Trading Week Ahead: Jobs and GDP Data Set to Drive Market Sentiment

As markets look for direction, this week’s US economic data could provide the answers. With Q1 GDP, JOLTS job openings, and the April non-farm payrolls report all scheduled, traders will be watching closely for signs of slowing growth or resilience. Will the numbers support the Fed’s patience?

• JOLTS Job Openings

The JOLTS report starts the week with a focus on the US labour market. The previous reading was 7.568 million, and any significant decline could indicate a decrease in labour demand, which may put pressure on the Fed to loosen policy. A steady or stronger print would support a “higher-for-longer” rate outlook.

• US Q1 GDP

Markets will closely watch the advance Q1 GDP reading, with expectations set sharply lower at 0.4%, down from 2.4% in Q4 2024. A significant slowdown could reinforce recession concerns and boost rate-cut expectations. However, an upside surprise might challenge dovish positioning and lift the dollar.

• Non-Farm Payrolls

The labour market spotlight intensifies with the April NFP report. Forecasts point to a sharp cooldown at 129K, compared to 228K previously. A soft print would likely strengthen the case for a summer rate cut, while a stronger number may revive hawkish sentiment and trigger USD upside.

Technical Analysis with FVG Strategy

This trading strategy uses the EMA 20 and EMA 50 to evaluate market trends and the Fair Value Gap (FVG) to identify areas of price imbalance. These imbalances, caused by rapid price movements, often indicate high-probability entry and exit points. This approach can be applied to currency pairs such as EURUSD and GBPJPY, as well as US30 and XAUUSD, and provides a review of recent price action and potential trading opportunities.

