Trading Crypto and Indices: Examples Explained

Trading Cryptocurrencies and Indices can be tricky from time to time as there are different specifications for different instruments. In this article, we will take a look at some different nuances that every trader should know about trading Cryptocurrencies and Indices.

Contract size

It is a standardized amount that tells buyers and sellers the exact quantities that are being bought or sold based on predetermined terms.

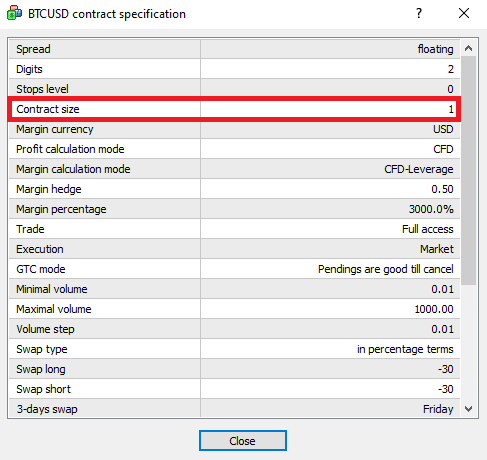

Cryptocurrencies

Most of the cryptocurrencies on the FTMO-Server have a contract size of 1, which means that each contract is worth $1 of the selected instrument (XRPUSD and ADAUSD have a contract size of 100, DOTUSD has a contract size of 10, and DOGEUSD has a contract size of 1,000). A $1 price change on a cryptocurrency would result in a $1 change in the PnL position as well. For example, if the selected cryptocurrency has a contract size of 10, if you own 1 contract, a price change of 1 point would result in a PnL change of the position which is 10 times the amount denominated in the margin currency of the instrument.

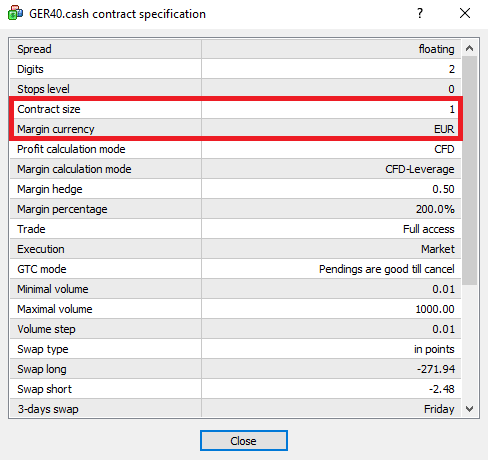

Indices

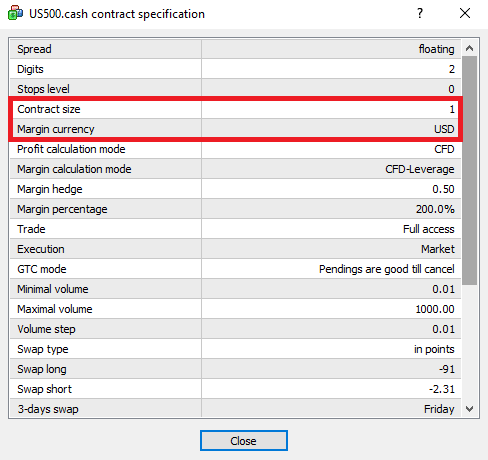

All indices at FTMO have a contract size of 1 (depending on the margin currency*).

* The margin currency of the instrument can be found in the “Specifications” tab in the trading platform.

Point

A unit of price change as a whole digit. If an asset worth $100 rises to $101, that is an increment of 1 point.

Point value

The value of a point based on the contract size of the instrument.

BTCUSD has a point value of $1/point (contract size = 1, profit currency = USD) where 1 point is defined as the 1st digit before the fractal comma.

US30.cash has a point value of $1/point (contract size = 1, profit currency = USD) where 1 point is defined as the 1st digit before the fractal comma.

