How to make money in the cryptocurrency bull market

Cryptocurrencies, led by Bitcoin, have seen a big surge in interest lately, pushing prices up a lot. Because a lot of FTMO Traders use them, it's no surprise that some traders are making more money than usual from this trend.

Today, we're going to have a look at a trader who has taken full advantage of the bullish trend in cryptocurrencies to score one of the best results among FTMO Traders. Most cryptocurrencies experienced their biggest boom in early 2021. In fact, the only cryptocurrency that was able to reach another peak in the second half of 2021 was Bitcoin, after which investor interest tended to wane.

While it is possible to profit from a decline through CFDs and traders were able to take advantage of a relatively strong downtrend, the drop in value was indeed significant for some currencies. In the last two years, it has thus been possible to make money rather on short-term fluctuations and stronger trends on this asset class have not been very common.

Bitcon itself bottomed out at the end of 2022, other currencies were mostly much worse off. A more significant breakthrough came earlier this year, when the US Securities and Exchange Commission (SEC) approved the trading of Bitcoin ETFs. This gave a boost to virtually the entire cryptocurrency market, and those who seized the opportunity and were in the right place at the right time were able to jump on the upward trend and book some impressive returns.

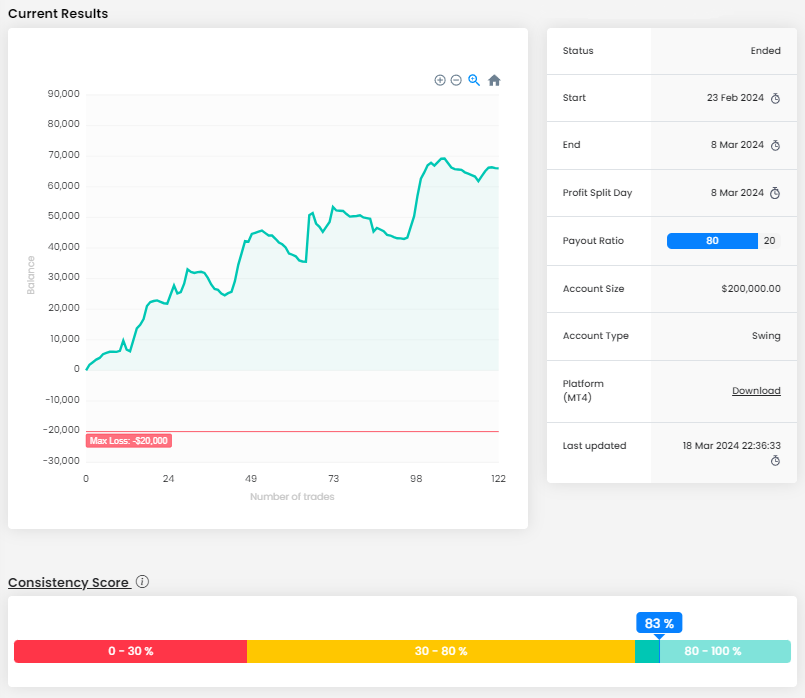

One of our traders began trading at the perfect moment during the latest uptrend phase following January's consolidation. This timing was evident in his consistently positive balance curve throughout the trading period. However, the trader did encounter some losing periods and even approached the Maximum Daily Loss limit on a couple of occasions.

