Trading Week Ahead: New Year, New Narrative?

A high-stakes week is shaping up as markets turn their attention to key US macro data. ISM Services PMI, JOLTS Job Openings, and Nonfarm Payrolls will offer crucial insight into the strength of the economy and the Fed’s likely path. With soft-landing hopes in the balance, this week could set the tone for Q1 volatility.

👉 ISM Services PMI

The index is forecast to edge lower to 52.2 from 52.6, remaining in expansion territory. A stronger print could lift yields and the dollar. A downside miss would fuel dovish sentiment and support risk-on assets.

👉 JOLTS Job Openings

November openings are expected to ease slightly to 7.65 million from 7.67 million. Even a small decline reinforces the trend of softening labour demand, potentially pressuring the dollar and boosting rate-cut odds.

👉 Nonfarm Payrolls

The headline figure is projected at 57K, down from October’s 64K. A weak report may encourage dovish repricing and lift equities. A stronger-than-expected print could delay cuts and support USD strength.

*All times in the table are in GMT+1

Technical Analysis with FVG Strategy

This trading approach leverages the 20- and 50-period Exponential Moving Averages (EMAs) to assess the prevailing market trend, while the Fair Value Gap (FVG) is used to pinpoint zones of price inefficiency. These gaps, formed during sharp price movements, often highlight optimal entry or exit levels. The strategy is suitable for instruments like EURUSD, GBPJPY, US100, and XAUUSD and provides insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

