“It will likely take longer than you expect to become consistently profitable”

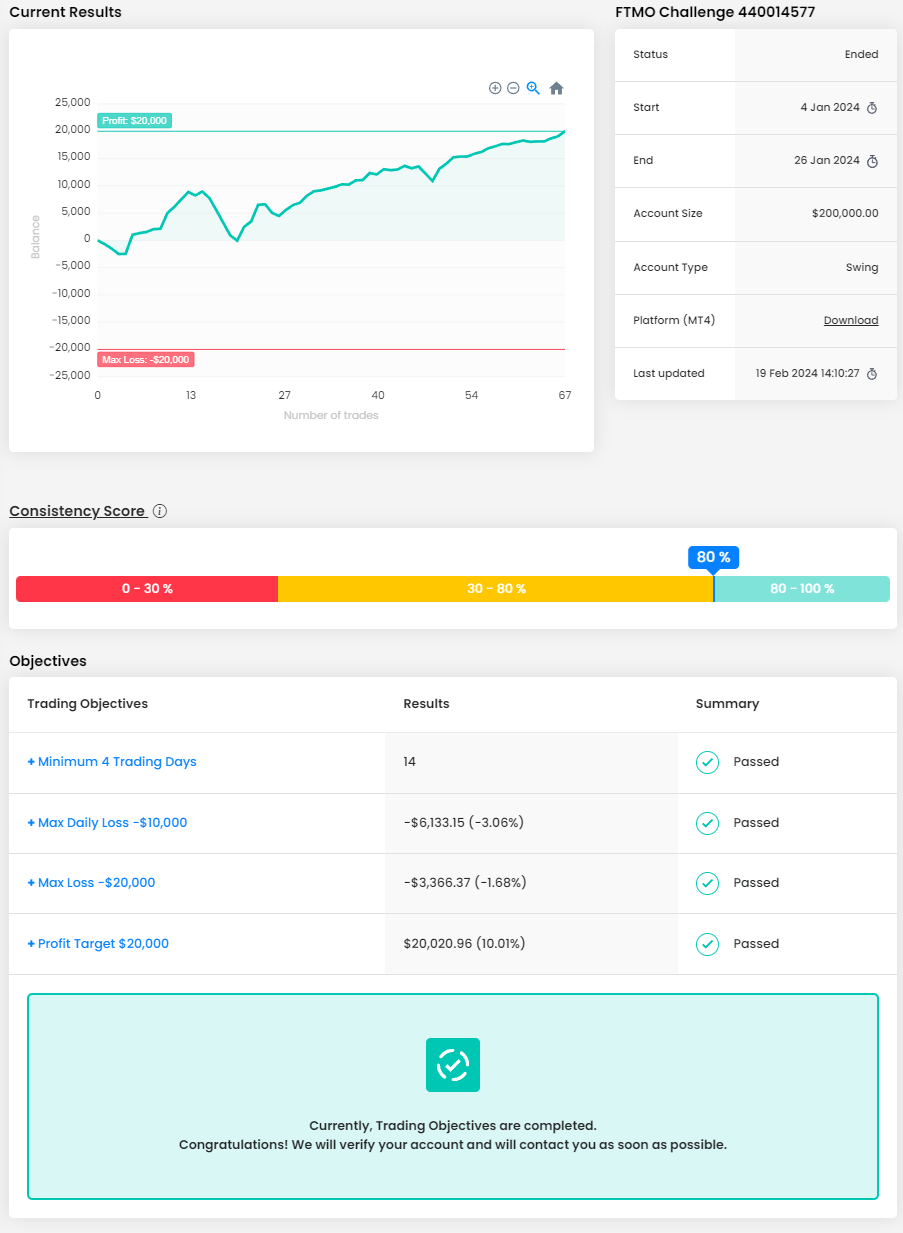

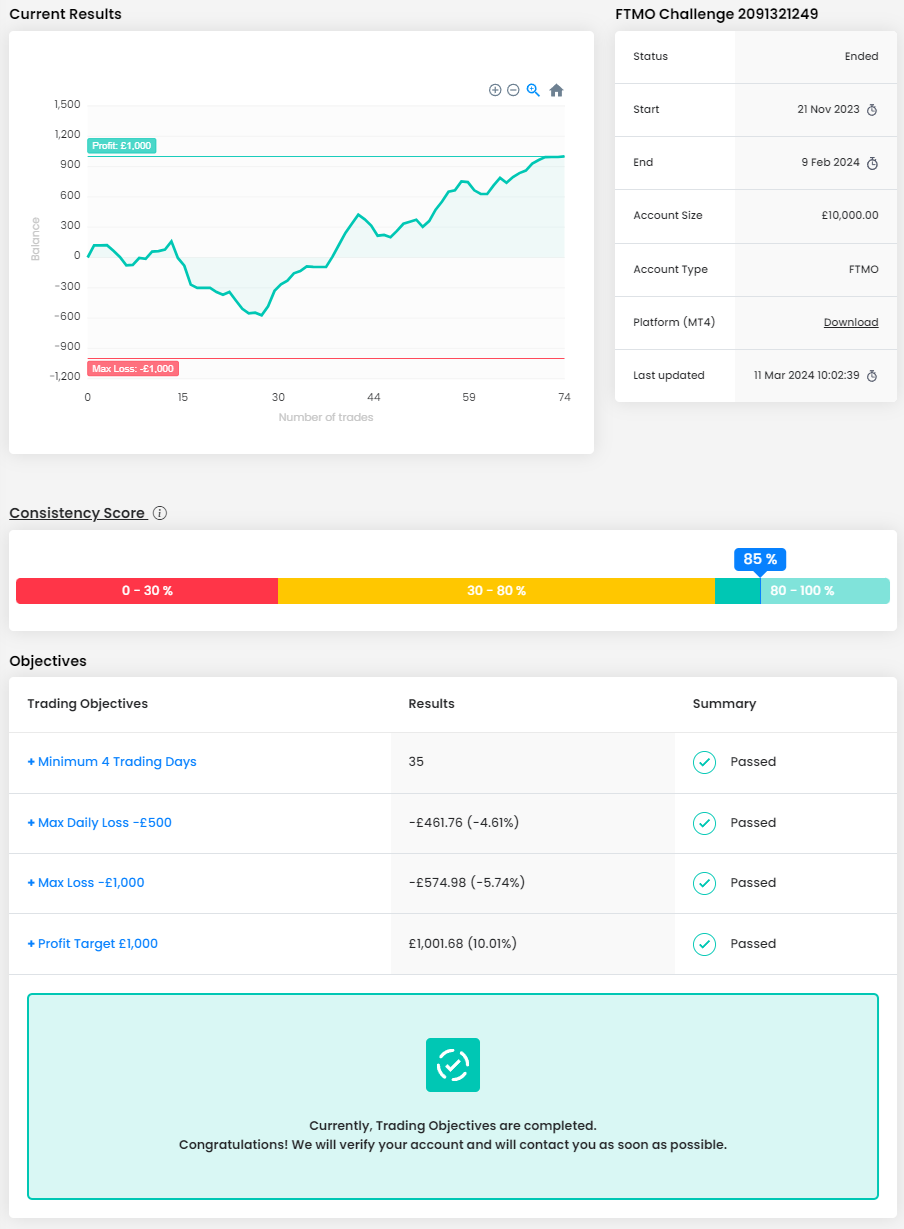

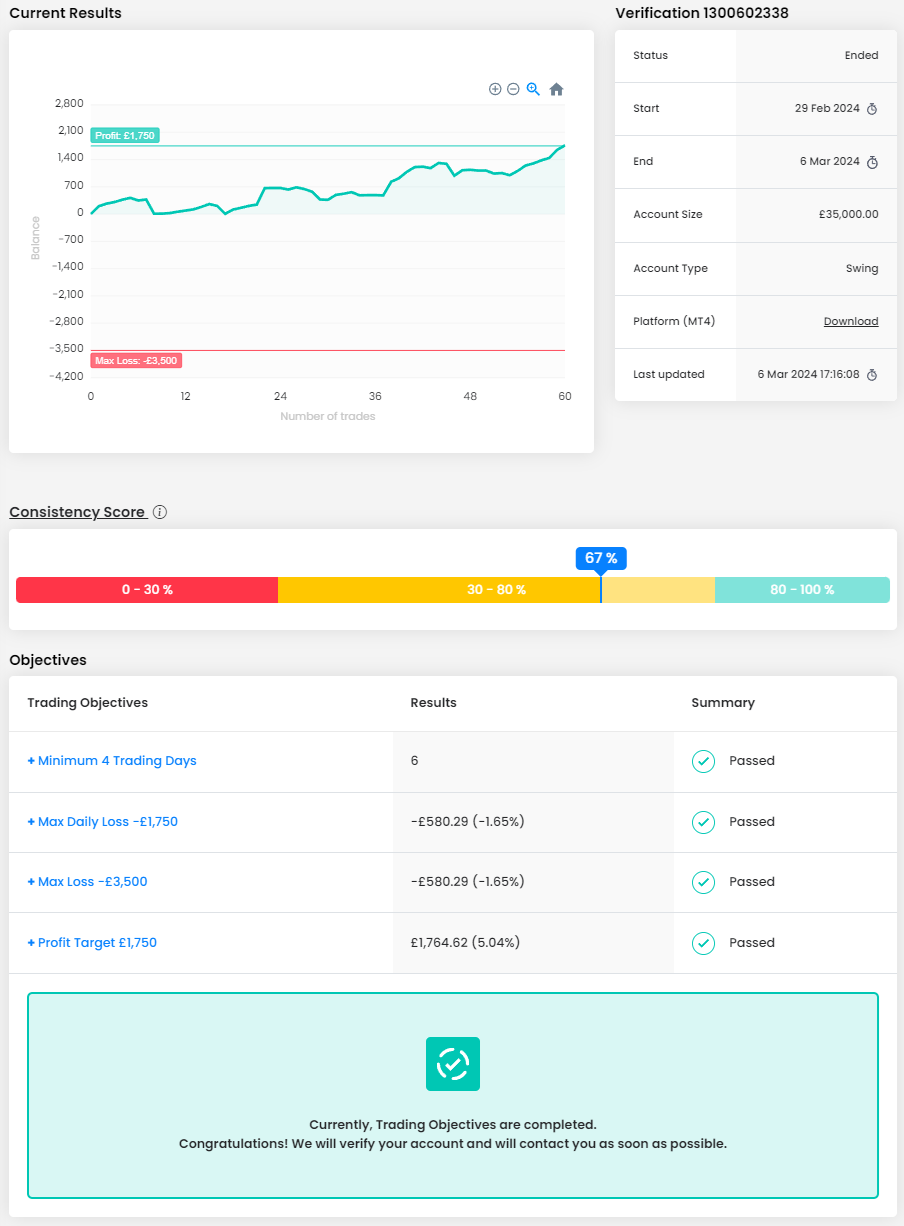

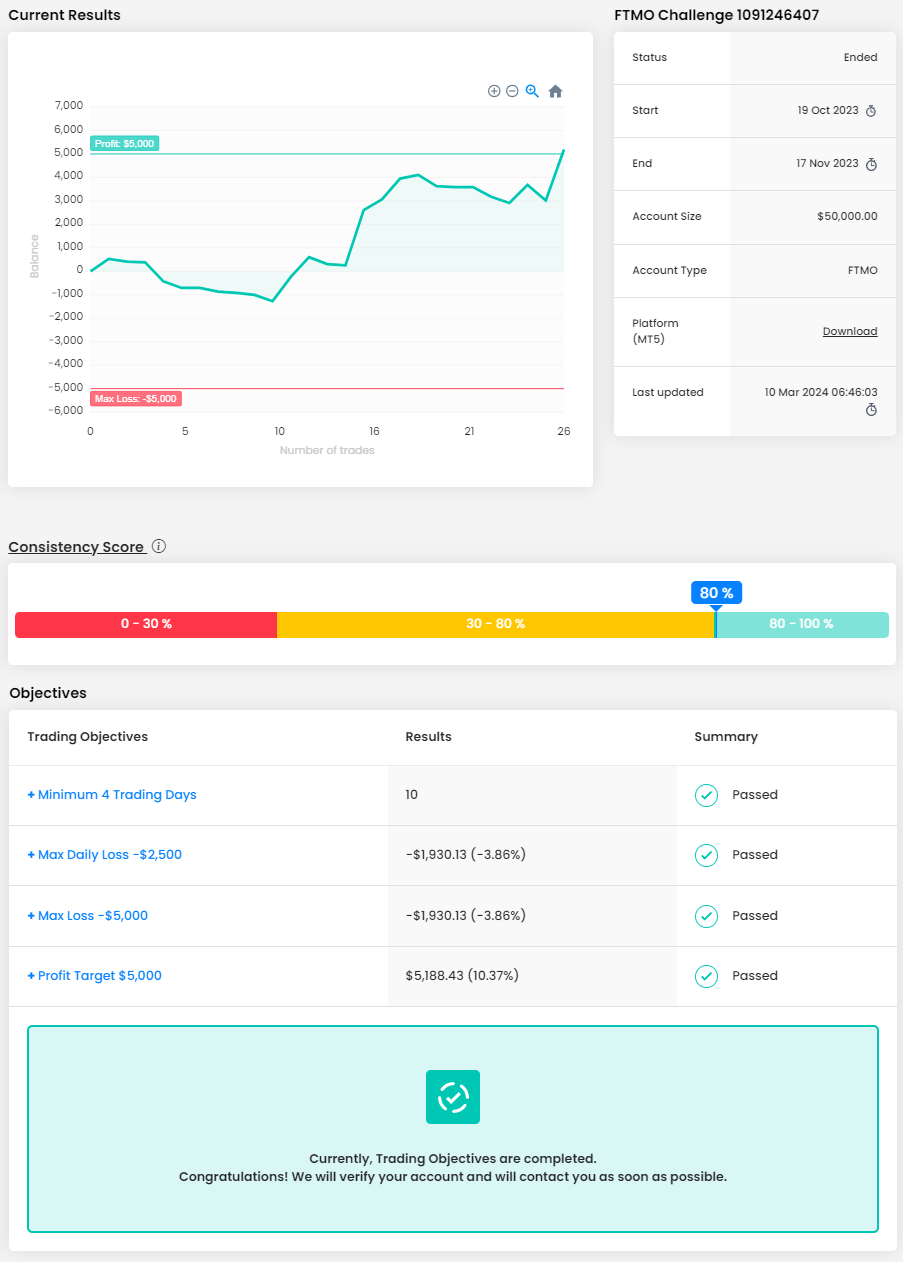

Lack of patience is one of the most common causes of long-term failure for most traders. Many trades with the vision of a quick profit is not the path that leads to consistent results and psychological well-being of a trader. Our new FTMO Traders Pedro, Cyret Shadied, Daniel Leonard and Ivaylo Nikolaev are well aware of this.

Trader Pedro: “The hardest obstacle was maintaining discipline amidst market volatility and emotional biases”

