Precise Risk Management Turned Gold Into a $77,249 Profit in 2 Weeks

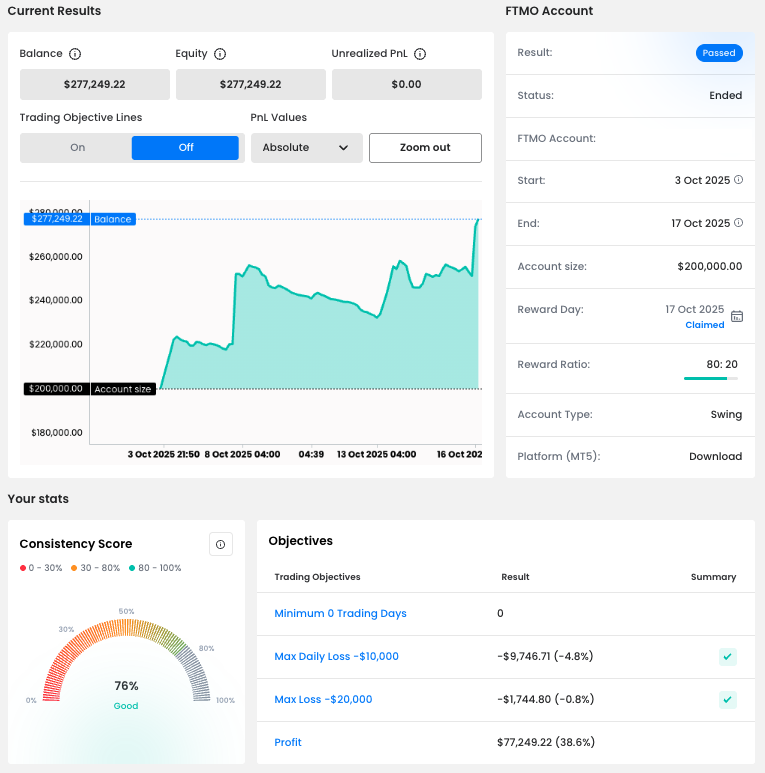

In this part of our Successful Trader Stories, we highlight a trader whose performance was a perfect combination of high reward-to-risk ratio and precise risk management. In just two weeks, he managed to achieve an impressive $77,249.22 profit (38.6%) on his $200,000 FTMO Account. A result that speaks for itself.

A Balance Curve Defined by Control

The Balance Curve and PnL Calendar clearly show a trader who understands control. Despite several deep pullbacks, he never violated the FTMO Trading Objectives. His Consistency Score of 76% confirms that the results were not random but the outcome of a well-structured plan.

Even on his toughest days (9, 10, and 14 October, when he recorded losses of –$9,174.71, –$8,704.00, and –$9,704.00) he remained within the Max Daily Loss limit of $10,000, proving his ability to manage exposure under pressure.

But the PnL Calendar also highlights one exceptional day: Tuesday, 7 October, when he booked a $32,345.87 profit – almost half of his total monthly gain. That day showcases both patience and conviction, and we’ll take a closer look at it in our case study below.

Numbers That Stand Out

The trader’s statistics tell an interesting story. His Win Rate of 31.96% means that barely one out of three trades was profitable, yet his outstanding reward-to-risk ratio of 4.89 made that entirely sufficient.

With an Average profit of $4,412.38 and an Average loss of –$902.04, he demonstrated that quality over quantity pays off when paired with disciplined execution. His Profit factor of 2.30 underlines this balance perfectly.

Smart Positioning and Market Focus

The trader primarily focused on XAUUSD (Gold), where he opened mostly long positions. His preference for gold trading was evident, yet he occasionally engaged in short setups as well, showing adaptability to different market conditions.

The timing of his entries, visible in the Open time hour chart, also suggests a well-defined strategy, often focusing on morning and early-session activity — a time of high volatility and opportunity in gold markets.

Case Study: Long on XAUUSD ($31,828.59 Profit)

The highlight of his trading period was a long position on gold (XAUUSD), opened on 7 October 2025 — the most successful day we mentioned earlier. He held it for over 14 hours (14:27:07) and closed it with a massive profit of $31,828.59.

The setup was clean and disciplined. He entered the trade with a clearly placed Stop Loss, managing it dynamically as the trend developed in his favor. What’s interesting — he closed the position just below the Take Profit level, locking in a near-perfect result.

This decision proved wise: the market began to reverse shortly after he exited, suggesting he likely read a fundamental signal correctly.

Conclusion

This trader’s two-week performance stands as a masterclass in composure, timing, and risk control. He showed that trading success isn’t defined by how many trades end in profit – but by how well you protect your capital when they don’t.

By focusing on gold, maintaining discipline through challenging sessions, and respecting every FTMO Trading Objective, he turned controlled precision into an extraordinary 38.6% return on his $200,000 FTMO Account.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?