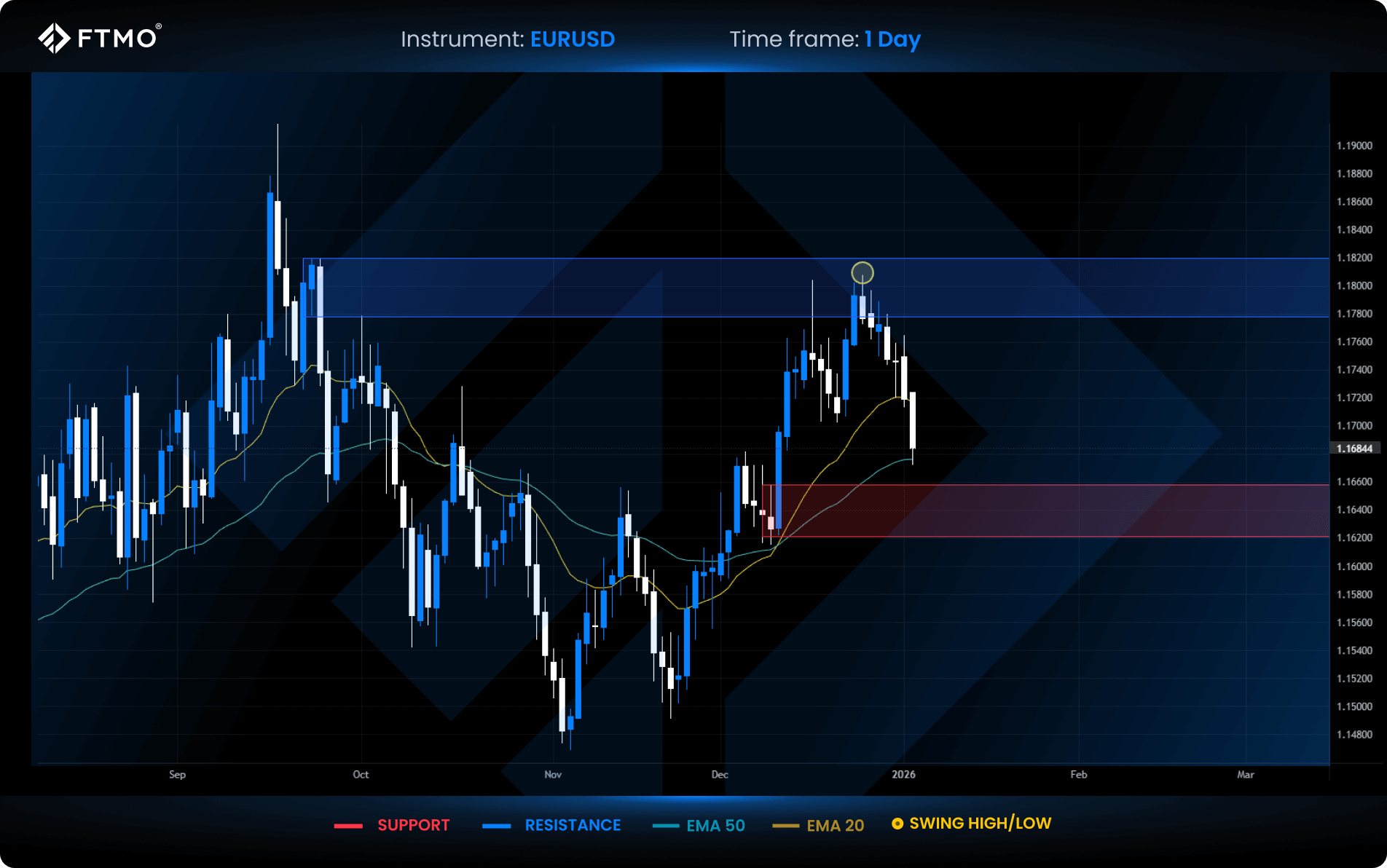

EURUSD

Market Context: EURUSD is currently in a corrective phase below the 20 EMA following a recent rejection from resistance. This bearish move is further supported by strong negative seasonality.

Bearish Scenario (Preferred): Continued correction toward the support zone, where renewed buyer interest is expected.

Bullish Scenario (Alternative): A bounce from the 50 EMA could trigger a short-term bullish reversal.

FVG Setup: No fair value gap formed this week.

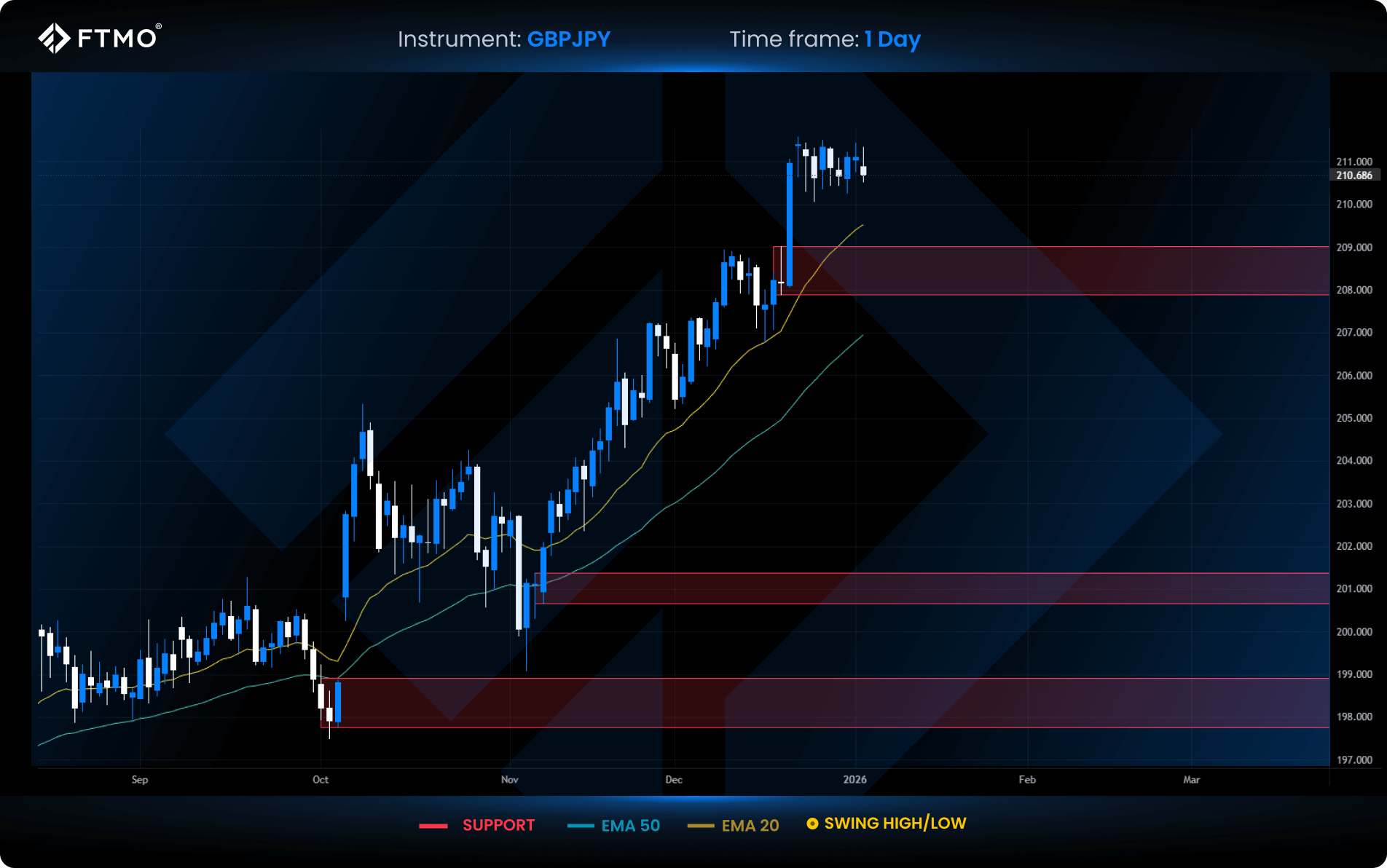

GBPJPY

Market Context: GBPJPY remains in multi-day consolidation, hovering near the upper edge of a gap that could serve as a launch point for further upside.

