Diversify wisely

In the next part of our series on successful FTMO Traders, we'll have a look at a trader who bet on correlation across asset classes and managed to achieve an interesting return.

Asset diversification is mainly addressed by long-term traders, who can address this method of return protection by investing in different asset classes or in index instruments, which themselves offer a diversified portfolio of individual instruments (stocks, commodities, etc.) in the index, or by combining index instruments from other asset classes. There are many ways of doing this, but the main aim is to combine instruments that show a low degree of correlation over the long term. Otherwise, correlation alone is not very meaningful.

Short-term traders can also take advantage of the opportunity to trade different instruments and different asset classes (forex, commodities, equities, indices, cryptocurrencies) because different instruments, for example, react differently to certain macro data, have different levels of volatility, or have different trading hours when trading volumes peak.

The trader we will be writing about in today's article also traded instruments from different asset classes and managed to achieve a very interesting return. His balance curve does not look ideal and there are a few losing periods, but as we constantly remind, trading without losses is practically impossible. The consistency score of 88% is also great.

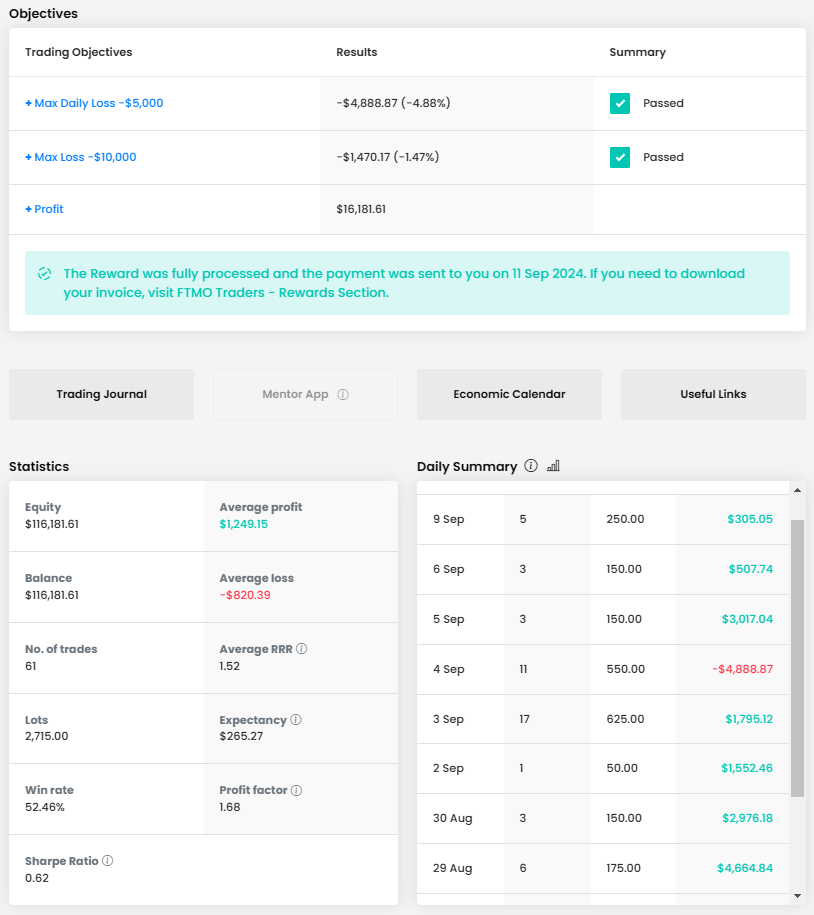

The Objectives show us that the trader earned a little over 20,000 euros, which is a very nice result for an account size of 160,000 euros. It also looks good in the risk management area, because the trader had no problem with the Maximum Loss or the Maximum Daily Loss.

The trader executed 112 trades with a total size of 11,618.22 lots during the trading period, which amounts to a little over 103 lots per position. At first glance, this may look like a lot indeed, but considering the instruments he traded, it's okay. Interestingly, even though the trader recorded an average RRR of less than 1 (0.83) and the win rate was "just" over two-thirds (67.86%), all trading days ended in the green. With so many trades, this daily success rate is truly impressive.

