How Can the Equity Simulator Elevate Your Strategy?

The right trading tools to assess and manage risk can make all the difference for traders aspiring to achieve consistent success. FTMO strives to empower traders and offers an innovative resource that functions as a trading simulator: the Equity Simulator.

In the fast-paced, high-stakes trading world, mastering risk management is not just an option—it’s a necessity. Especially if you are a day trader, you need a place to backtest your strategy— a day trading simulator that illustrates how your strategy could perform in the long term. So, let’s dive deeper into how the FTMO Equity Simulator can help you with your trading and risk management approach.

What is the FTMO Equity Simulator?

The Equity Simulator is a trading tool designed to give traders a glimpse into the future of their trading journey. Simulated equity curves demonstrate how a specific trading strategy might perform under various market conditions. It provides a statistical lens through which traders can evaluate their strategy and build confidence. You can also watch a short video about it on our YouTube channel.

When to use the FTMO Equity Simulator?

The simulator is an indispensable resource for traders testing a strategy and preparing to tackle the FTMO Challenge. It provides insights that can sharpen trading skills and refine your plan by using statistical modelling to reflect a strategy's potential ups and downs, offering a realistic view of what to expect.

Equity Simulator shows the probable scenario

The Equity Simulator does not eliminate the possibility of experiencing losses or consecutive losses; there is always a risk of losing in trading. However, the tool illustrates the probability of your strategy's success. Running the same numbers again will produce a slightly different chart because markets are not entirely predictable—this is both the thrill and the risk you accept as a trader. While we strive for wins, losses are an inherent part of trading.

How to use the Equity Simulator

- • Log in to your FTMO account.

- • Navigate to the Trading Tools & Services section.

- • Select the Equity Simulator from the available tools.

- • Test your strategy (requires basic data input).

