Trading Week Ahead: Japan’s Election & US Data

Markets face a busy week following Japan's historic election win, which sent stocks to record highs. Focus shifts to a heavy dose of delayed US jobs (NFP) and inflation (CPI) data, which will test Fed policy. Meanwhile, earnings from Cisco and Siemens Energy will further distinguish the true winners from the losers in the ongoing AI boom.

Here is all you need to know about what’s coming up in financial markets.

👉 US Retail Sales:

Tuesday’s report is forecast to show a 0.4% increase for January, down from 0.6% in December. A strong print could challenge rate cut expectations and lift the dollar. A miss may support risk assets.

👉 Nonfarm Payrolls:

Forecast at 70,000 after just 50,000 new jobs in the previous month, Wednesday’s NFP will be the week’s key release. A stronger figure could reinforce a cautious Fed stance. A weaker print may trigger sharp volatility.

👉 US CPI:

Headline inflation is expected to remain unchanged month-on-month. A hotter reading could weigh on equities and strengthen the dollar. Softer data would support the dovish case and risk-on sentiment.

*All times in the table are in GMT+1

Technical Analysis with FVG Strategy

This technical analysis uses the EMA 20 and EMA 50 to determine market trends, alongside the Fair Value Gap (FVG), which refers to price imbalances caused by aggressive movements, signalling key entry and exit points. This strategy applies to EURUSD, GBPJPY, US30, and XAUUSD, providing insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

