FTMO Quick Trade Manager - new options in MetaTrader

MetaTrader is the most widely used program among forex traders, and that applies to FTMO traders as well. The program's environment is intuitive and straightforward, however, its modifiability gives modders space to make it even better and user-friendly. And therefore, FTMO brings additional improvements to its traders, making trading in this platform easier.

FTMO offers its traders the most popular trading platforms, MetaTrader 4 and 5, as well as cTrader. We briefly covered these programs in a recent article. MT4 has long been the most used application, but it looks outdated compared to cTrader. In addition, the newer and more modern cTrader has a few extra features that make it easier for traders to enter orders.

One of the drawbacks of MetaTrader compared to cTrader is the inability to easily set SL and TP levels when entering an order, as well as determining the position size relative to the SL size directly in the application.

FTMO Quick Trade Manager for MetaTrader

At FTMO, we strive to provide our traders with better and more sophisticated solutions to help them achieve the best results. For those who want to simplify order entry in MetaTrader, we have developed an enhancement called FTMO Quick Trade Manager. The main goal is to speed up and streamline order entry, and in particular, to easily and quickly determine the position size at the desired SL and TP.

Usually, a trader trading in MetaTrader has to use various formulas or calculators to calculate the position size, but this obligation will be eliminated thanks to FTMO Quick Trade Manager. It is primarily a time-saver, which intraday traders and scalpers will appreciate because the trader does not have to open another program window for calculations, and everything is available directly in the MetaTrader application.

Installation

Traders can download the tool from the Downloads section in their Client Area. The FTMO Quick Trade Manager .zip file includes two folders, Experts and Images. In the MetaTrader window, the trader must open the File tab in the top menu and click Open Data Folder.

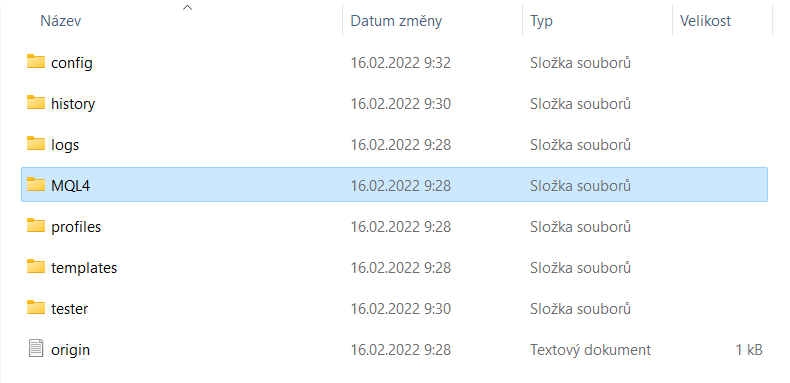

When the explorer window opens, click on the MQL4 folder.