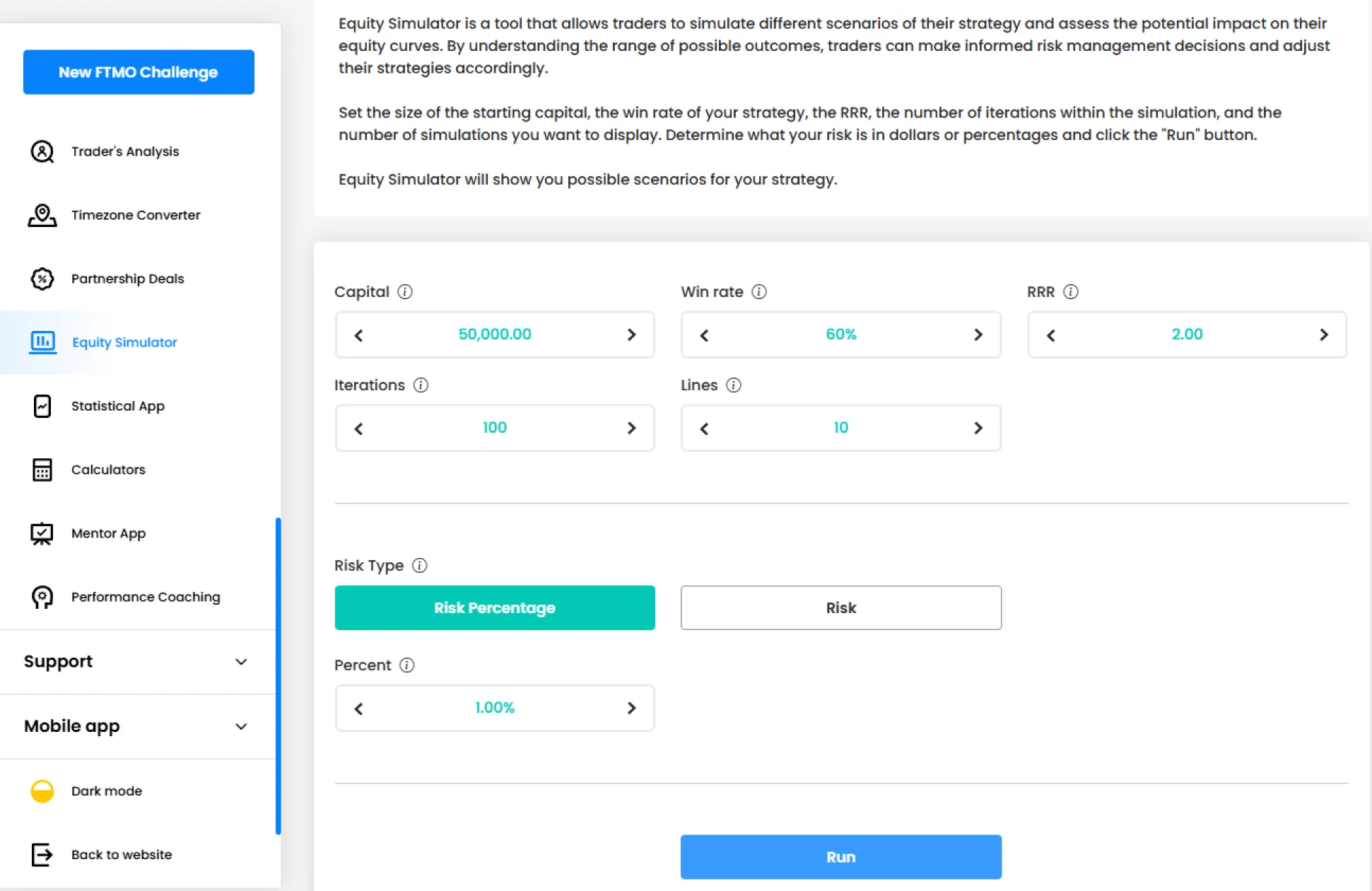

Input your strategy parameters

- • Win Rate: Enter your estimated trade win rate.

- • Reward-Risk Ratio (RRR): Specify the ratio between the potential profit and potential loss for each trade.

- • Iterations: Determine the number of trades to simulate.

- • Risk Type: Specify the risk as a percentage of the account (% risk) or the amount (Risk) you want to risk per trade.

Run the simulation

- • After entering your parameters, initiate the simulation.

- • The simulator will generate equity curves based on your inputs, illustrating potential account growth or drawdowns over the specified number of trades.

