Editorial note: All responses are 100% organic and received from our new FTMO Traders during the contract signing process. All responders agreed to have their feedback published and all their answers are not being edited by FTMO, hence they can include grammatical mistakes or typos.

September edition of our new FTMO Traders

The month of September is here and we would like to welcome our new FTMO Traders to our ranks. Get inspired by their journey.

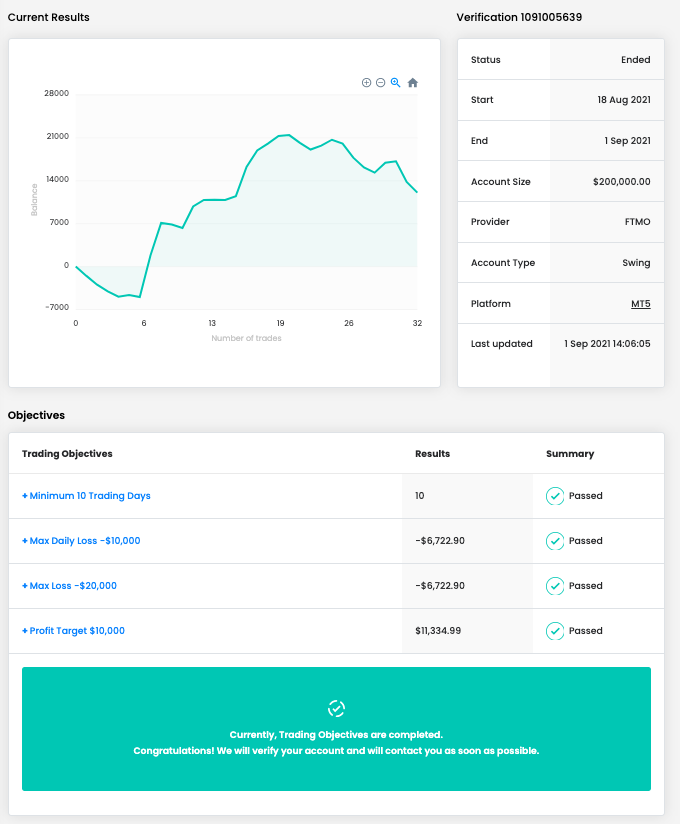

Trader Kyle - "Learn why markets move!"

Has your psychology ever affected your trading plan?

Yes. Anyone who says it does not is lying or is simply inhuman. My risk management plan helps mitigation of the risks of emotion in a trade.

How does your risk management plan look like?

I use technical support and resistance to select entries, exits, stop loss, and position size. I use fundamental analysis to choose my trades and weigh the risk.

This also plays into my position sizing. I typically will not risk more than 1.5% of equity on any particular trade unless my fundamental outlook will go up to 3% and no more.

As for psychology, I have a set of rules to help against the negative impacts of emotion in trading

1. Always set a stop loss and never move it.

2. Always set a take profit for at least 1/2 position size.

3. Never risk more than 5% of the equity at any given time.

4. Stick to what I know, the fundamentals. If a trade or hypothesis goes against me I will stop all trading till I figure out why.

5. Never flip position (short/long) without a strong fundamental reason

6. If loss of equity hits 5% in one day, close all trades and reevaluate. Do not take any more trades till a fundamental understanding is met and do not make any trades till the next trading day.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I will be doing another challenge for another $200k in capital

What was more difficult than expected during your FTMO Challenge or Verification?

Fighting the urge to over-trade

How did Maximum loss limits affect your trading style?

Very well! It is a wonderful tool to help keep from over-trading and restraint emotions. I love this and will be added to my personal accounts.

What is the number one piece of advice you would give to a new trader?

Learn why markets move!