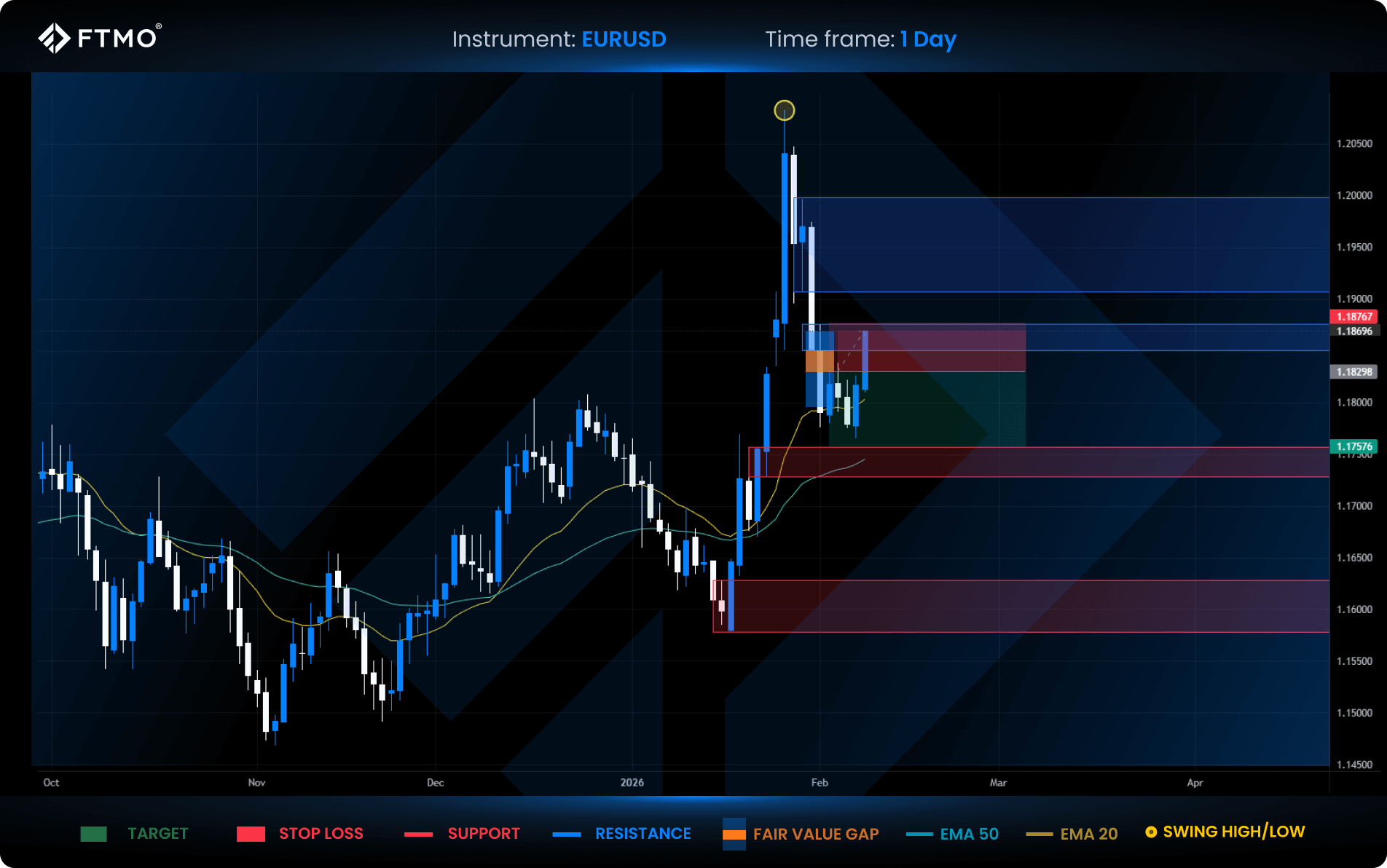

EURUSD

Market Context: Price action remained largely stagnant last week, oscillating around the 20 EMA. On Wednesday, the pair tested a short FVG setup, which remains active even though price is currently trading close to the stop-loss level.

Bearish Scenario (Preferred): The primary outlook remains short, targeting the nearest FVG support level below.

Bullish Scenario (Alternative): A continuation of the current upward momentum toward the nearest resistance. If breached, price could reach a higher resistance zone where sellers are expected to regain control.

FVG Setup: The short FVG setup was filled on Wednesday and remains in play.

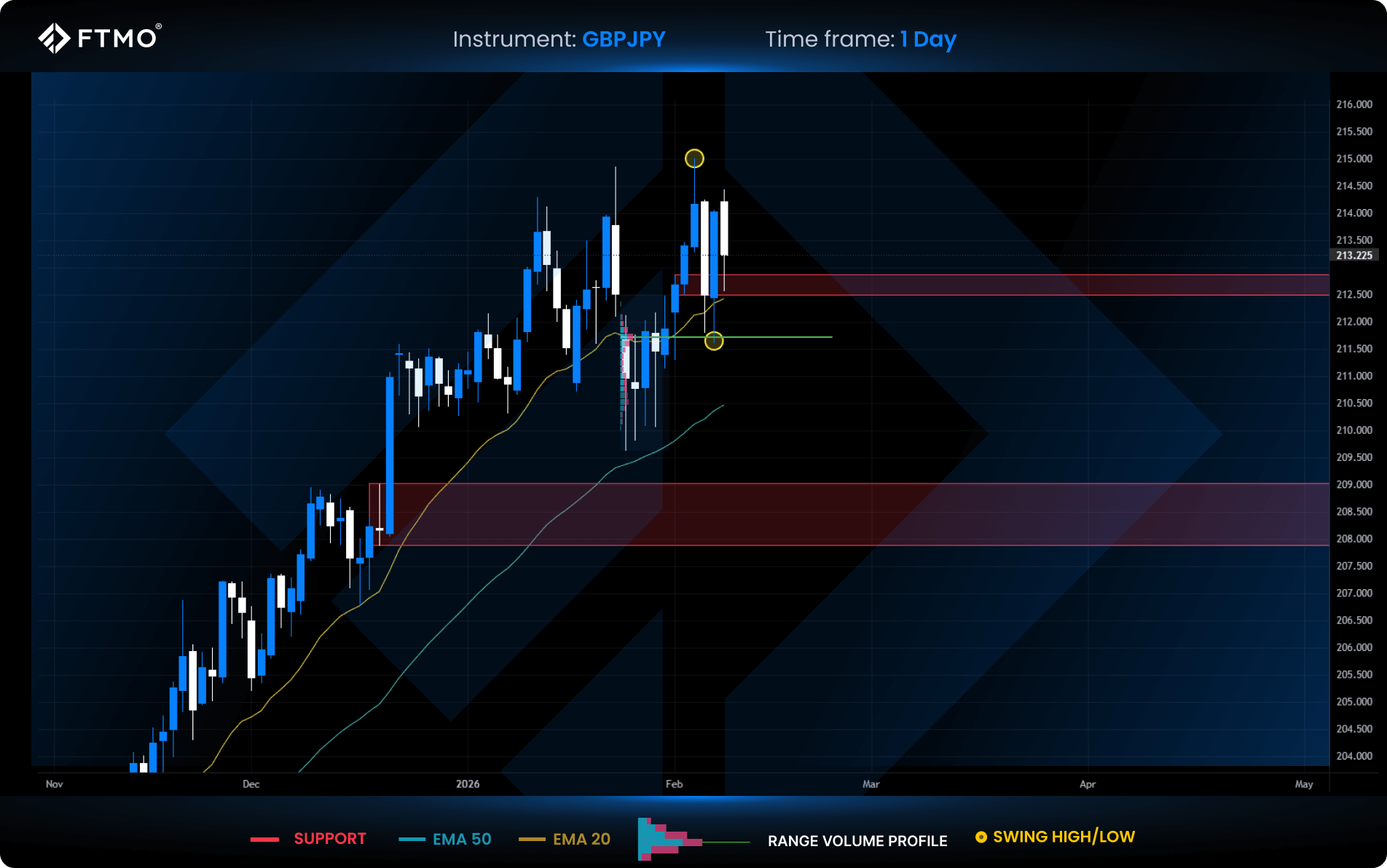

GBPJPY

Market Context: The pound remains in a broader bull market, confirmed by the price holding above the 20 EMA. However, after last Wednesday swept high, the pair showed brief bearish momentum, invalidating the previous long FVG. Despite this, support has held.