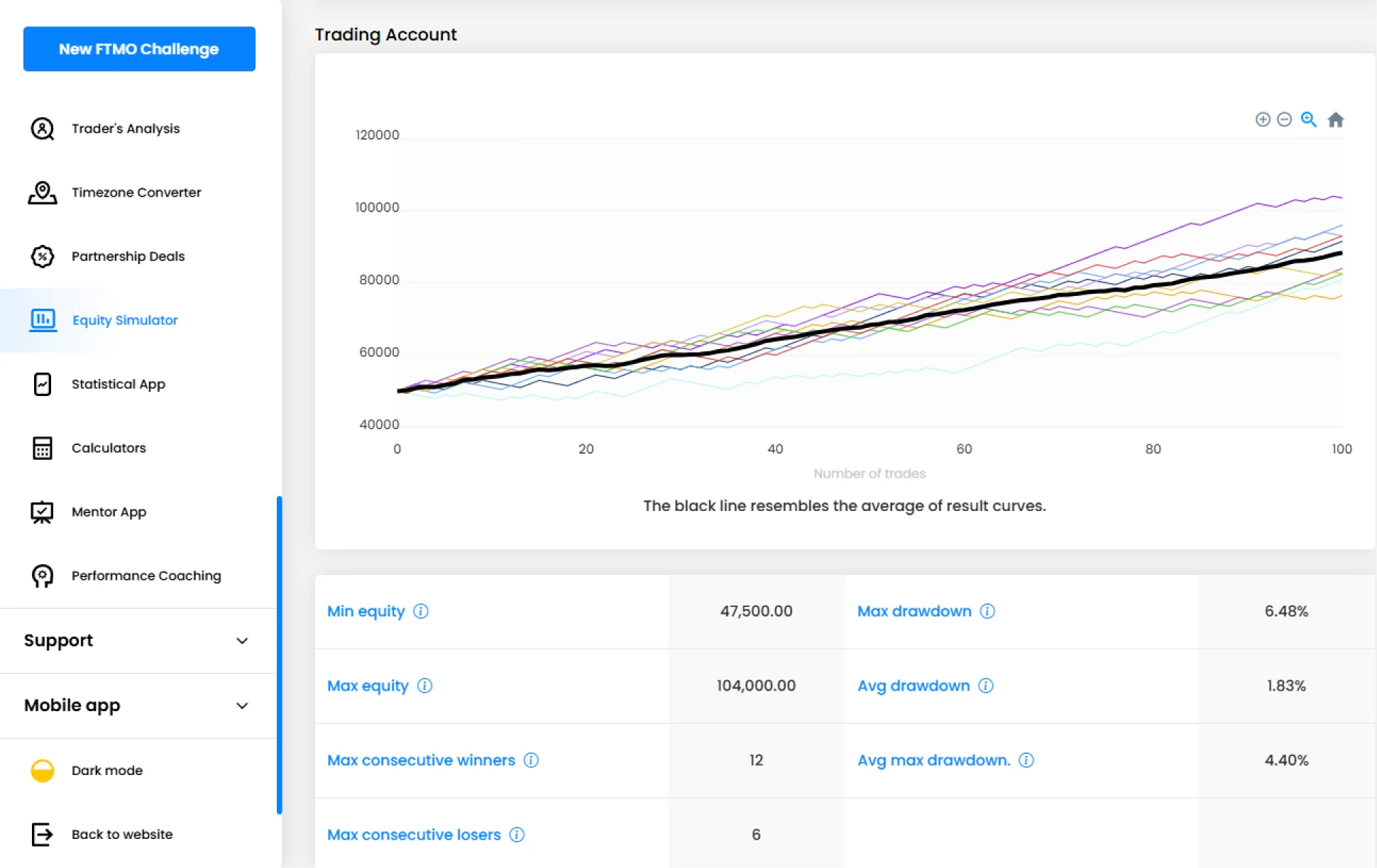

First simulation example:

How do you analyse results from the Equity Simulator?

