Mastering Shorts and High RRR Resulted in Over €40K Profit

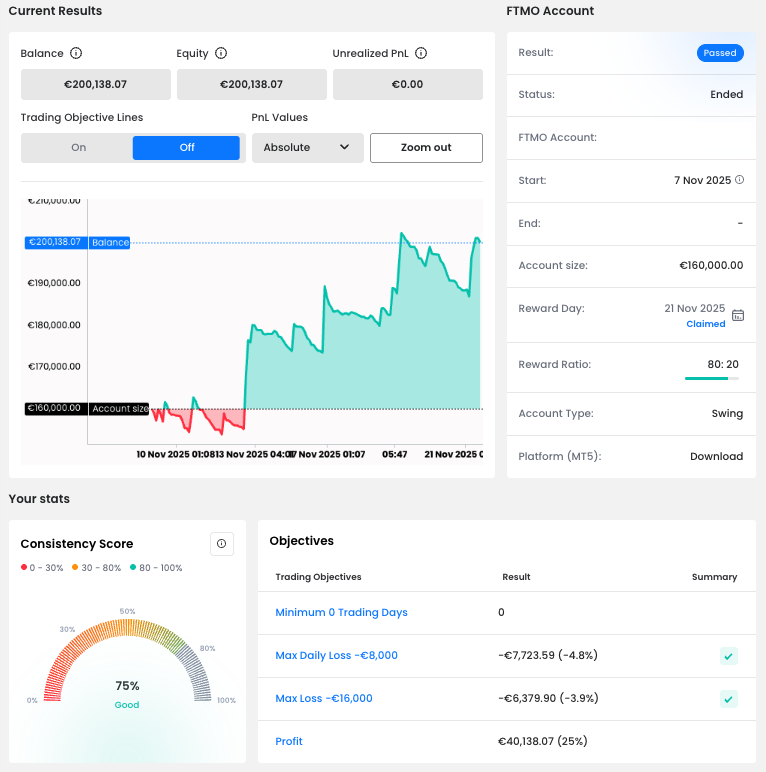

In this edition of Successful Trader Stories, we highlight a trader who turned a combined €160,000 FTMO Account into €200,138 in just two weeks. His disciplined preference for short setups, strong control of losses, and precise execution on gold trades helped him secure a remarkable €40,138 profit (+25%).

A Balanced Comeback

The Balance curve tells the story of a trader who started under pressure but stayed in control. After a brief early drawdown, he maintained composure and kept every loss within FTMO Trading Objectives. The Consistency Score of 75% confirms a steady and methodical recovery that peaked in the second week.

In the PnL Calendar, we see a crucial turning point: by 12 November, the trader locked in a strong daily profit of €21,369.72, setting the tone for the remainder of his trading period.

Interestingly, his best sessions often came mid-week and on Fridays – a recurring pattern showing he capitalized on volatility spikes typically found near the week’s end.

The Numbers Behind the Result

With a Win rate of just 22.67%, only about one in five trades closed in profit. However, the key lies in his Average RRR of 5.21 and Profit factor of 1.53 – showing that his average winners (€3,419.17) were over five times larger than his average losses (–€656.15).

In total, he executed 150 trades and kept his strategy simple but effective: control the downside, maximize strong setups, and let math and discipline do the work.

Structure and Strategy

The breakdown shows that short positions generated the majority of the trader’s profit, even though he also took long positions when the setup made sense. In terms of instruments, he achieved his strongest results on XAUUSD (Gold), while smaller trades on pairs like EURCAD or USDJPY had only a minor and less consistent impact.

The Open time hour chart suggests that he traded mostly between 5:00 and 9:00 AM, aligning with early European market volatility. His consistent performance during these hours highlights a structured approach – choosing quality trading windows over quantity.

Case Study: A €16,024 Short on Gold

His best trade came on 14 November, when he opened a short position on XAUUSD (1.85 lots) and held it for over 3 hours (03:23:39). The trade structure was textbook: a clean entry around 4,168.98, a well-placed Stop Loss at 4,179.05, and a Take Profit at 4,067.93 – all clearly defined in advance.

He managed the position calmly, allowing price to reach the Take Profit level exactly as planned. This single move earned him €16,024.63, perfectly illustrating the power of trusting your setup and letting the market do the work.

Conclusion

This two-week performance shows how far a trader can go when losses stay small and winners are allowed to grow. With a clear preference for short opportunities, disciplined execution on gold, and smart timing, he transformed volatility into opportunity and secured a clean +25% return.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?