Trading Week Ahead: XAUUSD Breaks Into New All-Time Highs

The second full week of 2026 brings a trio of high-impact US data releases that could quickly reshape market expectations. With CPI, PPI and retail sales scheduled, traders will gain fresh insight into inflation dynamics and consumer resilience.

These are critical indicators for the Fed’s policy path, and market reactions could be swift as volatility returns to kick off the new year.

👉 US CPI

The December CPI is forecast to rise 0.3%, matching the prior month. A hotter reading could lift Treasury yields and support the dollar. A softer print may strengthen the case for early rate cuts and fuel equity gains.

👉 US PPI

Producer prices are expected to climb 0.3%. A stronger-than-expected figure could renew inflation concerns and pressure risk assets. A weaker number would bolster the disinflation outlook.

👉 US Retail Sales

After stagnating in November, retail sales are projected to rebound 0.4%. Strong spending data could challenge dovish market pricing and boost the dollar. A downside surprise may support risk sentiment and weigh on yields.

*All times in the table are in GMT+1

Technical Analysis with FVG Strategy

This technical analysis uses the EMA 20 and EMA 50 to determine market trends, alongside the Fair Value Gap (FVG), which refers to price imbalances caused by aggressive movements, signalling key entry and exit points. This strategy applies to EURUSD, GBPJPY, US30, and XAUUSD, providing insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

