What is the difference between proprietary trading and modern prop trading?

The term proprietary trading has been historically used to refer to the practice of a bank or other financial institution investing on behalf of its own account, with its own funds. Today, a different alternative, a “modern” form of prop trading is becoming increasingly common.

Traditional proprietary trading is a very interesting way for financial institutions to increase their profits and achieve much higher returns compared to only trading commissions for clients. Although the 2007 - 2008 financial crisis has seen a significant reduction in proprietary trading opportunities, particularly for banks, it is still a relatively profitable activity that generates substantial profits for companies.

What is modern prop trading?

We use Modern Prop Trading primarily to refer to the different relationship between a trader and the firm they trade for.

Traditional Proprietary Trading involves allocating real capital to a trader who is physically present at the firm's workplace. This trader is well-known to the firm, which provides not only the necessary know-how but also a regular salary.

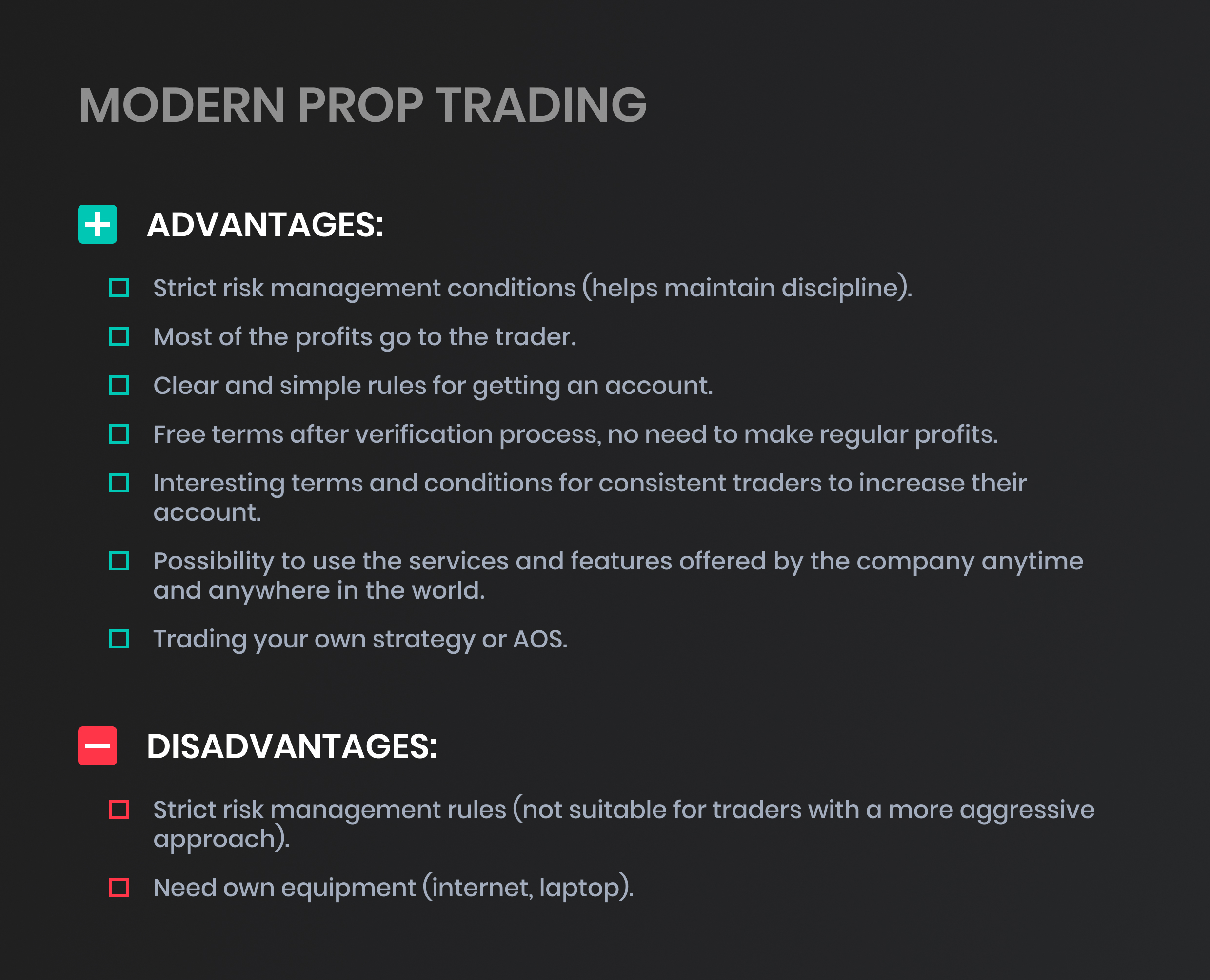

Modern Prop Trading offers much greater independence in all aspects. Traders can tailor their working hours, location, platform, trading method, and risk management to suit their preferences. To access capital, traders must first pass a paid exam and adhere to certain rules. The capital provided by the modern prop firm is virtual, and traders are rewarded for supplying the firm with data about their trading performance.

