How can seasonality affect financial markets?

Prices in the financial markets are influenced by a number of factors such as macroeconomic news, company results, etc. One of the important and often overlooked factors can be the influence of seasonality.

Looking at long-term charts of individual investment instruments, certain regularly recurring patterns can be observed. However, these are not the classic graphical formations used in technical analysis; rather, we can talk about the influence of seasonality. These patterns are probably most evident in some commodities, but certain patterns of investor behaviour can also be traced over the years, for example in the stock markets.

For some commodities, this seasonality is manifested, among other things, by the fact that in the long term their price may move within certain limits, which helps more experienced traders to better predict price movements.

Seasonality, cycles and trends

It is not a good idea to confuse seasonality, cycles and trends. Seasonality occurs at certain times, usually within the same year, and is affected by changes in supply and demand between seasons. Cycles are influenced by other factors and can last for any length of time.

Natural disasters or weather fluctuations can be frequent 'disruptors' of seasonal patterns. In recent years, the COVID-19 pandemic may have had a significant impact on seasonal patterns, and we must not forget geopolitical influences, including the current conflicts in Ukraine and the Middle East. However, the impact of such events is limited and gradually diminishes over time.

In some cases, technological progress and innovation can lead to changes in seasonal patterns, while changes in consumer behaviour and preferences, fashion trends, etc., have a significant impact on prices. These one-directional changes in demand and supply can also have a long-term effect and may permanently affect some seasonal patterns.