Last Week’s Opportunities

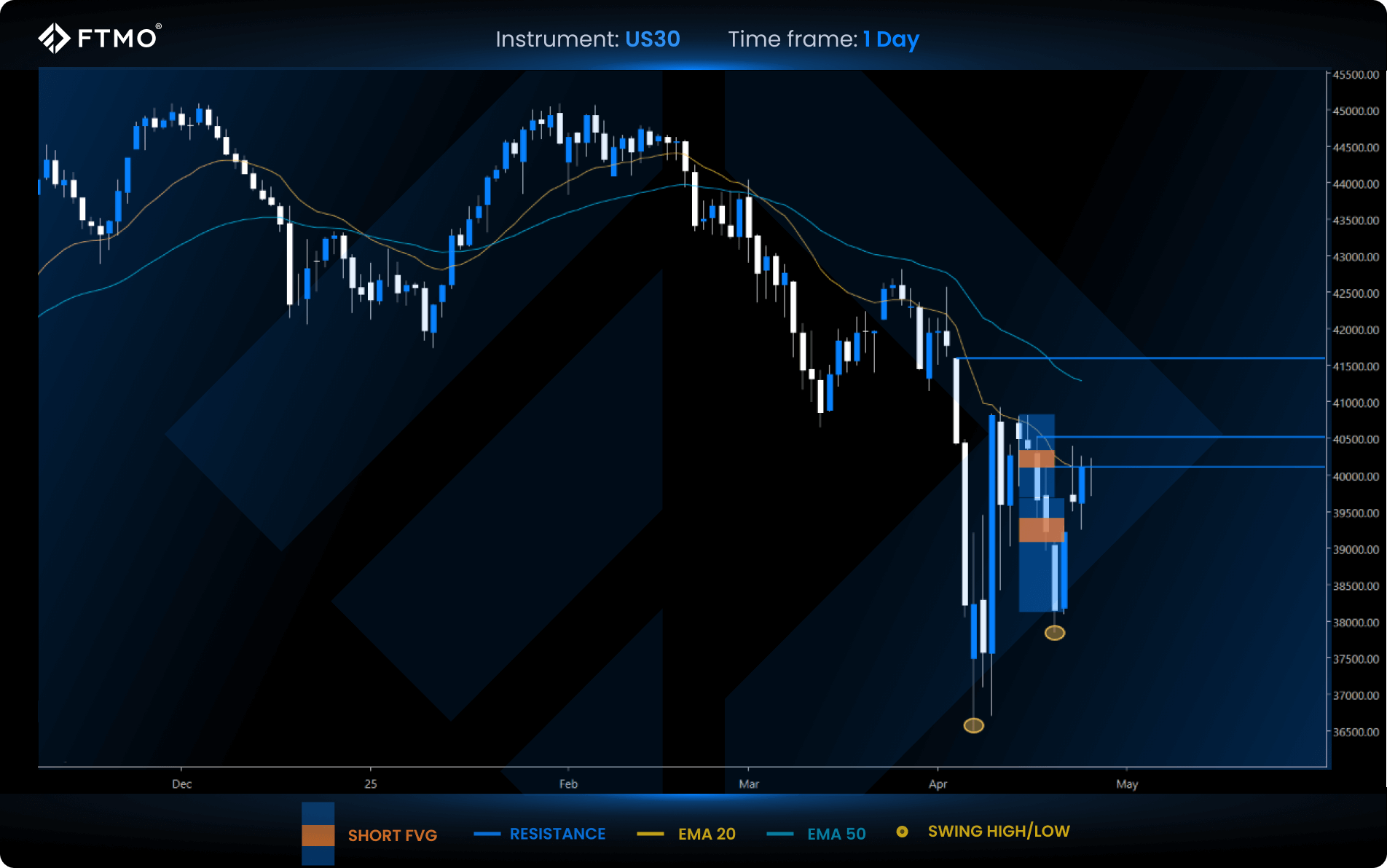

US30

Market Context: Indices are shifting momentum after a previous bearish phase. Last week saw the creation of two FVG short setups, the first being a missed entry, while the second ended in a Stop Loss. Currently, price is testing the EMA 20 and a local FVG resistance.

Bullish Scenario (Preferred): A break above the current FVG resistance zone and EMA 20 could open the door for further bullish expansion and filling higher FVG imbalances.

Bearish Scenario (Alternative): If resistance holds, a move lower toward recent swing lows and deeper FVG support zones could follow.

Setup: Watch for price action at the FVG resistance zone; failure to break higher may offer a short opportunity targeting lower liquidity areas.

XAUUSD

Market Context: Gold reached a new all-time high last Tuesday before pulling back into a nearby FVG zone, where buyers have already reacted. Overall bullish sentiment remains dominant.

Bullish Scenario (Preferred): Continuation of the uptrend is favoured as long as the price holds above the FVG support zone, with targets on new all-time highs.

Bearish Scenario (Alternative): A confirmed candle close below the FVG support could trigger a deeper correction, targeting liquidity pools in lower FVG areas.

Setup: A long FVG setup remains valid this week with a potential target swing high, while the current support holds.

Opportunities to Watch This Week

EURUSD

Market Context: Although EURUSD has been maintaining bullish momentum above the EMA 20 and EMA 50, recent price action shows signs of exhaustion after last week’s minor correction. Buyers are losing strength near key resistance zones.

Bearish Scenario (Preferred): If price fails to sustain above current resistance levels, a liquidity sweep above recent highs could trigger a deeper pullback into lower FVG zones. Short opportunities align with a potential shift in momentum.

Bullish Scenario (Alternative): If price finds strong support at the nearest FVG zone and regains upward momentum, a continuation toward higher resistance levels remains possible.

Setup: A short FVG setup is in play this week if price confirms rejection from resistance and breaks back below the recent imbalance.

GBPJPY

Market Context: After an extended consolidation, buyers have taken control of GBPUSD. The price is currently testing the EMA 50 and facing resistance derived from a previous FVG zone. Momentum favours the bulls, but key resistance remains in play.

Bullish Scenario (Preferred): As long as the price holds above the EMA 50 and breaks through the current FVG resistance zone, continuation toward the higher resistance zone remains the preferred outlook.

Bearish Scenario (Alternative): Rejection from the current resistance area could trigger a pullback into the FVG support zone, offering a reset before any renewed bullish momentum.

Setup: A long FVG setup is in play this week if price confirms a successful retest of the support imbalance.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations. FTMO companies do not act as a broker and do not accept any deposits. The offered technical solution for the FTMO platforms and data feed is powered by liquidity providers.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?