Points, pips and ticks

For a new trader, it may be quite difficult to understand trading terms that define units of price change. In this article, we will discuss the difference between Points, Pips, and Ticks.

Points

Points have 2 definitions, a practical one and a technical one.

Practical Definition

A Point in a practical definition is a unit that measures price change according to the last digit before a fractal comma.

Example: Stock A is priced at $100 and later, the price changes to $105. In this case, you can say that Stock A is up $5 or it is up 5 Points.

Technical Definition

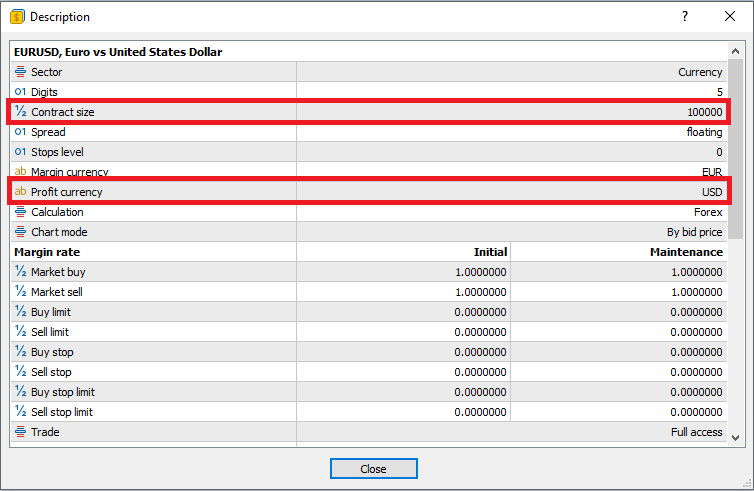

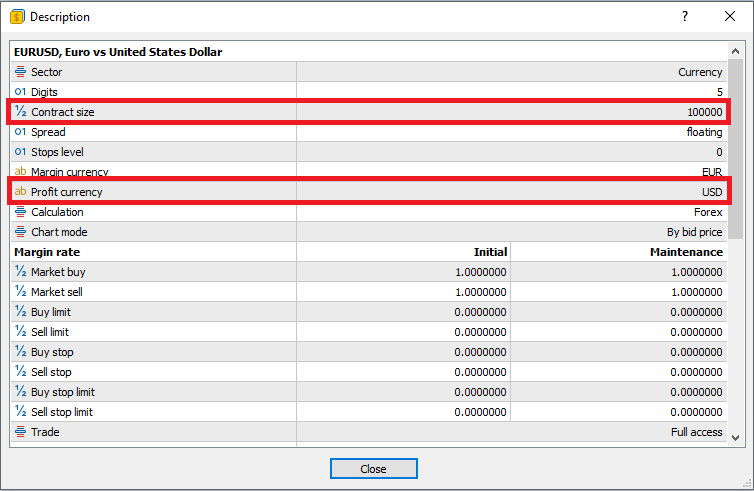

A Point in technical definition (in MetaTrader and cTrader) is defined as the last quoting digit unit of a specified symbol. In the following screenshot, we can see the Digit value of 5 for the symbol EURUSD.

This means that quotes received from EURUSD are precise up to 0.00001 (5 digits behind the fractal comma). The technical definition is used to define price changes according to the minimum precision digit which is important when specifying the spread, swap values, or working with the programming language MQL (Coding Language to create Indicators and Expert Advisors)

How do I know which definition to use?

In everyday trading discussions, you can assume that the practical definition is used as this is the most convenient one. The technical definition is used when working with technical values in the platform. You have to understand the context to determine which definition is being used.

Pips

A Pip is a unit in price change commonly used in Forex. PIP stands for Point-In-Percentage. Generally, you can multiply the price change value times 10 000 to get the pip value.

Example: EURUSD price increases from 1.21300 to 1.21450. The decimal increment of the price is 0.00150. It is evident, the price change is very small and for that reason, pips are used for a better understanding of small price changes. To get the pip value, we will multiply 0.00150 times 10 000 = 15 pips.

Forex pairs with Japanese Yen (JPY) are usually quoted with 3 decimal digits, however, the value of a pip is the second decimal digit. For example, if the price of USD/JPY moved from 127.160 to 127.235, the distance is 75 points or 7.5 pips.

Ticks

Ticks are commonly used in Futures and 1 unit of tick represents the minimal price change of the underlying symbol. An interesting fact about ticks is that prices can minimally increment by the tick size which is predefined for every symbol.

Example: FDAX (DAX - German Stock Index) at the EUREX Exchange has a tick size of 0.5. That means that if the price of FDAX is €10,000, the next minimum price change can be €10,000.50.

Example 1 - Calculate the Pip Value on EURUSD 2 lots:

The necessary information can be found in the symbol specifications in the trading platform.

In the contract specifications, we can see the following information for the calculation:

Calculation:

- size= 2 lots

- contract size= 100 000

- profit currency = USD

Formula:

pip value = (contract size * lots)/10 000

pip value = (100 000 * 2) / 10 000 = $20/pip (result is denominated in profit currency from the symbol specifications)

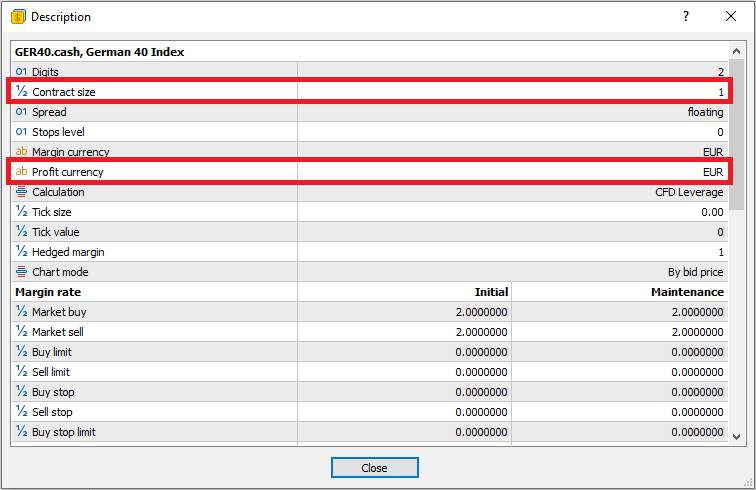

Example 2 - Calculate the PointValue on GER40.cash 1.5 lots:

The necessary information can be found in the symbol specifications in the trading platform.

In the contract specifications, we can see the following information for the calculation:

Calculation:

- size= 1.5 lots

- contract size= 1

- profit currency = EUR

Formula:

point value = (contract size * lots)

point value = (1 * 1.5) = €1.5/point (result is denominated in profit currency from the symbol specifications)

point value in USD = €1.5 * (current EURUSD exchange rate) = 1.5 * 0.98 (exchange rate used for this example) = $1.47

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.