“Passion first and after that edge, psychology, management, etc.”

Most traders start trading mainly because of the promise of quick and easy earnings. However, after a few losses, many find that it's not so much fun because it's not just about the money. If you simply don't enjoy trading, consistent results will be hard to achieve, as our new FTMO Traders also know.

Trader Huu Hoan: “If you stay patient and don’t give up, you’ll get there.”

What was the hardest obstacle on your trading journey?

Honestly, the hardest part is keeping a cool head when the market goes against you. There were times I found myself making impulsive trades just to recover from previous losses. It was stressful, but over time, I learned to accept losses and stick to my initial plan.

What do you think is the key for long term success in trading?

I think the key to long-term success in trading is discipline. Like, once you set your rules, you have to stick to them and not let emotions take over. Risk management is also super important because if you’re not careful, one bad move could wipe out your account.

What inspires you to pursue trading?

For me, the biggest motivation is freedom. Financial freedom and time freedom. I don’t want to be stuck in a 9-to-5 job; I want to make money based on my own skills. The feeling of being in control of my decisions in the market is what keeps me going.

How has passing the FTMO Challenge and Verification changed your life?

Passing the FTMO Challenge and Verification gave me a huge confidence boost. It opened the door to trade with a larger capital and created a stable income. It also reassured me that I can actually make a living from trading.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The hardest part was when the market didn’t present any clear opportunities, and I had to be patient and wait. There were times when I just wanted to jump into a trade for the sake of action, but I reminded myself that patience is key. Eventually, I stuck to my rules and made it through.

What would you like to say to other traders that are attempting the FTMO Challenge?

I’d just say, stick to your rules and don’t let emotions control you. Don’t worry too much about losing trades because it’s part of the game. The important thing is to manage your risk well and always learn from your mistakes. If you stay patient and don’t give up, you’ll get there.

Trader Dan: “Passion first and after that edge, psychology, management, etc.”

What was easier than expected during the FTMO Challenge or Verification?

Both have their own difficulties, but the Verification might bring more pressure and make you commit mental errors.

What was the hardest obstacle on your trading journey?

Constant failure followed by small improvements and more failure, but all boiling down to finding your edge and what actually works for you individually.

What do you think is the most important characteristic/attribute to become a profitable trader?

Passion. If you enter this business just for the money and during that process you do not become passionate about trading, you will give up eventually and/or fail because you will not focus on becoming a better trader but rather on the financial part. Passion first and after that edge, psychology, management, etc.

What was more difficult than expected during your FTMO Challenge or Verification?

It's a weird question because once you trade from a logical perspective, you're not going to be that attached by the fact you are doing a challenge or verification. But probably for me is patience in waiting for the trades to present themselves.

How did you eliminate the factor of luck in your trading?

I do not believe you can fully eliminate that factor. Even if you have a back tested strategy, you might go on losing streaks and that might be considered "bad luck" or the opposite. Plus, I never really had "luck" in trading, I was unprofitable for a long period when I didn't know what I was doing, I wasn't really "lucky".

One piece of advice for people starting the FTMO Challenge now.

You cannot force faith or the markets. Learn to recognize when to get up from the chair and recollect your thoughts. Even boxers during a match take a break, learn when you need one also, or you will get knocked out.

Trader Rick: “Stay focused, disciplined and keep dreaming of your vision.”

How did loss limits affect your trading style?

Not a lot. Of course, I kept it in my mind but in the end, I just followed the steps according to my strategy with a proper RRR.

What was the hardest obstacle on your trading journey?

To not give up after so much trial and error. Sometimes it was hard to push through. Journaling trades after losing the challenge wasn't always the most fun part to do. But I did it :)

What was more difficult than expected during your FTMO Challenge or Verification?

There was no difference, at a certain point coming close to finishing the verification phase, I had a small feeling of tension, but I just focused on my strategy, and I did what I always do. Trading with a plan.

How did you manage your emotions when you were in a losing trade?

It’s part of the job. I do care about protecting my capital but as long as my back test data shows me that I’m profitable, I’m convinced that I will be the same in the live market. A profitable strategy with proper risk management and an acceptable lot size will do it for me.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I use the Wyckoff methodology. I always follow my trading rules. When I don’t follow them I get punished instantly with a losing trade.

What is the number one advice you would give to a new trader?

Time = key => stay focused, disciplined and keep dreaming of your vision. It's you against the best, give yourself the time and education to learn how to benefit from them, once you find your way it will be worth it.

Trader Ignacio: “The hardest obstacle was developing and maintaining the right mindset.”

What was the hardest obstacle on your trading journey?

The hardest obstacle was developing and maintaining the right mindset. Managing emotions like fear, greed, and frustration, especially during losing streaks, was a significant challenge. It took time to cultivate the discipline to stick to my trading plan without being swayed by the emotional highs and lows of the market.