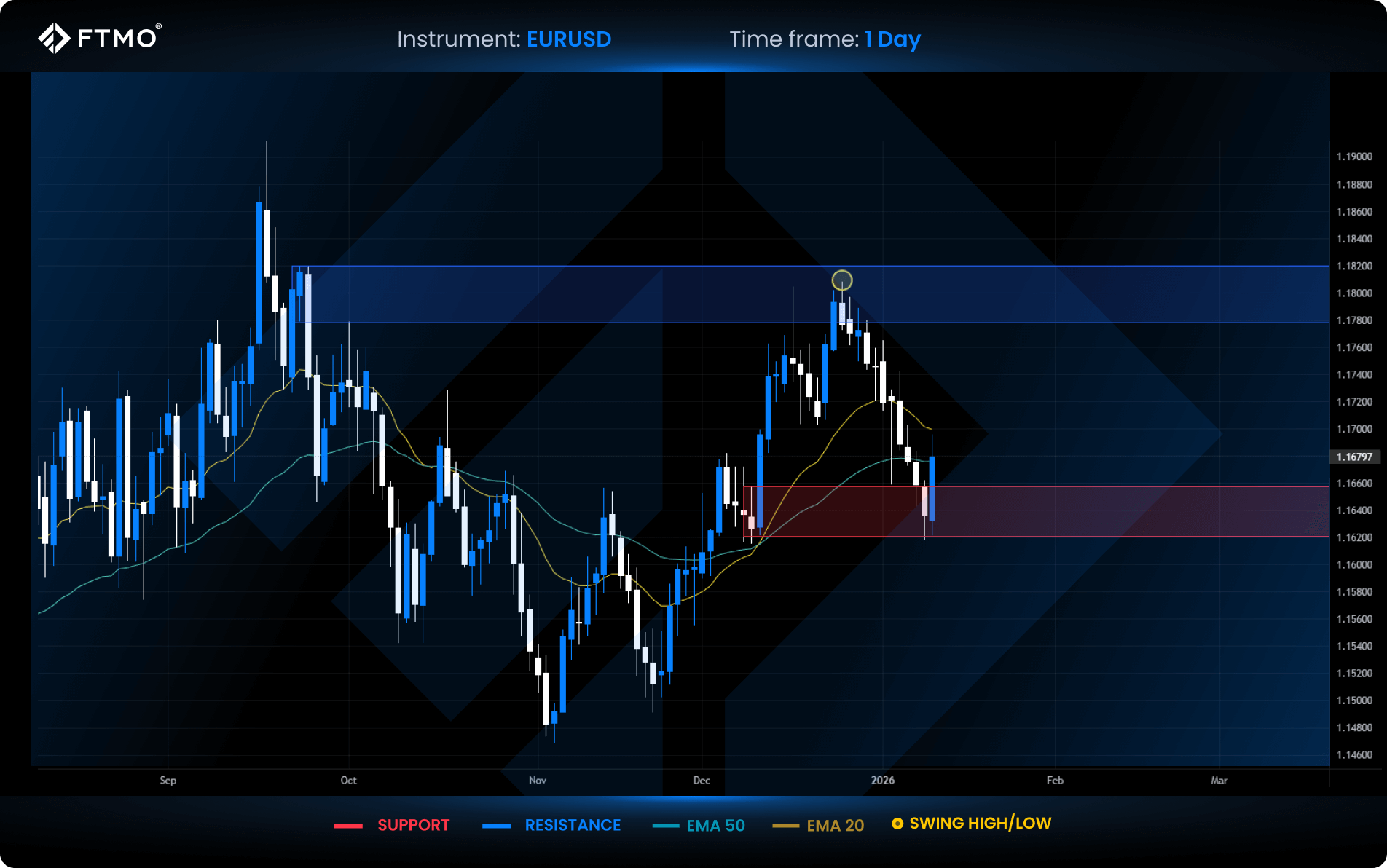

EURUSD

Market Context: After last week’s sharp drop, EURUSD found support and bounced strongly. The pair is now reacting to the 20 and 50 EMAs, a critical area that could determine the next directional move.

Bullish Scenario (Preferred): A continuation from support toward the next resistance zone, aligned with the swing high.

Bearish Scenario (Alternative): A close below support would confirm bearish continuation and further downside potential.

FVG Setup: No FVG was formed this week.

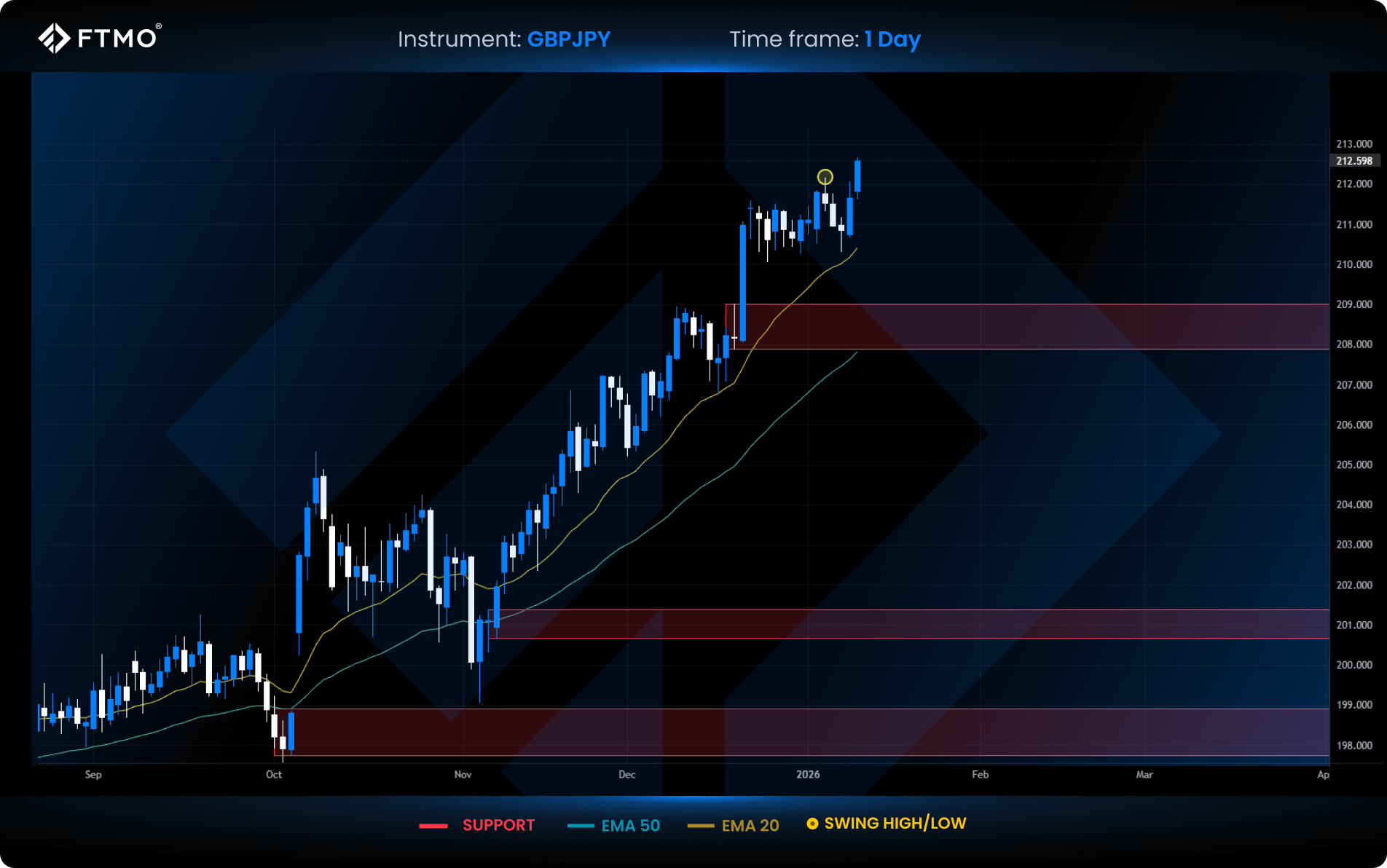

GBPJPY

Market Context: After a period of consolidation, GBPJPY is regaining bullish momentum. The recent close above the short FVG invalidated the bearish setup, confirming trend strength.

