Trading Week Ahead: FOMC Decision & ISM Services PMI

Markets thrive on information, and the week ahead promises impactful economic announcements from the US economy. Gain the competitive edge you need by preparing in advance for these pivotal events. Are you ready to navigate market volatility and seize opportunities?

• FOMC Meeting

Investors and traders alike will be tuned into the Federal Reserve’s latest monetary policy announcement. Expectations indicate the Fed Funds Rate will hold steady at 4.50%, matching the previous rate. However, market focus will primarily be on any hints or forward guidance about potential future rate moves, as even subtle signals can trigger notable volatility across the USD and broader financial markets.

• ISM Non-Manufacturing PMI

Monday’s ISM Non-Manufacturing PMI data is crucial as it reflects the strength and outlook of the significant US services sector. Analysts anticipate a modest dip in the index, forecasting a reading of 50.2, down from the previous 50.8. A result markedly different from this expectation could significantly impact USD valuation and investor sentiment, influencing trading strategies across various asset classes.

• Unemployment Claims

Weekly unemployment claims offer essential insights into the robustness of the US labour market. The previous reading stood at 241K, and while a specific forecast is not available, any unexpected shifts could heighten market reactions, especially as traders prepare for upcoming monthly employment data. This report will be closely watched as a potential indicator of broader economic trends.

Technical Analysis with FVG Strategy

This strategy combines the use of the 20- and 50-period EMA to assess market direction alongside the Fair Value Gap (FVG) to pinpoint zones of price inefficiency. These gaps, which emerge during sharp market moves, often highlight strong potential areas for trade entries and exits. The method is suitable for instruments like EURUSD, GBPJPY, US30, and XAUUSD, offering insights into recent market behaviour and identifying possible trading setups.

Last Week’s Opportunities

EURUSD

Market Context: EURUSD remains in a strong uptrend, holding above both the 20 EMA and 50 EMA. After a short-term pullback last week, the pair filled some liquidity below swing lows and entered an existing Fair Value Gap (FVG). Market sentiment is still broadly bullish, but price is now reacting to a key resistance zone.

Bearish Scenario (Preferred): If price rejects the current FVG resistance, a move lower is likely. This would allow the market to collect liquidity from lower zones and rebalance before attempting a new leg higher.

Bullish Scenario (Alternative): A strong close above the short FVG zone and break of the previous swing high could trigger further upside momentum in line with the broader bullish structure.

Setup: Last week’s short FVG setup remains active. Watch for price reaction at this zone. A rejection confirms the bearish outlook; a breakout favours bullish continuation.