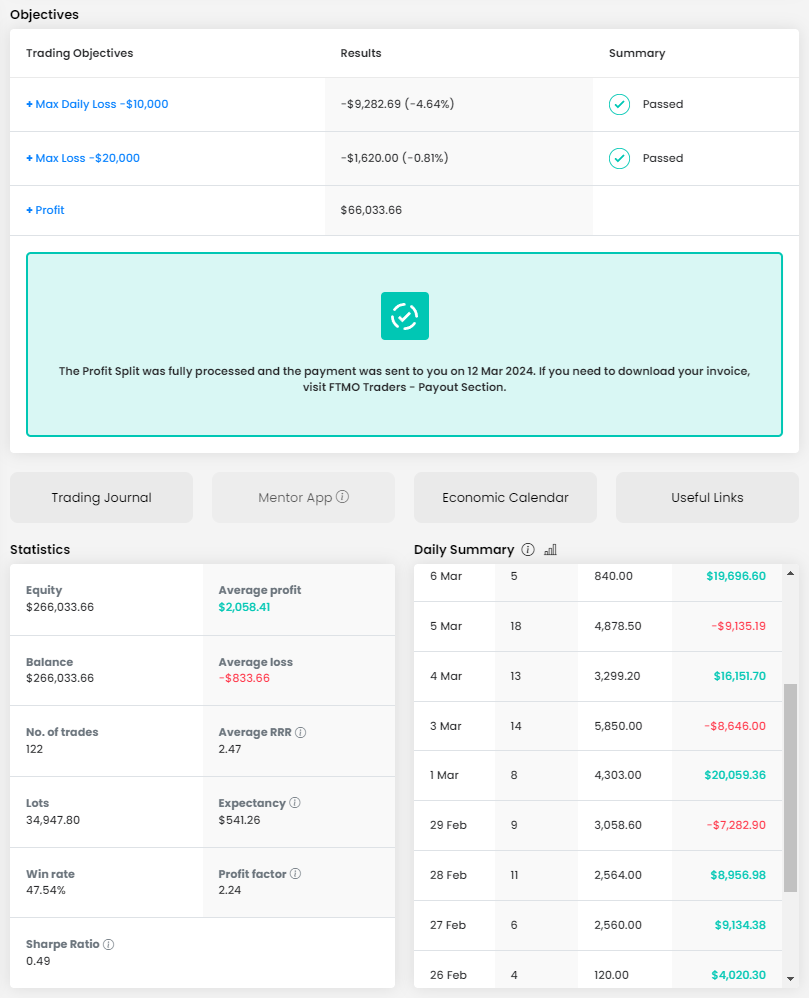

In the end, however, thanks to his consistent approach (consistency score of 83%), he managed to earn a whopping $66,033.66 in the trading period. That's more than 33% on an $200,000 FTMO Account. In fifteen trading days, the trader opened 122 positions with a total size of 34,947.8 lots. At first glance, this may seem like a ridiculously high number.

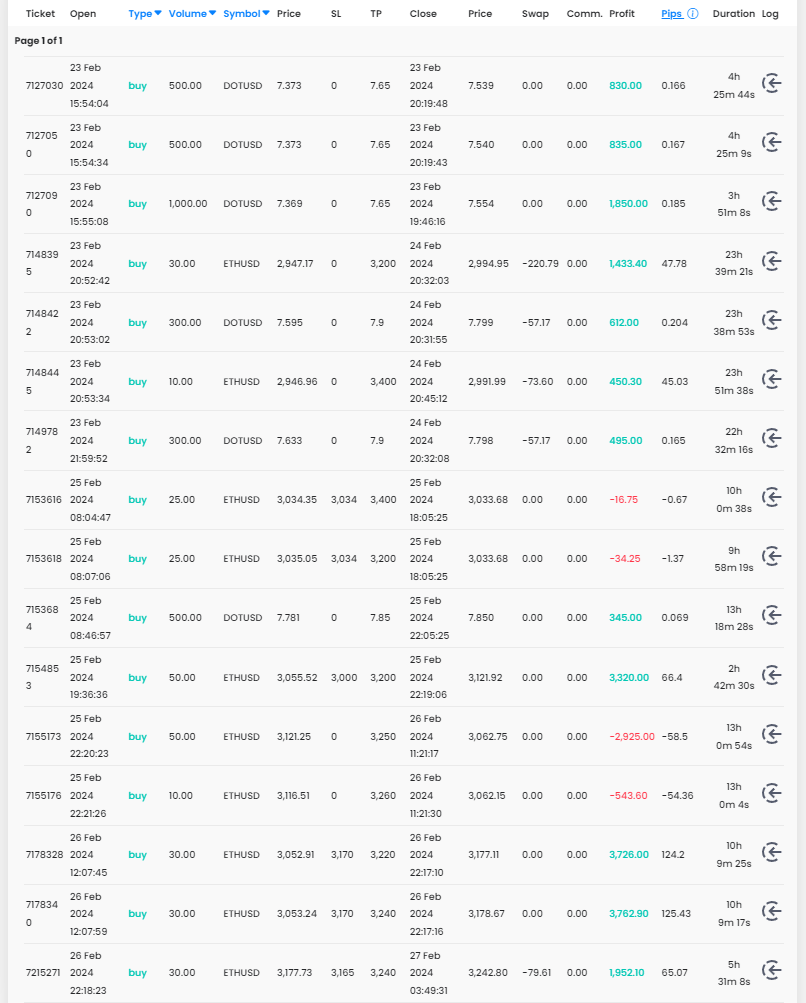

For most cryptocurrencies, given their negligible dollar value and low leverage (which is 1:1 in a swing account), lot size is calculated somewhat differently. In fact, trades of 500 lots on the Polkadot currency require a similar margin size to opening 0.4 lots on the EURUSD pair. After all, the average position size of 286.4 lots when a trader opens positions exclusively on cryptocurrencies is not very special.

