Trading Week Ahead: Key Data to Shape Fed’s December Decision

With the Fed considering a possible December rate cut and key data still limited by the government shutdown, this week’s ISM Services, ADP Jobs and UoM Inflation Expectations reports take on added importance. Markets will be watching for signs of economic strength or weakness that could influence the Fed’s next move.

👉 Here’s what traders need to know.

• ISM Services PMI

Wednesday’s services PMI is expected to rise to 50.8 from 50.0, signalling slight expansion. A stronger print could reduce rate cut hopes, lifting the dollar and yields. A miss may trigger a dovish shift and boost risk assets.

• ADP Nonfarm Employment Change

ADP jobs data is forecast at +28K after last month’s -32K drop. A rebound would challenge easing bets and support USD strength. Another weak print could weigh on the dollar and lift equities.

• University of Michigan Inflation Expectations

Friday’s UoM survey follows a previous 4.6% inflation expectation. Persistently high readings may keep the Fed cautious. A decline would support dovish sentiment and market optimism.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Monday, Nov. 3 | 4:00 PM |  USD USD |

ISM Manufacturing PMI, Prices |

| Tuesday, Nov. 4 | 4:00 PM |  USD USD |

JOLTS Job Openings (Tentative) |

| Wednesday, Nov. 5 | 2:15 PM |  USD USD |

ADP Nonfarm Employment Change |

| 3:00 PM |  USD USD |

ISM Services PMI | |

| Thursday, Nov. 6 | 1:00 PM |  GBP GBP |

BoE Interest Rate Decision |

| Friday, Nov. 7 | 2:30 PM |  CAD CAD |

Unemployment Rate |

| 4:00 PM |  USD USD |

Prelim UoM Inflation Expectations, Consumer Sentiment |

*All times in the table are in GMT+2

*US government data may be impacted by the shutdown. (Tentative) events are subject to delay, revision, or cancellation.

Technical Analysis with FVG Strategy

This trading strategy uses the EMA 20 and 50 to assess market trends and the Fair Value Gap (FVG) to identify areas of price imbalance. These imbalances, caused by rapid price movements, often indicate high-probability entry and exit points. This approach can be applied to currency pairs such as EURUSD and GBPJPY, as well as US30 and XAUUSD, and provides a review of recent price action and potential trading opportunities.

Opportunities to Watch This Week

EURUSD

Market Context: EURUSD continues to trend lower after a confirmed break in structure. Two previous swing lows were taken out, and the pair is now approaching a key support zone, which could act as a potential reversal area.

Bearish Scenario (Preferred): Continued move toward the lower support zone remains the base case, in line with the prevailing bearish structure.

Bullish Scenario (Alternative): A temporary pullback on lower timeframes may occur before the downtrend resumes. This would offer better entries for sellers or short-term opportunities for counter-trend traders.

FVG Setup: No new FVG formed this week. Last week's short FVG was stopped out despite the market ultimately moving in the expected direction.