Bullish Scenario (Preferred): A continuation higher to target the marked swing high remains the primary scenario.

Bearish Scenario (Alternative): A drop into the swing low zone, specifically around the range volume Point of Control (green line).

FVG Setup: No FVG has formed so far this week.

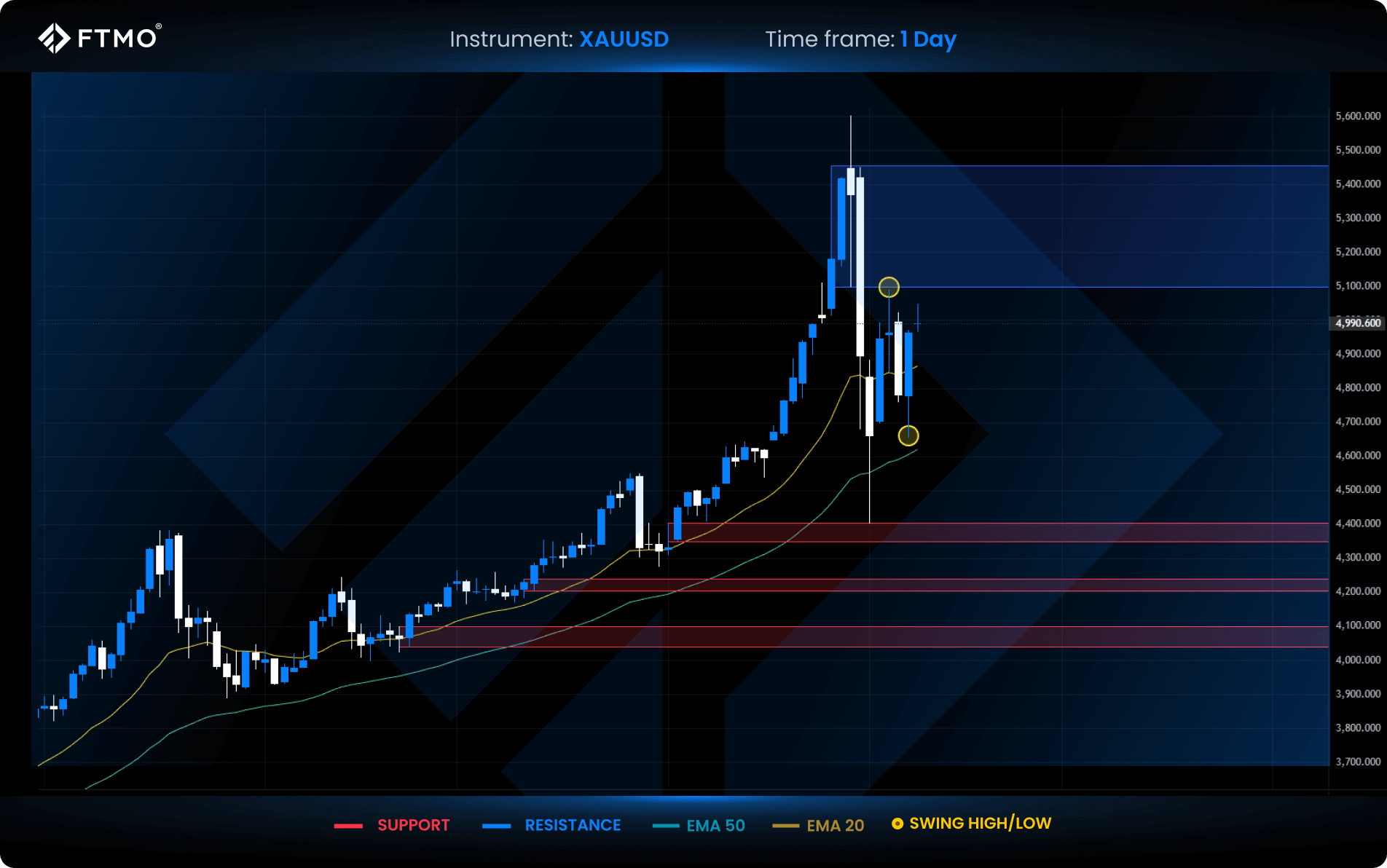

XAUUSD

Market Context: Gold opened with a bullish gap relative to Friday’s close, suggesting upward momentum toward an untested resistance zone and the previous swing high.