What was more difficult than expected during your FTMO Challenge or Verification?

I found managing my risk during volatile market conditions more difficult than expected. While I had a solid risk management strategy in place, the emotional stress and the fast-paced environment during volatile periods made it harder to stick to my predefined risk parameters.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part was maintaining consistency and discipline in following my strategy under the pressure of meeting the profit target. I overcame this by focusing on the process rather than the outcome, sticking strictly to my trading rules, and avoiding overtrading or chasing losses. Journaling my trades and reviewing my performance daily helped keep me grounded.

How would you rate your experience with FTMO?

I would rate my experience highly. FTMO offers a structured approach that enforces discipline, which is crucial for any trader’s success. The trading conditions are fair, and the profit-sharing model is rewarding. However, the strict drawdown limits can be stressful at times, but it encourages responsible risk management.

What do you think is the key for long term success in trading?

The key to long-term success is a combination of discipline, risk management, and continuous learning. Having a solid trading plan, sticking to your strategy, and managing risk effectively are essential. Additionally, being adaptable to market changes, constantly improving your skills, and maintaining emotional control are vital for sustained success.

What is the number one advice you would give to a new trader?

The number one piece of advice I would give to a new trader is to focus on risk management above all else. Trading is not just about making profits; it’s about protecting your capital. Always know how much you’re willing to lose on each trade, set strict stop-losses, and never risk more than a small percentage of your account on any single trade. Mastering risk management will keep you in the game long enough to refine your strategy and grow as a trader.

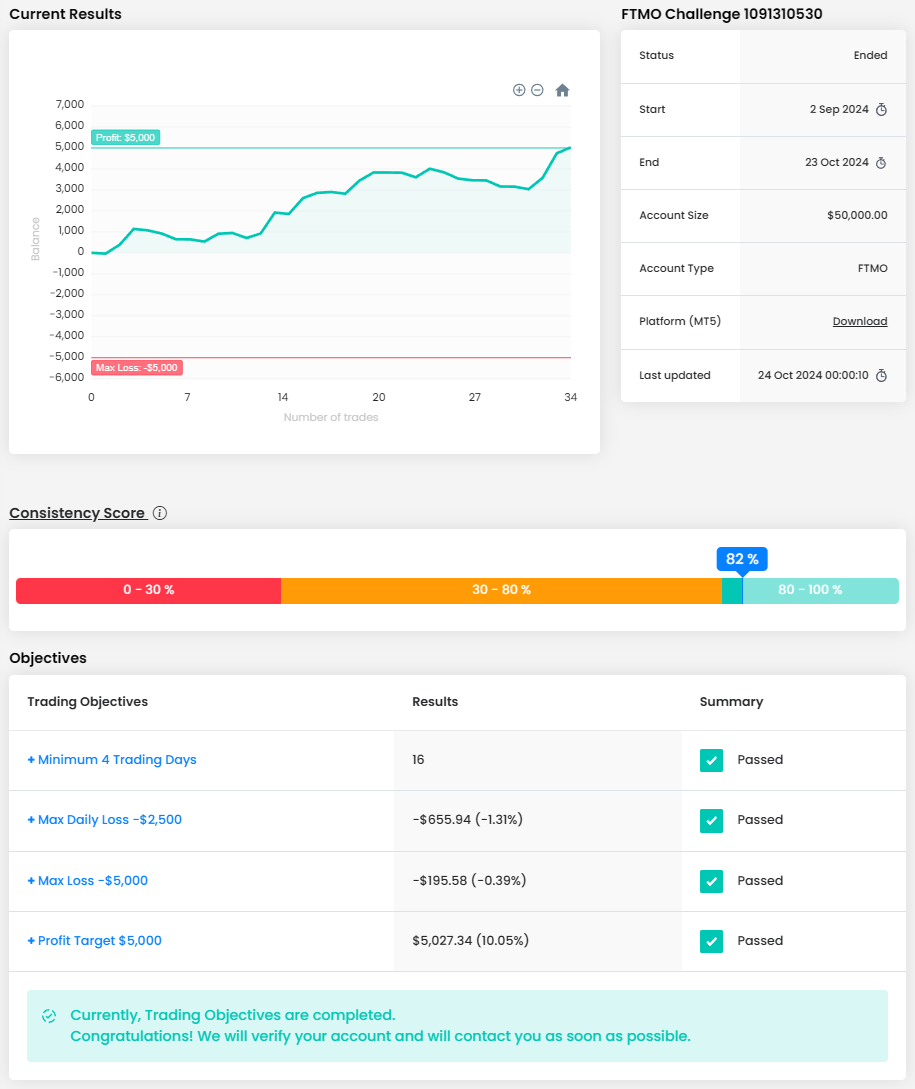

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?