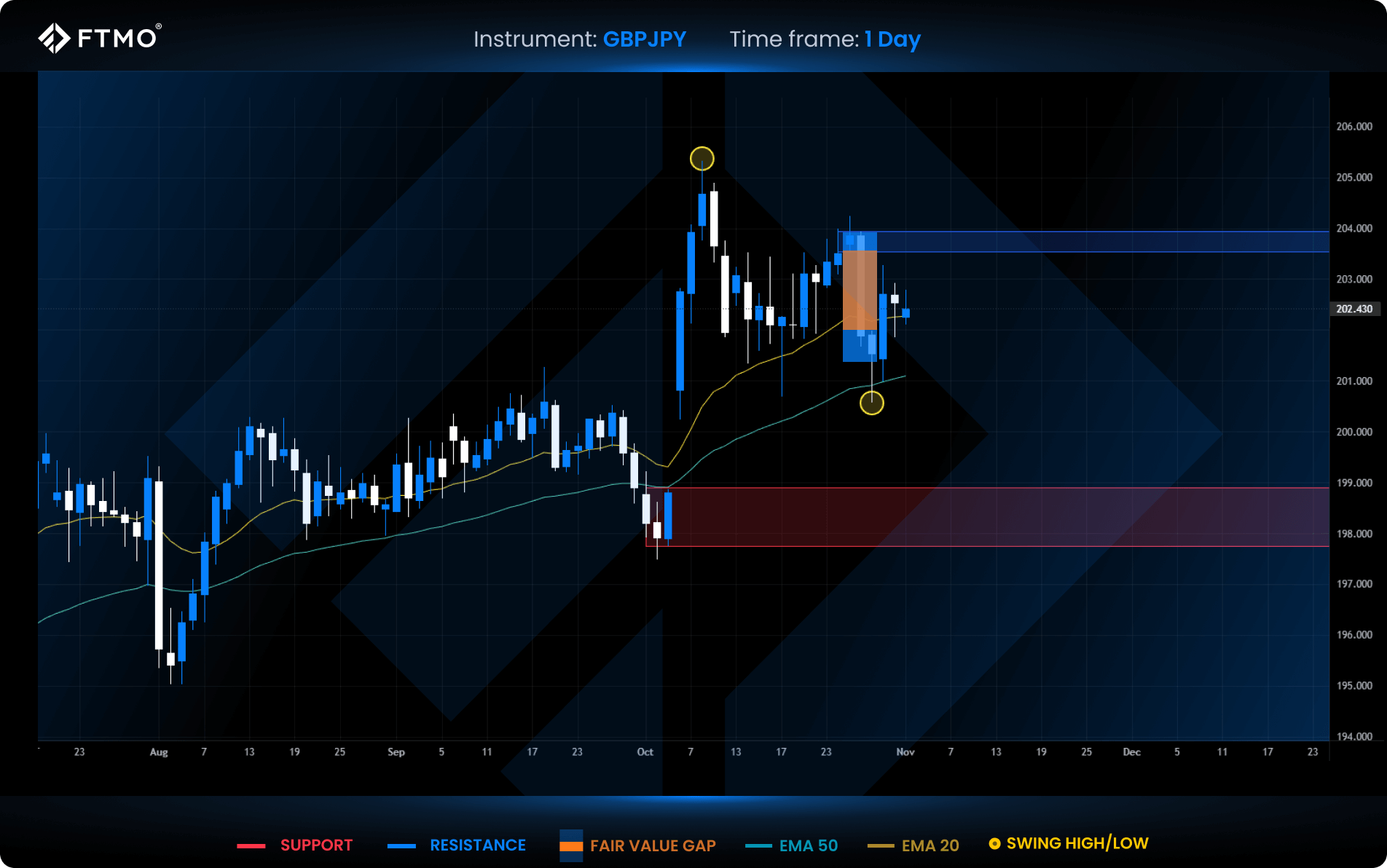

GBPJPY

Market Context: GBPJPY dropped significantly last week, creating a short FVG with downside potential targeting the unfilled overnight gap. However, this week’s opening above the 20 and 50 EMA suggests uncertainty about immediate continuation lower.

Bearish Scenario (Preferred): A move into resistance followed by rejection would support a continuation toward the overnight gap.

Bullish Scenario (Alternative): If price closes above resistance, the bearish FVG setup would be invalidated, and upside continuation may follow.

FVG Setup: A short FVG from last week remains valid but requires a bearish rejection from resistance for confirmation.

XAUUSD

Market Context: Gold closed below key support on Wednesday, shifting the market structure to bearish. After retesting resistance, price is now trading below the 20 EMA, increasing the risk of further downside.

Bearish Scenario (Preferred): Further downside move targeting the lower support zone, in line with the active short FVG setup.

Bullish Scenario (Alternative): Tuesday’s positive reaction from the support zone could signal buying interest. If price holds above resistance, a move higher toward the next resistance level is possible.

FVG Setup: A short FVG formed last week and remains in play. The setup awaits confirmation through continued bearish price action.

