Grow & Monetize

your demo TRADING

Master your trading skills on our simulated trading platform, improve your trading on A demo FTMO account WITH up to $200,000 and get A reward OF up to 90% of your simulated profits

4 Trading Platforms

4 Trading Platforms

FTMO Academy

FTMO Academy

Quantlane

Quantlane

Free Trial

Free Trial

Performance Coach

Performance Coach

Enhance your skills with Modern Prop Trading Firm

FTMO developed a unique Evaluation Process for traders, consisting of an FTMO Challenge and a Verification, specifically tailored to discover trading talents.

Upon completing the Evaluation Process, traders are offered to enhance their trading skills on an FTMO Account in a demo environment as FTMO Traders with a balance of up to $200,000 in fictitious funds. Despite trading on a demo account, FTMO Traders can be rewarded for their performance with up to 90% of the simulated profits they generate, without any risk of losing their own capital. The best-performing FTMO Traders can progress into our Premium Programme, where they can be employed as professional traders with fixed salary by Quantlane – a traditional proprietary trading company.

Journey to become an FTMO Trader might be challenging, but our educational Tools & Services are here to help everyone.

Show us your

talent and be rewarded

- Trading Tools & Services

- FTMO Account with fictitious funds up to $200,000

- Reward up to 90% of simulated profits

- Performance Coaching Sessions

- FTMO Premium Programme

- All - Trading Tools & Services

- Contract with fixed salary

- Performance & Mindset coach

-

Institutional Trading Conditions

- Spreads, Liquidity, Risk, Framework - Custom Platform & Tools

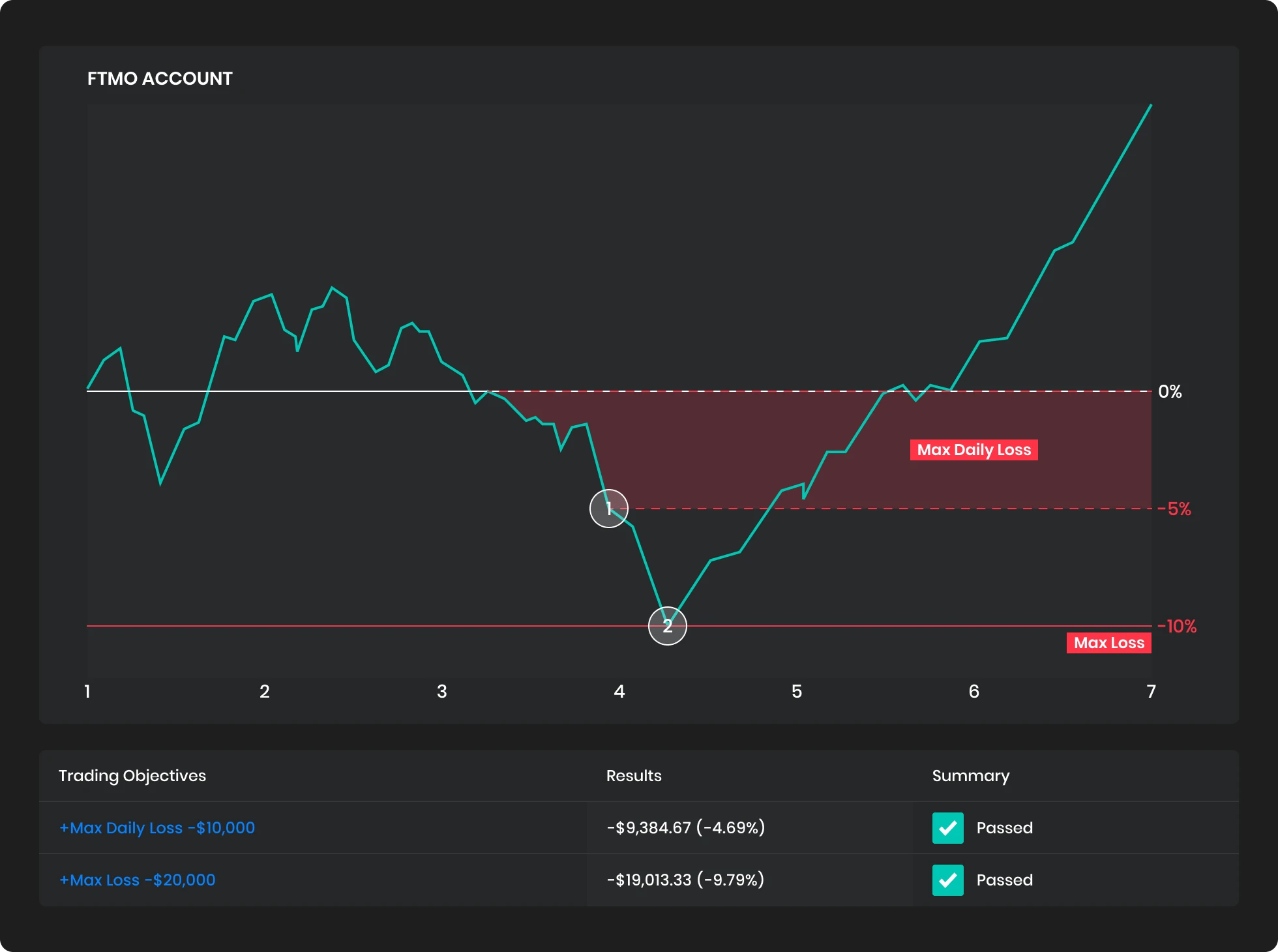

Trading Objectives

FTMO's Trading Objectives are based on risk management principles, and they verify that our clients can manage them effectively. By adhering to these objectives, clients enhance their skills and build healthy and sustainable trading habits.

Upon accomplishing Trading Objectives during FTMO Challenge and Verification, clients gain access to an FTMO Account. These objectives will remain in place, except for the Profit Target.

Find out how

you can benefit with FTMO

Customer support In 18 languages