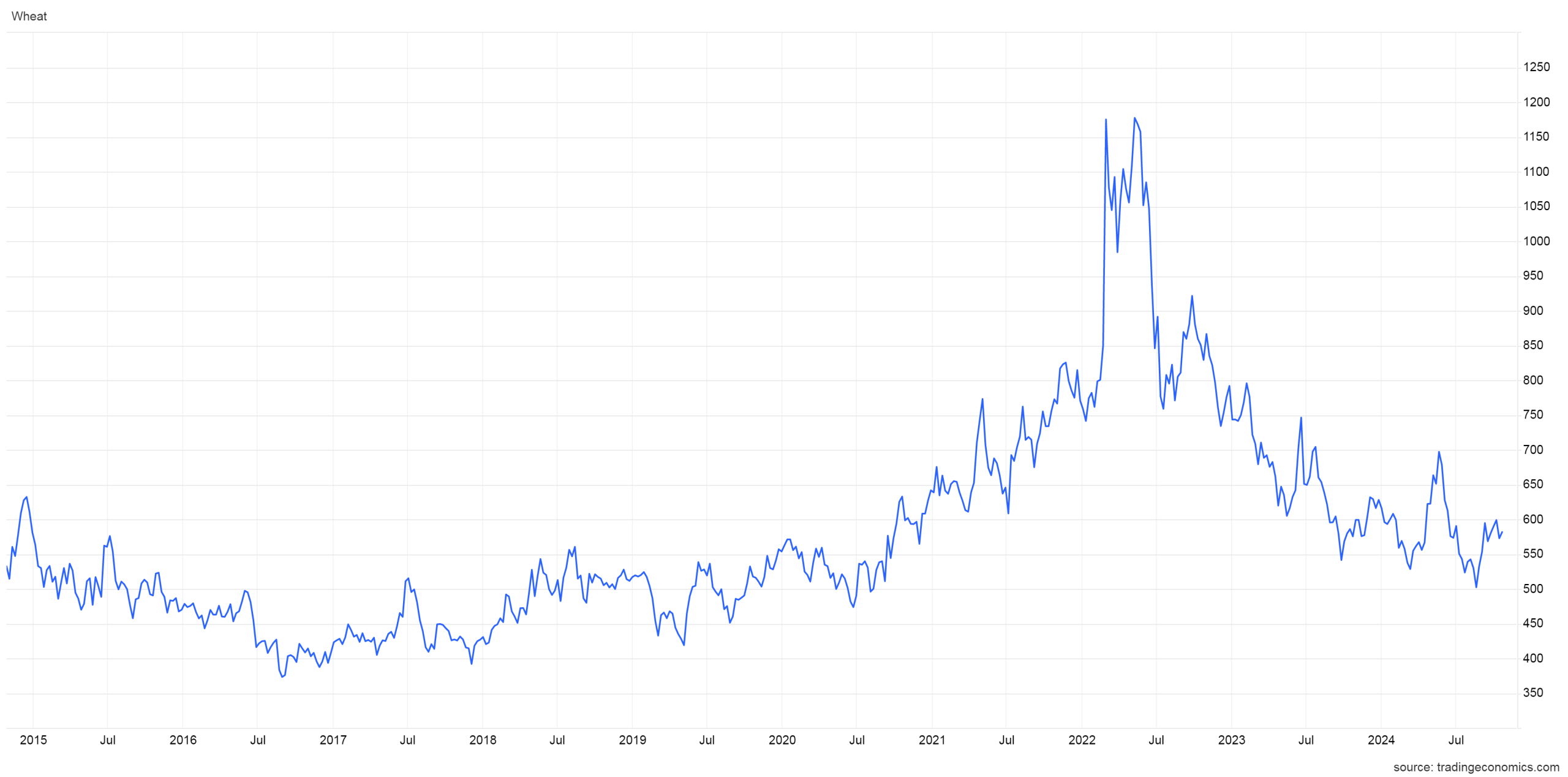

In the figure below, we can see the seasonal movement of the wheat price before 2022 and the dramatic increase in price after Russia attacked Ukraine. The impact of the event then moderates in the last year, and again we can see seasonal movements in the price of the commodity.

Gold

Seasonal influences are most often seen in commodity markets. For example, gold, which is the most popular instrument among FTMO traders, has historically seen price increases in the summer and winter, or before the end of the year. In the first case, the rise in demand for gold is in Asia, which is one of the largest consumers of gold. The second peak in gold is at the end of the year, when most of the western world celebrates Christmas, during which the demand for gold also increases. Given that gold has also played the role of a safe haven in times of geopolitical uncertainty over the past year, there is no question of any seasonality in gold this year, with its price breaking new records almost every week.

Energies

Seasonality has a relatively large impact on energy commodity prices, and this applies to both oil and gas. The price of oil, especially North American oil (WTI), is affected quite strongly by the summer season, when demand for gasoline increases significantly. A large part of the US population travels for holidays, and many people in the US also travel for Independence Day, so the price of oil tends to rise in the summer months.

Similarly, the price of natural gas rises in the summer, especially in years when it is very hot, as energy consumption increases significantly due to the operation of air conditioners. The price of gas also rises in winter, when temperatures are expected to be low, due to the high consumption of the commodity for heat generation. In severe winters, demand for heating oil, which is a crude oil product, also tends to rise, but this does not affect the price of crude oil that much.

Agricultural commodities

A relatively large influence of seasonality can be seen in agricultural commodities (which we have recently added to our product range at FTMO), where the sowing and harvesting of crops plays a large role. During the months when new crops are sown or planted, old crops that were harvested during the previous harvest are available on the markets and supply is lower. In the harvest months, new crops come on the market again, which increases the supply on the markets. So, although prices on futures markets (from which CFD prices are derived, which are also traded at FTMO) are influenced by maturity and delivery date (more expensive with longer delivery dates due to storage costs, etc.), seasonal influences change this logic somewhat. When the old crop is on the market and supply is lower, the price of contracts with closer delivery is higher, then when the crop is harvested and available, the price of contracts with the new crop falls.

Since most crops are harvested once a year, this seasonality manifests itself simply by harvesting pushing prices to a low and then gradually pushing prices back up as inventories are built up for the next time and supply falls. The price peaks during the sowing and planting season, when the market is most uncertain about the next harvest and possible fluctuations in production.

Stocks

We can also observe certain seasonal influences in stock markets, and these patterns even have their own established names. The January effect is related to the rise in stock prices at the beginning of the year and, among other things, it occurs that growth stocks outperform value titles. The rise in prices is related to portfolio rebalancing, where large investors who sold their loss-making titles at the end of the year replenish their portfolios. For retail investors, this phenomenon may be related to the fact that after year-end bonuses, investors are looking for opportunities to park their money.

Sell in May and go away may be related to the fact that in the summer months market activity is low and prices are range-bound and don't rise much. However, this effect is not regular.

The Halloween effect is based on the fact that in the months after summer ends, stocks do well. This may be related to the fact that after the holidays and the summer months, investors are in an optimistic mood and the markets are "alive" again. The Santa Claus rally, in turn, may be related to large investors and funds buying profitable titles to improve their portfolios (window dressing) or investors trying to prepare for the aforementioned January rally.

Using seasonal influences in trading and investing can be an interesting variation in strategy. At the same time, it should be noted that seasonal patterns are not a tool that works flawlessly and need to be seen in context. They can work well in trading as a tool to confirm entry or exit signals, but a trader's strategy should not be built on them alone.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?