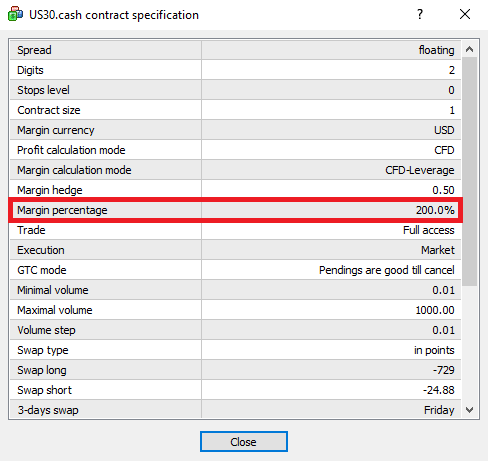

Leverage and margin

Leverage allows you to trade with more money than you have on your account. FTMO offers maximum leverage of 1:100 on all account types. The margin requirements on individual instruments may vary. The exact specifications can be checked on the platform or at https://ftmo.com/en/symbols/.

In order to open and maintain a leveraged trade, you need to have a certain amount of money on the account. It is called margin. The higher the leverage you have on your account, the smaller the margin you will have to provide. You need to check the margin requirements in the Specification of the instrument in order to calculate the necessary margin.

Margin percentage 100% -> 1:100 / 100% = leverage 1:100

Margin percentage 200% -> 1:100 / 200% = leverage 1:50

Margin percentage 333% -> 1:100 / 333% = leverage 1:30

Margin percentage 3,000% -> 1:100 / 3,000% = leverage 1:3.3

At FTMO, the following formula is used for the calculation of margin for CFDs:

Margin = Lots * Contract size * Price of the instrument / Leverage of the account

Example:

Symbol: US30.cash

Leverage of the account: 1:50

Contract size: 1

Number of lots: 2

Margin = 2 (number of lots) * 1 (contract size) * $34,427 (price of the instrument) / 50 (leverage) = $1,377.11

In order to buy 2 lots of US30.cash, you will need at least $1,377.11 to open the position.

In case your account has insufficient margin, the order will be rejected and you will receive a ‘not enough money’ alert.

If you have a different account currency than USD, you need to adjust the result at the current exchange rate. Therefore, the margin required on the GBP account will be £1,051.74 (1,377.11/1.30936).

This is similar if you are opening a position on an instrument whose margin currency is different from USD but you have a USD account (see examples below).

In order to improve our services to our clients, we have launched a Margin Calculator in the Client Area, thanks to which you no longer have to calculate the required margin manually.

Commission

When you buy or sell an instrument, you do that through a broker/provider. The broker/provider charges you a transaction fee whenever you open a trade. In FTMO, commissions for currency pairs are $3/lot, for metals and equity CFDs they are based on percentage/volume. Equity CFDs have a commission of 0.0040% per lot, metal CFDs (XAG, XAU, XPT and XPD) have a commission of 0.0010% per lot. For indices (cash CFDs including USOIL and UKOIL), cryptocurrencies and futures CFDs, no commission is charged by the FTMO.

The calculation for the commission is as follows:

Commission = Contract size * lots * Price of the instrument * Commission in %

The commission specifications for each instrument can be found here: https://ftmo.com/en/symbols/.

If the trade currency is not in the base currency of your account, the commission will be converted based on the exchange rate at the moment of opening the trade.

Calculations

To calculate the results of the trade (profit/loss) for indices and cryptocurrencies, we need to know the lot size, the amount of price change points, the point value, and the swap, which can be all found in the trading platform.

The formula for calculating Profit/Loss is as follows:

Profit/Loss = (Lot size * Point Value) * Points + (Commission+Swap)

It is important to keep in mind the account base currency and the margin currency of the instrument when calculating Profit/Loss!

Risk/lot calculations for cryptocurrencies and indices

Please note that in order to calculate the lot size of the trade, you should know the amount you want to risk, Point Value and number of Points (trade movement- the difference between opening and closing price), and the currency of the traded account.

Examples for cryptocurrencies

I have a $100,000 account, 1% risk, 50 points Stop Loss on BTCUSD. What should be my lot size to only lose $1,000 on the trade?

Lot size = Profit/Loss / (Point Value * Points)

Point value = Contract Size = 1

Lot size= 1,000 / (1 x 50) = 20

I have an €80,000 account, 1 % risk, 50 points Stop Loss on BTCUSD, What should be my lot size to only lose €800 on the trade?

