Why to trade on CFDs?

In this article, we will introduce the pros & cons of trading on the CFDs (Contract for Difference) and will illustrate the entire concept on the arithmetical and graphical example.

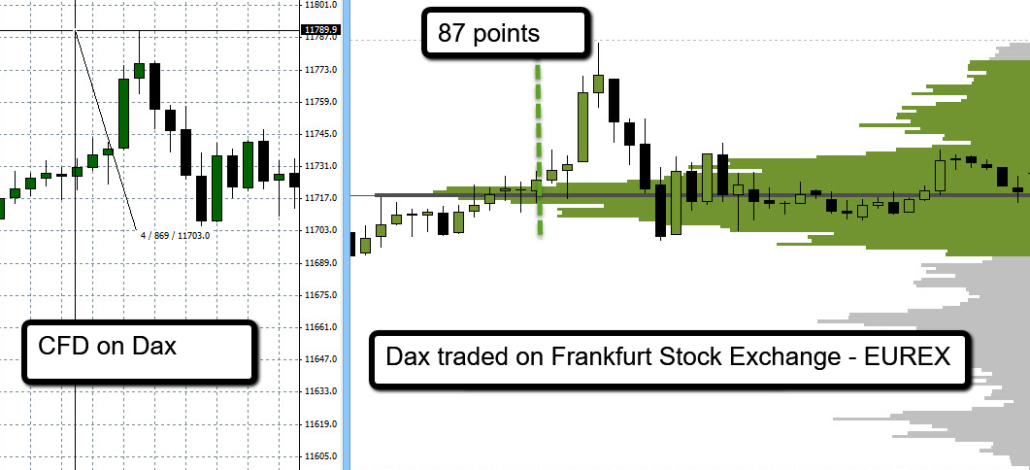

On the Futures market, we can trade not only currencies but also stock indexes such as S&P500 at CME or DAX at German Market Eurex. These instruments are part of the offerings with most reputable brokers worldwide. However, unlike Futures indexes, these instruments are not standardized as brokers allow us to trade them through CFDs.

CFD (Contract for Difference) is an agreement between the buyer and the seller, which obliges the seller to pay the beneficiary (buyer) a difference between the current value of the asset and the value of the asset at a time of contract closure. If the difference in price is negative, then the buyer pays the seller. CFDs are financial derivatives that allow us to speculate on the price development of the underlying asset, without the need to own the underlying asset. The underlying asset can be a stock index, commodity, equity or currency.

Our funded challenge FTMO Accounts allow trading CFD-based instruments with liquidity being delivered by multiple providers.

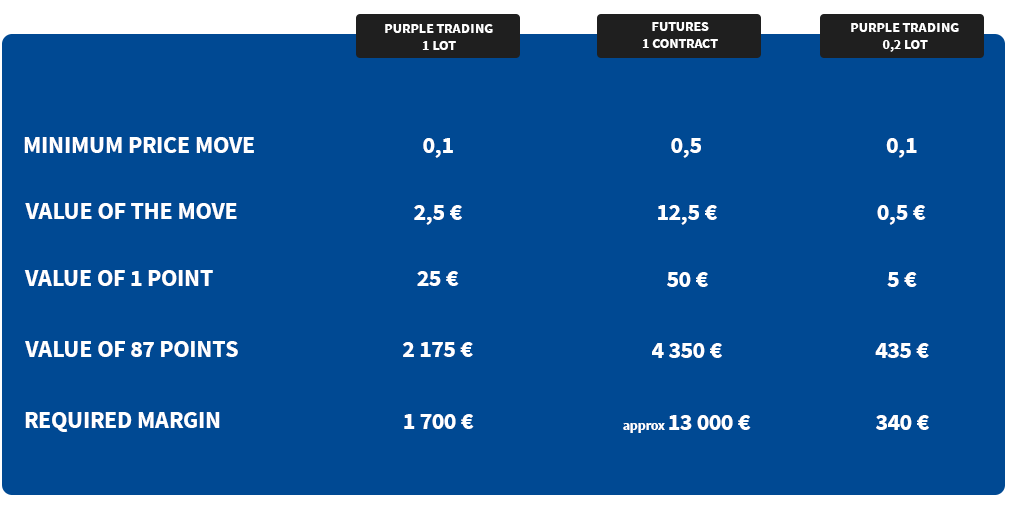

Let’s say that we want to trade the very popular German DAX on Futures markets. Due to the large volatility, the intra-day margin is around 11,000 € per contract. The intra-day margin is the reserve deposit on the account for opening the trade. If we were to hold the position overnight, then the margin reaches far beyond 21,000 €.

How about commissions? Well, the commissions for trading CFDs are generally far greater than on Futures. However, the truth is that trading Futures is still much more difficult financially, also for the reason of paying for the data feed and platforms. If we focus solely on trading commissions, then trading Futures is cheaper. All-inclusive round-turn commission for DAX (buy and sell) cost 6-7 € on average. The commission for one standard lot traded on DAX through CFD is approximately 20 €.

It is important to take into account that the majority of retail traders don’t have 21,000 € to spare for trading DAX from the beginning. This is where the best advantage of CFD comes in place as opposed to the Futures. Dividing the positions enable us to trade DAX with much smaller capital requirements. From the risk-taking perspective, having the possibility to trade DAX through CFD is yet more significant. From the commission comparison perspective, it is apparent that experienced traders managing multi-contracts rather trade DAX on the market as the difference in the commissions is notable.

Comparison of the capital requirements of the futures contract and the CFD on the DAX market

In the last column of the above table, we can see the DAX position sized 0.2 lots traded through CFD. The beauty of CFDs is in the possibility of working with multi-contracts while having a small capital. If we were to trade the highest position of 0.2 lots while having two different profit targets, CFD allows us to enter twice by 0.1 lots each and set the required parameters separately.

Finally, it’s important to mention that trading the futures indexes through CFDs isn’t suitable for all markets and this is due to the associated costs. This is predominantly for short-term traders who target smaller profits. Talking about the DAX index, the ratio between spread and the daily range is actually very good. The average daily range of DAX for the past 100 days is 224 points and the spread is 2 points. This makes DAX an ideal market to be traded through the CFD.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.