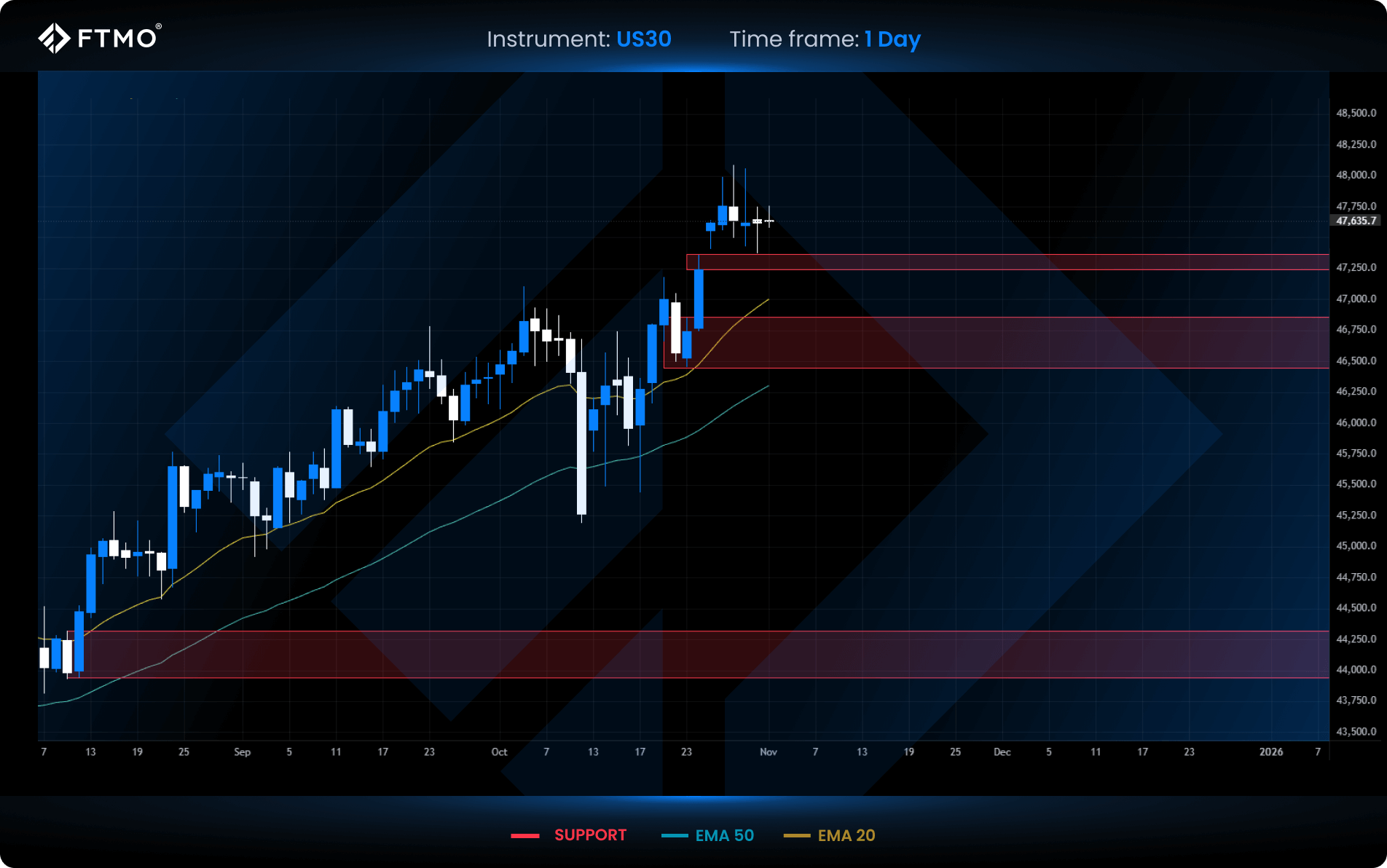

US30

Market Context: US30 reached new all-time highs but has since entered a consolidation phase. An unfilled overnight gap remains below, and Friday’s pin bar candle reacted positively off the top of that gap.

Bullish Scenario (Preferred): A continuation of the bullish trend from current levels, supported by recent price structure and Friday’s bullish reaction.

Bearish Scenario (Alternative): A dip to close the overnight gap and retest the prior week's close could occur before the market resumes its uptrend.

FVG Setup: No new FVG formed this or last week due to ongoing consolidation at the highs.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis, or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.