Since the margin currency of BTCUSD is USD, we need to convert EUR to USD.

Lot size = Profit/Loss / (Point Value * Points)

Point value = Contract Size =1

€800 = $898.74

Lot size = 898.74 / (1 * 50) = 17.97

As you can see, the account currency affects the lot size of a position.

Examples for indicies

I have a $100,000 account, 2% risk, 30 pip Stop Loss on US100.cash. What should be my lot size to only lose $2,000 on the trade?

Lot size= Profit/Loss / (Point Value * Points)

Lot size= 2,000 / (1 * 30) = 66.66

I have a £70,000 account, 2% risk, 30 pip Stop Loss on US100.cash. What should be my lot size to only lose £1,400 on the trade?

Since the margin currency of US100.cash is USD, we need to convert GBP to USD.

Lot size = Profit/Loss / (Point Value * Points)

£1,400 = $1,833.11

Lot size = 1,833.11 / (1 * 30) = 61.10

I have an €80,000 account, 2% risk, 30 pip Stop Loss on AUS200.cash. What should be my lot size to only lose €1,600 on the trade?

Since the margin currency of AUS200.cash is AUD, we need to convert EUR to AUD.

Lot size = Profit/Loss / (Point Value * Points)

€1,600 =AU$2,639.68

Lot size = 2,639.68 / (1 * 30) = 87.99

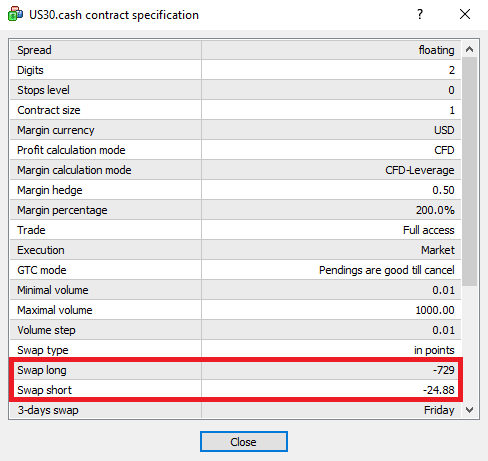

Profit/Loss calculation

Indicies

What will be my Profit/Loss if I place a 10 lot trade on US30.cash, considering I have a $50,000 account, and the movement is 40 points?

Profit/Loss = ((Lot size * Point Value) * Points) – (Commission + Swap)

Point value = Contract Size = 1

Swap and Commission is 0

Profit/Loss = (10 * 1) * 40 = $400

What will be my Profit/Loss if I place a 10 lot trade on US30.cash, considering I have a €40,000 account, and the movement is 40 points?

Profit/Loss = ((Lot size * Point Value) * Points) – (Commission + Swap)

Point value = Contract Size = 1

Swap and Commission is 0

Profit/Loss = (10 * 1) * 40 = $400, which is €356.05

Since the account base currency is EUR, the Profit will be €356.05.

What will be my Profit/Loss if I place a 10 lot trade on AUS200.cash, considering I have a £70,000 account, and the movement is 40 points?

Profit/Loss = ((Lot size * Point Value) * Points) – (Commission + Swap)

Point value = Contract Size = 1

Swap and Commission is 0

Profit/Loss = (10 * 1) * 40 = AU$400, which is £208.04

Since the account base currency is GBP, the Profit will be £208.04.

Cryptocurrencies

What will be my Profit/Loss if I place a 5 lot trade on LTCUSD, considering my account is a $50,000 account, and the movement is 20 points?

Profit/Loss = ((Lot size * Point Value) * Points) – (Commission + Swap)

Swap and Commission is 0

Point value = Contract Size = 1

Profit/Loss = (5 * 1) * 20 = $100

What will be my Profit/Loss if I place a 5 lot trade on LTCUSD, considering my account is a £35,000 account, and the movement is 20 points?

Profit/Loss = ((Lot size * Point Value) * Points) – (Commission + Swap)

Point value = Contract Size = 1

Swap and Commission is 0

Profit/Loss = (5 * 1) * 20 = $100 which is £76.37

Since the account currency is GBP, we need to convert the profit to GBP.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.