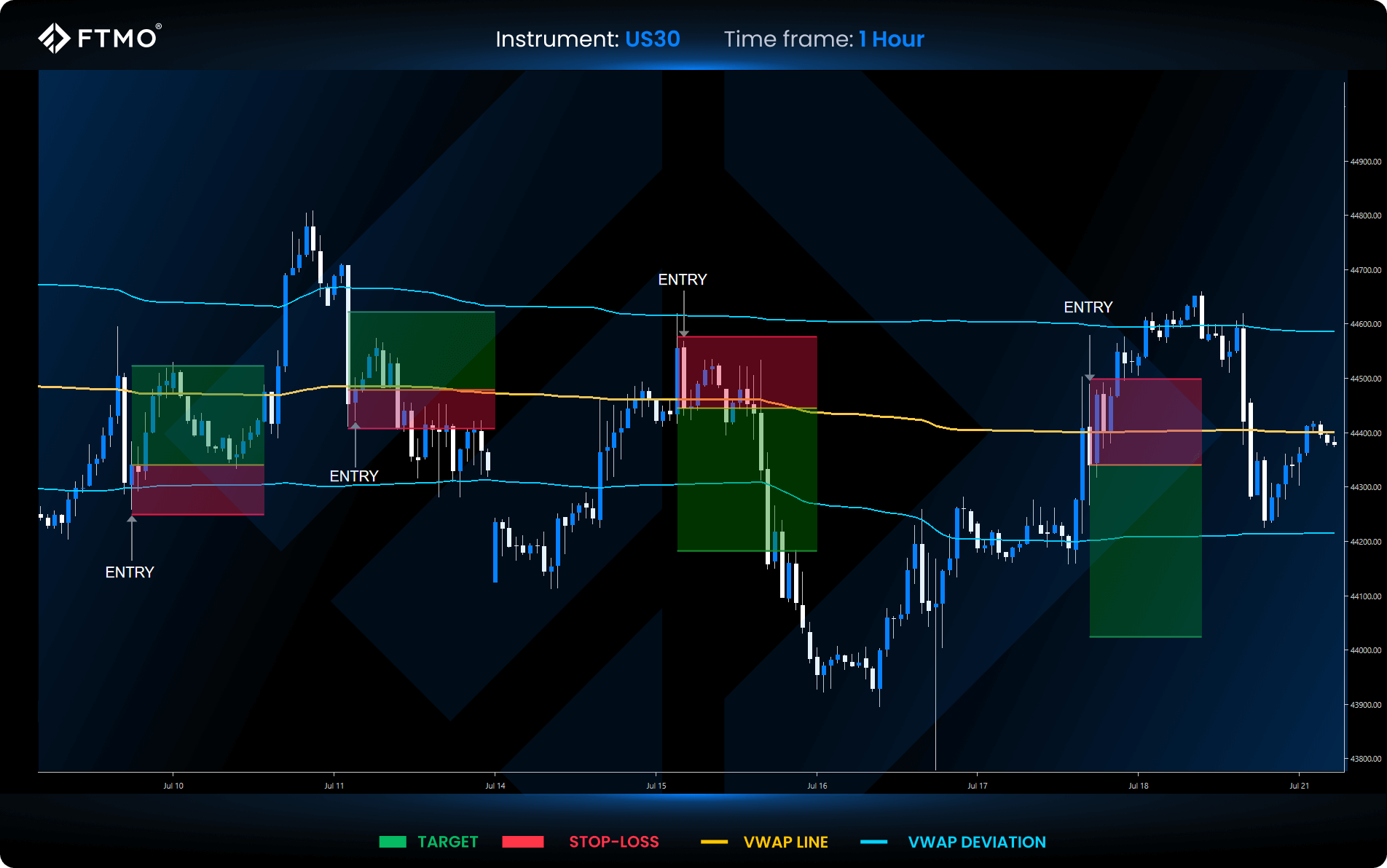

Reversal VWAP Strategy for Indices Traders

Looking to trade indices like the US500, US30, or DE40 without high fees? Discover how zero commission on indices trading supports your strategy and how to apply a VWAP setup on the 1-hour chart for consistent execution.

By combining volume confirmation with the VWAP as a dynamic support or resistance level, this strategy helps identify clean, momentum-driven setups with well-defined risk.

Strategy Concept

The VWAP (Volume Weighted Average Price) acts as a dynamic “fair value” line, representing the average price weighted by trading volume throughout the session. In professional trading environments, institutions often use VWAP to gauge market sentiment and ensure execution quality.

When price interacts with the VWAP either as support or resistance, it often signals a high-probability reversal or continuation zone. Especially when combined with volume spikes and confirmation candles.

Long Setup:

1. Price must be above the VWAP line.

2. A long bearish candle with high volume pulls back to test the VWAP.

3. If followed by a bullish confirmation candle (e.g., engulfing, pin bar), this is your entry signal.

4. Stop-loss is placed just below the confirmation candle.

5. The target is set using a 2:1 reward-to-risk ratio.

Short Setup:

1. Price must be below the VWAP line.

2. A long bullish candle with high volume tests VWAP from below.

3. If followed by a bearish confirmation candle, this becomes your entry signal.

4. Stop-loss is set just above the confirmation candle.

5. Apply a 2:1 RRR for the target.

Our Ongoing Commitment to Your Success

Whether you decide to try the reverse VWAP strategy or choose a different approach, trading indices with FTMO can be significantly more advantageous thanks to zero fees. We wish you the best of luck in your trading.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?