From the journal and the amount of trades, it is evident that he is an intraday trader or rather a scalper who does not hold trades for long. Only five of his trades lasted more than two hours, but it is true that these longer lasting trades are among the most profitable.

The trader opened positions of varying sizes, but the trading journal also shows that the position sizes grew as his total return grew. We appreciate this approach, it shows that the trader has risk management under control and does not need to try to make a lot of money at any cost right from the start. The fact that the trader set both Stop Loss and Take Profit on all his trades is also evidence of good risk management, which we clearly approve of.

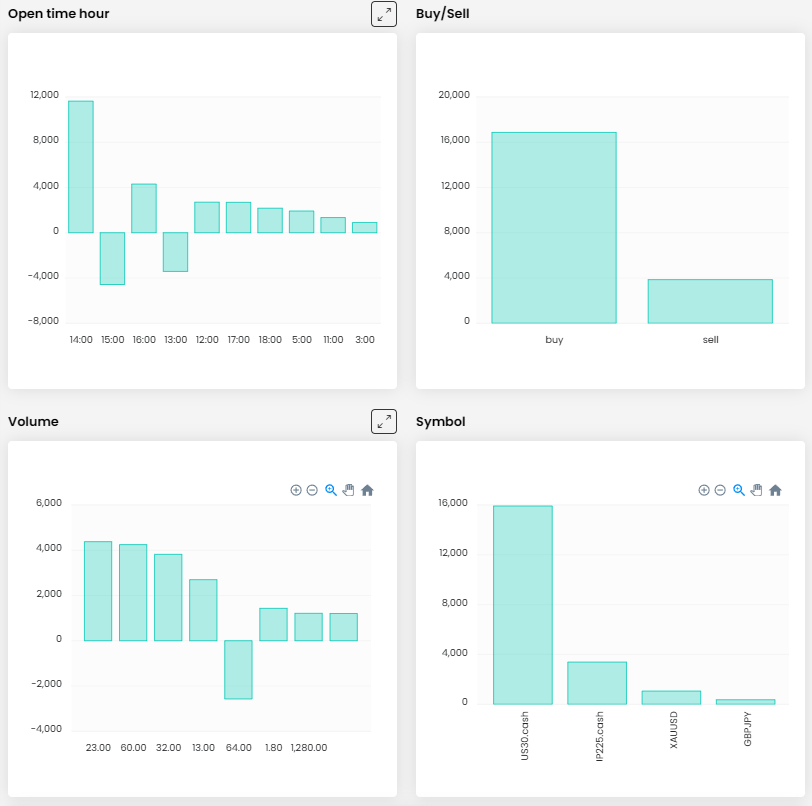

Although our trader's favourite instrument is the DJIA index (in our case as a symbol with the designation US30.cash, we wrote about it recently in this article), he has divided his trades into several different instruments. As we wrote above, such diversification can make sense because the correlation between assets such as currency pairs, stock indices and commodities is often not high.

Trading instruments that have a high correlation, whether positive or negative, does not make sense and may even be dangerous for traders. A trader in such a case may feel that by opening two or more trades he is limiting his potential losses, but in fact the opposite may be true and the trader is exposed to a one-sided exposure that he may not even be aware of. In addition, our trader chose instruments that can be traded with us without commissions and since he did not hold trades overnight, he saved quite a lot of money.

In the picture below we will show one of the trader's most profitable trades. He opened a long position on the US30.cash instrument after the price bounced off the local support, setting the SL below the low of the previous candle. We can say that he may have closed the position a bit prematurely, but since he opened four positions at this time, his total profit was almost $6,500 and the RRR was more than 4, we can accept this exit from the market.

Diversification between asset classes in forex and CFD trading makes sense, but there is no need to overdo it and you need to adjust your strategy accordingly. 4 instruments is about the maximum for a normal trader, tracking more instruments can be quite complicated and can be counterproductive. Trade safely!

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?