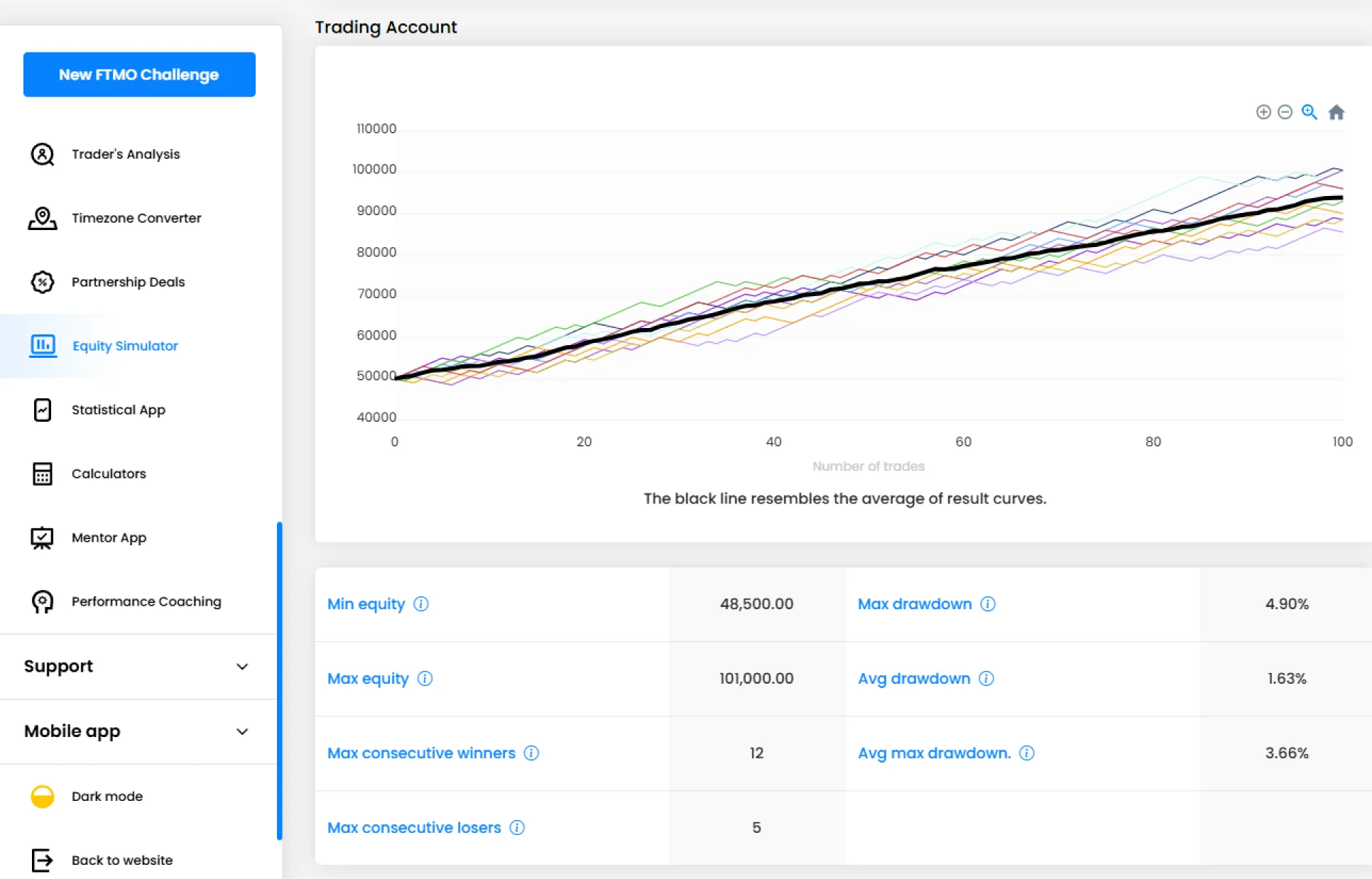

The simulator shows you the curves and gives you numbers on what to expect. If you run the simulation again, you will always get slightly different numbers, as the random market distribution has been considered.

Focus on three main aspects of the simulated result: equity curve, drawdowns, and overall profitability.

- • Equity Curve: Observe the trajectory of your simulated account balance over time.

- • Drawdowns: Identify the maximum potential losses during the simulation.

- • Profitability: Assess the overall simulated profit or loss.

Experiment with different parameters to see how changes affect the equity curve. Use insights you gained to refine your trading strategy, aiming for a balance between risk and reward that aligns with your trading goals.

Second simulation example:

Why is the Equity Simulator important?

Trading is inherently unpredictable, and markets can surprise even the most experienced traders. This unpredictability often leads to emotional decision-making, which can derail strategies and result in significant losses. The Equity Simulator counters this by providing traders with a data-driven perspective, enabling them to:

- • Develop Realistic Expectations: Many traders enter the market with inflated hopes of immediate success. The simulator offers a grounded perspective by showing a strategy's likely fluctuations and drawdowns.

- • Understand Risk Exposure: Visualising how capital can fluctuate under different scenarios helps traders better manage their risk and maintain discipline during difficult periods.

- • Strengthen Mental Resilience: Seeing potential drawdowns and recovery periods on a graph helps traders prepare mentally for the realities of trading, reducing the chances of panic during a losing streak.

What are the key features of the FTMO Equity Simulator?

The key features are customisable input parameters and interactive equity curves, which can give you an edge in scenario testing. Every trader wonders, “What if?” The simulator allows users to explore various scenarios:

- • How does the strategy perform during a losing streak?

- • What happens when the win rate changes slightly?

- • How would compounding profits accelerate account growth?