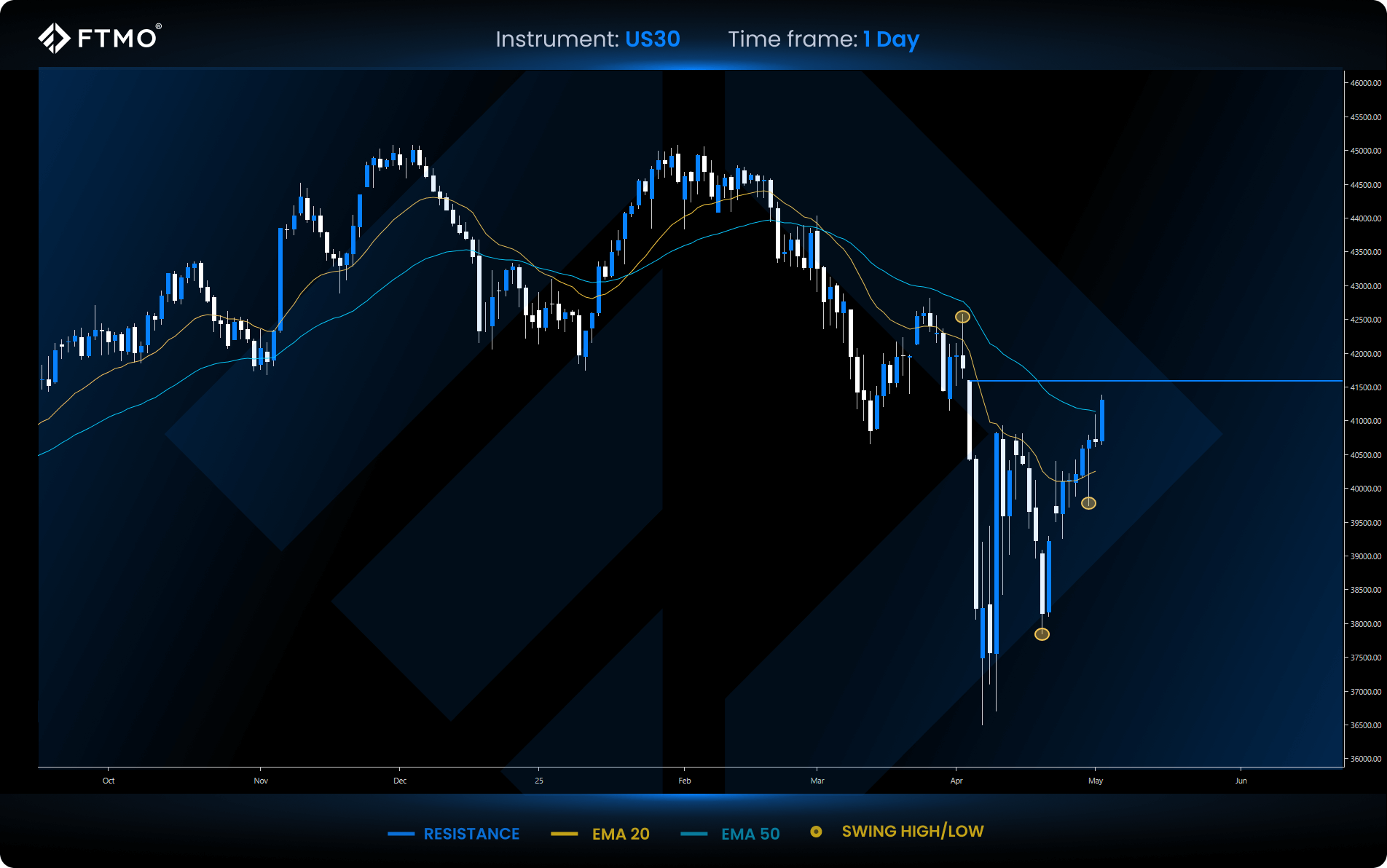

US30

Market Context: The US30 remains in bullish territory, trading above the 20 and 50 EMAs. Although momentum is intact, no new FVG setups have developed in the past two weeks, signalling stable price action but fewer imbalance-based entry points.

Bullish Scenario (Preferred): The index may continue higher into the next key support zone. A reaction from this area could open the door for another leg up.

Bearish Scenario (Alternative): If price stalls and breaks below recent swing lows, it could trigger a liquidity sweep before a potential rebound.

Setup: There are currently no active FVG setups. Focus remains on key levels and EMA zones for reaction-based trading opportunities.

Opportunities to Watch This Week

XAUUSD

Market Context: After reaching a new all-time high, gold has pulled back into FVG and EMA support zones. Despite short-term cooling, the longer-term trend remains bullish. Corrections in strong uptrends are normal and may offer a base for further gains.

Bullish Scenario (Preferred): If buyers defend support successfully, gold could resume its upward path and aim for new highs.

Bearish Scenario (Alternative): A breakdown below support, especially with a close beneath both the 20 and 50 EMAs, may suggest a shift in momentum toward a bearish trend.

Setup: A valid FVG short setup is active this week.

GBPJPY

Market Context: The pound continues to show strength against the yen, with price trading above both the 20 and 50 EMAs. Market structure supports the bullish trend, though no new FVG setups were formed this week or last.

Bullish Scenario (Preferred): If GBPJPY holds above current support and maintains momentum, the pair may continue pushing toward recent swing highs.

Bearish Scenario (Alternative): If price fails at nearby resistance, we could see a retracement into lower support zones, which may offer new buying opportunities later.

Setup: There is a valid long FVG setup currently in play.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations. FTMO companies do not act as a broker and do not accept any deposits. The offered technical solution for the FTMO platforms and data feed is powered by liquidity providers.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?