Bullish Scenario (Preferred): Trend continuation toward the monthly swing high remains the primary view.

Bearish Scenario (Alternative): A return into the previous range could create indecision and pause the uptrend.

FVG Setup: No FVG was formed this week.

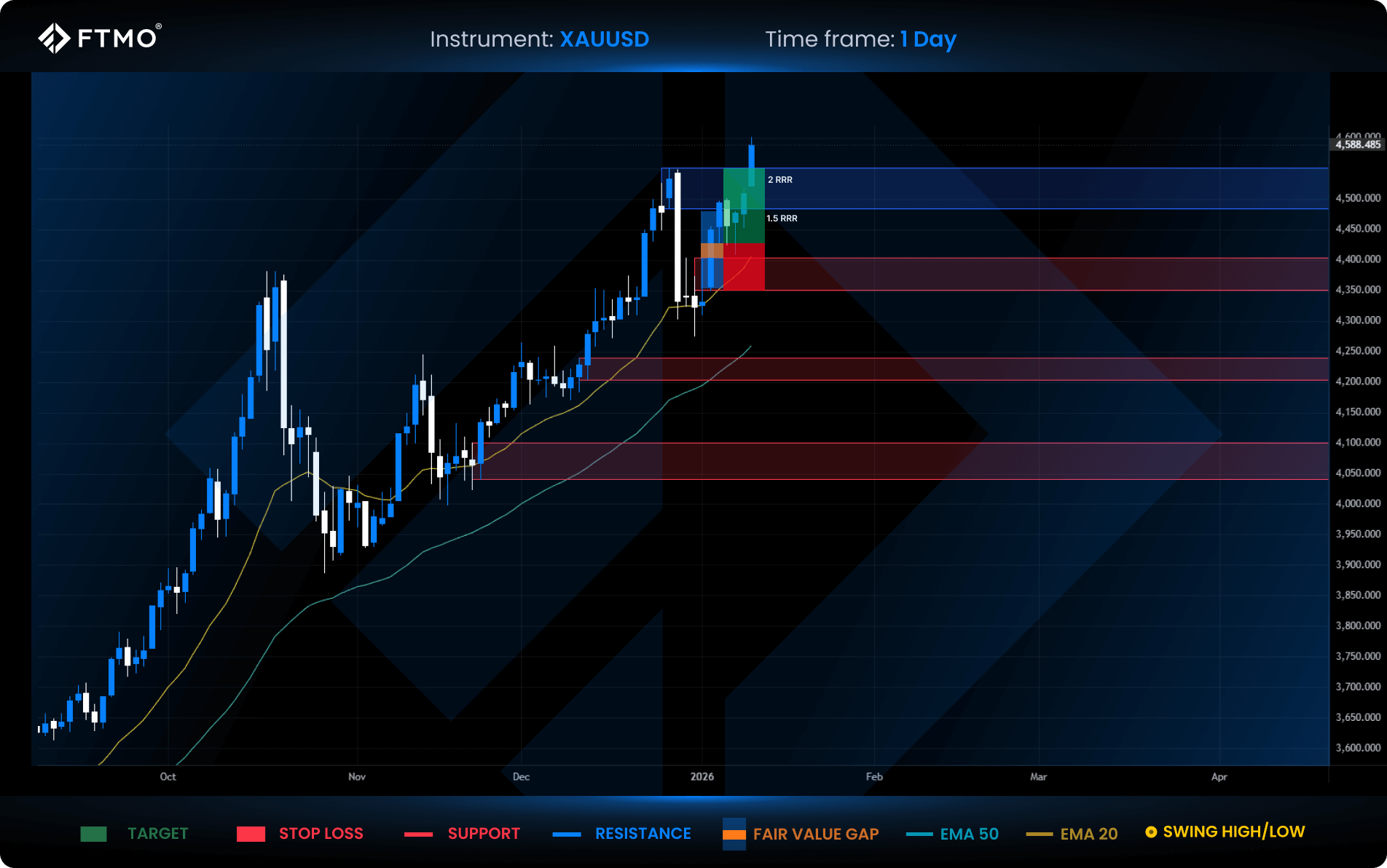

XAUUSD

Market Context: Gold continues to push into new all-time highs, supported by historically strong January seasonality, which is typically the most bullish month for gold.