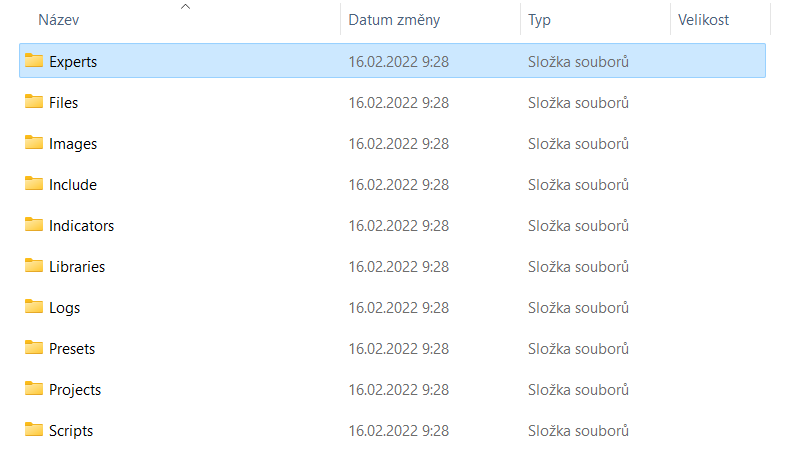

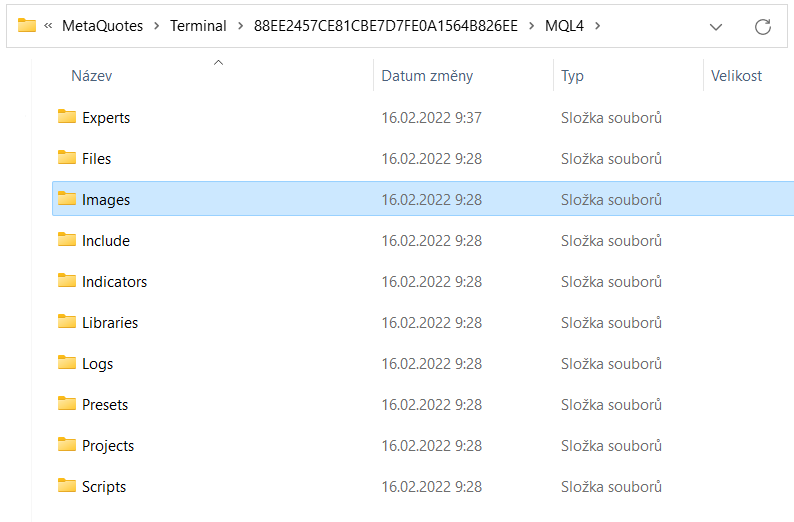

In the MQL4 folder, navigate to the Experts folder. There you need to copy the folder called FTMO Quick Trade Manager from the Experts folder from the downloaded zip file.

Then, in the MQL4 folder, go to the Images folder and copy the folder containing the necessary graphic elements. In the downloaded zip file, .just open the Images folder and copy the entire folder from there, which is called FTMO Quick Trade Manager.

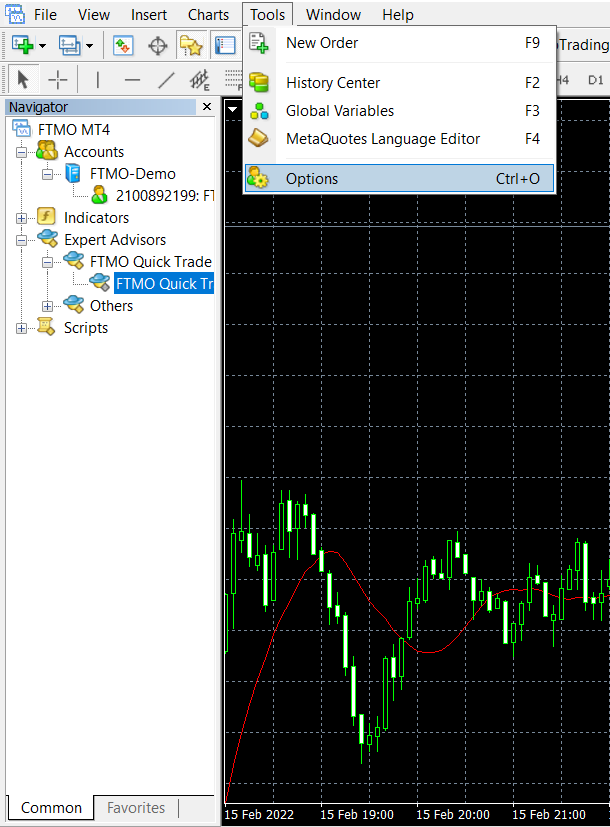

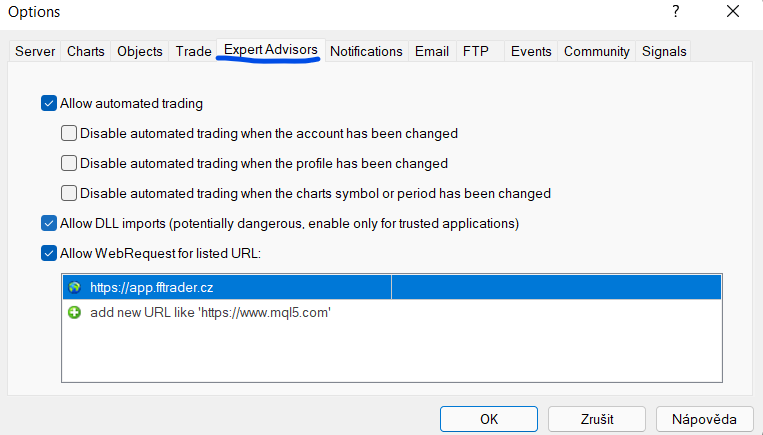

For proper functioning, you still need to open the Tools tab in the top menu and click Options.