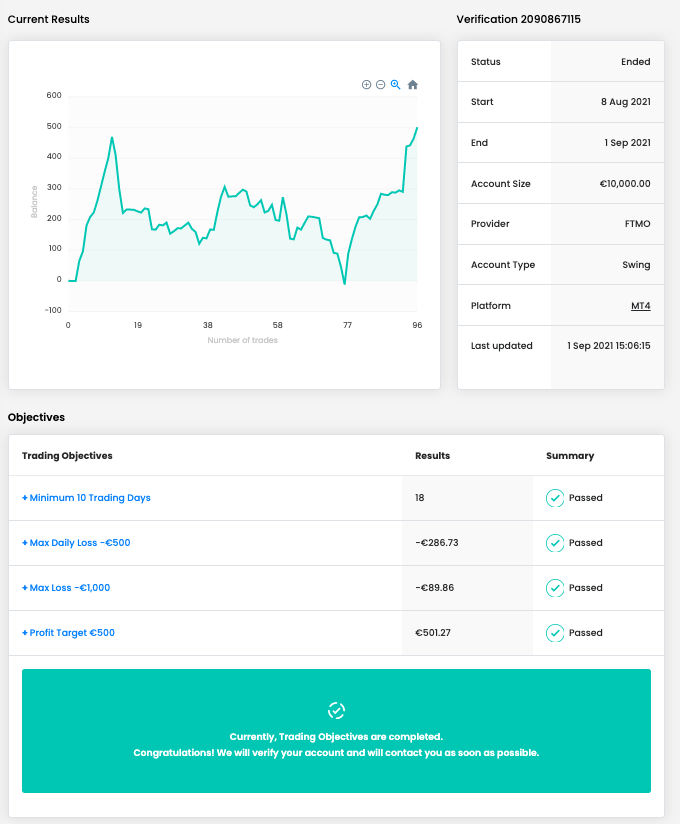

Trader Sten - "You have to kill your emotional side."

How did you eliminate the factor of luck in your trading?

Only have certain setups and proper risk management. This time I did some testing with a slightly different setup which worked as well.

What was more difficult than expected during your FTMO Challenge or Verification?

Verification. The market went more volatile and my setup was more focused on trading the trends. Not ranging volatile market. But with good risk management, I managed to work out a "ranging market setup" for myself. Now I like it even more than trading with the trend :D

What was the hardest obstacle on your trading journey?

For me, the hardest part is always - letting the good trades run. Tend to take profit/partials too early. Working on it :). Need to trade more in "shoot and run" style.

How did Maximum loss limits affect your trading style?

The maximum loss did not affect me at all. Good risk management, setup trades only and controlled emotions. Daily loss is the affecting factor.

Do you have a trading plan in place, and do you follow it strictly?

Yes, but I like to keep evolving. So I follow it strictly but after backtesting new ideas I might try them with a live account. Mostly system itself is the same. Some confirmation details might change during time etc.

What is the number one piece of advice you would give to a new trader?

Mess around in demo only as long as u have some basic fundamental knowledge. BUT I truly think trading with demo otherwise is wasted time. U GOT TO GET IN THERE and start trading with money.

U have to kill your emotional side. U have to be numb like a fish. And that only happens after getting hurt a couple of times. Second - RISK MANAGEMENT. Yeah, some guys here get the challenge done in 1 day. To me that only show they can blow up fast too. Third - Effort & Focus. Study, test, trade, sacrifice other things for learning and trading. Fourth- DISCIPLINE. When u finally nail all those things down, STICK TO IT AND ACTUALLY DO THOSE THINGS. That would be my advice to anyone who just started trading.

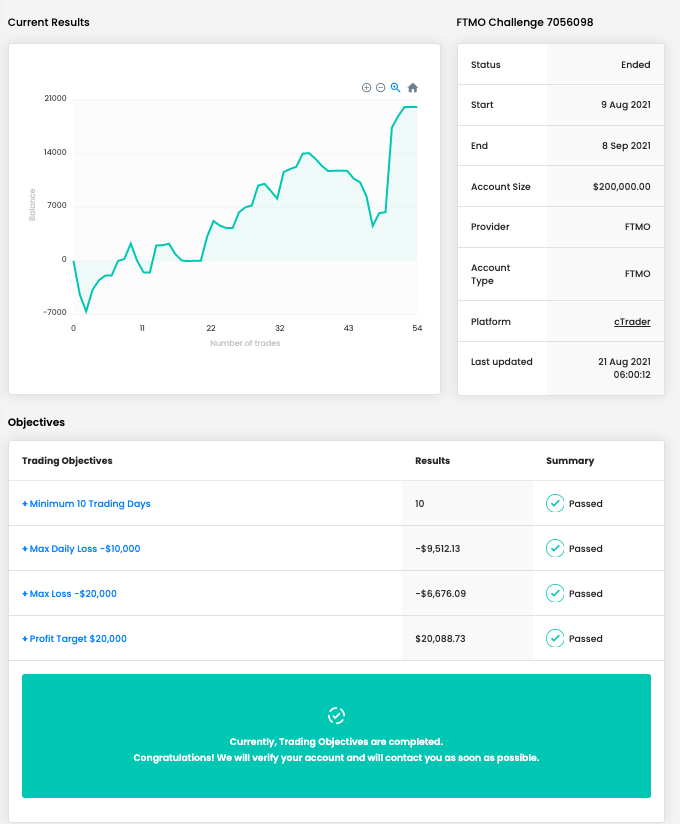

Trader Etienne - "Take your time and don't overthink."