Bullish Scenario (Preferred): A breakout continuation in line with the long-term uptrend remains the primary outlook.

Bearish Scenario (Alternative): A drop toward support may offer a better entry opportunity before the trend resumes.

FVG Setup: No FVG formed this week due to the market’s range-bound structure.

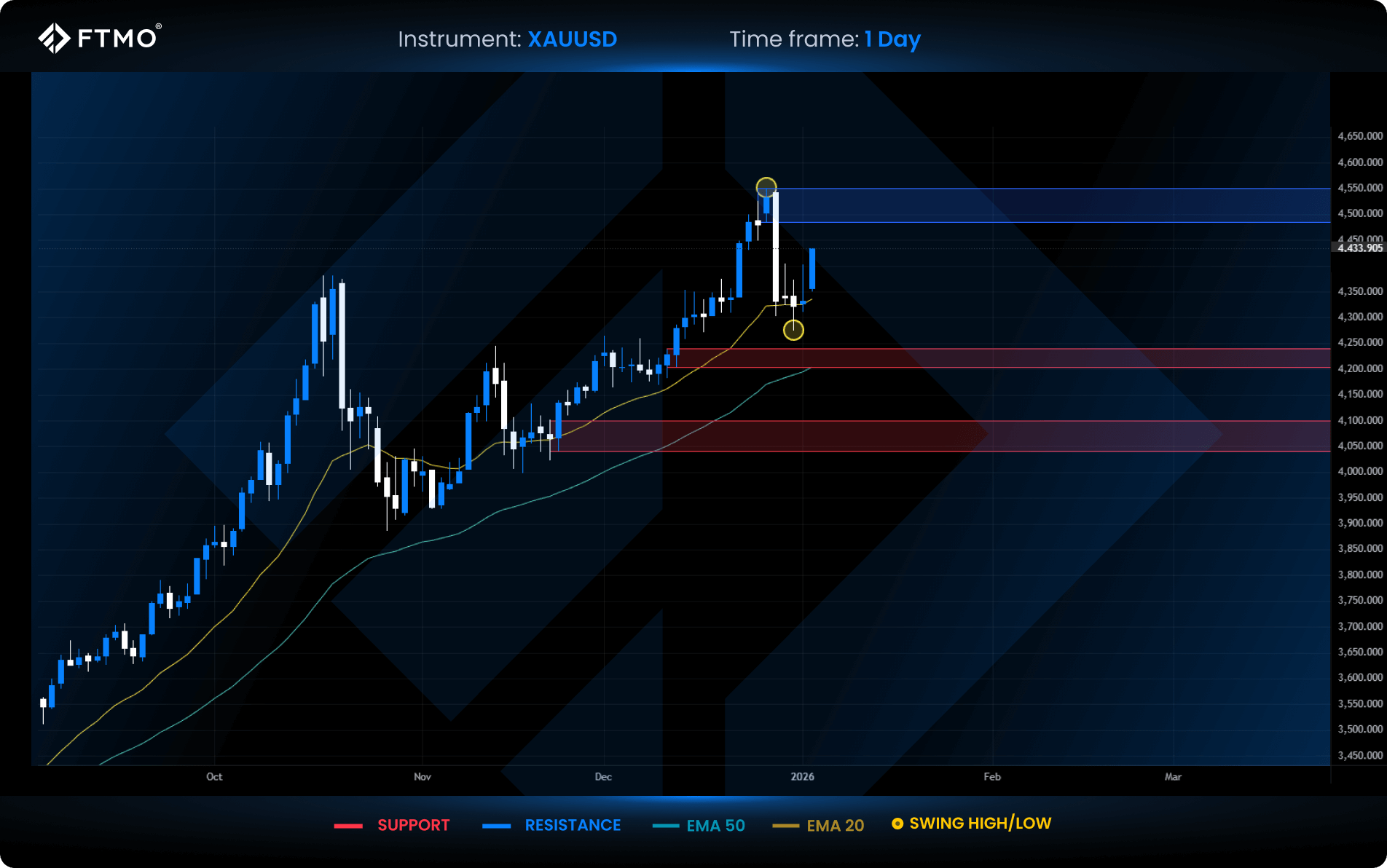

XAUUSD

Market Context: After last week’s sharp selloff candle, gold is regaining strength. Price held above the 20 EMA and is now pushing toward resistance.