How did you manage your emotions when you were in a losing trade?

Managing emotions in a losing trade involves maintaining a disciplined approach by adhering to a pre-defined trading plan, practicing risk management to limit the impact of any single loss, and accepting that losses are an inevitable part of trading, which helps in keeping a clear, objective mindset.

What was more difficult than expected during your FTMO Challenge or Verification?

One of the most challenging aspects I faced during the FTMO Challenge was the psychological pressure of having to perform and follow the rules. Balancing the need to meet profit targets while managing risk and adhering to the challenge's constraints tested my discipline and emotional resilience, especially during periods of market volatility.

What was the hardest obstacle on your trading journey?

The hardest obstacle was maintaining discipline amidst market volatility and emotional biases, particularly in sticking to my trading strategy during losses without being swayed by fear or greed.

What do you think is the key for long term success in trading?

For me, the key to long-term success in trading hinges on maintaining strict discipline, adhering to a thoroughly tested strategy, and implementing effective risk management. Constant learning and adaptability are also essential, allowing me to refine my approach in response to both market shifts and personal trading insights. Above all, cultivating emotional resilience helps me navigate the highs and lows, making decisions based on logic rather than emotion.

How has passing the FTMO Challenge and Verification changed your life?

Passing the FTMO Challenge and Verification was a pivotal moment for me, marking a transition to trading with significant capital and opening new financial doors. It affirmed my trading skills, boosted my confidence, and instilled a deeper sense of discipline in my approach, profoundly impacting both my financial independence and personal growth.

What is the number one advice you would give to a new trader?