The Equity Simulator creates a safe environment for testing assumptions and refining strategies on the FTMO platform.

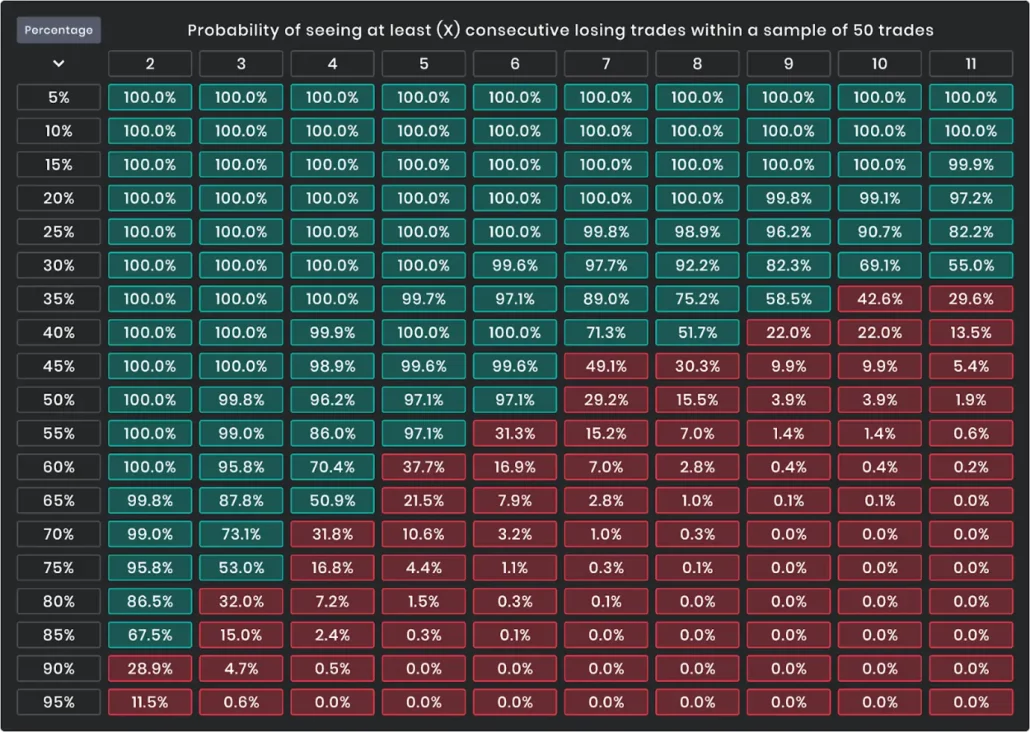

Statistical probability analysis

The tool provides probability distributions that show the likelihood of different outcomes, such as reaching a certain profit level or experiencing specific drawdowns. This empowers traders with data to make informed decisions.

Who should use the Equity Simulator?

The simulator is a useful tool for traders preparing for the FTMO Challenge. It helps them understand the statistical realities of trading and ensures they have a solid strategy for long-term success. Traders prioritising good risk management over aggressive profit-taking will appreciate the simulator’s ability to highlight the risks and potential losses associated with different strategies. Even experienced traders can benefit from the simulator by using it to stress-test new strategies or refine existing ones, experiment with position sizing, or analyse the potential impact of market conditions.

How to incorporate the Equity Simulator into your trading routine

- Define Your Strategy: Have a clear trading plan before using the simulator. Include key metrics like your risk per trade, win rate, and reward-to-risk ratio.

- Test Various Scenarios: Use the simulator to explore your strategy's performance under different market conditions.

- Analyse the Results: Review the simulated equity curves and probability distributions. Look for insights that can help you refine your strategy.

- Prepare for Real-World Trading: Use the knowledge gained from the simulations to set realistic goals, establish risk parameters, and strengthen your mental resilience.

Don’t leave your trading success to chance. Explore the FTMO Equity Simulator today and take the first step towards mastering risk management. Enjoy trading, and trade safe!

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?