What do you think is the key for long term success in trading?

Discipline, emotions control and consistency.

How did you manage your emotions when you were in a losing trade?

When you accept a losing trade as a part of the process there's no need to worry about any emotions.

Has your psychology ever affected your trading plan?

Yes sometimes, I'm not perfect but it happens way less than before. I manage to control it 99% of the time now but when it does happen I will take a day off to review my mistake to make sure I won't let myself slip again.

How did Maximum loss limits affect your trading style?

It didn't affect my trading style since I have good risk management.

What do you think is the most important characteristic/attribute to become a profitable trader?

Emotional Intelligence and if I could add one, good adaptive capacity.

What would you like to say to other traders that are attempting the FTMO Challenge?

Take your time and don't overthink. Set up a plan and focus on it. Don't think about the time and percentage that you have to accomplish otherwise you'll lose focus and start doing psychological mistakes in order to pass your challenge by fear of missing out on time. If you know you're ready to take the challenge, you won't doubt your plan, otherwise, it might be a good idea to keep practising.

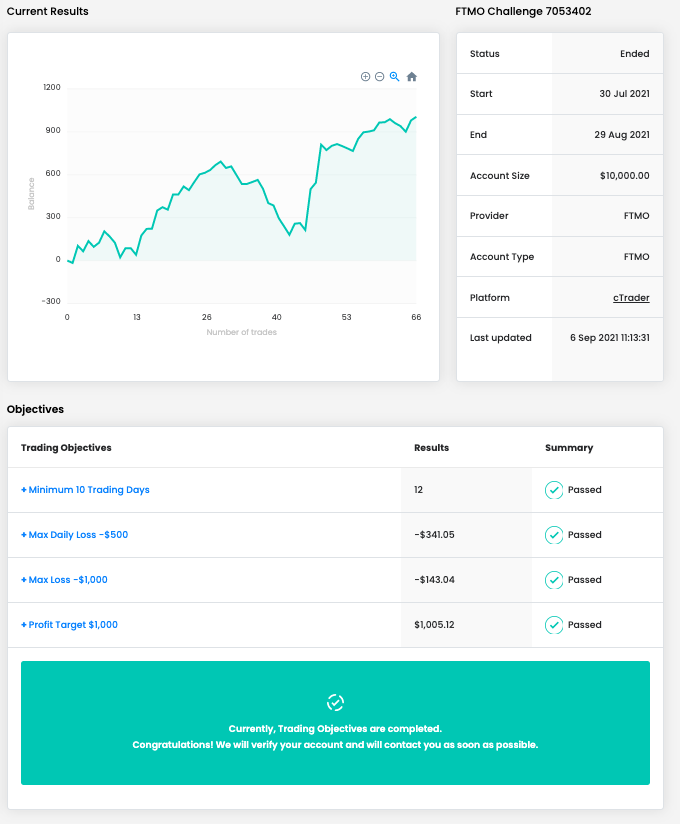

Trader Gert - "It is impossible to win with every trade."

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, but I will first see how I do with the smaller account.

How did you manage your emotions when you were in a losing trade?

It's never pleasant to experience a loss, but just accept it, it happens, it will happen again, and it will happen again...., be realistic - it is impossible to win with every trade. If you are at work or you run a business, is every transaction or every day at work a winner?

How did Maximum loss limits affect your trading style?

It did not affect me at all. I kept position sizes small enough so that it was never a real threat.

How does your risk management plan look like?

I endeavour to maintain "at least" a 1:1 profit to loss ratio and to have more winners than losers, but its a bonus if I get a better ratio, let's say 1.5:1

What was more difficult than expected during your FTMO Challenge or Verification?

The pressure of completing the first stage in 1 Month. 10% growth on capital in 20 trading days is very difficult to achieve, and it's not realistic to think it will be achieved consistently.

What would you like to say to other traders that are attempting the FTMO Challenge?

See it as a "challenge" / "an adventure" to achieve something or to do something you have not done before. Don't take it so seriously that it becomes a matter of life and death, because you will become too emotional about not succeeding. The challenge is for people with at least a number of years of experience as a trader. It is unlikely that you will succeed in the challenge as a total beginner.

__________

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.