In the Expert Advisors window, check the Allow automated trading option and leave all the options below it unchecked.

You must also check the Allow DLL imports and Allow WebRequest for listed URL options. Then in the window below this option, enter the address https://app.fftrader.cz.

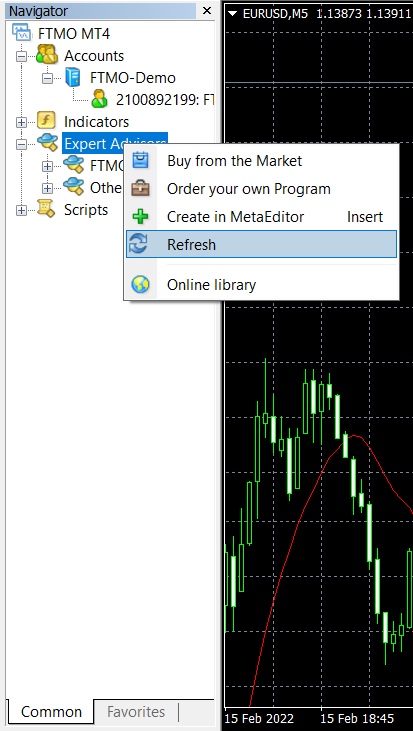

You should be all set. You can now restart the application or right-click on Expert Advisors in the Navigator panel and select Refresh.

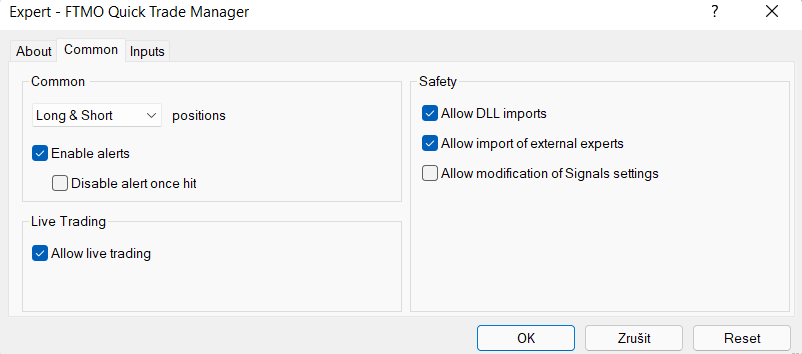

Then just double-click to launch the application. Check that you have enabled DLL import and that the EA is allowed to trade.

Order window

At the top of the FTMO Quick Trade Manager window, the trader can see the OHLC offer of the investment instrument. Below the FTMO logo are the largest buttons for executing Sell and Buy orders. Below that is a menu where the trader can specify the position size in lots.

Then below the button that takes the trader to the macroeconomic news section, there are checkboxes for determining the position size. These checkboxes should be used by every trader who follows the rules of money management and risk management. Checking them means that the trader will automatically see the SL and TP in the application in the given size after entering an order. Combining the position size in lots and the SL size in points then provides the investor with an overview of how much USD will represent his SL or TP.

It is important to note that the trader here enters the size in points, not in pips. The point is the smallest unit for each symbol traded and is different for different instruments. For currency pairs, the point represents the fifth (third for JPY pairs) decimal place, for index instruments (DAX, US indices, etc.) or for metals, it represents the second decimal place. Furthermore, the trader can set the Trailing Stop and Break-Even values and the Offset value.

The Break-Even value is the value that the trader wants the market to reach in his/her favorable direction. Once the market reaches this gap, the program will automatically move the SL to the entry price.

The Offset value is there to cover the cost per trade. The trader pays the commission and spread when entering the trade. In order for the trade to end at zero, there is an option to set the Offset, or the value the trader adds to the entry price to cover the cost of the trade.

At the bottom, the trader then has information about the current spread in points, the value of one point and interesting information about how much time is left until the current candle is closed.

We believe that this new indicator will also help FTMO Traders achieve long-term stable results or take their skills and capabilities to a new level.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.