Bullish Scenario (Preferred): Ongoing trend continuation, potentially extending the breakout beyond the previous ATH.

Bearish Scenario (Alternative): A short-term pullback after sweeping the ATH, possibly leading to a retest of support.

FVG Setup: A long FVG formed last Wednesday and reached 1.5 RRR if resistance was the target, or 2.8 RRR if targeting the all-time high.

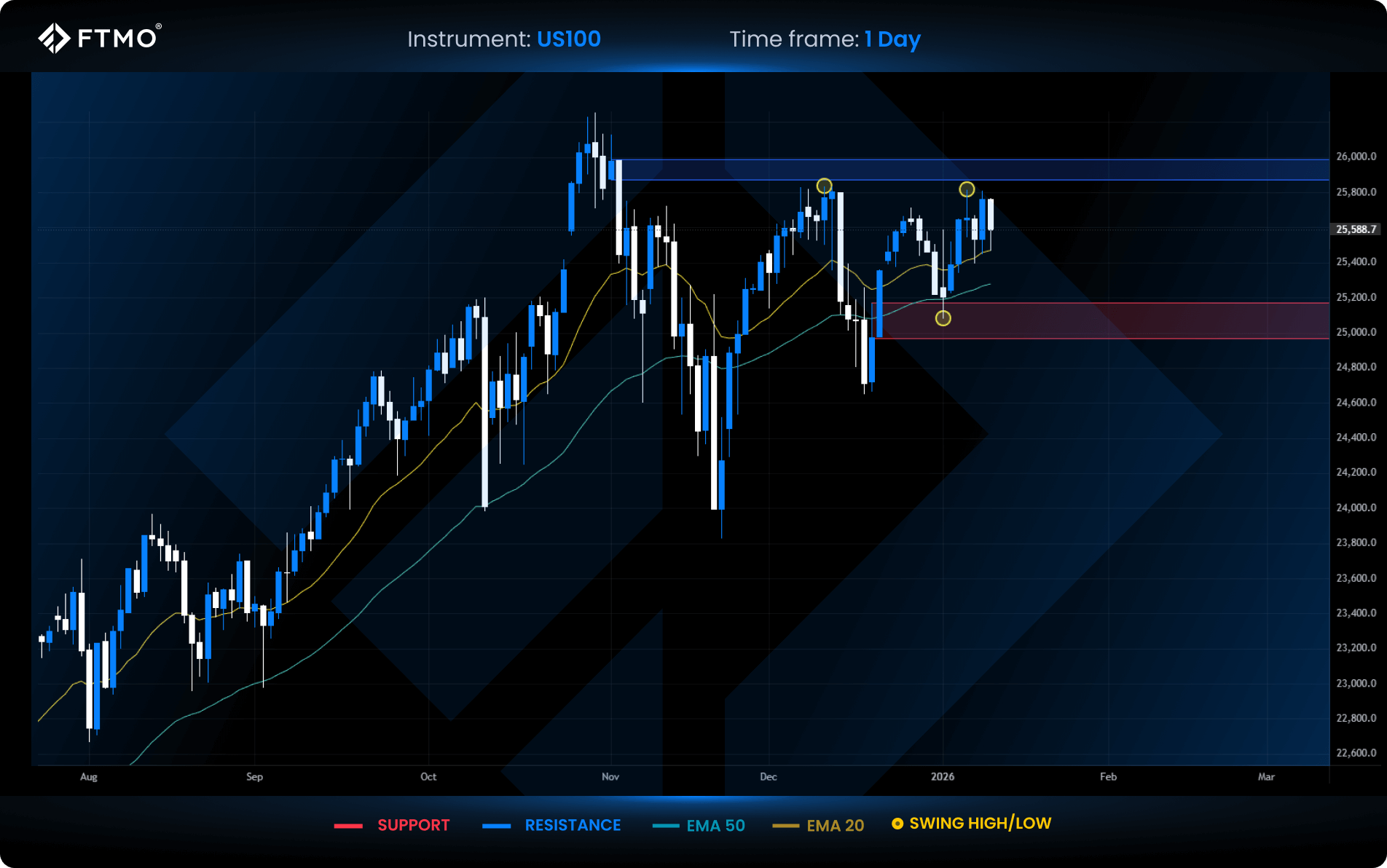

US100

Market Context: The US100 remains in the early phase of a bullish trend. Unlike the S&P 500, it has not yet reached a new all-time high.

Bullish Scenario (Preferred): A continued move higher toward resistance and potentially a breakout to new all-time highs.

Bearish Scenario (Alternative): Failure to hold the 20 EMA could trigger a short-term correction toward support, where the next directional decision would unfold.

FVG Setup: No FVG formed this week due to the market’s low-aggression movement.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?