Symbols

You can compare live spreads and explore the details of each symbol

Ticker

Symbol Specifications & Trading Hours

note: Weekend trading hours on Cryptocurrencies may vary on each platform due to weekly scheduled maintenance times. Please check the trading hours of the symbol in the platform you are using and refer to our Trading Updates site for the latest platform maintenance times, scheduled outages and other trading-related updates. Note the standard market closure countdown in the table below doesn’t take into consideration any amended market hours, platform maintenance times or other changes as displayed on the Trading Updates site.

- As many Free Trials as you need

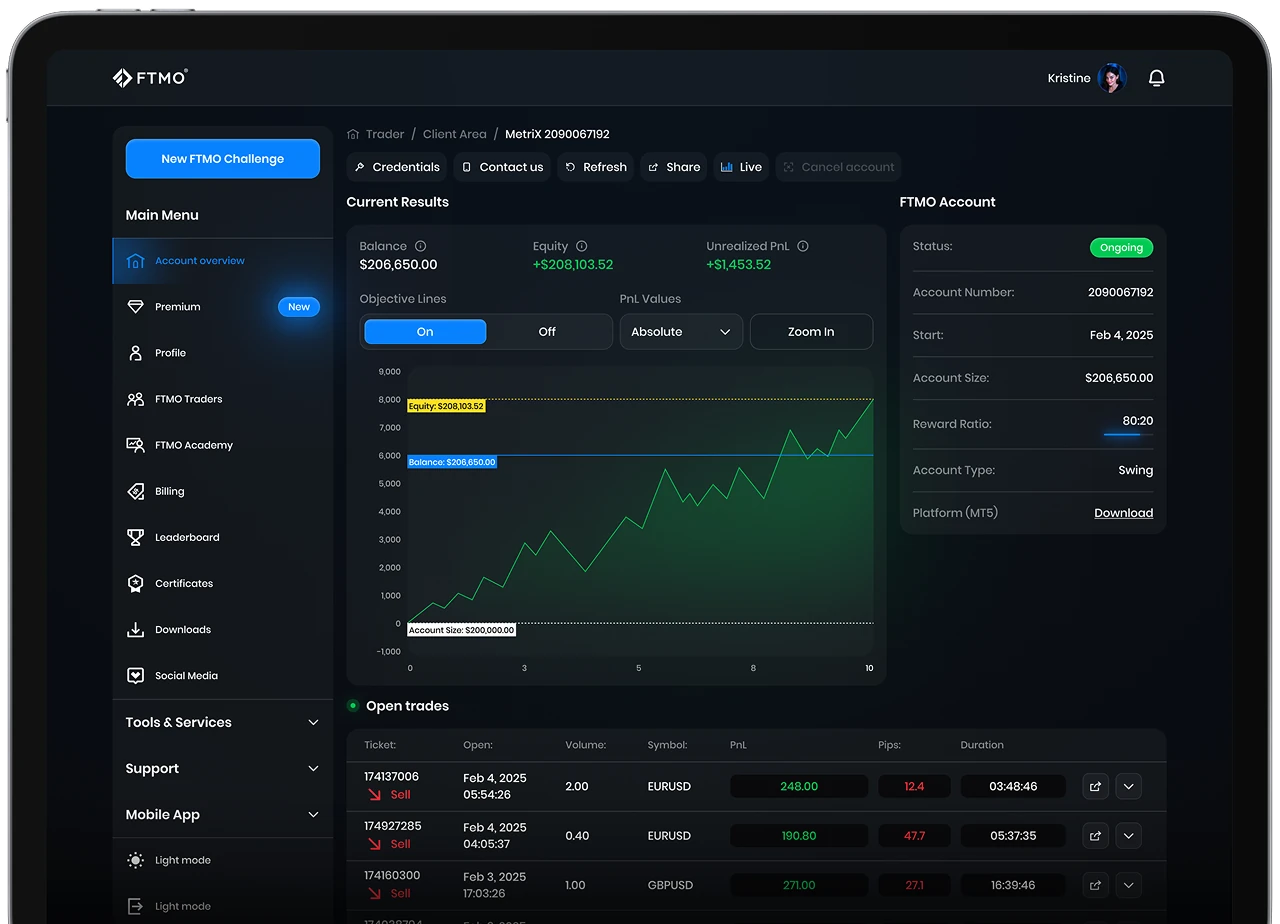

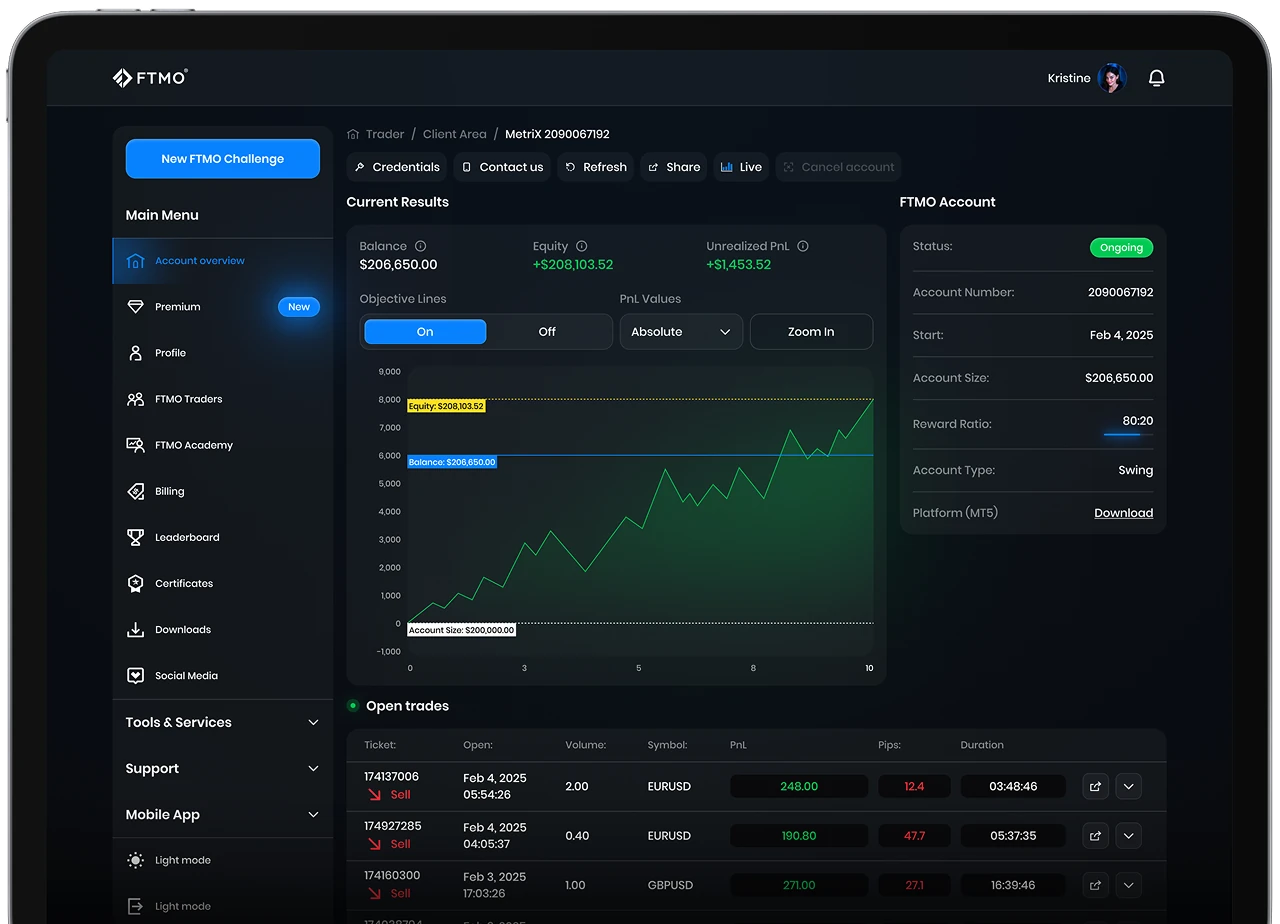

- Up to $200,000 FTMO Account

- Performance-based rewards

Worldwide Reviews