The average RRR of 2.47 is fine, and the trader didn't need an overly high success rate (47.54%). Out of 15 trading days, the trader ended up in profit on ten occasions, and especially at the end of the trading period he managed to earn consistently, even if it wasn't a record daily earning.

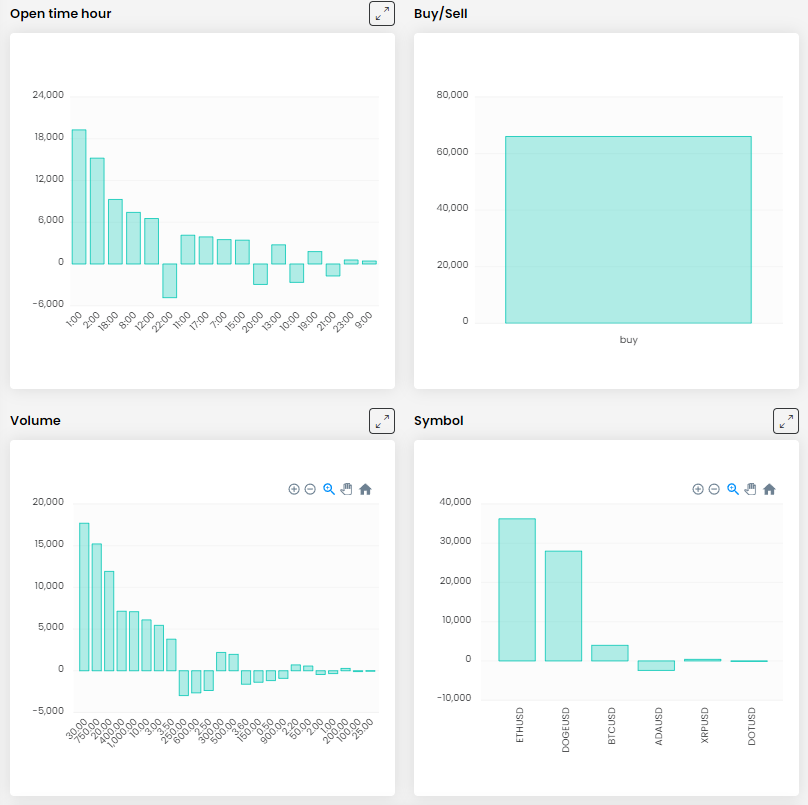

It is clear at first glance from the trading journal that the trader opened only long positions. On the one hand, this is not exactly the ideal way to make money in the CFD markets, as the trader is robbing himself of many interesting opportunities. On the other hand, in this case it was not that big of a problem, because the trader benefited from a strong uptrend, on most cryptocurrencies. Short positions could often be counterproductive in such an environment.

Of course, we have to praise the Stop Loss and Take Profit orders on every position, which is practically a must for such volatile instruments as cryptocurrencies. It is also good news that only one losing position ended up with a loss of more than $4,000, which shows a disciplined approach to risk management.

This is a typical intraday trader who, except in a few cases, does not hold positions overnight. He holds trades between a few seconds and a few hours, and perhaps not surprisingly, the trades that lasted the shortest amount of time are among the most losing.

Due to the choice of investment instrument, the trader normally trades on weekends (this is possible for cryptocurrencies). It should be noted that he actually did well over the weekends and earned over 26,000 USD during them. Since the trader took advantage of the period when trading volumes increased significantly in the cryptocurrency markets, traders did well over the weekends and there was no increased risk of liquidity shortages.

The trader traded exclusively cryptocurrencies, and did not focus solely on the most well-known and largest Bitcoin. In addition, he also traded Cardano, Ripple and Polkadot. However, he opened the most positions on the currency Dogecoin and was most successful on Ethereum.