Tempting offer

Equally, it is still an attractive opportunity for traders who want to operate in the financial market and do not have access to their own substantial capital amounts. The prospect of a big company, the ability to trade with really large amounts of money and access to tools and information, that an average trader has no chance of accessing, is appealing to many potential traders. However, because it is a highly competitive and profit-driven environment, it is not easy to get a job at a proprietary trading firm. Firms have relatively high expectations of their potential candidates.

Nothing comes for free

Investment companies that use proprietary trading methods will not and cannot provide money for trading to just anyone. Since the financial market is quite heavily regulated today, institution often impose very strict requirements on employees who execute trades on their behalf. Such employees often have to pass tests to obtain certain certifications, have to possess higher education or undertake psychology testing. Without fulfilling these requirements, which are not easy to pass and may even cost a considerable amount of money, a potential trader cannot practice as a trader in a proprietary trading firm.

In addition, applicants for a trader position must have a certain history or should be able to demonstrate a track record of trading. In the financial market, profits come first and firms are generally not very interested in people who do not have trading experience. If a trader is able to demonstrate a long enough history of good trading results, they may be of interest to a trading firm.

The demands are high

In addition, firms require their candidates to have a fairly broad knowledge of how financial markets operate, as well as mathematics, statistics, probability theory and many other disciplines that are not at first glance relate to trading. Many proprietary trading firms today use complex strategies and approaches that may not suit every trader.

Nor does the mere acceptance of a proprietary trader’s position necessarily mean that the trader has won. It is a highly competitive environment where only success is judged. The trader has to deal with a stressful environment and has to take into account that, especially at the beginning, it can be very difficult for him. Traders in firms are evaluated by results, and the split of profits between the trader and the firm can be quite unfavourable for the trader, so it may happen that the trader ends the month with earnings which are below average.

Modern prop trading

An interesting alternative to classic proprietary trading is the recent offer of prop trading firms, including FTMO. These firms offer potential traders the opportunity to find out whether they have what it takes to become a real trader, but without some of the restrictions we mentioned above.

Modern prop firms are companies which goal is to find aspiring traders and provide them with the tools, education and the environment to experiment with their trading abilities.

For this purpose, modern prop firms each have developed their own way to objectively identify and educate potential traders in the ranks of those interested in trading, without the risk of financial loss on the part of clients. During this course clients get access to online training programs, analytical applications and an online platform that allows simulated trading in various financial instruments. This helps prop firms identify clients with the best potential for trading in real markets.

With a prop trading firm such as FTMO, all a client needs to do is sign up, try the Evaluation Course and the client can start experimenting with trading with the desired fictional account size. There is no need to document any trading history, only the actual results are important.

A lot of music for a little money

It is not free here either, of course, but the conditions are clear to all in advance and relatively simple. The client will pay a small fee, which will be refundedin case of first payout if he or she manages to meet the conditions of the Evaluation Course.

The biggest benefit for the client is, of course, the ability to try out trading without the risk of actual losses and with various account sizes. With FTMO account, the clients have up to $200,000 fictional capital at their disposal to experiment with, which is already a sum with which an actual trader could earn very good money each month.

Freedom to trade

A big advantage for most clients is the independence that using a prop trading firm offers them. No specific trading strategies are required from clients when using a prop trading firm and client can also use automated trading systems. Of course, there is also a fairly wide selection of trading instruments to choose from on the demo account. For many aspiring traders, the fact that they can try what it feels like to trade from anywhere is also an advantage.

The main condition a client has to watch out for is the risk management and Trading Objectives in the form of Maximum Loss and Maximum Daily Loss. These conditions force clients to use FTMO services responsibly and help them in improving discipline, which is also very important for consistent trading.

In addition, at FTMO, the client receives very good services in the form of customer support in up to 18 languages. Since we know that psychology is very important in trading, we also offer our clients in the FTMO Account stage services of a performance psychologist who can help them achieve even better results.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?