My number one advice to a new trader would be to prioritize risk management above all else. Understanding and effectively managing risk is fundamental to sustaining your trading career. It's essential to only risk what you can afford to lose, set realistic Stop Loss orders to protect your capital, and never let emotions drive your trading decisions. This foundational principle can help safeguard your capital and provide the stability needed to learn, grow, and succeed in the unpredictable world of trading.

Trader Cyret Shadied: “At first, it was about money when I looked into trading, but now I enjoy the knowledge and the edge.”

How did you eliminate the factor of luck in your trading?

Sticking to my strategy and having patience.

What do you think is the key for long term success in trading?

For me, it’s just having patience and waiting for the strategy to play out. Understanding that trading is about probabilities and going with the strongest probability that matches your strategy.

What inspires you to pursue trading?

At first, it was about money when I looked into trading, but now I enjoy the knowledge and the edge. I find it quite rewarding when my strategy plays out.

What was the hardest obstacle on your trading journey?

I think for me, it was watching my trade, too much and living in fear, while I was in a trade, which made me make some bad decisions. I have reduced how many times I watch my trades and I now set necessary alerts.

One piece of advice for people starting the FTMO Challenge now.

Be patient, be super patient and don’t enter it for fast money. Enter it for consistency.

Trader Daniel Leonard: “Take as much time as you need.”

How did you manage your emotions when you were in a losing trade?

By reminding myself of the longer-term goals. That I will recover from a loss and feel better quickly once you make the decision to cut a trade when the original trade idea is shown to be wrong. Also, your position sizing must be appropriate and consistent with your account size.

What does your risk management plan look like?

I size each trade at about 0.3%. However, if I am adding to a position or believe the market environment has changed in some way, I will allow up to about 1% per position before looking to mitigate any loss. Obviously, there is the daily 5% loss limit but increasingly if I am down 2% or 3% in a day, I will consider stopping trading for the day/session.

What inspires you to pursue trading?

Independence, potentially unlimited gains and to master myself to achieve consistency in the markets.

Describe your best trade.

I don’t have 1 best trade in particular, but I would say that when I became more able to wait patiently for the best setups, I started to have much better trades with less stress and drawdown.

Where have you learnt about FTMO?

I learnt about FTMO some years ago almost certainly from other traders on Twitter.

What is the number one advice you would give to a new trader?

Know that it will likely take longer than you expect to become consistently profitable and so you need to foster patience in yourself. Now that there is no time limit, take as much time as you need. DO NOT hit the Daily Loss Limit, no matter how annoyed and frustrated you may be with yourself at the time. Walk away and come back the next day with a fresh and optimistic mindset, and you will be surprised how quickly you can repair the damage done previously. Once you have done this a few times and understand that it is possible then you just need to submit to time, and you will get there in the end.

Trader Ivaylo Nikolaev: “One definitely needs to be consistent in trading.”

What do you think is the key for long term success in trading?

One definitely needs to be consistent in trading. I've been doing this for 2 years now, and it's been a hard journey. But the breakpoint for me was to start managing the risk properly. I've been hearing about this "risk managing" thingy from various traders, but I never understood what it really means. Now I know that even the most simple and raw trading strategy could be profitable if you apply good risk management and execution. 📈

How did trading with FTMO impact you?

I learned a lot from FTMO. FTMO helped me to apply rules to my trading routine.

What was the hardest obstacle on your trading journey?

I was too emotional while trading, and this led to early cuts or non-proper execution 😱. With time, I developed a trading approach that kept my emotions as low as possible. Once trading became boring, things started to work better for me.

What inspires you to pursue trading?

I've been watching a few guys on video platforms (I won't mention their names), and I saw them grow from 0. So, I knew it is possible to succeed with trading, I just needed to be consistent and not quit.

What do you think is the most important characteristic/attribute to become a profitable trader?

I think one just needs persistence! The rest can be learned.

What is the number one advice you would give to a new trader?

Focus on that, any strategy can be profitable if you apply risk management. Learn the real meaning of that term. Develop your trading strategy that works best for you, ... and do a lot of backtesting. Backtesting will give you the confidence that you need in order to suppress your emotions. If I tell you the amount of data I've backtested and analyzed, you won't even believe me :D Go simple, trading should be easy and smooth.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.