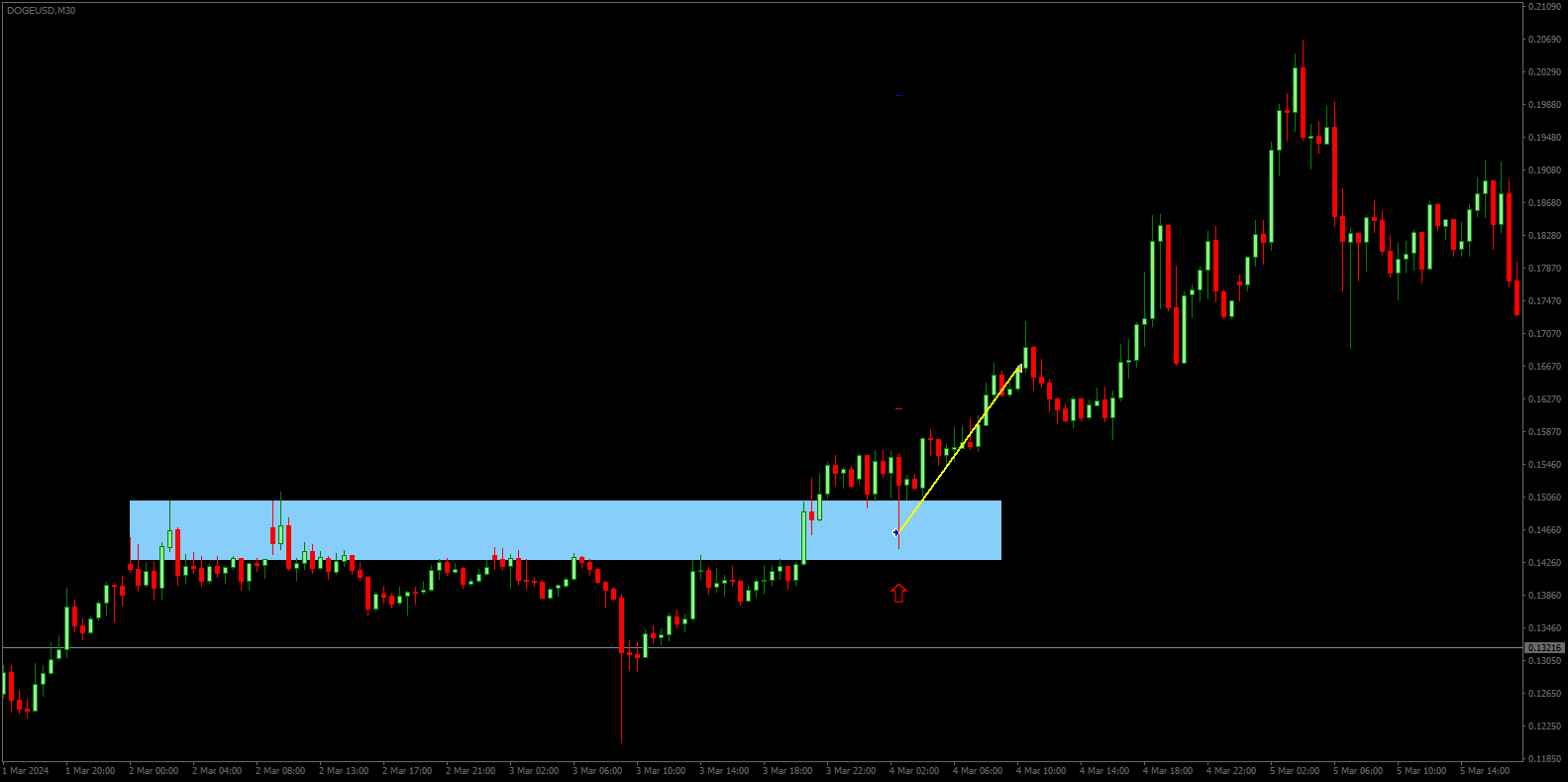

Looking at the most profitable trade made by a trader on Dogecoin, it can be seen that he was probably reacting to the break of a resistance level, which became support after a downward swing. A good entry, moving the SL level, but eventually exiting the position, probably manually. In hindsight, it is easy to judge, but had the trader stayed in the trade longer, price would have eventually reached TP and the return could have been much better. Even so, this is ultimately a very successful trade.