Bullish Scenario (Preferred): Movement into the resistance zone, with the potential to find FVG entries on lower timeframes.

Bearish Scenario (Alternative): A drop back to Friday’s low or the nearest support level, likely triggered by high-impact macro news.

FVG Setup: No FVG setups formed this week or last week.

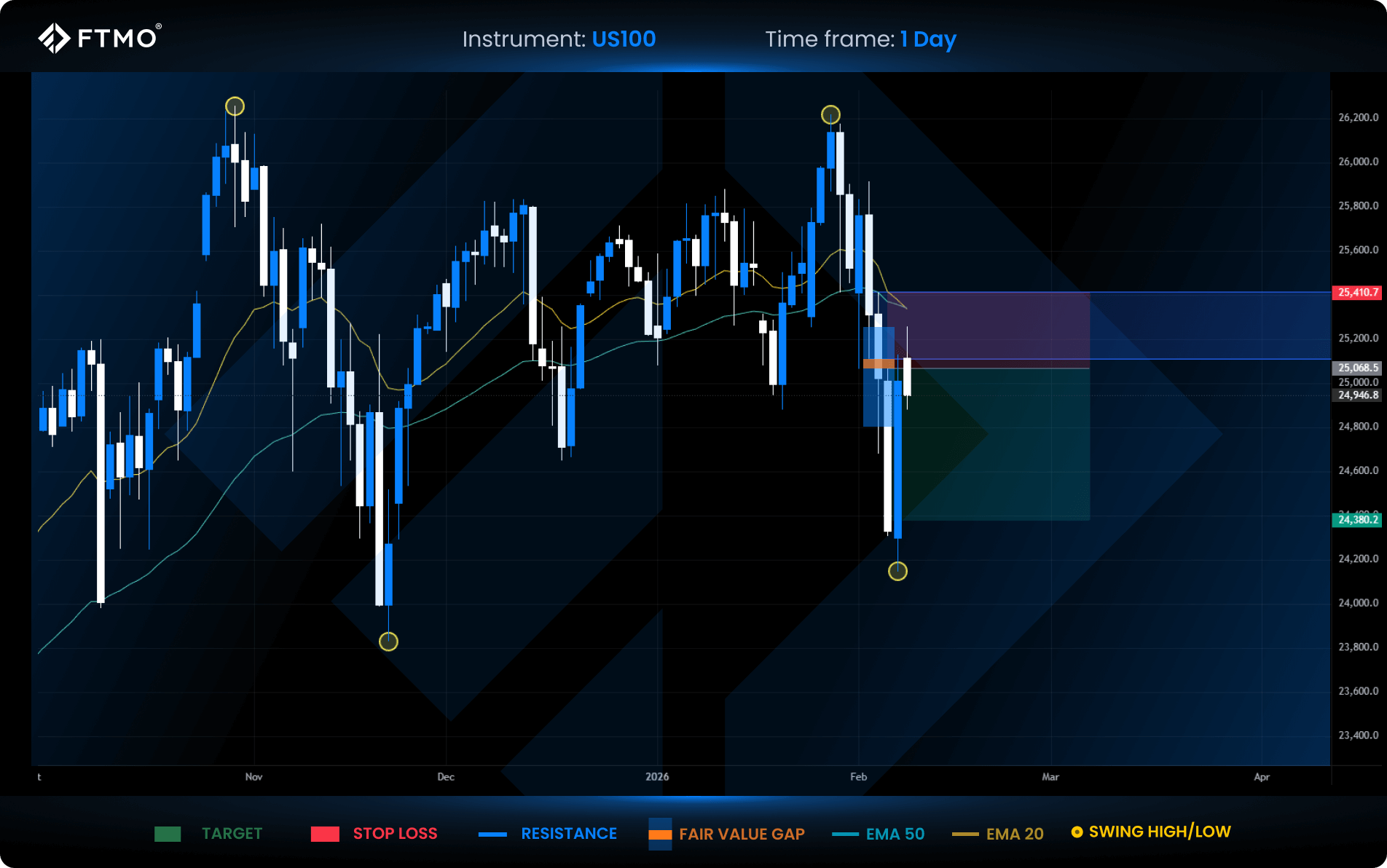

US100

Market Context: The market is trading below both the 20 and 50 EMAs, signalling a short-term bearish trend. Following Friday’s large trend candle, a non-trending day with lower ATR (Average True Range) is expected today.

Bearish Scenario (Preferred): Continuation of the short trend following the FVG fill on Friday.

Bullish Scenario (Alternative): A daily close above resistance, which would signal a potential trend reversal.

FVG Setup: The short FVG formed last week is active, with a fixed potential target of 2.00 RRR or an extension to Friday’s low at 2.70 RRR.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?