Bullish Scenario (Preferred): A continued move higher into resistance, in line with the recovering bullish momentum.

Bearish Scenario (Alternative): A reaction from the short FVG could trigger a move lower toward the swing low and broader support zone.

FVG Setup: A short FVG formed after a strong bearish candle, but the entry was not triggered within three candles.

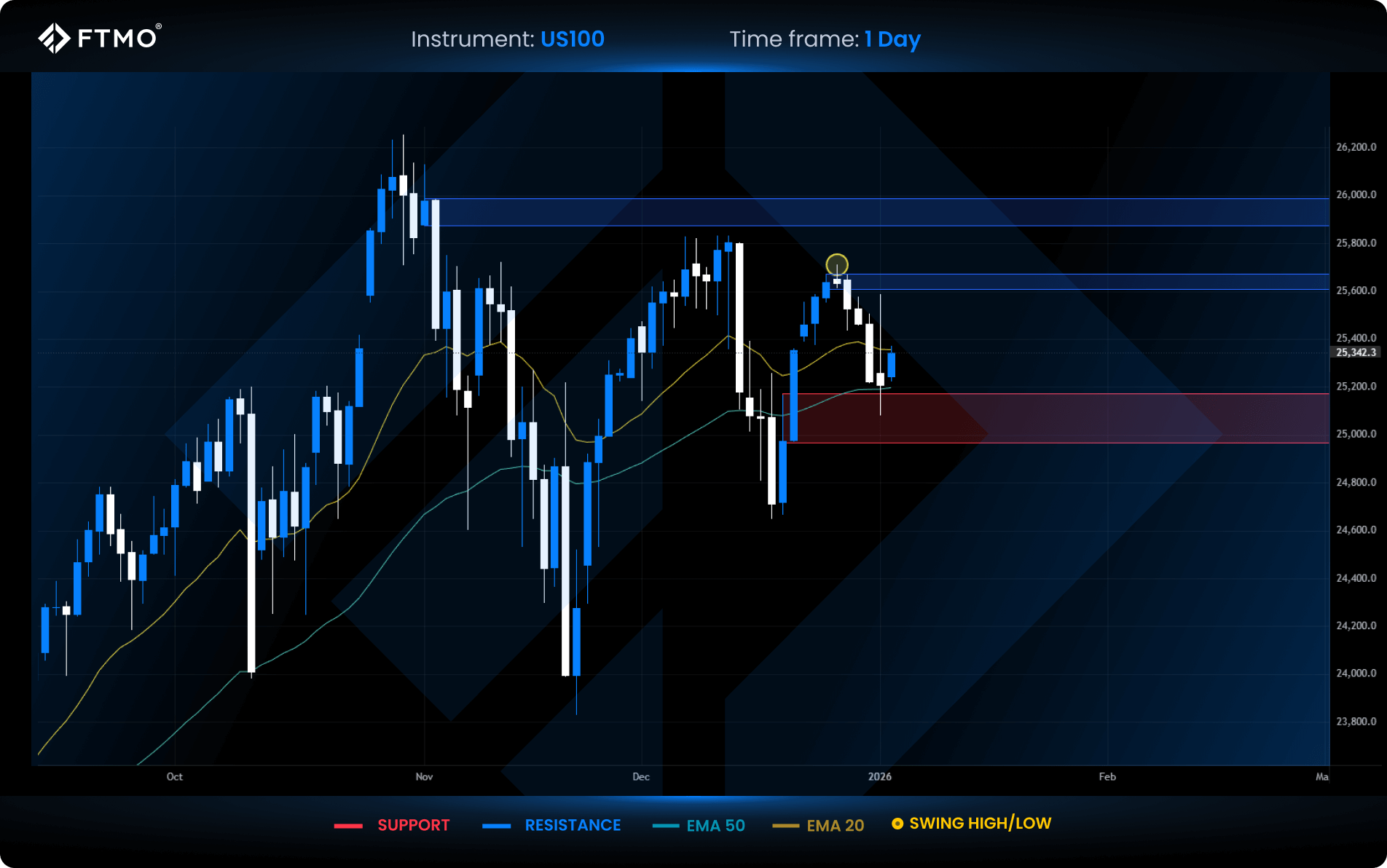

US100

Market Context: Following a successful support test, the Nasdaq opened higher today, suggesting the potential for bullish continuation.

Bullish Scenario (Preferred): A move higher into resistance or a run toward the swing high remains the primary scenario.

Bearish Scenario (Alternative): A daily close below support would shift bias to the downside, targeting the marked swing low where liquidity may reside.

FVG Setup: No FVG formed this week, but a setup may emerge on lower timeframes following the recent support reaction.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?