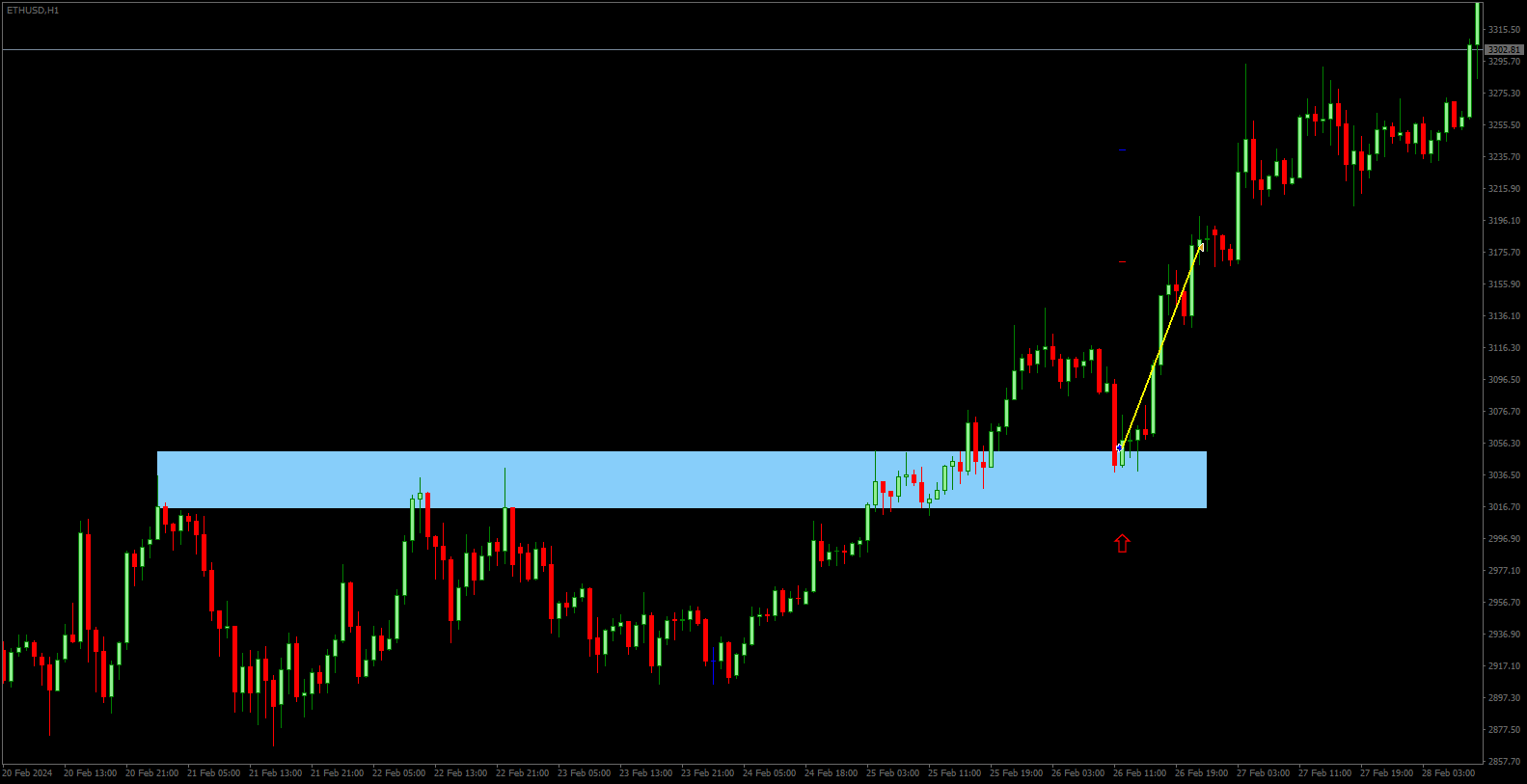

In the second case, this time on Ethereum, a trader used a similar setup to enter a long position. As in the first case, he moved the Stop Loss when the trade was developing positively. In the end, however, he closed the trade manually and a bit prematurely, because if he had waited, he could have seen a better result when the TP was reached. Again, it is not explicitly a mistake, but it is a pity.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.