Economic calendar - central banks as a major player in the market

In this part of our series on important dates in the economic calendar and their impact on forex trading, we look at the influence of central banks on financial markets. Central banks are in the crosshairs of investors and traders perhaps more than before in mid-2022, and hence they must not be forgotten on our blog.

Central banks are (or should be) institutions whose primary role is to ensure the stability of a country's currency and economic growth. They also act as regulators of financial institutions, issue the national currency, provide credit to other financial institutions and act as lenders of last resort.

Financial stability and a stable currency

The most important activity of the central bank is to maintain financial stability by intervening in financial markets. It can do this through open market operations, where it buys financial assets (usually government bonds) from other banks to add liquidity to the market (or conversely, when it wants to reduce liquidity in the market), or by setting interest rates.

Forex traders closely follow the actions of central banks virtually all over the world, but only a few institutions have a significant say in what happens in the forex market. As the most traded currency in forex is the USD, the US central bank, the Federal Reserve, or Fed for short, has the most significant influence on forex events. In addition to the Fed, traders follow the actions of seven other central banks from countries whose currencies form major pairs with the US dollar (European Central Bank, Bank of England, Bank of Japan, Swiss National Bank, Bank of Canada, Reserve Bank of Australia, and Reserve Bank of New Zealand).

Traders need to beware whenever a monetary policy meeting is scheduled at one of these central banks. Interest rates are decided within the central bank by its chief executive. Within the Fed is the Federal Open Market Committee (FOMC); within the ECB is the Governing Council, the Bank of England has a Monetary Policy Committee, etc.

Interest rates have a relatively significant impact on the economy of individual countries, with central banks being guided mainly by inflation, but also the overall state of the economy, the labour market, etc., can also influence their decisions. For example, higher interest rates in a given country make debt financing more expensive (for both companies and consumers), which leads to a reduction in investment, consumption and a possible increase in savings, which is how central banks try to curb inflation (as is the case in 2022). At the same time, they must be careful not to cool the economy too much and avoid a recession.

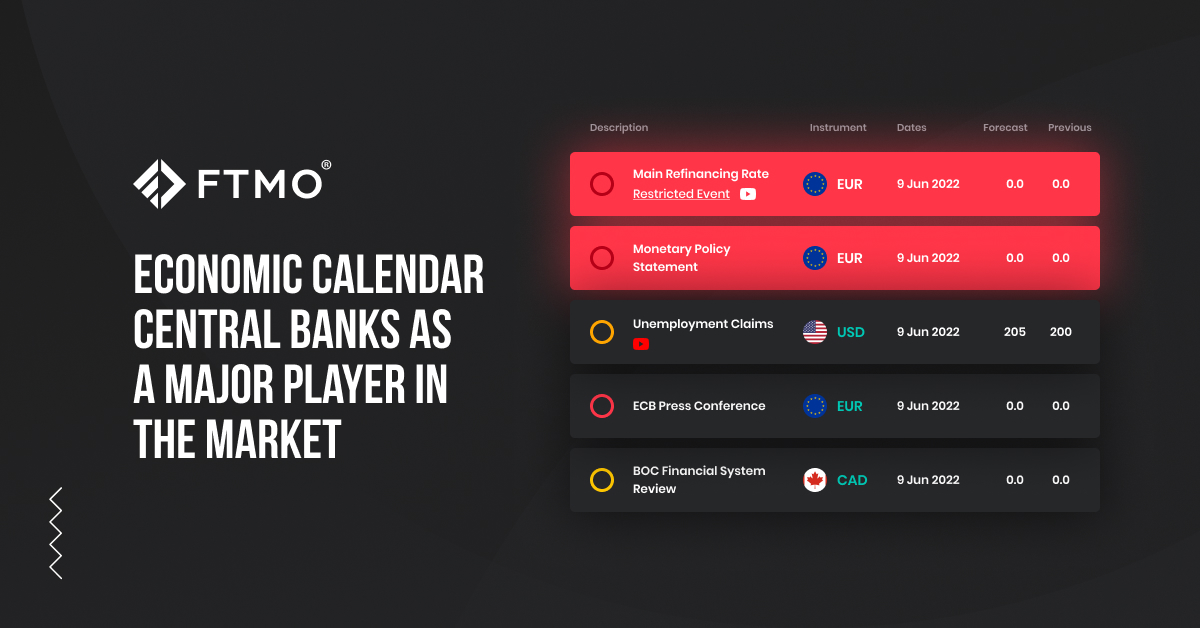

From the point of view of investors and traders, an increase in interest rates on a given currency makes it more attractive (higher rates on deposits and bonds), which in turn leads to the currency appreciating against other currencies. A change in rates alone may not lead to significant movements, as currency movements are usually factored into exchange rates thanks to the so-called "forward guidance" of central banks. Even so, there may still be an increase in volatility in the markets after the Monetary Committee meeting, similar to what happened after the ECB meeting on 9 June 2022.

This forward guidance is usually provided by individual members of monetary committees, or central bank governors, who can offer clues to investors about the direction of monetary policy in the near future.

Not all central banks act in the same way

Although the basic operating principle of central banks around the world is the same, with price stability as the main objective, the actions of individual institutions can vary considerably. Thus, by mid-2022, we may see most central banks fighting inflation, but some exceptions can be found.

The US Fed started raising interest rates in March and plans further rate hikes of up to 0.5% at its meetings (the current rate in June is in the range of 0.75% to 1%). Until March, it had been running a quantitative easing programme and started quantitative tightening in June. The ECB plans to start raising interest rates in July, with the current base rate at zero. However, it does not intend to rush into quantitative tightening. The Bank of England started raising rates in December, has the rate set at 1% in June and plans to raise the rate by 0.25% at subsequent meetings.

The Bank of Japan, unlike all others, maintains an extremely easy monetary policy. Although the Japanese yen is the weakest it has been in twenty years, the BoJ has no intention of changing its stance and is comfortable with this state of affairs because Japan can expect to see at least some inflation for the first time in a very long time.

However, this disparity in favour of the US dollar may affect not only the European and Japanese currencies, but also the economies of many emerging countries. Indeed, the flight of investors into the dollar may mean a sell-off and devaluation of currencies, an outflow of capital from these emerging countries and a consequent slowdown in economic activity and a demand reduction.

Central banks are essential players in the financial markets. These institutions literally influence the functioning of financial markets and the value of currencies through their interventions, and their actions should therefore be monitored very closely by investors and forex traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?